From streaming movies and music to surprise subscription boxes, software, and home delivery services: we live in the era of the subscription economy. This model combines the Italian tradition of direct debit for utility bills with the innovation of digital services. While the convenience is undeniable, it’s also easy to lose track of expenses and run into trouble when you decide to cancel a service. In Italy, consumers spend an average of 13.28 euros per month on each subscription, with an average of two subscriptions per person. Managing these recurring payments consciously is crucial for your financial health.

This article provides a comprehensive guide to safely navigating the world of recurring payments. We’ll explore how they work, the hidden risks behind their apparent simplicity, and, most importantly, the most effective strategies for managing them stress-free and the correct procedures for canceling them when they’re no longer needed, in full compliance with your consumer rights protected at the European level.

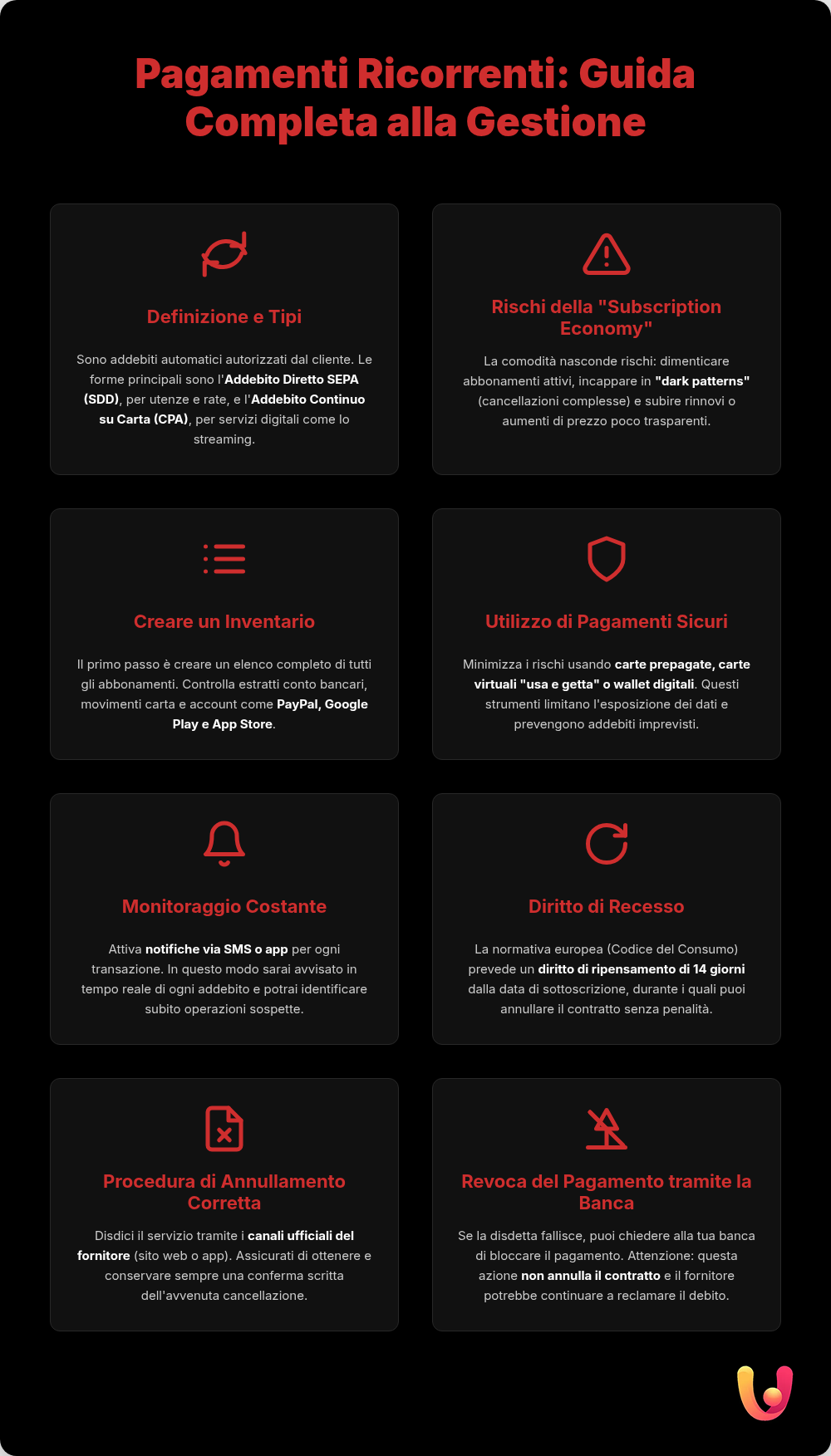

What Recurring Payments Are and How They Work

A recurring payment is an authorization a customer gives to a company to automatically charge a specific amount from their bank account or card at regular intervals (monthly, annually, etc.). This mechanism is the foundation of all subscription services and primarily takes two forms: the SEPA Direct Debit (SDD), more common for utilities and installment plans, and the Continuous Payment Authority (CPA) on a card, typical of online services like streaming platforms, software, and apps. The authorization, called a mandate, is granted once and remains valid until revoked. This continuity ensures a stable revenue stream for companies and uninterrupted service for customers.

The process is simple: when subscribing, the user enters their payment method details and agrees to the terms of service, which include the automatic renewal clause. From that moment on, the company is authorized to withdraw the agreed-upon amount on the scheduled dates. This logic combines tradition, like the automatic debit for phone bills our parents knew well, with the extreme speed of digital innovation, where a new service can be activated with just a few clicks. The modern challenge is to maintain the same attention and caution of the past in a much more fragmented and fast-paced digital context.

The Pros and Cons of the Subscription Economy

The success of subscriptions is built on a balance between customer convenience and predictable revenue for the company. However, it’s important to be aware of both the benefits and the potential pitfalls of this rapidly growing economic model.

The Benefits of Convenience

The main advantage of recurring payments is automation. You no longer need to remember every single due date, whether it’s for your electricity bill or your gym membership. This eliminates the risk of late payments, potential service interruptions, and late fees. For consumers, it means continuous and immediate access to goods and services, often with lower initial costs compared to an outright purchase. For companies, this model ensures a steady cash flow and promotes customer loyalty, creating a lasting relationship that goes beyond a single transaction. In fact, 42% of Italian consumers appreciate the convenience offered by online companies.

The Hidden Traps

The same convenience that makes subscriptions attractive can turn into a risk. It’s easy to forget about active subscriptions, especially small-amount ones, which can silently eat away at your monthly budget. Another significant problem is so-called dark patterns: deliberately complex cancellation interfaces and procedures designed to discourage users from unsubscribing. Added to this are non-transparent automatic renewals and price increases that are not clearly communicated. Furthermore, managing numerous subscriptions multiplies the potential points of exposure for your financial data. For this reason, it’s crucial to use secure payment methods, such as disposable virtual cards, which minimize risks in the event of a data breach.

How to Manage Your Subscriptions Effectively

Careful and proactive management is the secret to enjoying the benefits of subscriptions without falling into their traps. Adopting a few simple habits and using the right tools can make a big difference in maintaining full control of your finances.

Take a Complete Inventory

The first step to effective management is awareness. It’s essential to create a complete list of all your active subscriptions. To do this, carefully review your bank and credit card statements from the last few months, looking for all recurring charges. Don’t forget to also check services linked to platforms like PayPal, Google Play, or the Apple App Store, which often manage third-party subscriptions. For each subscription, note the cost, renewal date, and the service it relates to. This simple ‘census’ will give you a clear picture of where your money is going and help you decide which services to keep and which to cut.

Use Secure Payment Tools

The choice of payment tool is crucial for security. One of the most effective strategies is to use prepaid cards or virtual cards to sign up for new subscriptions. By loading only the amount needed for renewal, you can avoid any unexpected or higher-than-agreed-upon charges. Another valid option is a digital wallet, which acts as an intermediary and adds an extra layer of protection by not sharing your card details directly with the merchant. These tools, combined with a healthy dose of caution, are the best defense against fraud and unauthorized charges, allowing you to enjoy digital innovation with timeless security.

Monitor Your Spending

The initial inventory is a great starting point, but monitoring must be ongoing. The easiest way to keep everything in check is to enable SMS or app notifications for every transaction made with your cards or from your account. This way, you’ll be alerted in real-time of every charge, recurring or not, and can act immediately in case of suspicious or unrecognized transactions. Many banking apps now offer intuitive dashboards to view and categorize expenses, helping you maintain financial discipline. This total control over your expenses is a cornerstone of sound financial management, a principle that applies as much to large purchases as it does to small monthly subscriptions.

Canceling a Subscription: The Correct Procedure

Canceling a subscription should be as easy as signing up for it, but that’s not always the case. Knowing your rights and the correct procedure is essential to stop a service without incurring additional costs or disputes with the provider.

The Right of Withdrawal: What the Law Says

European legislation, adopted in Italy by the Consumer Code, protects online shoppers. For distance contracts, such as subscriptions signed up for on the internet, the consumer has a 14-day cooling-off period from the date the contract is concluded. During this time, you can withdraw without giving any reason and receive a refund for what you’ve paid. If the seller has not clearly informed the user of this right, the withdrawal period is extended to 12 months and 14 days. But be careful: if you start using digital content (e.g., streaming a movie) and agree to waive your right of withdrawal, you can no longer exercise it.

How to Cancel Directly with the Provider

The primary way to cancel a subscription is always through the provider’s official channels. The standard procedure involves logging into your personal area on the website or app, looking for the ‘Subscription,’ ‘Billing,’ or ‘Account’ section, and following the cancellation instructions. It is crucial to ensure you receive a written confirmation (usually via email) of the cancellation and to save it. Be prepared to encounter the aforementioned dark patterns, such as very prominent ‘keep subscription’ buttons and nearly invisible cancellation links, designed to hinder the process. Staying calm and carefully following the steps is the key to successfully completing the task.

Revoking the Payment Through Your Bank

If canceling through the provider proves impossible or if charges continue after cancellation, you can intervene directly through your bank. You can request to revoke the SEPA Direct Debit mandate or block recurring payments on a credit card. However, it’s important to understand a key distinction: blocking the payment is not the same as canceling the contract. The company may still consider the contract valid and accumulate a debt in your name, which it could then try to collect through legal means. This option should therefore be used as a last resort or in parallel with a formal cancellation notice sent to the provider, such as via certified email (PEC) or registered mail with acknowledgment of receipt.

In Brief (TL;DR)

Discover how to securely manage your subscriptions and recurring payments, from direct debits for bills to streaming services, and learn the correct procedure to cancel them without any surprises.

You will learn how to keep track of all your subscriptions and correctly deactivate them when they are no longer needed.

Finally, we will provide you with all the necessary instructions to cancel a subscription or revoke a direct debit permanently and securely.

Conclusion

Recurring payments and subscriptions are an increasingly integrated part of our daily lives, a bridge between the tradition of automatic debits and the innovation of on-demand digital services. They undoubtedly offer great convenience, but they require a new level of attention and financial management to prevent them from becoming a source of uncontrolled spending and stress. The key to a peaceful relationship with the subscription economy lies in three pillars: awareness, monitoring, and action.

Being aware of every active subscription, constantly monitoring expenses using the digital tools at our disposal, and acting promptly to cancel unnecessary services are the golden rules. Knowing your rights, like the right of withdrawal, and the correct cancellation procedures allows you to confidently handle even the most complex situations. By adopting an approach that combines the prudence of Mediterranean tradition with an openness to innovation, you can make the most of the opportunities in the digital market while always maintaining full control of your financial well-being.

Frequently Asked Questions

To get a complete picture, regularly check your bank and credit card statements. Many banking apps have a dedicated section for recurring payments or SEPA Direct Debits. If you use services like PayPal, you can view active ‘automatic payments’ directly from your account. There are also specific apps, like Tilla, Subtrack, or SubX, that help you track and manage all your subscriptions in one place, sending notifications before renewal dates.

The procedure varies. For subscriptions (e.g., streaming, software), you need to log into your profile on the service’s website or app and look for the option to turn off automatic renewal. For a SEPA Direct Debit (e.g., utility bills), the general rule is to contact the provider (creditor) directly to request the cancellation. Alternatively, you can contact your bank, which can block future payments to a specific beneficiary. Many banking institutions also allow you to manage and revoke SEPA mandates through their home banking app.

Generally, canceling a subscription stops future payments but does not entitle you to a refund for the period already paid for. However, European consumer rights legislation provides for a 14-day right of withdrawal for contracts concluded at a distance. A recent ruling by the EU Court of Justice clarified that for subscriptions with a free trial period that then becomes a paid service, the right of withdrawal applies only once, at the beginning, provided the consumer was clearly informed of the future cost.

If you notice a payment you don’t recognize, contact your bank or card issuer immediately. For unauthorized SEPA Direct Debits, you have up to 13 months to request a refund. If the amount is correct but simply unexpected or excessive, you have 8 weeks to dispute it and request a refund. It’s good practice to regularly check your statements to promptly identify any anomalies.

Online management is safe if you take the right precautions. The main risk is unintentionally signing up for subscriptions, often hidden behind free trial offers (subscription traps). To increase security, always use secure connections, read the terms and conditions carefully before entering your card details, and prefer payment methods that offer more control, such as disposable virtual cards or services like PayPal, which make it easier to revoke automatic payments. Major credit card companies, in agreement with European authorities, have also strengthened rules to make recurring costs more transparent at the time of payment.

Still have doubts about Recurring Payments: A Guide to Managing and Canceling Them?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.