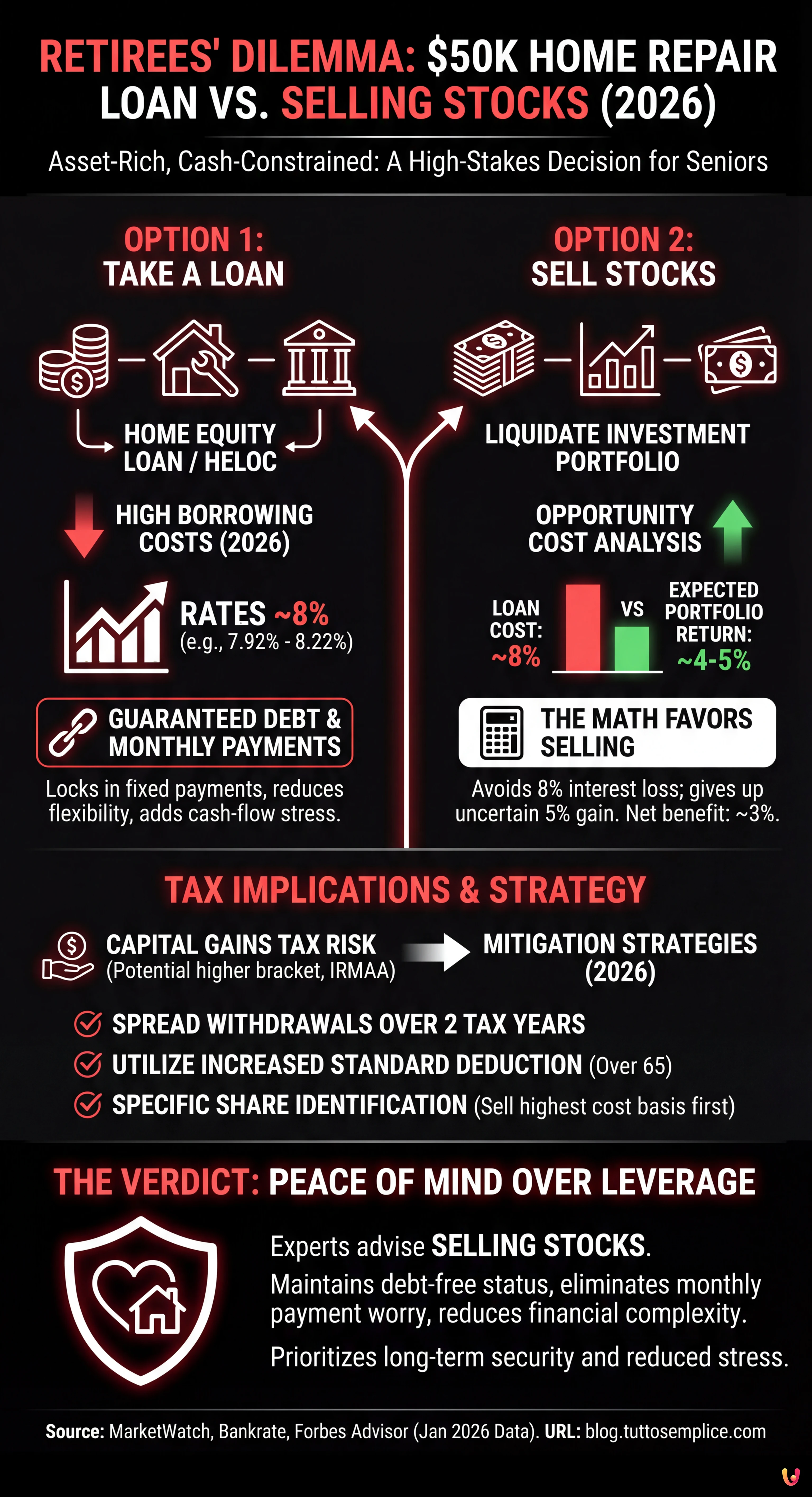

In the shifting financial landscape of early 2026, many retirees are finding themselves in a familiar yet high-stakes predicament: they are asset-rich but cash-constrained when facing major expenses. A recent case highlighted by MarketWatch’s "The Moneyist" column has brought this issue to the forefront, featuring a couple in their 70s who are living on Social Security and pensions. Despite having a paid-off home and a healthy investment portfolio of nearly $1 million, they are grappling with how to fund $50,000 to $60,000 in necessary home repairs.

The couple’s dilemma is one that resonates with millions of seniors this year. With their home fully paid off, they are hesitant to take on new debt, yet they worry about the long-term impact of withdrawing a lump sum from their investment accounts. "Our house is paid off," they emphasized, noting that they also maintain a $30,000 emergency fund. The core question they face is a classic financial trade-off: Is it better to lock in a loan at today’s interest rates or liquidate stocks and potentially miss out on future market gains? The answer, according to financial experts, lies in the stark mathematical reality of the 2026 economy.

The High Cost of Borrowing in 2026

For retirees living on fixed income sources like Social Security and pensions, taking on new debt is a decision that requires careful scrutiny of current interest rates. According to data from Bankrate and Forbes Advisor as of late January 2026, the financial environment for borrowers remains challenging. Home equity loan rates are currently hovering around 7.92% to 8.16%, while Home Equity Lines of Credit (HELOCs) are averaging approximately 8.22%.

For the couple in question, taking out a $50,000 loan at an 8% interest rate would result in significant interest payments over the life of the loan. Unlike the historic lows seen in 2021, today’s rates mean that borrowing costs are a substantial burden. Quentin Fottrell, the "Moneyist" columnist, pointed out that taking on new debt at these levels "locks you into fixed payments at a time when flexibility matters most." For a retiree, adding a mandatory monthly debt obligation can create unnecessary cash-flow stress, even if the household has substantial assets on paper.

Investment Returns vs. Loan Interest: The Math

The decision ultimately comes down to a comparison between the cost of debt and the expected return on investments. Fottrell’s analysis highlights a critical "opportunity cost" calculation. While the long-term average return of the stock market is often cited as 7% to 10%, retirees typically hold more conservative portfolios to preserve capital. For a couple in their 70s, a balanced portfolio might realistically be expected to return closer to 4% to 5% annually.

In this scenario, the math heavily favors selling assets. If the couple’s investments are earning 5% while a loan would cost them 8%, they are effectively losing 3% per year on that $50,000 by choosing to borrow. "The financial advantage of borrowing largely disappears" when viewed through this lens, Fottrell noted. By selling stocks, they avoid the guaranteed 8% loss (interest expense) in exchange for giving up a potential, but uncertain, 5% gain.

Tax Implications and Strategic Withdrawals

One of the main fears retirees have about selling stocks is the tax bill. Liquidating $50,000 in investments can trigger capital gains taxes, which could inadvertently push a household into a higher tax bracket or increase their Medicare premiums through Income-Related Monthly Adjustment Amounts (IRMAA). However, the 2026 tax landscape offers some relief that can mitigate this impact.

According to the IRS inflation adjustments for the 2026 tax year, tax brackets and standard deductions have increased. Furthermore, recent legislative updates have introduced additional standard deduction amounts for seniors over age 65, which can help offset the taxable income generated by a stock sale. Financial planners suggest spreading the withdrawal over two tax years if possible—taking half in December and half in January—to keep taxable income within lower brackets, such as the 12% or 22% marginal rates.

Additionally, for those with significant appreciation in their portfolios, utilizing specific identification of shares allows investors to sell the lots with the highest cost basis first, thereby minimizing the realized capital gain. This strategy, combined with the 2.8% Cost-of-Living Adjustment (COLA) for Social Security in 2026, can help retirees manage the cash flow shock of a major repair without derailing their long-term financial security.

The Verdict: Peace of Mind Over Leverage

Beyond the spreadsheets and interest rate comparisons, there is a psychological component to retirement finance that cannot be ignored. Carrying debt into retirement is generally discouraged because it introduces risk. If the couple were to take a loan, they would be leveraging their paid-off home—their sanctuary—against market performance. If the market were to downturn while they held the loan, they would still owe the monthly payments, potentially squeezing their fixed income.

By using their investment portfolio to fund the renovation, they maintain their debt-free status and eliminate the worry of monthly payments. As Fottrell advised, "reducing stress, risk and tax complexity" is often more valuable than trying to arbitrage a small difference in interest rates. With a $1 million portfolio and a $30,000 emergency fund, this couple is well-positioned to absorb the cost of the repairs without jeopardizing their financial future, provided they execute the sale of assets strategically.

In Brief (TL;DR)

Asset-rich retirees often struggle to choose between high-interest home equity loans and liquidating their investment portfolios.

Experts recommend selling stocks because current borrowing costs significantly outpace the expected returns of conservative retirement portfolios.

Careful tax planning allows seniors to withdraw funds efficiently without triggering excessive levies or increasing Medicare premiums.

Conclusion

For retirees in 2026, the choice between borrowing and spending down assets is starker than in previous years due to elevated interest rates. In the case of the 70-year-old couple needing $50,000 for home repairs, the professional consensus is clear: with home equity loan rates exceeding 8% and conservative investment returns likely hovering around 5%, self-funding the project is the prudent financial move. By avoiding high-interest debt and carefully managing the tax implications of selling stocks, retirees can protect their monthly cash flow and enjoy their renovated homes with the peace of mind that comes from being truly debt-free.

Frequently Asked Questions

In the 2026 financial climate, experts generally advise selling stocks rather than borrowing for major expenses. With home equity loan rates exceeding 8 percent and conservative investment portfolios returning only about 4 to 5 percent, the cost of debt outweighs the potential market gains. Self-funding avoids guaranteed interest losses and preserves monthly cash flow flexibility.

Liquidating a large sum like 50,000 dollars can trigger capital gains taxes and potentially increase Medicare premiums through IRMAA. However, retirees can mitigate this by spreading withdrawals over two tax years or using specific share identification to sell lots with the highest cost basis first. Utilizing the increased standard deduction for seniors over 65 also helps offset the taxable income.

With home equity loans and HELOCs averaging around 8 percent in early 2026, borrowing has become a substantial financial burden compared to previous years. Taking on new debt at these levels creates a guaranteed negative return if your investment portfolio earns less than the loan interest rate. Consequently, high borrowing costs make leveraging home equity less attractive than using existing liquid assets.

Taking on a loan introduces a mandatory monthly obligation that can cause stress if fixed income sources are limited. Financial columnists emphasize that maintaining a debt-free status eliminates the risk of market downturns squeezing your budget. Peace of mind and reducing financial complexity are often valued higher than the small potential arbitrage of keeping money invested while borrowing.

The opportunity cost analysis compares the guaranteed interest expense of a loan against the uncertain returns of keeping money invested. If a retiree pays 8 percent interest on a loan but only earns 5 percent on their portfolio, they effectively lose 3 percent annually on that capital. Therefore, the prudent financial move is to avoid the high interest cost by liquidating lower-yielding assets.

Did you find this article helpful? Is there another topic you'd like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.