Receiving your salary on a prepaid card with an IBAN is an increasingly common choice in Italy, a country where financial culture oscillates between an attachment to tradition and a rapid adoption of digital innovations. This solution, which combines the convenience of a payment card with the functionality of a basic bank account, has established itself as a flexible and low-cost alternative. Since 2018, Italian law has required salaries to be paid through traceable methods, excluding cash to combat undeclared work. In this context, cards with an IBAN have become a legitimate and appreciated tool not only by young people and first-time workers but also by those seeking a more streamlined way to manage their finances.

This trend is part of a European market where digital payments are growing strongly, albeit with significant cultural differences. While in some Northern European nations the use of cash is almost residual, in the Mediterranean context, and particularly in Italy, a connection to physical money persists. However, the convenience and reduced costs of prepaid cards are accelerating the transition to electronic payment methods, with a significant increase in their number in circulation. Let’s explore the advantages and disadvantages of this choice to understand if it’s really worth abandoning a traditional account for salary deposits.

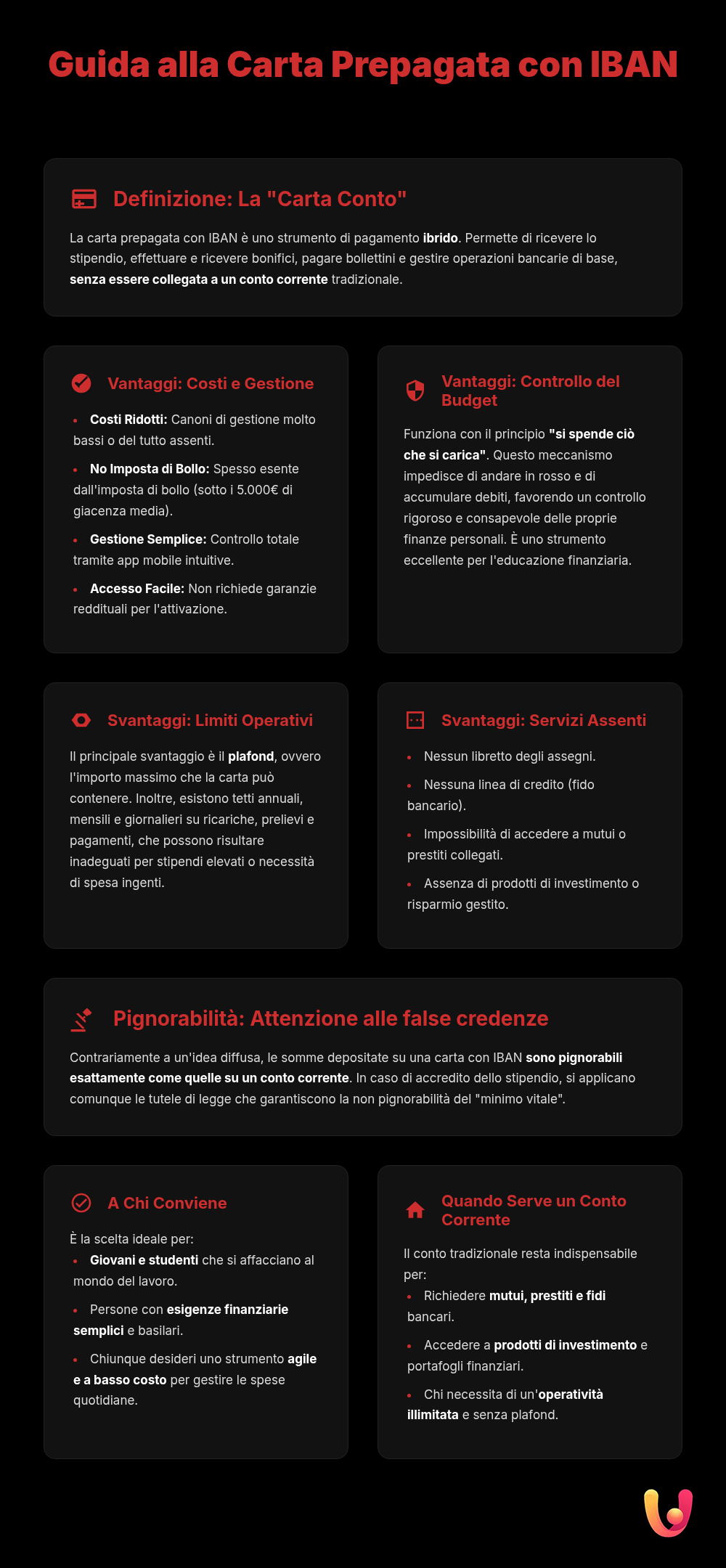

The Prepaid Card with IBAN Explained Simply

A prepaid card with an IBAN, often called a card account, is a payment instrument that combines the simplicity of a rechargeable card with the essential functions of a bank account. Unlike a standard prepaid card, the presence of an IBAN (International Bank Account Number) makes it uniquely identifiable, allowing you to make and receive bank transactions. This means you can use it not only to pay in physical and online stores or to withdraw cash but also to receive wire transfers, such as your salary or pension, and to set up payments, like direct debits for utilities.

How it works is intuitive: you can only spend the amount previously loaded onto the card. This clearly distinguishes it from a credit card, which allows you to spend “borrowed” money made available by the bank (the so-called credit limit), with the charge applied later. Since it is not directly linked to a traditional bank account, a card with an IBAN offers autonomous operation, representing an effective hybrid between different payment instruments.

The Advantages of Receiving Your Salary on a Prepaid Card

Choosing a prepaid card with an IBAN to receive your salary offers a series of tangible benefits, especially appreciated by those who want flexibility and cost control. These tools are known for their accessibility and simplified management, which is often entirely digital.

Low Costs and Simple Management

One of the most obvious advantages is cost savings. Many prepaid cards with an IBAN have very low or even no annual fees, especially for younger customers. Unlike traditional bank accounts, there is often no annual stamp duty for average balances over €5,000. Management is done almost entirely through a smartphone app, making operations like checking your balance, sending wire transfers, or blocking the card if it’s lost, simple and immediate. This operational agility, combined with low activation and maintenance costs, makes them a modern and streamlined financial solution.

Accessibility and Budget Control

Cards with an IBAN are extremely accessible. They usually do not require income guarantees or financial solvency checks, making them available even to students, temporary workers, or people who have had financial difficulties in the past. This makes them an inclusive tool. Furthermore, by operating on the “spend what you load” principle, they help maintain strict control over expenses. It’s impossible to “go into the red,” a risk always present with bank accounts that have an overdraft facility. This feature is particularly useful for those who want to manage their budget in a disciplined way, avoiding unnecessary spending.

A prepaid card with an IBAN is a smart and secure solution for managing money flexibly, especially if you want to avoid high banking fees.

The Disadvantages to Consider

Despite the many pros, using a prepaid card with an IBAN for salary deposits also has some limitations and disadvantages. It is essential to be aware of them to make an informed choice that suits your financial needs, which can evolve over time.

Operational Limits and Ceilings

The main disadvantage lies in the operational limits. Prepaid cards often have a ceiling, which is a maximum amount of money they can hold, and annual top-up limits. These caps, which can range from a few thousand up to €50,000, may not be suitable for those with high salaries or who need to manage large sums. Additionally, there are daily and monthly limits for withdrawals and payments. Another aspect not to be underestimated is the lack of ancillary services typical of a bank account, such as the ability to request a checkbook, access lines of credit (overdraft), or subscribe to investment products.

Garnishability and Security

A common mistake is to believe that funds deposited on a prepaid card are safe from legal action. In reality, cards with an IBAN are just as garnishable as a bank account. As traceable instruments registered in the Financial Relationships Registry, the funds are subject to the same third-party garnishment procedures in case of debt. However, the law provides protections: if a salary is credited to the card, the garnishment cannot affect the entire amount but is subject to specific limits to guarantee a minimum living wage for the debtor. Regarding security, although the risk in case of theft or cloning is limited to the loaded amount, it is essential to take the same precautions as with a normal payment card, such as activating transaction notifications and blocking it immediately in case of problems. For greater protection, it is useful to know the procedures related to the ISEE declaration and tax monitoring of the cards.

Prepaid Card with IBAN vs. Traditional Bank Account

The choice between a prepaid card with an IBAN and a traditional bank account essentially depends on personal needs and the complexity of one’s financial life. The card account is ideal for those looking for an agile, low-cost solution focused on basic operations: receiving a salary, paying bills, making purchases, and managing everything from an app. It’s perfect for young people, those with modest incomes, or those who want a separate tool to manage specific expenses without the complexities and costs of a full bank account.

The bank account, on the other hand, remains the necessary choice for those with more structured needs. It offers unlimited operations, the ability to access financing, mortgages, credit cards with high limits, and investment products. Many banks offer accounts with no monthly fees if you have your salary direct-deposited, making them competitive. However, they involve more bureaucracy and ancillary costs, such as stamp duty. In summary, the prepaid card wins for simplicity and economy, while the bank account prevails for completeness and advanced services. Knowledge of the legal implications, such as the garnishability of a card with an IBAN, is crucial for both options.

In Brief (TL;DR)

Find out if getting your salary on a prepaid card with an IBAN is really worth it by analyzing all the pros and cons of this alternative to a traditional bank account.

This solution offers a low-cost alternative to traditional bank accounts, but it has some important limitations to consider before choosing it.

We will delve into every aspect, from costs to usage limits, to help you understand if receiving your salary on a prepaid card is the right choice for your needs.

Conclusions

Choosing to have your salary deposited onto a prepaid card with an IBAN represents an excellent compromise between innovation and tradition, particularly suited to the Italian context. It offers a concrete response to the need for traceable payment methods, as required by current regulations, combining digital flexibility with low management costs. This solution proves to be a winner for a wide range of users: from young workers entering the financial world for the first time, to those who want stricter control over their budget, to those looking for a simple, no-frills alternative to a traditional bank account.

However, it is crucial to be aware of its limitations. Top-up and spending ceilings, the absence of complex financial services like loans or investments, and the garnishability of funds are aspects to be carefully evaluated. The final decision will therefore depend on a careful analysis of one’s spending habits and future needs. If the goal is daily salary management with simplicity and low costs, the card with an IBAN is a modern and smart choice. For more complex needs, a traditional bank account, perhaps optimized with solutions like Postepay Evolution for recurring payments, remains an irreplaceable tool.

Frequently Asked Questions

Yes, it is perfectly legal. To combat tax evasion, Italian law requires salaries to be paid through traceable methods. A prepaid card with an IBAN fully qualifies as one of these methods, as it allows you to receive wire transfers just like a bank account. The important thing is that the card is registered in the worker’s name.

Prepaid cards with an IBAN offer high security standards, often comparable to those of a bank account, with protection systems for online purchases and transaction notifications. A potential advantage is that, since they are not directly linked to an account holding all your savings, the risk in case of fraud or cloning is generally limited only to the amount loaded onto the card itself.

If the salary amount exceeds the card’s maximum top-up limit, the employer’s wire transfer will be rejected, and the sum will be returned. It is therefore essential, before providing your IBAN, to carefully check the top-up limits and the maximum balance allowed by the chosen card to ensure they are adequate to receive your monthly income without issues.

Yes, funds credited to a prepaid card with an IBAN can be garnished, just like those in a bank account. As a registered and traceable financial instrument, it is among the assets that can be seized by creditors according to third-party garnishment procedures. The rules and limits applied to salary garnishment are the same as those for bank and postal accounts.

A prepaid card with an IBAN offers many of the functionalities of a bank account, such as receiving your salary, sending and receiving wire transfers, paying bills, and making purchases. However, there are differences: for example, with a card account, you usually cannot have a checkbook, apply for overdrafts or loans, and there may sometimes be limitations on setting up direct debits for all utilities (SEPA Direct Debit).

Still have doubts about Salary on a Prepaid Card: Is It Worth It? Pros and Cons Explained Simply?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.