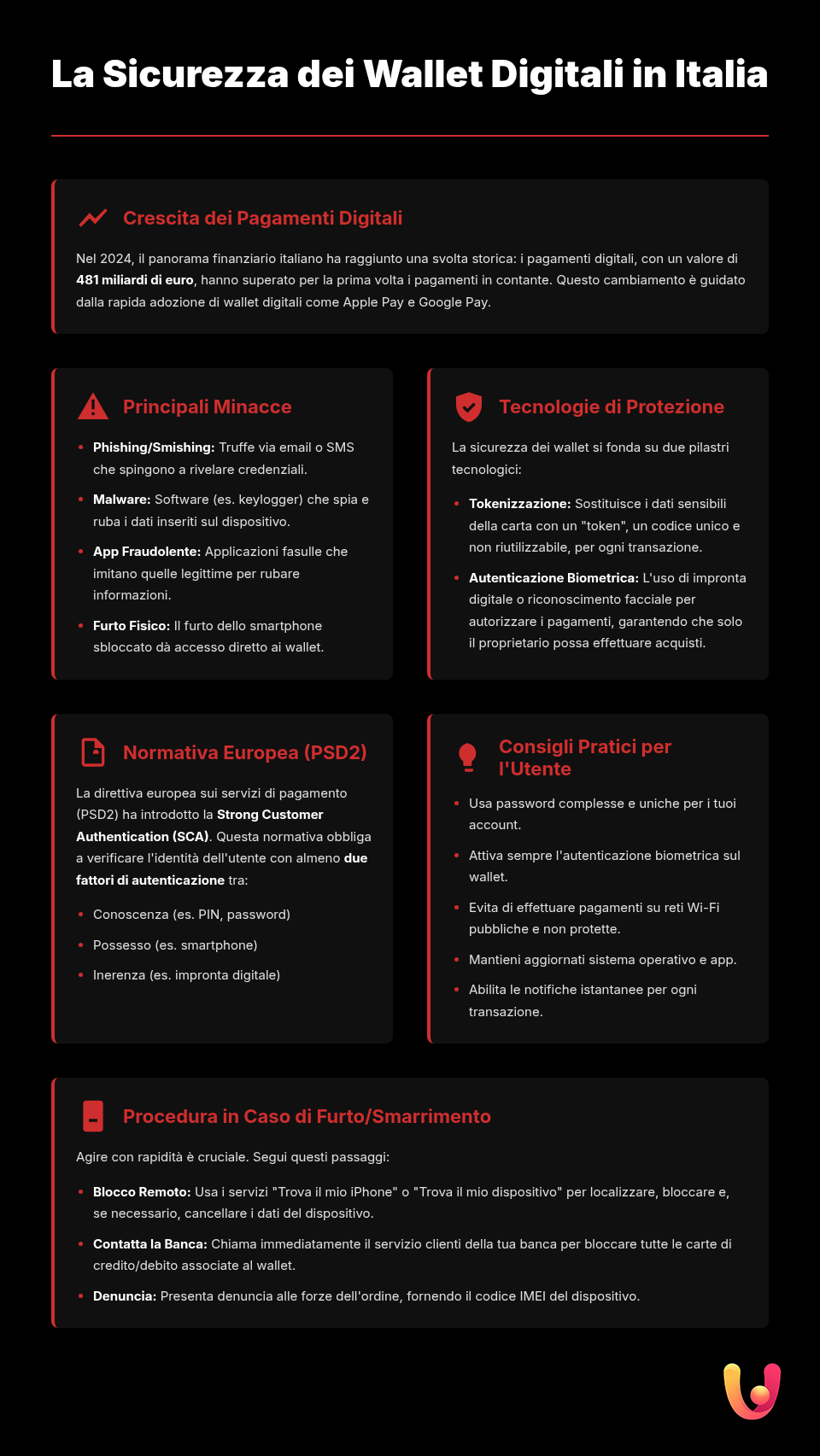

In the digital age, the smartphone has become our wallet. Mobile payment apps have transformed how we manage money, offering unprecedented convenience. In Italy, a country where tradition constantly meets innovation, the adoption of these tools is booming. In 2024, for the first time, digital payments surpassed cash, reaching 481 billion euros and accounting for 43% of total consumption. This monumental shift, led by digital wallets like Apple Pay, Google Pay, and Samsung Pay, brings new security challenges. Protecting your digital wallet has become as important as safeguarding your physical one.

The growing popularity of smartphone payments, which saw a 53% increase in 2024, highlights a significant cultural transition. Italians, while maintaining a strong connection to traditional habits, are confidently embracing new technologies. However, this evolution exposes users to new cyber risks, such as malware and phishing, which aim to steal sensitive data and money. Understanding the threats and adopting the right countermeasures is essential to fully leverage the benefits of mobile payments, combining the convenience of innovation with the peace of mind of solid protection. This article serves as a comprehensive guide to safely navigating the world of digital wallets.

The Mobile Payment Landscape in Italy and Europe

The digital payments market in Italy is experiencing unprecedented growth, marking a turning point in consumer habits. In 2024, the value of digital transactions reached 481 billion euros, surpassing cash for the first time. An emblematic figure of this transformation is the 53% increase in innovative payments via smartphones and wearable devices, which reached 56.7 billion euros. This trend is not isolated but is part of a broader European push towards the digitalization of payments, also promoted by regulations like PSD2 (Payment Services Directive 2). The directive aims to strengthen security and promote innovation, creating a single, competitive market.

In this context, Mediterranean culture, often perceived as more tied to tradition and cash, is showing a remarkable ability to adapt. The exponential increase in contactless payments, which account for nearly 90% of in-store card transactions, attests to a growing familiarity and trust in new technologies. The challenge for consumers and businesses now is to balance this rapid innovation with an equally strong awareness of security-related issues, to build a digital payment ecosystem that is not only efficient but, above all, safe and reliable for everyone.

The Hidden Risks in Your Digital Wallet

The convenience of digital wallets hides potential pitfalls that every user should know to defend themselves effectively. One of the most common threats is phishing and smishing, techniques where scammers, through fraudulent emails or SMS messages, try to trick the victim into revealing login credentials or financial data. These messages often mimic communications from banks or legitimate service providers, creating an illusion of authenticity that is hard for an untrained eye to detect. It is crucial to learn how to recognize these fraud attempts to protect your account, as explained in our guide on phishing and smishing.

Another significant risk is related to malware, malicious software that can infect a smartphone and intercept sensitive data. Some malware, known as keyloggers, can record everything typed on the keyboard, including PINs and passwords for payment apps. There are also fake apps, disguised as useful tools, that actually aim to empty linked accounts. Finally, the risk associated with physical access to the device should not be underestimated: if an inadequately protected smartphone is stolen or lost, criminals could have free access to the digital wallet. Awareness of these threats is the first step toward effective defense.

The Technologies Defending Your Payments

To counter the risks associated with digital payments, advanced security technologies have been developed to protect transactions at multiple levels. One of the most important is tokenization. When you register a card in a wallet like Apple Pay or Google Pay, the actual card number is not stored on the device or transmitted to the merchant during payment. Instead, a “token” is generated—a unique, random numerical code that identifies that specific transaction. This process makes the card data useless to fraudsters, even if they manage to intercept it. To better understand how this technology ensures secure purchases, you can consult our guide on smartphone payment security.

Another pillar of security is biometric authentication. Facial recognition (Face ID) or fingerprint scanning (Touch ID) adds a personal and hard-to-replicate layer of protection. To authorize a payment, it’s not enough to have the phone; you must prove you are the legitimate owner through your unique physical characteristics. This measure, combined with tokenization, creates a robust barrier against unauthorized access. These technologies work in synergy to ensure that every payment is not only fast and convenient but also extremely secure.

European Regulation: The PSD2 Directive

The security of digital payments in Europe is heavily regulated by the Payment Services Directive 2 (PSD2), a regulation that has revolutionized the sector. The main goal of PSD2 is to increase consumer protection, promote innovation, and make online payments more secure. One of the key elements introduced is Strong Customer Authentication (SCA). SCA requires that for most electronic transactions, the user’s identity must be verified using at least two of the following three factors: knowledge (something only the user knows, like a password or PIN), possession (something only the user has, like their smartphone), and inherence (something the user is, like a fingerprint or facial recognition).

This regulation has a direct impact on the daily user experience, as it strengthens defenses against fraud. For example, when making an online purchase, it is no longer sufficient to just enter card details; further confirmation is required via the bank’s app or a code sent by SMS. PSD2 also introduced the concept of “Open Banking,” allowing authorized third-party providers (TPPs) to access bank account data, with the customer’s consent, to offer innovative financial services. This regulatory framework creates a more competitive and secure environment where consumer trust is central.

Practical Tips for a Hacker-Proof Wallet

Technology offers powerful protection tools, but the first line of defense is always the user. Adopting good habits is essential to ensure the security of your digital wallet. First and foremost, it is crucial to use complex and unique passwords for each service and, especially, for unlocking your smartphone. Always enable biometric authentication, such as fingerprint or facial recognition, for accessing the device and individual payment apps. This simple action makes it nearly impossible for a thief to access your funds if your phone is stolen.

Another golden rule is to be wary of public Wi-Fi networks for making financial transactions. These networks are often insecure and can be exploited by malicious actors to intercept data. If you need to make a payment and have no alternative, use your mobile carrier’s data connection. It is also crucial to always keep the phone’s operating system and applications updated. Updates often contain important security patches that fix newly discovered vulnerabilities. Finally, enable notifications for every transaction: this way, you will be alerted in real-time to any suspicious activity on your account and can act promptly. If a transaction seems suspicious, you can learn more by reading our guide on how to handle suspicious charges.

What to Do if Your Smartphone is Lost or Stolen

Losing or having your smartphone stolen can cause panic, especially if you use a digital wallet. However, by acting quickly and clearly, you can secure your funds. The first action to take is to try to locate and lock the device remotely. Both Android (“Find My Device”) and iOS (“Find My”) offer free tools that not only let you see the phone’s location on a map but also lock it with a code and display a custom message on the screen. If you believe the device is unrecoverable, you can use the same feature to remotely erase all data, thus protecting your privacy and financial information.

At the same time, it is essential to immediately contact your bank or the issuer of the cards registered in the wallet to block them. Even though tokenization offers a high level of security, a preventive block is an indispensable precautionary measure. Inform the operator that the cards were associated with a digital wallet on a stolen device. Many banks offer quick procedures via app or toll-free number for these emergencies. Finally, file a theft report with law enforcement. This document is crucial not only for any insurance matters but also for disputing any fraudulent transactions that might occur despite the precautions taken.

In Brief (TL;DR)

With the growing popularity of mobile payment apps, it’s crucial to know the best strategies to protect your digital wallet, securing your funds from fraud and unauthorized access.

We will explore best practices, from using biometric authentication to properly managing app permissions, to ensure maximum protection.

We will delve into how using strong passwords, biometric authentication, and careful management of app permissions are essential for preventing fraud and unauthorized access.

Conclusions

The advent of digital wallets marks a fundamental stage in the evolution of payments, combining technological innovation and cultural change. The fact that digital payments surpassed cash in Italy in 2024 is not just a statistic, but a symbol of a transition towards a more connected and efficient future. Technologies like tokenization and biometric authentication, supported by a solid European regulatory framework like PSD2, provide the foundation for a secure payment ecosystem. However, absolute security does not exist, and the ultimate responsibility lies with the user. Awareness of risks, such as phishing and malware, and the adoption of simple but effective security habits are crucial. Protecting your digital wallet requires a proactive approach: updating devices, using strong passwords, and monitoring transactions are simple actions that make a big difference. Embracing innovation responsibly is the key to fully enjoying the benefits of an increasingly cashless world without compromising your financial security.

Frequently Asked Questions

Generally, paying with a mobile payment app like Apple Pay or Google Pay is considered safer. This is because the apps use a technology called ‘tokenization,’ which replaces your actual card data with a unique digital code for each transaction. This way, your card number is never stored on the device or shared with the merchant. Additionally, every payment requires biometric authentication (fingerprint or facial recognition) or a PIN, adding another layer of protection.

If your smartphone is lost or stolen, the first thing to do is immediately contact your bank to block the credit and debit cards associated with the digital wallet. Next, use the ‘Find My Device’ feature (for Android) or ‘Find My’ (for iPhone) from another device to locate, lock, or, if necessary, remotely erase all data from the phone. Finally, file a theft or loss report with law enforcement.

Both Apple Pay and Google Pay are considered very secure and use high protection standards, such as tokenization and multi-factor authentication. The main difference lies in how they handle data: Apple Pay does not store the full card number, while Google Pay encrypts all card data on its servers. Both systems require authentication on your device to authorize transactions, preventing a hacker from using your payment methods even if your Google or Apple account were compromised.

It is not recommended to use payment apps on unsecured public Wi-Fi networks, as they could expose your data to risks like ‘man-in-the-middle’ attacks. If you need to make a transaction and have no alternative, it is preferable to use your mobile data connection. Alternatively, using a VPN (Virtual Private Network) can encrypt your connection, making transactions safer even on public networks.

Biometric authentication adds a crucial layer of security because it is based on unique physical characteristics that are difficult to replicate or steal. Unlike a PIN, which can be spied on, a fingerprint or facial recognition confirms that it is actually you authorizing the payment. This system, combined with tokenization, creates a dual barrier of protection that makes mobile transactions extremely secure.

Still have doubts about Secure Digital Wallet: A Guide to Protecting Your Money?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.