In Brief (TL;DR)

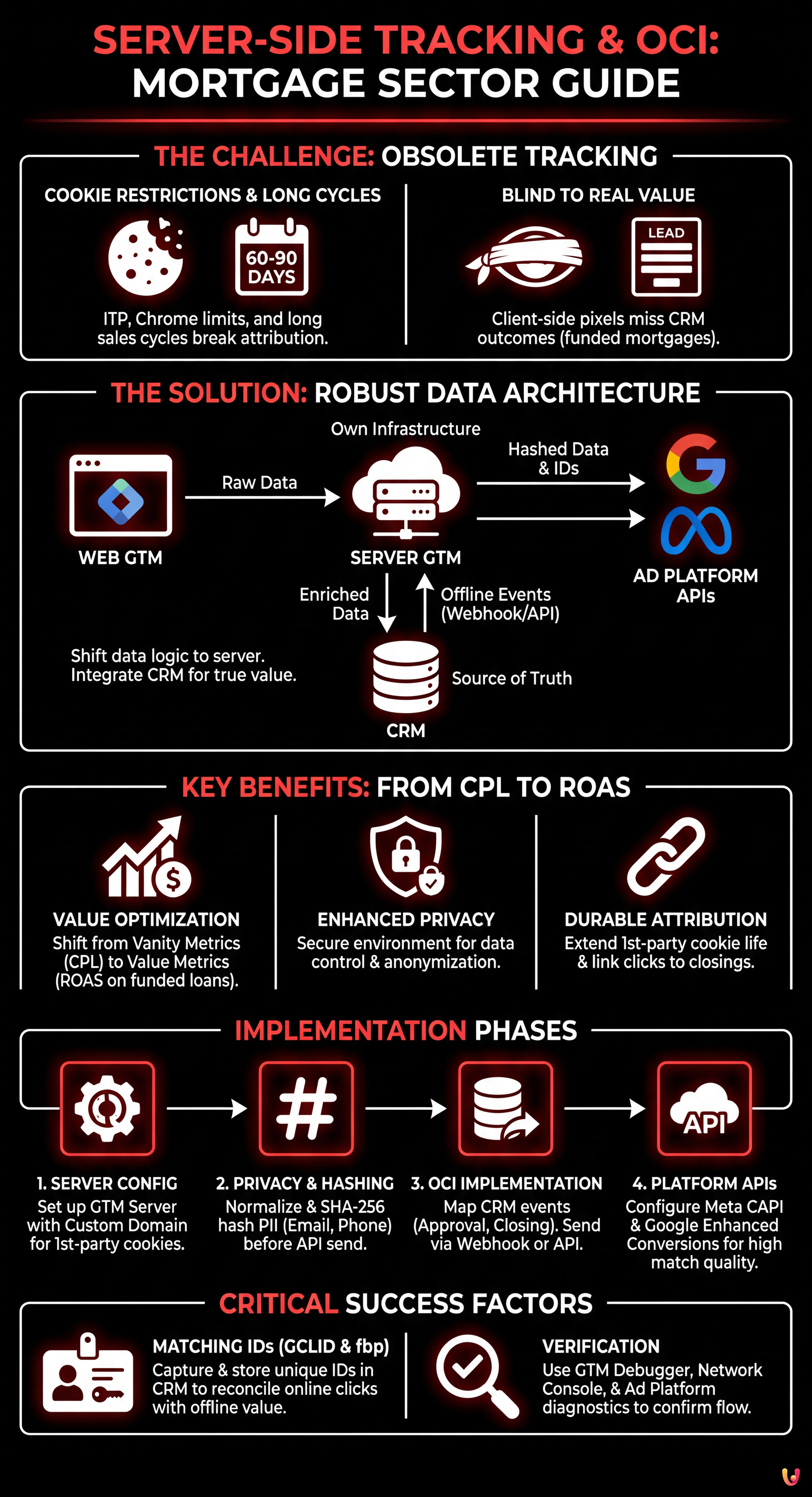

Server-side tracking is now indispensable to bypass cookie restrictions and correctly track long sales cycles.

Correct GTM Server-side configuration ensures sensitive data security via hashing and cookie duration extension.

OCI integration unites CRM data with ads campaigns, shifting focus from simple leads to actually disbursed mortgages.

The devil is in the details. 👇 Keep reading to discover the critical steps and practical tips to avoid mistakes.

In the financial digital marketing landscape of 2026, relying exclusively on cookie-based tracking is an obsolete and risky strategy. With increasingly stringent restrictions from Safari’s ITP (Intelligent Tracking Prevention), the disappearance of third-party cookies on Chrome, and privacy regulations, server-side tracking has become the only acceptable standard for those operating in the mortgage sector. This technical guide explores how to implement a robust data architecture using Google Tag Manager (GTM) Server-side and Offline Conversion Import (OCI) to link actual mortgage disbursement to advertising campaigns.

Why Server-Side Tracking is Vital for Mortgages

The credit brokerage sector presents a long and complex sales cycle. A user who fills out a form today might finalize the closing in 60 or 90 days. Traditional client-side tracking (browser pixels) fails in this scenario for two reasons:

- Cookie Duration: Modern browsers limit cookie duration to 7 days or less (in some cases 24 hours), interrupting attribution for long-term conversions.

- Blindness to Real Data: The pixel only sees the “Lead” (form submission) but does not know if that lead meets credit requirements, if the application has been processed, or if the mortgage has been funded.

By implementing server-side tracking, we move the data collection logic from the user’s device to a server we own (e.g., Google Cloud Platform). This allows us to extend cookie life (setting them as real first-party), protect user data, and, most importantly, integrate CRM data.

Data Architecture: From Click to Closing

The goal is to shift from optimization based on Vanity Metrics (CPL – Cost Per Lead) to one based on Value Metrics (ROAS on funded mortgages). To do this, we must build a bridge between the website, the CRM, and advertising platforms (Google Ads, Meta, TikTok).

Infrastructure Components

- GTM Web Container: Collects basic events and sends them to the Server Container instead of directly to Google/Facebook.

- GTM Server Container: Receives data, normalizes it, enriches information (e.g., PII hashing), and routes it to advertising platform APIs.

- CRM (Salesforce, HubSpot, Custom): The source of truth that records the application progress status.

- Data Warehouse / Middleware: An intermediate layer (optional but recommended) to manage OCI event queues.

Phase 1: GTM Server-Side Configuration

Assuming you already have a Google Cloud Platform (GCP) account or a hosting service like Stape.io, the first step is to configure the client to receive data.

GA4 Client Configuration

In the Server container, the GA4 Client is the standard entry point. Ensure you configure your GA4 tag in the Web container to send data to your tracking server URL (e.g., tracking.yourdomain.com) and not to Google Analytics servers.

Best Practice: Use a custom subdomain (Custom Domain) that matches the main site domain. This allows setting HttpOnly and Secure cookies that browsers recognize as proprietary, bypassing many ITP limitations.

Phase 2: Privacy Management and PII Hashing

In the mortgage sector, we handle sensitive data. When sending data to conversion APIs (Meta CAPI or Google Enhanced Conversions), we must NEVER send emails or phone numbers in plain text. Server-side tracking allows us to manage anonymization in a secure environment before data leaves our infrastructure.

Normalization and SHA-256 Hashing

Before sending user data (necessary for matching), it must be normalized (remove spaces, all lowercase) and then encrypted with the SHA-256 algorithm. Here is a logical example of how to treat data on the server:

// Conceptual example of data treatment Input Email: " Mario.Rossi@Email.it " Normalization: "mario.rossi@email.it" SHA-256 Hashing: "e3b0c44298fc1c149afbf4c8996fb92427ae41e4649b934ca495991b7852b855" Output to API: Send only the hashed string

In GTM Server-side, use built-in variables or custom templates to perform this hashing automatically before the tag (e.g., Meta CAPI Tag) sends the payload.

Phase 3: OCI (Offline Conversion Import) Implementation

This is the critical phase for the mortgage sector. We must signal to advertising platforms when a lead changes status in the CRM.

Mapping Conversion Events

Do not limit yourself to tracking “Lead Submitted”. Configure the following standard events in your system:

- Qualified Lead (MQL): The contact is real and reachable.

- Application Processed: The user has submitted income documents.

- Income Approval: The bank has given preliminary approval (high value).

- Mortgage Disbursed (Closing): Final conversion (maximum value).

Technical Integration CRM -> GTM Server

There are two main methods to send these offline events:

Method A: Webhook from CRM (Real-time)

Configure your CRM to send a webhook to your GTM Server Container URL every time a lead status changes. The JSON payload should include:

event_name: e.g., “mortgage_disbursed”match_keys: Hashed Email, Hashed Phone, and especially thegclid(Google Click ID) orfbp(Facebook Browser ID) that you saved in the CRM when the lead was created.value: The economic value of the conversion (e.g., brokerage commission).currency: “EUR”.

Method B: API Upload (Batch)

If real-time is not possible, create a script that extracts updated files daily and sends them to Google Ads and Meta CAPI APIs. However, the server-side method via webhook is preferable for the timeliness of bidding signals.

Phase 4: Platform API Configuration

Meta Conversions API (CAPI)

In GTM Server, use the official “Facebook Conversions API” tag. Map the data received from the CRM or Web. It is crucial to send the fbp and fbc (click ID) parameters to ensure an Event Match Quality greater than 8.0. Without these parameters, Meta will fail to attribute the disbursed mortgage to the campaign that generated the lead months earlier.

Google Ads Enhanced Conversions for Leads

For Google, the key is the GCLID. Ensure that every form on your site captures the GCLID parameter from the URL and saves it in a hidden field in the CRM. When the mortgage is disbursed, the GTM Server will send a conversion event to Google Ads containing that GCLID and the conversion value. This allows Smart Bidding strategies like tROAS (Target ROAS) to function correctly.

Troubleshooting and Verification

Once server-side tracking is implemented, verify its operation:

- GTM Preview Mode: Use the server container debugger to see Incoming Requests and Outgoing Requests tags. Verify that PII data is hashed correctly.

- Network Console: Check that calls originate from your subdomain and return status 200.

- Ads Platforms: After 24-48 hours, check the conversion status. On Google Ads, check the “Diagnostics Status” column for offline conversions. On Meta, check the “Events Manager” panel to see deduplication between browser and server events.

Conclusions: Business Impact

Adopting server-side tracking and OCI in the mortgage sector is not just a technical update; it is a structural competitive advantage. By moving from a model that optimizes for “clicks” to one that optimizes for “closings”, companies typically see an increase in lead quality and a reduction in real customer acquisition cost (CAC). In a saturated market, the ability to feed AI algorithms with real business data (profits) instead of proxies (form fills) is what defines market leaders in 2026.

Frequently Asked Questions

The mortgage sales cycle often lasts between 60 and 90 days, a period that widely exceeds the standard cookie duration of modern browsers, often limited to 7 days or less. Server-side tracking allows extending cookie life by setting them as first-party and linking CRM data to advertising platforms, ensuring conversions are correctly attributed to the original campaign even months after the initial click.

Offline Conversion Imports (OCI) allow sending value signals to advertising platforms based on real events recorded in the CRM, such as income approval or closing, rather than simple online form submission. This process trains Smart Bidding algorithms to look for users similar to those who actually obtain the mortgage, shifting optimization from vanity metrics like CPL to value metrics like ROAS.

It is fundamental never to send plain text personal data (PII) to external platforms. Sensitive information like emails and phone numbers must be normalized and encrypted using the SHA-256 hashing algorithm within the proprietary server before being transmitted. This ensures that matching with Meta and Google APIs occurs in a secure environment compliant with privacy regulations.

These unique identifiers are essential for reconciling online activity with offline events. The GCLID for Google and fbp for Meta must be captured at the moment of the click and saved in the CRM along with lead data. When mortgage disbursement occurs, the server uses these codes to attribute the economic value of the conversion to the specific campaign that generated the contact months earlier, allowing for a precise calculation of return on investment.

Configuring a custom subdomain (for example tracking.yourdomain.com) allows setting real and secure first-party cookies. This technical approach is crucial for bypassing Intelligent Tracking Prevention (ITP) restrictions in Safari and other privacy-oriented browsers, making tracking much more resilient and durable compared to using default domains provided by cloud hosting services.

Did you find this article helpful? Is there another topic you'd like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.