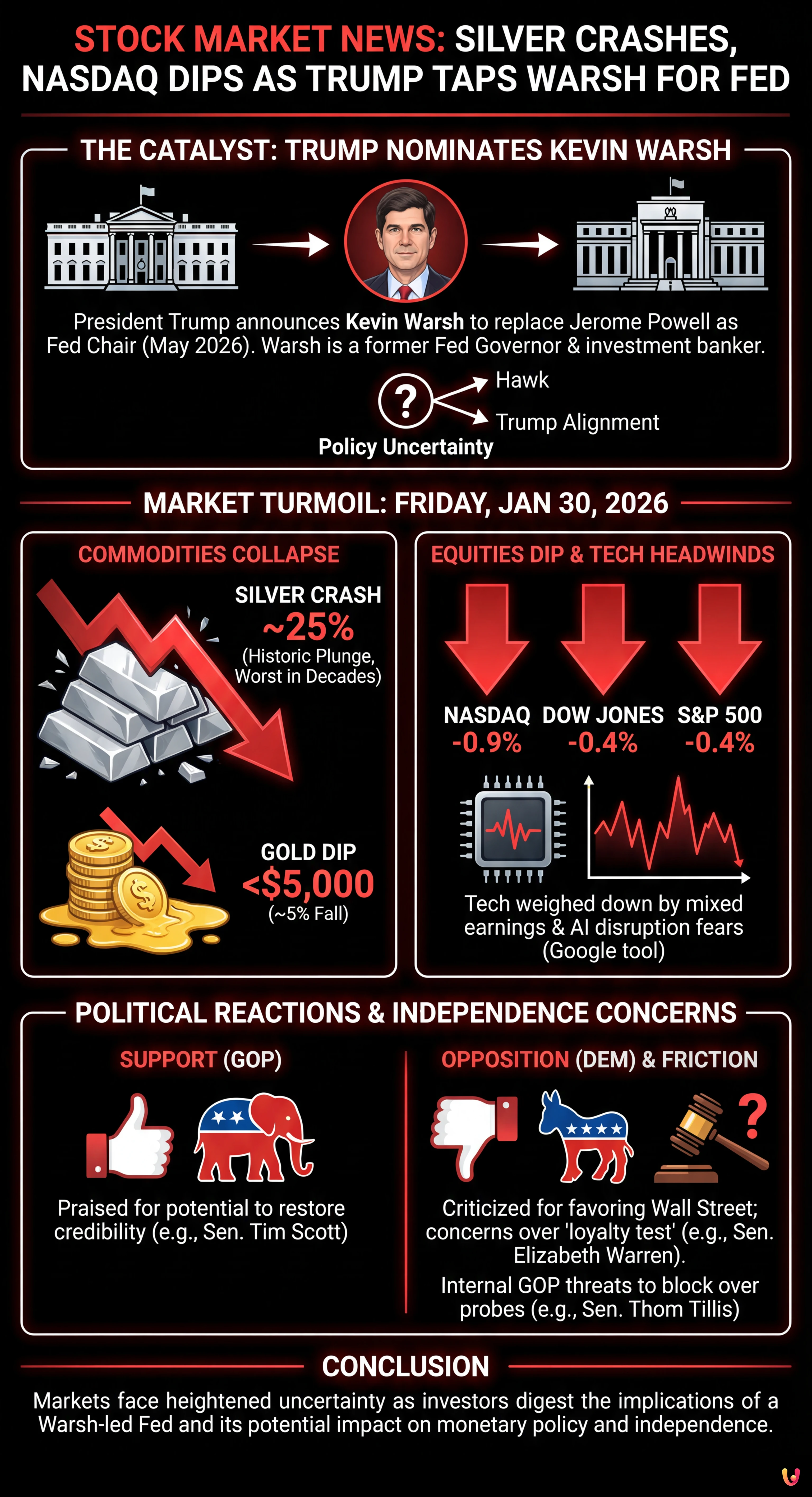

New York – The financial markets closed a volatile week on a sour note this Friday, January 30, 2026, as investors reacted sharply to President Donald Trump’s announcement of his pick for the next Federal Reserve Chair. The nomination of former Federal Reserve Governor Kevin Warsh to replace Jerome Powell sparked a significant selloff in commodities, with silver suffering a historic plunge, while the Nasdaq Composite and other major indices finished in the red.

The trading session was defined by uncertainty and a rapid unwinding of speculative positions. While equity futures initially showed a muted reaction, sentiment soured throughout the day. By the closing bell, the technology-heavy Nasdaq Composite had fallen 0.9%, while the Dow Jones Industrial Average and the S&P 500 both shed 0.4%, according to data from MarketWatch. However, the most dramatic action was seen in the precious metals market, where silver prices crashed, marking their worst single-day performance in decades.

Kevin Warsh Nominated to Replace Powell

President Trump officially announced Kevin Warsh as his nominee to chair the Federal Reserve, a move that would see Warsh replace current Chair Jerome Powell when his term expires in May 2026. Warsh, a former investment banker who served on the Fed’s Board of Governors during the 2008 financial crisis, has been a vocal critic of the central bank’s recent policies.

According to PBS News, the nomination comes after an unusually public search. While Warsh has historically been viewed as a “hawk”—favoring tighter monetary policy—he has recently expressed support for the administration’s economic agenda, which includes deregulation and tax cuts. This pivot has left Wall Street struggling to decipher his potential policy stance. “The market reaction to the Fed chair nomination suggests widespread belief that Warsh is a hawkish nominee and will be slow to cut rates,” noted a discussion on market sentiment, though others argue his views now align more closely with the President’s desire for lower borrowing costs.

Commodities Collapse: Silver and Gold Plunge

The most violent market reaction occurred in the commodities sector. Silver prices plummeted, with Finviz reporting a crash of up to 25% in what some analysts described as the metal’s “biggest drop in 46 years.” The selloff was not limited to silver; gold also faced heavy selling pressure, sinking below the $5,000 mark and falling nearly 5%.

Analysts attribute this massive drop to a “double-whammy” of profit-taking and shifting expectations regarding inflation and interest rates. “Precious metals, which had been on a tear in recent months, remain sharply lower,” reported PBS News. The sharp reversal suggests that the “speculative silver trade” that had driven prices to record highs is rapidly unwinding as investors reassess the likelihood of aggressive rate cuts under a Warsh-led Fed.

Tech Stocks and Earnings Weigh on Nasdaq

In the equity markets, the technology sector faced significant headwinds. The Nasdaq’s 0.9% decline was driven by a combination of the Fed news and mixed reactions to a slew of earnings reports from tech giants. According to market reports, investors have been digesting results from companies like Apple, Microsoft, and Meta Platforms. While some earnings prompted individual stock gains, the overall sentiment remained “risk-off.”

Adding to the pressure on the tech sector were specific industry developments. Video game stocks slid following reports of a new Google AI tool capable of generating “playable worlds,” which investors fear could disrupt the traditional gaming industry model. Meanwhile, MarketWatch cited Dominic Pappalardo, chief multi-asset strategist at Morningstar Wealth, who observed that “the immediate market reaction in U.S. equities was muted early this morning,” but futures eventually moved lower as the reality of the nomination set in.

Political Reactions and Independence Concerns

The nomination has ignited a fierce debate in Washington regarding the independence of the Federal Reserve. Senator Tim Scott, the Republican chair of the banking committee, praised the choice, stating, “Federal Reserve independence remains paramount, and I am confident Kevin will work to instill confidence and credibility in the Fed’s monetary policy.”

Conversely, Democrats have voiced strong opposition. Senator Elizabeth Warren criticized the pick, asserting that Warsh “cared more about helping Wall Street after the 2008 crash than millions of unemployed Americans” and has “apparently passed the loyalty test.” Furthermore, the nomination faces potential hurdles from within the President’s own party; Senator Thom Tillis has threatened to block the nomination unless the Department of Justice drops an ongoing probe into current Chair Jerome Powell.

In Brief (TL;DR)

President Trump shook financial markets by nominating former Governor Kevin Warsh to replace Jerome Powell as the next Federal Reserve Chair.

Commodities faced a historic rout as silver prices crashed significantly while gold fell below the five thousand dollar mark.

Major indices finished in the red with the Nasdaq leading declines as investors reassessed the likelihood of future rate cuts.

Conclusion

As the markets close on this tumultuous Friday, the path forward remains clouded with uncertainty. The combination of a new Federal Reserve nominee with a complex policy history, a historic crash in silver prices, and ongoing volatility in the tech sector suggests that investors are bracing for a shifting economic landscape. With confirmation hearings on the horizon and inflation concerns lingering, Wall Street will be closely watching Kevin Warsh’s next moves to gauge the future direction of U.S. monetary policy.

Frequently Asked Questions

Kevin Warsh is a former Federal Reserve Governor and investment banker selected by President Donald Trump to replace Jerome Powell when his term expires in May 2026. His nomination stems from his alignment with the administrations economic agenda, including deregulation and tax cuts. Although historically viewed as a policy hawk favoring tighter monetary control, his recent pivot toward supporting lower borrowing costs has made him a leading choice, despite concerns from Wall Street regarding his future stance on interest rates.

The commodities market experienced a historic selloff due to shifting expectations regarding inflation and interest rates under a potential Warsh led Federal Reserve. Silver plummeted by approximately 25 percent, marking its worst single day performance in decades, while gold sank below the 5,000 dollar mark. Analysts attribute this collapse to a combination of profit taking after recent highs and the unwinding of speculative trades as investors anticipate a potentially slower pace of rate cuts.

Major US indices finished in the red as volatility increased throughout the trading session. The tech heavy Nasdaq Composite declined by 0.9 percent, while both the Dow Jones Industrial Average and the S&P 500 fell by 0.4 percent. The market sentiment shifted to risk off as investors digested the implications of the new Fed nominee alongside mixed earnings reports from major technology companies like Apple and Microsoft.

The nomination has sparked debate in Washington about the political neutrality of the central bank. While Republican supporters believe Warsh will restore credibility to monetary policy, critics like Senator Elizabeth Warren argue he may prioritize Wall Street interests over the general public. Additionally, internal political friction exists, with some senators threatening to block the confirmation unless specific legal probes into current Chair Jerome Powell are dropped, adding a layer of uncertainty to the transition.

Beyond the macroeconomic news regarding the Federal Reserve, the gaming sector faced specific headwinds due to developments in artificial intelligence. Reports of a new Google AI tool capable of generating playable worlds caused anxiety among investors, who fear this technology could disrupt traditional business models in the video game industry. This specific fear contributed to the broader decline in the technology sector during the volatile trading session.

Did you find this article helpful? Is there another topic you'd like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.