Realizing your wallet is gone is a blood-curdling experience. Your first thought rarely goes to the cash, but to your cards. Debit card, credit card, prepaid card: tools we use every day that can turn into a serious problem in the wrong hands. Whether it’s due to a moment of distraction at a café or the skill of a pickpocket, the result is the same: a wave of panic and the pressing question, “Now what do I do?”. The answer is simple: act. And act fast. This guide is designed to walk you through the blocking and reporting procedures step by step, calmly and clearly, turning a moment of crisis into a manageable and solvable problem.

Italy, with its vibrant Mediterranean culture, blends tradition and innovation even in how we manage money. While the habit of using cash is still deeply rooted, digital payments have become an integral part of our daily lives. This duality makes it even more important to know how to protect our electronic payment methods. Losing a card doesn’t just mean losing money; it means exposing yourself to risks like identity theft and complex fraud. Fortunately, technology and regulations, such as the European PSD2 directive, offer a solid protective shield. Knowing the right steps to take is the first, crucial step to ensuring your security and peace of mind.

The Importance of Acting Immediately

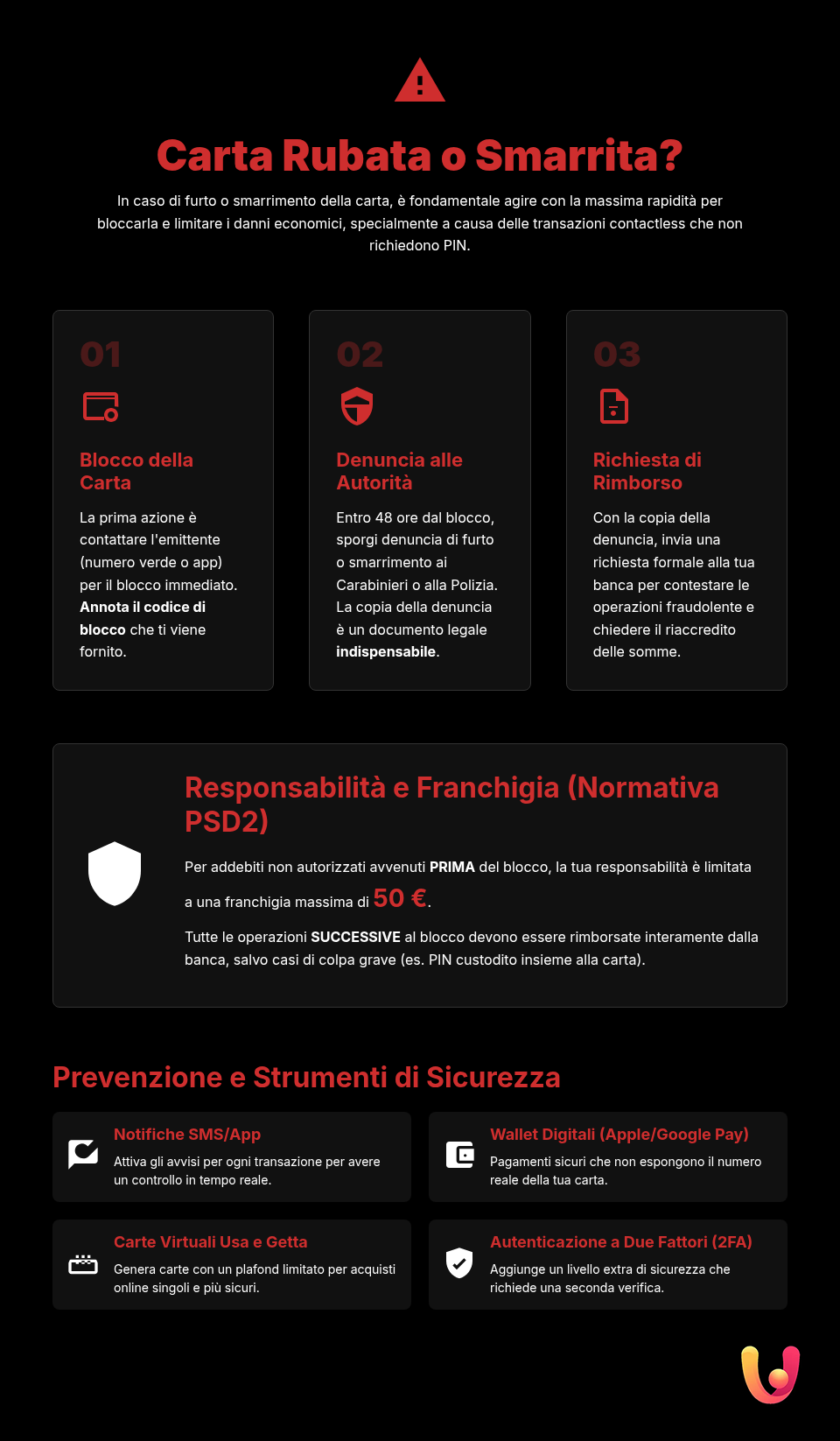

When you realize your card is missing, every minute is precious. Criminals act quickly, taking advantage of the time between the loss and the block to make purchases, especially online or with contactless technology. The latter, while convenient, allows transactions below a certain threshold without a PIN, making the first few moments after the theft extremely critical. Blocking the card is the only action that instantly stops any possibility of fraudulent use. Delaying this step means increasing the risk of financial loss and complicating subsequent refund procedures.

Step 1: Block the Card Immediately

The very first thing to do is contact your card issuer to request an immediate block. This action makes the card unusable for any transaction, both in-person and online. Once you’ve made the call and received a block confirmation code, your liability for any future fraudulent use ceases. It’s a decisive step that protects you from further financial damage. Many banks also offer the option to “suspend” the card via their app for 48 hours, a useful feature if you think you’ve only misplaced it and want some time to look for it before proceeding with a permanent block.

How to Find the Toll-Free Blocking Number

The toll-free number for blocking your card is a free service, available 24/7. It’s usually found on the back of the card itself, but obviously, you can’t check it if you’ve lost it. The alternatives are:

- Bank’s website: Every financial institution has a section dedicated to emergency contacts.

- Home Banking App: Modern banking apps allow you to block the card directly with a few taps or clearly display the numbers to call.

- Bank statements: The emergency number is often also listed on paper or digital documents sent by the bank.

- Bank’s website: Every financial institution has a section dedicated to emergency contacts.

- Home Banking App: Modern banking apps allow you to block the card directly with a few taps or clearly display the numbers to call.

- Bank statements: The emergency number is often also listed on paper or digital documents sent by the bank.

It’s a good habit to save these numbers in your phone’s contacts or write them down in a safe place, separate from your wallet.

- Bank’s website: Every financial institution has a section dedicated to emergency contacts.

- Home Banking App: Modern banking apps allow you to block the card directly with a few taps or clearly display the numbers to call.

- Bank statements: The emergency number is often also listed on paper or digital documents sent by the bank.

It’s a good habit to save these numbers in your phone’s contacts or write them down in a safe place, separate from your wallet.

Useful Numbers for Major Networks and Banks

To simplify your search during a stressful time, here is a list of the main toll-free numbers for blocking cards in Italy. Remember to always check your institution’s official website for the most up-to-date contacts, especially for calls from abroad.

- Bancomat Network: 800 822056

- Visa: 800 819014

- Mastercard: 800 870866

- American Express: 06 72900347

- Poste Italiane (Postepay): 800 003322 (from Italy) or +39 02 82443333 (from abroad)

- Intesa Sanpaolo: 800 303303 (from Italy) or +39 02 87109001 (from abroad)

- UniCredit: 800 575757 (for debit cards) and 800 078777 (for credit and prepaid cards)

- Nexi (CartaSì): 800 151616

What to Tell the Operator

When you call the blocking service, have the necessary information on hand to identify yourself. The operator will likely ask for your personal details (name, last name, date of birth, fiscal code), the card number if you know it, and may ask some security questions. At the end of the procedure, the operator will provide you with a block confirmation code. Write down this code, along with the date and time of the call: it will be essential for filing the report and for your refund request.

Step 2: File a Report with the Authorities

After blocking the card, the second mandatory step is to file a report of theft or loss. This formality must be completed within 48 hours of blocking the card at a Carabinieri station or a Polizia di Stato (State Police) precinct. The report is not just a bureaucratic act but a legal document that protects you from any liability for the fraudulent use of the card and is essential to initiate the process of disputing charges and obtaining a refund from your bank.

Where and How to File the Report

You can go in person to the nearest Police or Carabinieri station. To speed things up, both the Polizia di Stato and the Carabinieri offer an online reporting service (“Denuncia via web”). This system allows you to fill out most of the document online from home, and then you only need to go to the office to formalize the report with your signature and pick up the official copy. Remember to bring a valid ID and the block confirmation code provided by your bank. A copy of the report will need to be sent to your financial institution.

Step 3: Request a Refund for Fraudulent Transactions

With a copy of the report in hand, you can proceed to dispute any unauthorized transactions on your statement. The European consumer protection regulation, known as PSD2 (Payment Services Directive 2), sets clear rules to protect you in these cases. If you blocked the card promptly, your liability for fraudulent charges made before the block is limited to a maximum deductible of 50 euros. All amounts stolen after you report it must be fully refunded by the bank. The right to a refund is only waived in cases of fraud or gross negligence on the part of the cardholder, such as keeping the PIN with the card.

How to Send the Request to the Bank

To request a refund, you must send a formal communication to your bank, usually via registered mail with return receipt, Certified Electronic Mail (PEC), or by filling out a specific form at a branch (often called a “dispute form” or “fast claim”). You will need to attach the following to this request:

- A copy of the report filed with the police.

- A detailed list of all the transactions you do not recognize.

- The card’s block confirmation code.

- A copy of the report filed with the police.

- A detailed list of all the transactions you do not recognize.

- The card’s block confirmation code.

Once the bank receives the documentation, it will start its investigation and proceed to credit back the amounts owed. For a more specific guide on this topic, you can consult the article on how to handle unauthorized payments and request a refund.

- A copy of the report filed with the police.

- A detailed list of all the transactions you do not recognize.

- The card’s block confirmation code.

Once the bank receives the documentation, it will start its investigation and proceed to credit back the amounts owed. For a more specific guide on this topic, you can consult the article on how to handle unauthorized payments and request a refund.

Prevention: Tips for the Future

The experience of a theft or loss, however unpleasant, can teach a lot about prevention. Adopting a few simple habits can drastically reduce the risk of the incident happening again or having serious consequences. Caution is the best ally for security. Never keep your PIN with your card, avoid leaving it unattended, and periodically check your account activity to spot any anomalies right away. These small actions, combined with knowledge of modern tools, create a solid protective barrier.

Modern Security Tools

Technology today offers advanced solutions to protect our money. Activating SMS or app notifications for every transaction allows you to have real-time control over the use of your cards. Using digital wallets on your smartphone (like Apple Pay or Google Pay) adds another layer of security, thanks to tokenization, which doesn’t share the actual card number with the merchant. For online shopping, consider using disposable virtual cards, which limit the risk to a single purchase. Finally, always ensure your online accounts are protected by two-factor authentication (2FA), a crucial defense against unauthorized access.

In Brief (TL;DR)

This quick guide explains step by step how to block your payment card and file a report in case of theft or loss.

Here are the essential steps: block the card promptly and file a report with the proper authorities.

After blocking your card, find out how and where to file a report to protect yourself and request a new card.

Conclusion

Losing a payment card is an annoying inconvenience, but not a tragedy if you know how to act. The procedure to follow is clear and can be summarized in three fundamental steps: block the card immediately, file a report within 48 hours, and dispute the charges to request a refund. Speed is the key factor in limiting damages and asserting your rights, which are protected by European regulations designed to safeguard consumers. Remember that prevention is just as important: keeping your cards safe and using digital security tools are the best strategies for enjoying the convenience of electronic payments with complete peace of mind.

Frequently Asked Questions

If you don’t block your card promptly, the main risk is that criminals will use it to make purchases and withdrawals in your name. By law, losses from unauthorized transactions made before you report the block are your responsibility up to a maximum of 50 euros. However, if your gross negligence is proven (for example, if you kept your PIN with your card), you could be held liable for the entire amount stolen. Acting immediately is therefore essential to limit the damage.

Yes, most modern banks offer the ability to block your payment card directly through their mobile banking app. This is often the quickest and most convenient solution. Generally, in the section dedicated to cards, you’ll find an option for an immediate or temporary block. Alternatively, you can always use the toll-free number provided by the bank or go to a branch.

The online report, through the “Denuncia vi@ Web” service of the Carabinieri or Polizia di Stato, has a preliminary value. After filling out the online form, you will receive a code and must still go to the chosen station or precinct within 48 hours to formalize the report with your signature. The main advantage is a significant time saving, as the process will already be started and you will have a priority lane.

Once you have blocked the card, you are no longer responsible for any fraudulent use. For unauthorized transactions that occurred before the block, your liability is limited to a maximum of 50 euros, unless fraudulent behavior or gross negligence on your part is proven. After you file the report, the bank is required to refund the illegally withdrawn amounts.

The time and cost for reissuing a new card vary depending on the bank and the type of card. Generally, after filing a police report and sending a copy to the bank, you can request the new card. Delivery usually takes up to 15 days. Some institutions may charge a reissue fee, while for others it may be free. It is advisable to check the specific terms in your card agreement or contact your institution’s customer service directly.

Still have doubts about Stolen or Lost Card? A Guide to Blocking and Reporting It?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.