In Brief (TL;DR)

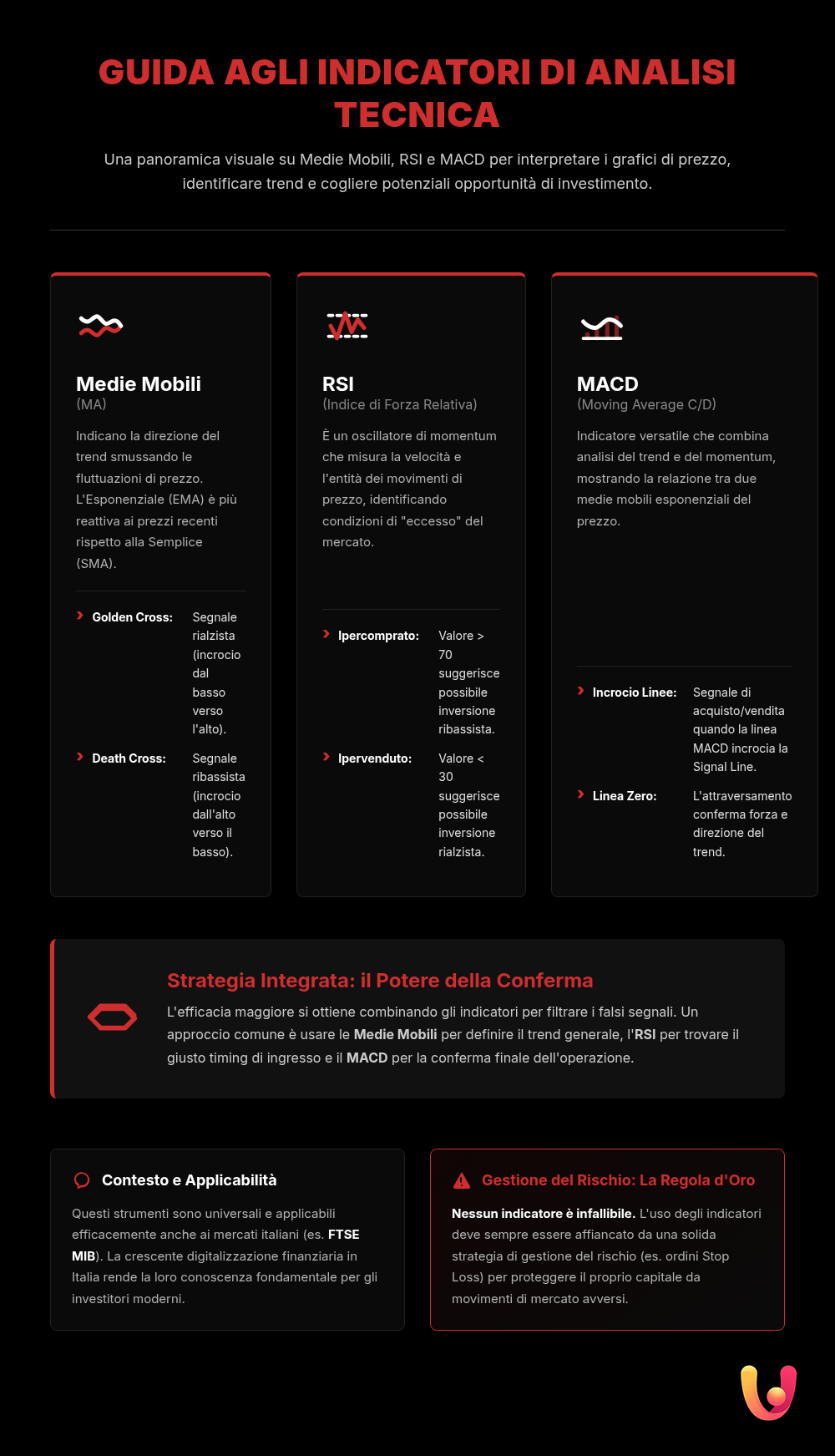

Learn how to use essential trading indicators, including RSI, MACD, and moving averages, to analyze markets and define effective investment strategies.

Discover how to use moving averages, RSI, and MACD to analyze market trends and make more informed trading decisions.

Mastering the combined use of these tools is key to developing more informed and effective trading strategies.

The devil is in the details. 👇 Keep reading to discover the critical steps and practical tips to avoid mistakes.

Navigating the financial markets can seem like a complex undertaking, similar to sailing on the open sea. Just as an experienced sailor would never leave port without a compass, sextant, and nautical charts, a trader shouldn’t venture into the markets without the right tools. Trading indicators are just that: analytical tools that transform price charts from a chaotic series of highs and lows into a readable map, rich with signals and potential opportunities. In a context like Italy, where a savings culture blends with growing digitalization, understanding these tools has become essential.

This article explores three of the most powerful and widely used indicators: Moving Averages, the Relative Strength Index (RSI), and the MACD. These are not magic formulas, but logical, math-based aids that, when used correctly, can provide a significant strategic advantage. We will get to know them one by one, learn to interpret their signals, and, most importantly, combine them to build a more solid and informed trading approach, suitable for both novices and more experienced investors operating in the Italian and European markets.

Understanding the Markets: A Mix of Tradition and Innovation

Italian financial culture has deep roots in tradition. For generations, the average investor has favored the security of “brick and mortar” (il mattone) and the stability of government bonds, like BTPs. This approach, based on prudence and a preference for tangible assets, reflects a typically Mediterranean mindset focused on wealth preservation. However, the advent of online trading platforms has triggered a true revolution, opening the doors of global markets to an increasingly vast and diverse audience. This wave of innovation has necessitated a paradigm shift.

According to a recent report by CONSOB, the Italian market supervisory authority, using the internet for financial information research is now common practice, and access to online trading is valued for its convenience, reduced costs, and autonomy.

In this scenario, technical analysis indicators represent the ideal bridge between traditional prudence and the opportunities offered by innovation. They do not eliminate risk, but they provide a rational method for analyzing the market, turning instinct into a structured strategy. They allow today’s investors to honor the caution of the past while arming themselves with the analytical tools of the future to navigate the complexity of modern markets with greater awareness.

Moving Averages: The Trader’s Compass

Moving Averages (MA) are among the simplest and most widespread indicators in technical analysis. Their main function is to “smooth out” price fluctuations to more clearly show the direction of the underlying trend. Imagine them as a compass that, instead of pointing north, indicates the general market trend: bullish, bearish, or sideways. There are several variations, but the most common are the Simple Moving Average (SMA) and the Exponential Moving Average (EMA).

Simple Moving Average (SMA)

The Simple Moving Average (SMA) calculates the average price of an asset over a specific number of periods. For example, a 20-day SMA sums the closing prices of the last 20 days and divides the total by 20. The result is a smooth line that follows the price action, filtering out short-term “noise.” Analysts use it to identify the direction of the main trend: if the price is consistently moving above its moving average, the trend is considered bullish; if it is below, it is bearish.

Exponential Moving Average (EMA)

The Exponential Moving Average (EMA) is a more reactive version of the SMA. While it also calculates an average, it assigns greater weight to more recent prices. This makes it more sensitive to sudden market changes and capable of signaling new trends slightly earlier than its simple counterpart. For this reason, many traders prefer the EMA for short-term strategies, where the timeliness of signals is crucial.

How to Use Them: The Golden Cross and the Death Cross

One of the most classic trading signals generated by moving averages is the crossover. When a short-term moving average (e.g., 50-day) crosses above a long-term one (e.g., 200-day), a signal known as the Golden Cross occurs. This event is often interpreted as the beginning of a long-term bullish trend. Conversely, when the 50-day average cuts below the 200-day average, it’s called a Death Cross, a potentially bearish signal. These crossovers can indicate significant shifts in market sentiment and volatility.

The RSI (Relative Strength Index): Measuring the Market’s Fever

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and magnitude of recent price changes. Developed by J. Welles Wilder, this indicator fluctuates between 0 and 100 and is used to identify overbought and oversold conditions of an asset. We can think of it as a thermometer that measures the market’s “fever”: when the fever is too high (overbought), a correction may be needed; when it’s too low (oversold), a recovery could be imminent.

Overbought and Oversold Zones

The RSI’s operation is based on two key levels: 70 and 30.

- Overbought (>70): When the RSI exceeds the 70 level, it means the asset has been aggressively bought and its price has risen very quickly. This condition suggests that the bullish trend might be overextended and nearing a reversal or a pause.

- Oversold (<30): When the RSI drops below the 30 level, it indicates the asset has been heavily sold and its price has fallen sharply. This can signal that selling pressure is exhausting and a rebound may occur.

- Overbought (>70): When the RSI exceeds the 70 level, it means the asset has been aggressively bought and its price has risen very quickly. This condition suggests that the bullish trend might be overextended and nearing a reversal or a pause.

- Oversold (<30): When the RSI drops below the 30 level, it indicates the asset has been heavily sold and its price has fallen sharply. This can signal that selling pressure is exhausting and a rebound may occur.

It is important not to interpret these levels as automatic buy or sell signals, but as warnings that require further confirmation.

- Overbought (>70): When the RSI exceeds the 70 level, it means the asset has been aggressively bought and its price has risen very quickly. This condition suggests that the bullish trend might be overextended and nearing a reversal or a pause.

- Oversold (<30): When the RSI drops below the 30 level, it indicates the asset has been heavily sold and its price has fallen sharply. This can signal that selling pressure is exhausting and a rebound may occur.

It is important not to interpret these levels as automatic buy or sell signals, but as warnings that require further confirmation.

Divergences: Hidden Signals Not to Be Ignored

One of the most powerful uses of the RSI is identifying divergences. A divergence occurs when the indicator’s movement does not confirm the price’s movement, suggesting a potential weakening of the current trend.

- Bearish Divergence: The price marks a new high, but the RSI fails to do the same, marking a lower high. This can indicate that the bullish momentum is losing steam.

- Bullish Divergence: The price hits a new low, while the RSI forms a higher low. This can signal that selling pressure is diminishing and a bullish reversal may be near.

- Bearish Divergence: The price marks a new high, but the RSI fails to do the same, marking a lower high. This can indicate that the bullish momentum is losing steam.

- Bullish Divergence: The price hits a new low, while the RSI forms a higher low. This can signal that selling pressure is diminishing and a bullish reversal may be near.

Analyzing divergences, combined with the study of Japanese candlesticks, can provide very effective reversal signals.

- Bearish Divergence: The price marks a new high, but the RSI fails to do the same, marking a lower high. This can indicate that the bullish momentum is losing steam.

- Bullish Divergence: The price hits a new low, while the RSI forms a higher low. This can signal that selling pressure is diminishing and a bullish reversal may be near.

Analyzing divergences, combined with the study of Japanese candlesticks, can provide very effective reversal signals.

The MACD (Moving Average Convergence Divergence): The Rhythm of the Trend

The MACD, an acronym for Moving Average Convergence Divergence, is a versatile indicator that combines the features of a trend-following indicator and a momentum oscillator. Developed by Gerald Appel, its purpose is to reveal changes in the strength, direction, momentum, and duration of a trend. The MACD consists of three main components: the MACD line, the Signal Line, and the histogram.

The MACD is calculated by subtracting a 26-period Exponential Moving Average (EMA) from a 12-period EMA. The result is the MACD line. A 9-period EMA is then calculated on this line, which serves as a “signal line” to generate trading alerts.

Crossovers and Trading Signals

The most common trading signals generated by the MACD come from crossovers between the MACD line and the Signal Line.

- Bullish Crossover: When the MACD line crosses above the Signal Line from below, a buy signal is generated. This suggests that momentum is turning positive and a new upward move may begin.

- Bearish Crossover: When the MACD line crosses below the Signal Line from above, a sell signal is produced. This indicates that momentum is turning negative and a downward phase may begin.

- Bullish Crossover: When the MACD line crosses above the Signal Line from below, a buy signal is generated. This suggests that momentum is turning positive and a new upward move may begin.

- Bearish Crossover: When the MACD line crosses below the Signal Line from above, a sell signal is produced. This indicates that momentum is turning negative and a downward phase may begin.

The MACD histogram visualizes the distance between the two lines: when the histogram widens, momentum is strong; when it narrows, momentum is weakening.

- Bullish Crossover: When the MACD line crosses above the Signal Line from below, a buy signal is generated. This suggests that momentum is turning positive and a new upward move may begin.

- Bearish Crossover: When the MACD line crosses below the Signal Line from above, a sell signal is produced. This indicates that momentum is turning negative and a downward phase may begin.

The MACD histogram visualizes the distance between the two lines: when the histogram widens, momentum is strong; when it narrows, momentum is weakening.

The Zero Line Value

Another important signal is the MACD crossing the zero line. When the MACD line moves above zero, it means the short-term moving average is higher than the long-term one, confirming a bullish trend. Conversely, a move below zero indicates that the short-term trend is weaker than the long-term one, confirming a bearish dynamic. These signals, although slower than crossovers, provide stronger confirmation of the main trend’s direction and integrate well into a quantitative analysis strategy.

Putting It All Together: An Integrated Strategy

No trading indicator is infallible when used alone. The real potential emerges when you learn to combine them, creating a strategy where different tools confirm each other, filtering out false signals. An integrated approach allows for a more complete view of the market, simultaneously analyzing trend, momentum, and volatility. The goal is not to clutter the chart with lines and oscillators, but to choose a few effective tools that work in synergy.

A practical example of a combined strategy could be:

- Identify the underlying trend with moving averages. For example, only consider bullish opportunities if the price is above the 200-period SMA.

- Measure momentum with the RSI. Wait for the RSI to exit an oversold zone (e.g., crossing above the 30 level) to get confirmation of growing buyer strength.

- Look for the entry signal with the MACD. The buy trade is executed only after a bullish crossover of the MACD line over its Signal Line.

- Identify the underlying trend with moving averages. For example, only consider bullish opportunities if the price is above the 200-period SMA.

- Measure momentum with the RSI. Wait for the RSI to exit an oversold zone (e.g., crossing above the 30 level) to get confirmation of growing buyer strength.

- Look for the entry signal with the MACD. The buy trade is executed only after a bullish crossover of the MACD line over its Signal Line.

This three-filter approach helps reduce impulsive trades and increases the probability of getting in sync with the market. It is also crucial to always accompany any strategy with solid risk management, such as by calculating the Value at Risk (VaR).

- Identify the underlying trend with moving averages. For example, only consider bullish opportunities if the price is above the 200-period SMA.

- Measure momentum with the RSI. Wait for the RSI to exit an oversold zone (e.g., crossing above the 30 level) to get confirmation of growing buyer strength.

- Look for the entry signal with the MACD. The buy trade is executed only after a bullish crossover of the MACD line over its Signal Line.

This three-filter approach helps reduce impulsive trades and increases the probability of getting in sync with the market. It is also crucial to always accompany any strategy with solid risk management, such as by calculating the Value at Risk (VaR).

The European and Italian Context: What the Data Says

The application of technical indicators also finds fertile ground in the financial markets of the Old Continent, including the Italian FTSE MIB index. Analyzing the main Italian stock exchange index using tools like RSI, MACD, and moving averages is a common practice for both retail traders and institutional analysts. For instance, signals like the Golden Cross or Death Cross on the 50-day and 200-day moving averages are closely monitored to anticipate medium-to-long-term trends of the index.

The CONSOB 2024 Report on the investment choices of Italian households highlights increasing digitalization and a rise in financial market participation. Although traditional products like postal savings bonds and government bonds remain widespread (48% and 39% of portfolios, respectively), a doubling of investments in crypto-assets is noted from 2022 to 2024 (from 8% to 18%). This growing interest in more volatile assets underscores the importance for Italian investors to equip themselves with adequate analytical tools to navigate complex markets. The primary goal remains capital protection (81%), but the search for growth (55%) is increasingly pushing savers to explore online trading.

Conclusions

Trading indicators like Moving Averages, RSI, and MACD are not crystal balls, but powerful analytical tools that, if understood and used correctly, can transform an impulsive approach into a reasoned strategy. They offer a common language to interpret price movements, identify trend direction, and measure market momentum. In the Italian and European context, where the traditional propensity for saving meets the new frontiers of digital finance, mastering these tools means building a bridge between prudence and innovation.

The key to success lies not in using a single indicator, but in their intelligent combination and integration with rigorous risk management. Technical analysis does not eliminate uncertainty, but it provides a map to navigate it with greater awareness. For the modern investor, whether a curious novice or an experienced operator, dedicating time to learning and disciplined application of these tools is the first step toward making more informed decisions and building a sustainable investment path over time.

Frequently Asked Questions

For beginners, a great starting point is the combination of Moving Averages (MA), the Relative Strength Index (RSI), and MACD. Moving Averages help identify the main trend direction by smoothing out price fluctuations. The RSI acts as a market ‘thermometer,’ indicating potential overbought or oversold conditions. The MACD, in turn, measures trend momentum and strength. Using them together provides a more complete view and reduces the risk of false signals.

It is strongly discouraged. Relying on a single indicator significantly increases the risk of encountering false signals. The best practice is to look for ‘confluence,’ which is confirmation from multiple, non-correlated indicators. For example, you can use a moving average to define the trend, the RSI to find a good entry point in an oversold zone, and the MACD to confirm that momentum is turning positive. This multi-layered approach increases the reliability of each trade.

Yes, Moving Averages, RSI, and MACD are versatile tools and work on any timeframe, from one minute to monthly. However, their behavior changes: on lower timeframes (like 1 or 5 minutes), they generate many more signals, but also more ‘noise’ and false alarms, requiring quick reactions. For beginners, it is often advisable to start with higher timeframes, such as the daily or 4-hour chart, where trends are more defined and signals are cleaner.

Absolutely. Technical indicators like RSI, MACD, and Moving Averages are mathematical calculations based on price and volume, which are universal concepts in all financial markets. Their effectiveness does not depend on geography but on the liquidity and clarity of the trends of the instrument being analyzed. They work very well on liquid indices like the FTSE MIB, as well as on individual large-cap stocks (the so-called blue chips) and currency pairs like the EUR/USD.

No indicator is infallible, but there are strategies to minimize false signals. First, never act on a single signal; always look for confirmation from a second or third indicator. Second, use indicators in harmony with the main trend: in a strong uptrend, buy signals are generally more reliable than sell signals. Third, integrate technical analysis with a basic understanding of market fundamentals. Finally, always apply strict risk management, using stop losses to protect your capital if the market moves against your prediction.

Did you find this article helpful? Is there another topic you'd like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.