In Brief (TL;DR)

It exists only in digital format.

Card numbers are stored securely and encrypted.

Creating it is simple and fast.

The devil is in the details. 👇 Keep reading to discover the critical steps and practical tips to avoid mistakes.

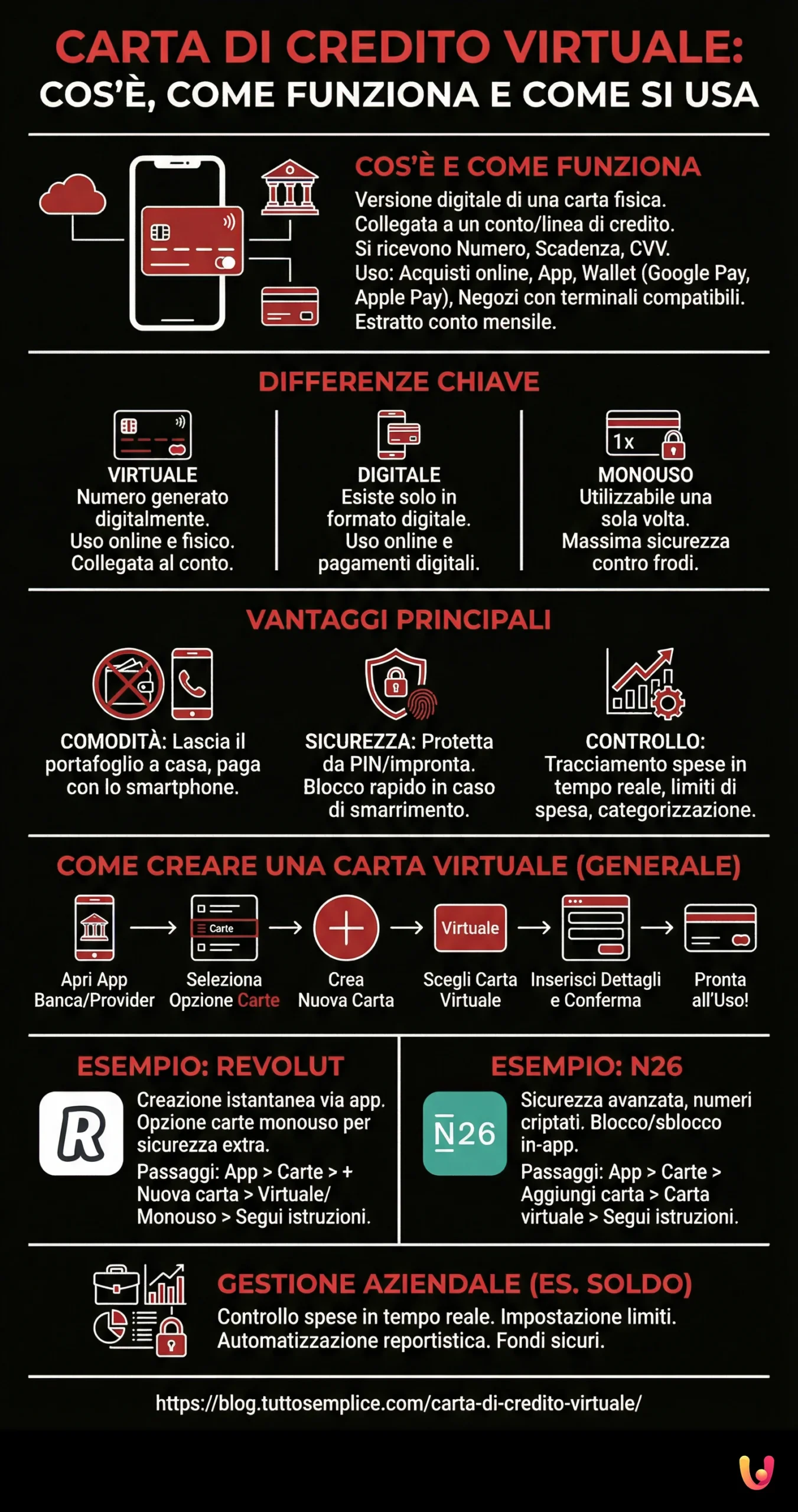

A virtual credit card is a digital version of a physical card. It can be used to make purchases online or in physical stores with compatible payment terminals. A virtual credit card is similar to a traditional card. It is linked to an account or a line of credit. It is used to make payments. You receive a monthly statement with your expenses. Unlike a traditional card, you do not have a physical medium. After the request, you receive a card number, an expiration date, and a security code (CVV). You can use them to shop online or via mobile banking apps or payment wallets like Google Pay or Apple Pay.

What is the difference between virtual, digital, and disposable cards?

Virtual, digital, and disposable credit cards have some fundamental differences. A virtual credit card is a digitally generated card number linked to your checking account or credit line.

It can be used for online purchases or at physical points of sale, just like a traditional card.

A digital credit card, on the other hand, is a card that exists only in digital format. It can be used for online purchases and at all points of sale that accept digital payments via smartphone or smartwatch.

A disposable card is a virtual card that can be used only once. After the transaction is made, the card number becomes unusable.

This type of card offers a high level of security, as it protects bank account information from potential fraud or data theft.

How to create a virtual card

Creating a virtual card is a relatively simple and fast process that can be completed in a few minutes. Here are the steps you need to follow:

- Open the app of your bank or payment service provider.

- Search for the ‘Cards’ option or a similar option in the main menu.

- Select ‘Create a new card’ or a similar option.

- Choose ‘Virtual card’ if asked for the type of card you wish to create.

- Complete the required details, such as the card name or spending limit.

- Confirm the creation of your virtual card.

Once these steps are finished, your virtual card will be ready for use. Each payment provider has a different procedure, so check the instructions from your bank or payment provider.

Leave your wallet at home and pay with virtual cards

With the advent of virtual credit cards, it has become possible to make purchases without physically carrying a wallet. You can simply use your smartphone to pay, whether it’s for a coffee, grocery shopping, or buying online.

Furthermore, these cards offer an additional advantage in terms of security. If you lose your cell phone, don’t worry about someone using your card; it is protected by a PIN or fingerprint.

Therefore, not only are virtual credit cards convenient, but they also add an extra layer of security, making purchases safer.

How the Revolut virtual card works

The Revolut virtual card works like a normal payment card, with the exception that there is no physical version of it. You can create a virtual card through the Revolut app, and it will be ready for use almost instantly.

The payment process is the same as standard credit cards: you enter your card details at checkout when shopping online. A special feature of Revolut virtual cards is the ability to use disposable virtual cards.

These cards are valid for only one purchase, then the data becomes unusable, protecting against fraud or data theft.

How to create virtual cards with Revolut

Creating a virtual card with Revolut is a simple and fast process. First of all, you need to have a Revolut account.

If you don’t have one, download the Revolut app from Google Play or the Apple Store and follow the instructions to create one. Once you have access to your account, follow these steps:

- Open the Revolut app and log in to your account.

- On the main screen, select the ‘Cards’ section at the bottom of the screen.

- Click on the ‘+ New card’ button.

- Select ‘Virtual Card’ or ‘Disposable Virtual Card’.

- Follow the on-screen instructions to complete the creation of your virtual card.

After completing these steps, your virtual card will be ready for use. You can view the card details by selecting it from your list of cards in the Revolut app.

Remember that disposable virtual cards can only be used for one transaction and the card details become obsolete after use.

Easy payments, control over business expenses

Virtual credit cards, like those offered by Revolut, not only facilitate payments but also offer detailed control over business expenses.

These digital tools allow you to track and categorize expenses in real-time, reducing the time spent managing accounts and ensuring greater financial transparency.

Furthermore, virtual cards can be set with specific spending limits, offering companies an additional tool for budget control.

Thus, by combining ease of payment with expense control, virtual credit cards are revolutionizing the way companies manage their finances.

N26 virtual card

Just like Revolut, N26 also offers the possibility to create virtual cards, providing its customers with a secure and convenient way to manage online transactions. Once you have opened an N26 account, you can create your virtual card by following these steps:

- Open the N26 app and log in to your account.

- Go to the ‘Cards’ tab.

- Click on ‘Add card’.

- Select ‘Virtual card’.

- Follow the on-screen instructions to complete the creation of your virtual card.

Once your N26 virtual card has been created, it will be immediately ready for use. You can view the card details directly in the N26 app.

N26 virtual cards offer the same level of control over business expenses as Revolut cards, allowing you to track and categorize expenses in real-time.

Make payments in-store and online in total safety

With the N26 virtual card, you can make payments in-store and online with maximum security. This card, in fact, offers a series of advanced security features.

For example, card numbers are stored securely and encrypted, and are never displayed in full in the app.

Additionally, the N26 virtual card offers the ability to lock and unlock the card directly from the app, giving you total control in case of theft or loss.

Finally, the N26 virtual card also offers fraud protection, which alerts you in case of suspicious activity.

Keep company funds safe with Soldo expense management

Soldo is another financial solution that keeps your company’s funds safe and allows for efficient expense management.

This system controls business expenses by monitoring transactions in real-time, setting spending limits, and locking or unlocking cards as needed.

Furthermore, Soldo allows you to automate the expense reporting process, saving valuable time that can be dedicated to other business activities. With Soldo, the security of your business funds and efficient expense management are always at hand.

Conclusions

Virtual credit cards are becoming increasingly popular due to their convenience and improved security levels compared to traditional cards. If you want to protect your money, avoid foreign transaction fees, or have a more convenient payment method, virtual cards are the best choice. However, as with any financial decision, it is essential to do your own research and fully understand the terms and conditions before proceeding.

Frequently Asked Questions

In Italy, several banks offer virtual cards as an additional service. Some of these banks include Intesa Sanpaolo, Unicredit, and ING Direct. These banks offer a range of advanced features for their virtual cards to ensure transaction security, such as data encryption and fraud protection. In addition to these, some online banking platforms like N26 and Revolut also offer the possibility of obtaining a virtual card. We always remind you to check the conditions and terms of use directly with the bank.

Getting a virtual credit card is a fairly simple process. The first thing to do is open an account with one of the banks or online payment platforms that offer this service. After opening the account, you should be able to request a virtual card through the online user interface or the bank’s mobile app. Once the request is approved, you will receive your virtual card details, which include the card number, expiration date, and CVV security code. These details can be used to make online purchases or for payments where a physical card payment is not necessary.

Virtual cards work similarly to traditional cards, with the difference that there is no physical medium. This type of card can be used to make purchases online or by phone, or anywhere electronic payment is accepted. When making a payment, the card details are provided to the seller, who then charges the transaction amount to the card. Some virtual cards are disposable and expire after a single transaction or after a short period of time, offering an additional level of security against fraud. A virtual card may have costs like a traditional card. Read the terms and conditions carefully before using it.

Determining the «best» virtual card can vary based on individual needs. However, there are some key features to consider when choosing a virtual card. These may include low or no startup costs, no fees for international transactions, and an easy-to-use and secure app to protect your data. Some of the most popular and well-reviewed virtual cards include Revolut, N26, and Monzo.

Creating a PayPal virtual credit card is a rather simple process.

1. First, log in to your PayPal account.

2. Go to the «Wallet» section.

3. Click on «Link a card» or «Link a new card».

4. Enter your physical card details.

5. After entering the details, click on the «Link card» button.

The main difference between a virtual credit card and a disposable credit card lies in their usage and security. A virtual card is linked to your account or physical card and can be modified or canceled for security reasons. On the other hand, a disposable credit card, as the name suggests, is used only once and then discarded. This type of card is often used for online transactions to protect the main card’s data.

Yes, disposable virtual cards exist. These cards allow you to make online transactions securely without putting your original card details at risk. Disposable virtual cards are generated for a single use, and the card details become obsolete once the transaction is made. Some of the main providers of this type of card include Privacy.com, Entropay, and EcoPayz. However, it is always important to verify the security and reliability of the provider before using such cards.

Did you find this article helpful? Is there another topic you'd like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.