In the wallets of millions of Italians, alongside IDs and some cash, there is almost always a payment card. Whether it is a debit, credit, or prepaid card, it is very likely to bear one of these three names: Visa, Mastercard, or American Express. These global giants handle the vast majority of electronic transactions worldwide, but they operate with very different philosophies and business models. Understanding these differences is crucial for choosing the tool best suited to your spending habits, travel needs, and lifestyle, especially in an Italian and European context where tradition and innovation in payments meet every day.

The choice of payment network influences not only where and how we can pay, but also the costs, additional services, and level of security we benefit from. While Visa and Mastercard focus on universality by collaborating with thousands of banks, American Express stands out for a more exclusive approach, acting as both the network and the direct issuer of its cards. This article explores the distinctive features of each operator, offering a clear guide to navigating the complex yet fascinating world of digital payments.

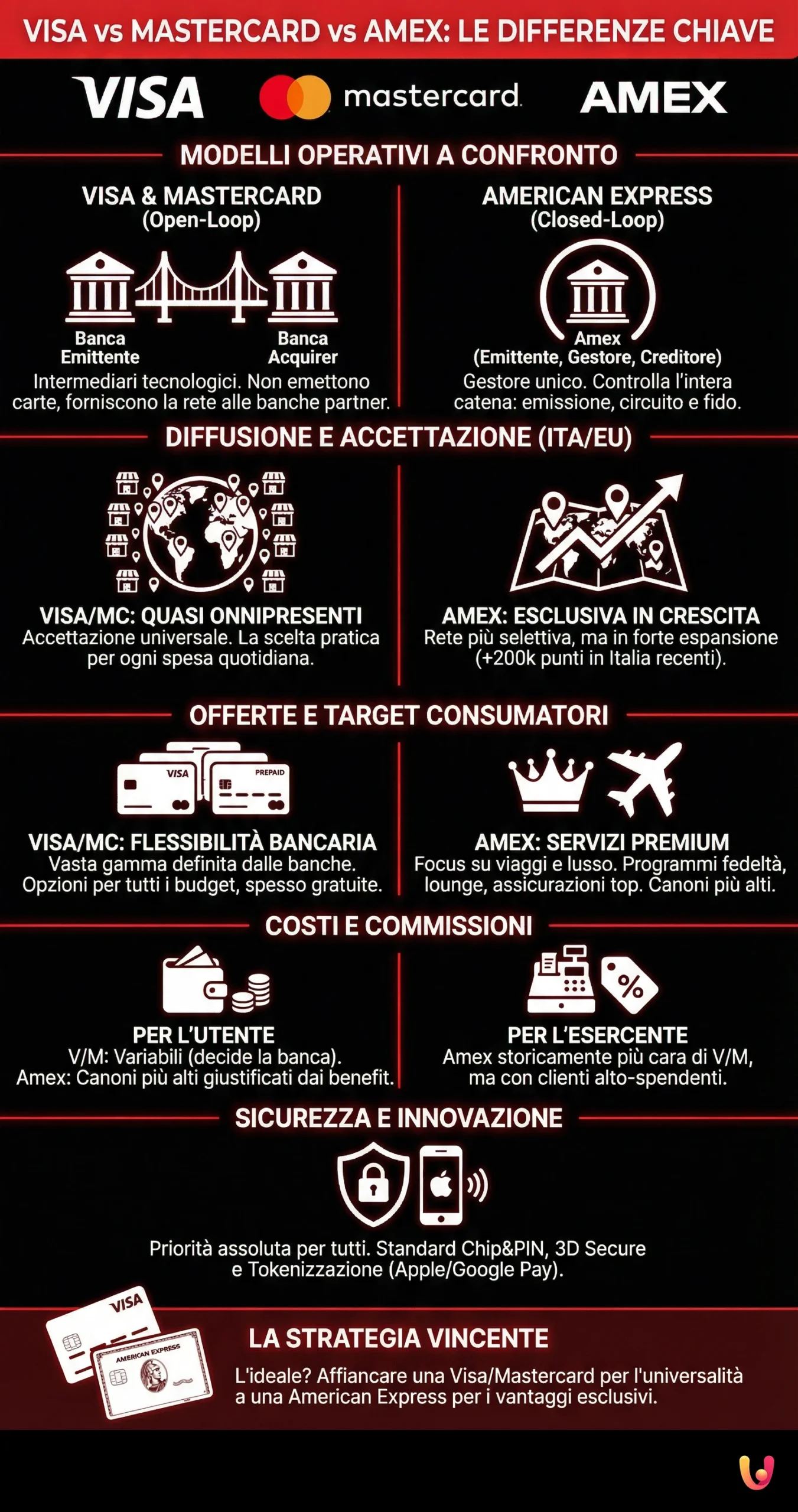

Business models compared

The deepest difference between these payment giants lies in their operating model. Visa and Mastercard operate according to an “open” model (open-loop). They do not directly issue cards nor do they grant credit to cardholders. Their role is to provide the technology and network that connects the customer’s bank (issuer) and the merchant’s bank (acquirer). In practice, they are technological intermediaries that ensure transactions work. This model allows them to collaborate with a vast number of financial institutions worldwide, guaranteeing widespread distribution of their cards.

American Express (Amex), on the contrary, uses a “closed” model (closed-loop). The company acts simultaneously as the card issuer, the payment network manager, and, in the case of credit cards, the institution granting the credit line. This gives it total control over the entire value chain of the transaction, from customer management to merchant relationships. While this approach limits its distribution compared to competitors, it allows Amex to offer highly personalized services and exclusive loyalty programs, targeting a specific clientele.

Distribution and acceptance in Italy and Europe

When it comes to acceptance, Visa and Mastercard are almost omnipresent. Thanks to their open model, cards from these networks are accepted in tens of millions of commercial establishments worldwide, including Italy. It is extremely rare to find a shop, restaurant, or e-commerce site that accepts electronic payments but not a Visa or Mastercard. This universality represents their greatest strength and makes them the most practical choice for everyday spending.

American Express has historically had a narrower acceptance network, especially in Italy and Europe. The main reason lies in transaction fees, which are on average higher for merchants compared to Visa and Mastercard. However, in recent years, Amex has invested heavily to expand its network. In Italy, over 200,000 new points of sale have been affiliated in the last two years, including not only large chains and luxury restaurants but also small neighborhood shops. Although coverage is not yet equal to that of its competitors, the situation is clearly improving, making the card increasingly usable in daily life.

Types of cards and consumer offers

Choosing a payment card goes beyond the simple logo of the network. Each operator offers a range of products designed for different needs, from simple daily expense management to luxury packages for frequent travelers. The decision between a credit, debit, or prepaid card is just the first step in identifying the tool most aligned with your profile.

Visa and Mastercard: universality at the service of banks

Since Visa and Mastercard delegate card issuance to banks, the variety of available products is immense. Each credit institution customizes the offer, defining fees, credit limits, reward programs, and insurance. Options range from basic debit cards linked directly to a checking account, to prepaid cards for managing a limited budget, up to Gold or Platinum credit cards with premium services. This flexibility allows anyone to find a Visa or Mastercard suitable for their finances and needs, with a wide choice of free or low-cost options.

American Express: a world of exclusive services

American Express deliberately positions itself in the premium segment of the market. Its cards, such as Green, Gold, and Platinum, are famous for the additional services they offer. These include loyalty programs like Membership Rewards, which allows points to be accumulated and converted into discounts, travel, or rewards, comprehensive travel insurance, airport lounge access, and high-level customer service. Although annual fees are generally higher, they are often justified by the benefits offered, designed for a clientele that travels frequently or desires superior service. For those seeking the ultimate in luxury, the American Express Platinum Card represents a benchmark in the industry.

Security and technological innovation

Security is a top priority for all three networks, which constantly invest in technologies to protect consumers from fraud. Systems like Chip&PIN are now a standard, and all offer strong authentication protocols for online purchases, such as Visa Secure, Mastercard Identity Check, and American Express SafeKey. These systems, known as 3D Secure, add a layer of identity verification to authorize online transactions, making illicit card use more difficult.

Furthermore, all three networks have been pioneers in adopting innovative technologies such as contactless payments and tokenization, which is the basis of digital wallets like Apple Pay and Google Pay. Tokenization replaces sensitive card data with a unique code (token), protecting real information during the transaction. This makes smartphone payments not only convenient but also extremely secure.

Costs and commissions: what’s behind a transaction

The costs associated with a payment card can be of two types: those borne by the cardholder and those borne by the merchant. For the consumer, the main costs are the annual fee of the card and commissions on specific operations, such as cash withdrawals (especially abroad) or currency exchange. For Visa and Mastercard cards, these costs are defined by the issuing bank. American Express cards often have higher fees, but these are justified by a richer package of services.

For the merchant, the main cost is the interchange fee, a percentage deducted from each transaction. American Express commissions are historically higher than those of Visa and Mastercard, which is why some shopkeepers, especially smaller ones, choose not to accept it. However, Amex argues that its cardholders have a higher average spending capacity, which would offset the higher cost for the merchant.

The right choice for you: which network to prefer?

There is no single answer, as the best choice depends strictly on individual needs. For those seeking maximum acceptance and a versatile card for everyday expenses, without necessarily wanting extra services, Visa or Mastercard are the most logical and safe choice. The wide range of options offered by banks ensures that you can easily find a card, even a free one, suitable for every wallet.

For those who travel often, seek impeccable customer service, and want to benefit from exclusive advantages such as insurance, access to events, and high-level loyalty programs, American Express represents a very attractive option. The investment in an annual fee can be amply repaid by using the included services. Growing acceptance in Italy and Europe is also reducing one of its main historical disadvantages. The ideal strategy might be to possess a Visa or Mastercard for its universality and pair it with an American Express to take advantage of its unique benefits.

In Brief (TL;DR)

Discover the main differences between Visa, Mastercard, and American Express payment networks to choose the card that best suits your needs.

An analysis comparing their diffusion, acceptance levels at merchants, security protocols, and additional services offered.

From global reach to exclusive services, we analyze the key differences to help you choose.

Conclusions

Visa, Mastercard, and American Express dominate the electronic payment landscape, but they do so with deeply different strategies and philosophies. Visa and Mastercard have built their success on universality and collaboration with the banking system, offering a practical solution accepted everywhere. American Express has instead focused on exclusivity and an integrated model that allows it to directly manage the relationship with the customer, offering premium services that go far beyond the simple transaction. The choice between the three networks is no longer just a question of acceptance, but reflects a lifestyle and specific spending needs. In an increasingly digital world, knowing these differences allows you to move with greater awareness, choosing not just a card, but a partner for your daily finances.

Frequently Asked Questions

For the end user, the differences between Visa and Mastercard are almost non-existent. Both networks enjoy vast acceptance in Italy and worldwide, with millions of affiliated merchants. The real distinction does not lie in the services offered to the consumer, which depend mainly on the bank issuing the card (costs, benefits, insurance), but in their business model. Both are open networks that provide technology to banks, which then physically issue the cards to customers.

The lower distribution of American Express, especially in small commercial establishments in Italy and Europe, is mainly due to the higher commissions that Amex requires from merchants for each transaction. While large chains, luxury hotels, and airlines commonly accept it, many small shopkeepers prefer not to bear these higher costs, opting for Visa and Mastercard networks which have lower commissions.

To ensure the maximum possible acceptance, it is advisable to travel with a Visa or Mastercard, as they are accepted in over 200 countries and territories. However, American Express cards are renowned for offering exclusive benefits for travelers, such as comprehensive insurance on travel and purchases, airport lounge access, and dedicated customer service. The ideal strategy is therefore to carry a Visa or Mastercard for maximum coverage and, if looking for premium benefits, pair it with an American Express.

No, all three networks offer extremely high security standards that are very similar to each other. They use advanced technologies like Chip&PIN, tokenization for digital payments, and sophisticated anti-fraud protection systems, such as Verified by Visa. The practical differences for the user are minimal; for example, the security code (CVV/CVC) is 3 digits on the back for Visa and Mastercard, while for American Express it is 4 digits and located on the front. Transaction security is a top priority for all three networks.

Visa and Mastercard do not issue cards directly to consumers. They operate as technological payment networks («open» model), licensing their networks to banks and financial institutions, which are then the entities that issue the cards and define costs and conditions. American Express, on the other hand, operates primarily with a «closed» model: in most cases, it issues its own cards directly, managing the entire relationship with the end customer.

Still have doubts about Visa vs Mastercard vs Amex: The Differences You Need to Know?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.