An unexpected phone call. On the other end, a calm, professional voice introduces themselves as an operator from your bank or, worse, law enforcement. They warn you of suspicious activity on your checking account, of an unauthorized access attempt. The request is always the same: confirm your personal details to “secure” the account. This is the typical scenario of vishing, an increasingly sophisticated and dangerous phone scam. By combining tradition, like trust in the human voice, and innovation, like technology to mask the phone number, criminals exploit our psychology to access our savings.

The term vishing comes from the fusion of two English words: voice and phishing. It is a type of fraud that occurs over the phone, where scammers use social engineering techniques to manipulate victims into sharing sensitive information. This information can include credit card numbers, home banking passwords, OTPs (One-Time Passwords), or other personal data. The ultimate goal is one and the same: identity and money theft. Unlike other online scams, vishing relies on direct human interaction, making it particularly insidious and convincing.

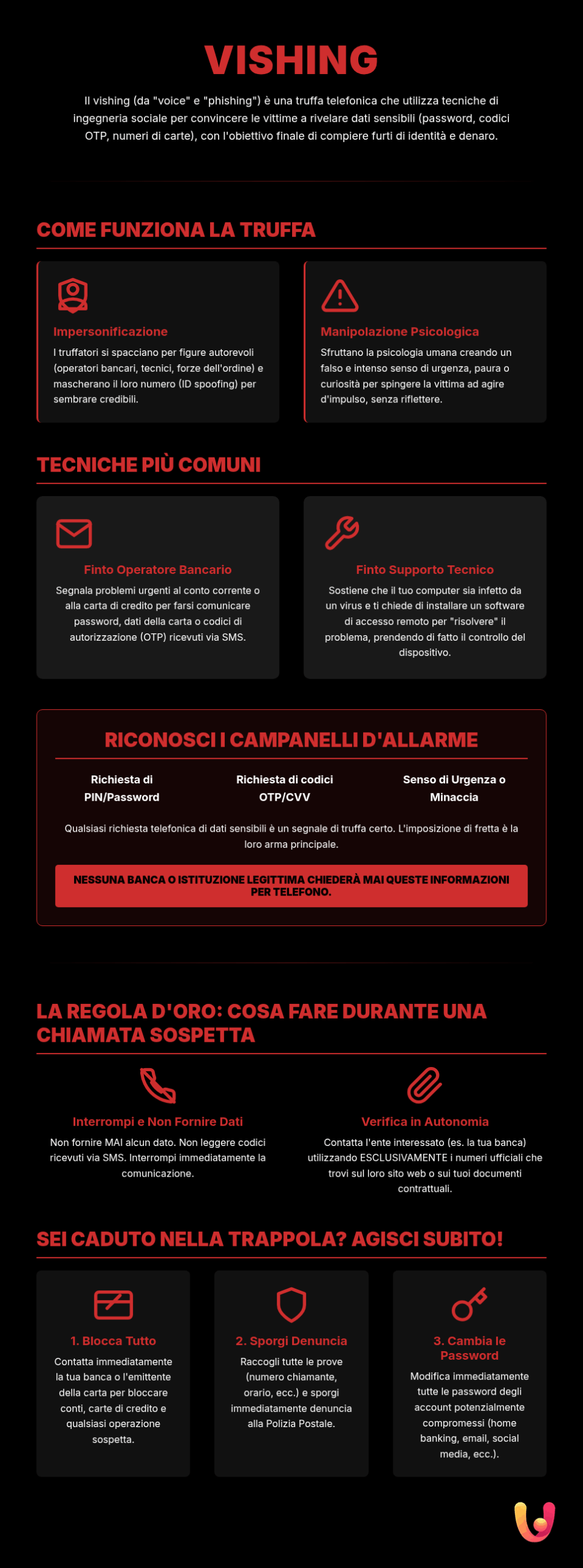

What Vishing Is and How It Works

Vishing is a form of cyberattack carried out over the phone, often exploiting VoIP (Voice over IP) technology that allows the caller’s identity to be masked (ID spoofing). This way, the call appears to come from a legitimate number, like your bank’s or the Postal Police’s. The criminals, called vishers, pretend to be authority figures to win the victim’s trust. They prey on emotions like fear and urgency, communicating a serious and imminent problem that requires immediate action. This psychological pressure clouds judgment, leading the person to take actions they normally wouldn’t, such as revealing secret codes.

The conversation is planned down to the last detail. The scammer uses technical yet reassuring language, mimicking the manner of a real operator. They might ask you to read a code received via SMS aloud, claiming it’s necessary to block a fraudulent transaction. In reality, that code is used to authorize a payment to the criminal. Scammers are skilled at personalizing the attack based on information gathered online, perhaps from social networks, making their story even more credible. It’s a psychological manipulation designed to bypass all our rational defenses.

The Most Common Techniques Used by Scammers

Cybercriminals are constantly refining their strategies to make vishing attacks more and more effective. Knowing the most common scenarios is the first step to avoid falling into the trap. The techniques vary, but the goal remains the same: to extort data and money by leveraging trust and fear. Scammers may pose as public officials, IT technicians, or representatives of well-known companies, exploiting the reputation of these entities for their illicit purposes.

The Fake Bank Operator: A Timeless Classic

The fake bank operator scam is one of the most common. The scammer contacts the victim reporting alleged “anomalies” on their checking account or credit card, such as unauthorized access or suspicious payments. To make the call credible, criminals often already have some of the victim’s data, like the card number, obtained through other illegal activities. At this point, they ask the person to cooperate in a “security procedure,” which consists of providing personal codes, passwords, or the OTP code just received via SMS. It is crucial to remember that no bank or credit institution will ever ask for this information over the phone.

The Tech Support Scam

Another widely used technique is the fake tech support scam. The scammer calls, claiming to be a technician from a famous tech company, and informs the victim that their computer has been infected with a virus. To solve the “problem,” they ask the victim to install remote access software. Once they gain control of the device, the criminal can steal personal files, login credentials, and install malware to spy on the victim’s activities. In other cases, the request is for a payment for a bogus virus removal service, which, of course, will never be performed.

Social Engineering: The Cybercriminals’ Psychological Weapon

Social engineering is the art of manipulating people into performing actions or divulging confidential information. It is the engine behind almost all vishing attacks. Scammers don’t exploit technological vulnerabilities, but human weaknesses: trust, fear, curiosity, and the desire to help. In the context of Mediterranean culture, where interpersonal relationships and a certain degree of trust in others are still important values, these techniques can be particularly effective. The tradition of dialogue and conversation is distorted and used as a weapon.

Criminals create credible and personalized scenarios, making the victim feel special or, conversely, in grave danger. Impersonating authority figures, like a bank official or a police officer, preys on our respect for institutions. Urgency is another key element: phrases like “act now or you’ll lose all your money” are designed to trigger panic and prevent clear thinking. It’s an attack that targets our minds before our wallets, which is why it’s so hard to counter without proper preparation.

How to Recognize a Vishing Attempt

Recognizing a vishing attempt requires attentiveness and a healthy dose of skepticism. The first red flag is the request for sensitive data. Banks, post offices, law enforcement, or government agencies never ask for passwords, PINs, full credit card numbers, or security codes (CVV) over the phone. Another clue is a sense of urgency or threat. If the caller tries to rush you, scare you with the prospect of financial loss or legal consequences, it is very likely a scam.

Also, pay attention to the number the call is coming from. Although scammers can spoof it, calls from unknown, private, or foreign numbers should raise suspicion. However, you shouldn’t blindly trust a number even if it seems to be your bank’s official one. Incredibly good offers, like prizes you’ve won or loans at negligible rates, are another common bait. Remember the golden rule: if something seems too good or too scary to be true, it almost certainly isn’t.

What to Do (and Not Do) During a Suspicious Call

If you suspect you are being targeted by a visher, the first rule is to stay calm. Don’t let yourself be panicked by the scammer’s manufactured crisis. Do not confirm or provide any personal data, even if the caller seems to already know some of it. Never read the codes you receive via SMS aloud during the call. These codes are used to authorize transactions, and sharing them is like handing over the keys to your account. Do not install any software on your computer or smartphone at the caller’s request.

The safest move is to end the communication. Simply say you prefer to verify in person and hang up. Immediately after, contact your bank or the entity mentioned by the scammer yourself, but use the official phone numbers found on their website or on your contractual documents. Never call back the number from which you received the suspicious call. Reporting the scam attempt helps both the institution take countermeasures and other people avoid falling into the same trap.

Fell for the Trap? Here Are the Steps to Follow

If you realize you have given your data to a scammer, acting quickly is crucial. The first thing to do is contact your bank or credit card issuer immediately to block the account, card, or any suspicious transactions. Explain what happened in detail. An immediate block can limit or, in some cases, prevent financial damage. Gather all possible evidence: the caller’s phone number (if visible), the date and time of the call, and any other information that might be useful.

The next step is to file a report with the appropriate law enforcement agency. You can go to a police station in person or use available online reporting services. Filing a report is essential not only to attempt to recover the money but also to allow authorities to investigate and combat these criminal networks. Remember to change all the passwords for your online accounts (home banking, email, social media) that may have been compromised. For the future, consider using tools like two-factor authentication to increase the security of your accounts.

In Brief (TL;DR)

Vishing is a phone scam that uses social engineering to steal your data: learn to recognize it and defend yourself.

This article reveals the most common techniques used by scammers and teaches you how to respond to protect yourself.

Learn to recognize scammers’ techniques and protect your personal information.

Conclusion

Vishing represents a real and constantly evolving threat, combining the psychological manipulation typical of social engineering with increasingly accessible technologies. In a context like Italy and Europe, where tradition and innovation coexist, criminals exploit trust in interpersonal relationships to target people of all ages and social classes. Statistics show an increase in cyber fraud, with considerable economic damage. However, awareness is our most powerful weapon.

Learning to recognize the signs of a suspicious call, staying calm, and not giving in to psychological pressure are essential skills for our digital and financial security. It is crucial to be wary of any phone request for sensitive data, to end the communication, and to always verify the caller’s identity through official channels. Adopting good security practices, such as using strong passwords and enabling alert systems, helps create an additional layer of protection. Informing yourself and others, especially more vulnerable people like the elderly, is a civic duty to build a collective defense against this increasingly pervasive form of crime. In a digital world, you can never be too careful, especially when it comes to protecting our assets and our identity from invisible threats like those that travel over the phone line.

Frequently Asked Questions

Vishing is a phone scam whose name comes from the combination of ‘voice’ and ‘phishing’. Scammers contact you by phone, pretending to be operators from trusted entities like your bank, the post office, utility companies, or law enforcement. The goal is to deceive you using social engineering techniques to make you reveal personal, financial, or security data, such as passwords, PINs, or access codes. They prey on emotions like fear or urgency, communicating fake problems with your account or card to push you to act without thinking.

Recognizing a vishing attempt is possible by paying attention to a few signs. Always be wary of unexpected calls that create a sense of urgency or alarm, for example, by threatening to close your account or impose imminent penalties. A key red flag is the request for sensitive data: no bank or institution will ever ask you for full passwords, PINs, card security codes (CVV), or OTPs (the temporary passwords you receive via SMS) over the phone. Also, be careful with offers that seem too good to be true or calls from unusual numbers, like mobile phones or foreign area codes.

The first rule is to stay calm and not panic. *Never* provide any personal or financial information they ask for. Take control of the conversation by asking specific questions to verify the caller’s identity, without confirming any data they might already have. The safest action is to end the call. If you still have doubts, contact the entity in question (your bank, the post office, etc.) directly using only the official phone numbers you find on their website or on documents you have.

If you think you’ve fallen for a vishing trap, act immediately. Contact your bank or credit card issuer right away to block your cards and dispute any fraudulent transactions. Immediately change all passwords for online accounts that may have been compromised (home banking, email, etc.). It is also essential to file a report with the appropriate law enforcement agency, providing all possible details about the call you received. Your report is crucial for investigations and for protecting other people.

No, absolutely not. No bank, financial institution, or government agency will ever ask you to provide sensitive data like your full home banking password, card PIN, or OTP security codes over the phone, by email, or via SMS. If you receive a call like this, even if the number looks like your bank’s official number (scammers can spoof it), it is a scam attempt. Hang up and, if you have any doubts, contact the bank yourself through its official, verified channels.

Still have doubts about Vishing: Don’t Fall for the Phone Trap?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.