Imagine sailing on the open sea. Sometimes the waters are calm and the crossing is smooth; other times, sudden waves make the journey unpredictable and risky. The financial markets are not so different. There is a force, called volatility, that measures the very magnitude and speed of these “waves” in the prices of stocks, bonds, and other instruments. Understanding the difference between historical and implied volatility, and especially knowing the VIX Index, known as the “fear index,” is essential for every investor, from the most experienced to the novice entering this world for the first time.

This article will guide you through these concepts, explaining in simple terms what they are, how they are measured, and why they are so important for interpreting market sentiment. We will see how these indicators, born in the United States, also apply to the European and Italian context, which is characterized by a financial culture that balances tradition and innovation.

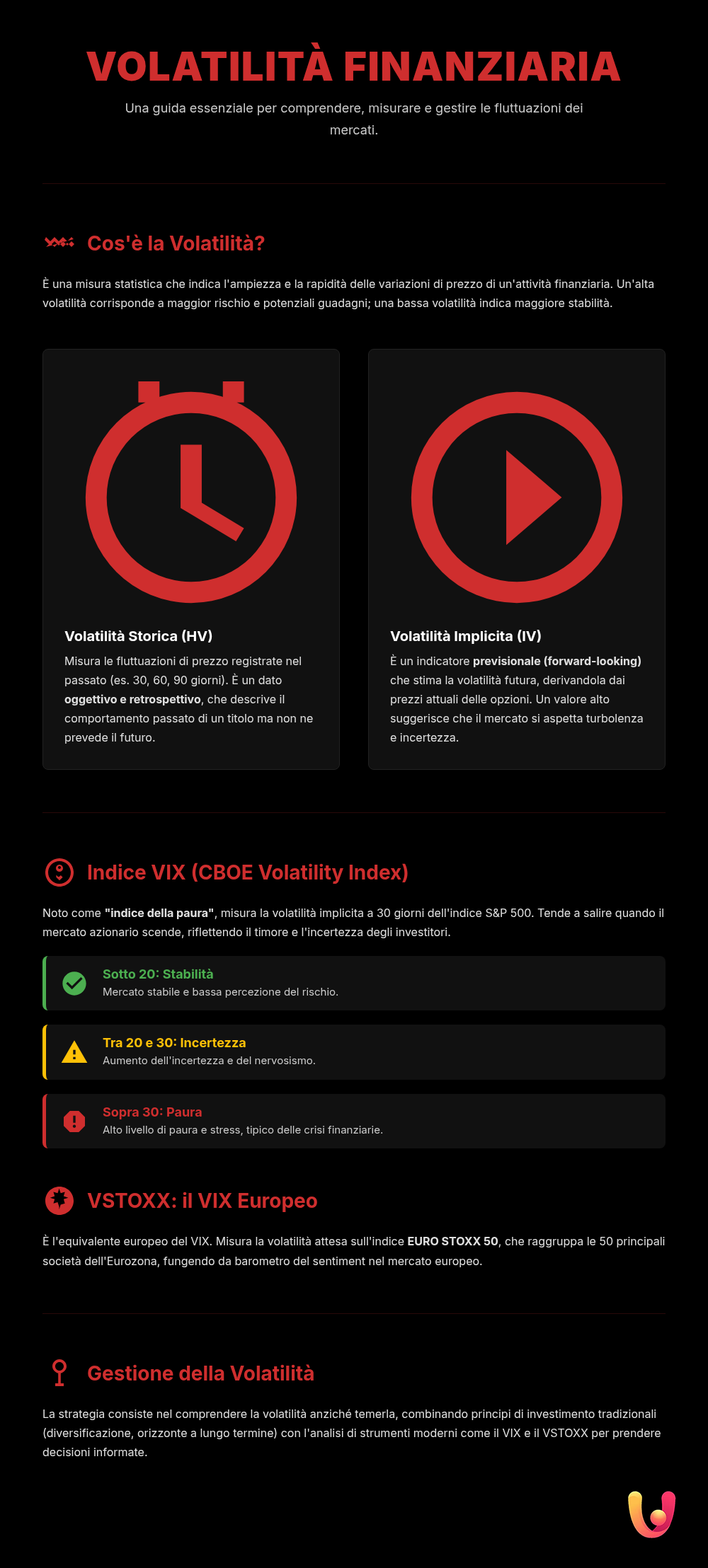

What is Volatility: A Key Concept in the Markets

In finance, volatility is a statistical measure that indicates the price variation of a financial asset over a given period. In simple terms, it tells us how quickly and how intensely the value of a security, like a stock, can rise or fall. High volatility means the price can experience large and sudden swings, entailing greater risk but also potential opportunities for profit. Conversely, low volatility suggests the price is more stable over time. It’s a bit like the weather: a high-volatility day is a storm, while a low-volatility day is a sunny day without a cloud in the sky.

Volatility is a crucial factor not only for assessing the risk of an investment but also for pricing complex financial instruments like options. There are two main ways to measure it, offering two different but complementary perspectives: historical volatility, which looks to the past, and implied volatility, which tries to anticipate the future.

Historical Volatility: Looking to the Past to Understand the Present

Historical volatility (often abbreviated as HV) is the measure of price fluctuations recorded in the past. It is calculated as the standard deviation of an asset’s returns over a specific time frame, such as the last 30, 60, or 90 days. This figure, expressed as a percentage, gives us an objective snapshot of how “nervous” an asset has been over a certain period. If a stock has had high historical volatility, it means its prices have undergone sharp swings.

In essence, historical volatility is a numerical summary of a financial asset’s past behavior and, therefore, is a purely mathematical reference that says nothing about the future behavior of the underlying asset.

Technical analysts often use historical volatility to build indicators like Bollinger Bands, which help identify potentially excessive price levels. Although it only looks in the rearview mirror, analyzing past volatility is an indispensable starting point for understanding the character of an investment and its intrinsic risk level.

Implied Volatility: Predicting the Future Through Options

Unlike its historical counterpart, implied volatility (IV) is a forward-looking indicator. It is not based on past prices but is “implied” or derived from the current prices of options on a specific stock or index. Options are contracts that give the right, but not the obligation, to buy (call and put options) or sell an asset at a predetermined price by a certain date. Their price depends on various factors, including the market’s expectation of future volatility.

If investors expect a period of turbulence, they will be willing to pay more for options as a form of insurance or to speculate on large price movements. This drives up option premiums and, consequently, implied volatility. For this reason, implied volatility is considered a powerful thermometer of market sentiment: when it rises, it indicates that traders expect tension and uncertainty; when it falls, it signals calm and confidence. Complex models like the Black-Scholes model are essential for calculating this value.

The VIX: The Fear Gauge Explained Simply

The most famous indicator based on implied volatility is the CBOE Volatility Index, universally known as the VIX. Created in 1993 by the Chicago Board Options Exchange (CBOE), the VIX measures the 30-day implied volatility of the S&P 500 index, the main U.S. stock market index. Because the S&P 500 is considered a barometer of the health of the entire American economy, the VIX has become a global benchmark for measuring investor sentiment.

The VIX is commonly nicknamed the “fear index” or “fear gauge” because it tends to spike during periods of financial stress, uncertainty, and panic, when investors fear market crashes.

Its behavior is based on a typically inverse correlation with the stock market: when the S&P 500 falls, the VIX rises, and vice versa. This makes it not only an indicator but also a tradable instrument through futures and options, used for portfolio hedging strategies or to speculate directly on volatility.

How to Interpret the VIX: Signals for Investors

Understanding how to read the VIX is essential for investors. Although there is no magic formula, there are indicative thresholds that help interpret its value:

- VIX below 20: Generally indicates a stable market and a low level of fear among investors. This phase is often associated with rising or sideways stock markets.

- VIX between 20 and 30: Signals an increase in uncertainty and volatility. The market begins to show signs of nervousness, often in response to negative economic or geopolitical news.

- VIX above 30: Indicates a high level of fear and stress in the market. Such high values are typically recorded during sharp corrections or financial crises, as happened in 2008 or during the 2020 pandemic.

It is important to remember that the VIX measures expectations; it does not predict the future with certainty. A very high VIX can signal panic, but for long-term investors, it can also represent a buying opportunity, when “blood is in the streets,” as Warren Buffett would say. The use of quantitative analysis tools can help contextualize these signals.

Volatility in Italy and Europe: A Mediterranean Context

Although the VIX is tied to the American market, its impact is global. A similar indicator also exists in Europe, the VSTOXX (EURO STOXX 50 Volatility Index), which measures the expected volatility on the EURO STOXX 50 index, which groups the 50 leading blue-chip companies in the Eurozone. The VSTOXX functions similarly to the VIX and is considered the “European VIX,” providing a valuable indication of market stress in the Old Continent.

In the Italian context, volatility trends are influenced by both global dynamics and factors specific to our economic and political system. The Mediterranean culture, often perceived as more risk-averse than the Anglo-Saxon one, is reflected in investors’ choices. There is a strong tradition tied to investments considered “safe,” such as real estate and government bonds. However, financial innovation and greater education are pushing more and more savers to explore different tools for building a modern portfolio, learning to manage volatility rather than passively enduring it.

Tradition and Innovation: Managing Volatility Today

Managing volatility is a balance between prudence and courage. On one hand, tradition teaches us the importance of diversification and a long time horizon to smooth out short-term fluctuations. Not reacting impulsively during phases of panic is one of the golden rules that great investors like Benjamin Graham and Warren Buffett have always preached. Emotion is often the investor’s worst enemy.

On the other hand, innovation offers us increasingly sophisticated tools to measure and manage risk. Indicators like the VIX and VSTOXX, once accessible only to professionals, are now available to everyone. Understanding the difference between historical volatility, which tells us about the past, and implied volatility, which tells us about future expectations, allows for more informed decisions. It’s about combining the wisdom of tradition with the power of innovative tools to successfully navigate the financial markets.

In Brief (TL;DR)

Understanding the difference between historical and implied volatility is crucial for interpreting signals from the VIX, also known as the financial markets’ fear gauge.

The analysis focuses on the distinction between historical (retrospective) and implied (predictive) volatility, introducing the VIX index as a barometer of market expectations.

It then analyzes the VIX, known as the fear index, as a fundamental tool for measuring market expectations and implementing trading strategies.

Conclusion

Volatility is not an enemy to be feared, but an intrinsic characteristic of financial markets to be understood and managed. Distinguishing between historical volatility, a measure of the past, and implied volatility, an anticipation of the future, is the first step to becoming a more conscious investor. The VIX index, or “fear index,” has established itself as an irreplaceable barometer of global sentiment, with its European counterpart, VSTOXX, playing a similar role for our continent’s markets. Learning to read these indicators doesn’t mean predicting the future, but rather understanding the market’s “mood,” to avoid falling prey to panic during storms and to seize opportunities when the sea calms again. In a world that balances tradition and innovation, knowledge remains the most powerful tool to protect and grow one’s savings.

Frequently Asked Questions

The VIX index, also known as the ‘fear index,’ is an indicator that measures the market’s expectation of volatility in the U.S. stock market for the next 30 days. In practice, it tells us how much investors think the market will swing in the short term. A high VIX suggests nervousness and possible sharp movements, while a low VIX indicates a calmer, more stable market.

Historical volatility looks at the past: it analyzes how much an asset’s prices have fluctuated over a specific period by calculating the standard deviation of its returns. Implied volatility, on the other hand, looks to the future: it is an estimate of future swings based on the current prices of options on an index, like the S&P 500 for the VIX. The former is a statement of fact; the latter is an expectation.

The VIX is nicknamed the ‘fear index’ because it tends to rise sharply when investors are worried and there is uncertainty in the markets, often coinciding with steep downturns. A rise in the VIX reflects increased demand for ‘insurance’ (put options) against potential market crashes, signaling a sentiment of fear and risk aversion among traders.

Not necessarily. While a high VIX indicates significant uncertainty and fear, which can lead to losses, it also creates opportunities. For traders who operate on volatility, a high VIX means greater potential for profit from rapid price fluctuations. Additionally, some long-term investors view VIX spikes as signs of an oversold market, and therefore as potential buying opportunities at attractive prices.

Yes, the European equivalent of the VIX is called VSTOXX (EURO STOXX 50 Volatility Index). This index measures the expected 30-day volatility of the Eurozone stock market, based on options on the EURO STOXX 50 index, which includes the 50 largest companies by capitalization in the euro area. Like the VIX, the VSTOXX is an important barometer of investor sentiment in the Old Continent.

Still have doubts about Volatility and VIX: A Guide to the Fear Index?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.