In Brief (TL;DR)

The BIC/SWIFT code is essential for international transfers with prepaid cards with IBAN, but not all cards have one.

If you need to receive a transfer from abroad, you will need your card’s BIC/SWIFT code, while to send money abroad you will need the recipient’s code.

In the absence of the code, you can use online money transfer services or open a traditional bank account.

The devil is in the details. 👇 Keep reading to discover the critical steps and practical tips to avoid mistakes.

Prepaid cards with IBAN are gaining more and more space in the world of payments, offering a simple and secure way to manage your money. But what happens when you need to make an international transfer or receive one? The BIC/SWIFT code comes into play, a fundamental element for cross-border transactions. However, not all prepaid cards with IBAN are equipped with one, and this can cause confusion. In this complete guide, we will discover how to find the BIC/SWIFT code on your prepaid card, analyze the situations in which it is necessary, and provide you with alternative solutions for your international transfers. Get ready to navigate the world of global payments with clarity and security!

What Is the BIC/SWIFT Code?

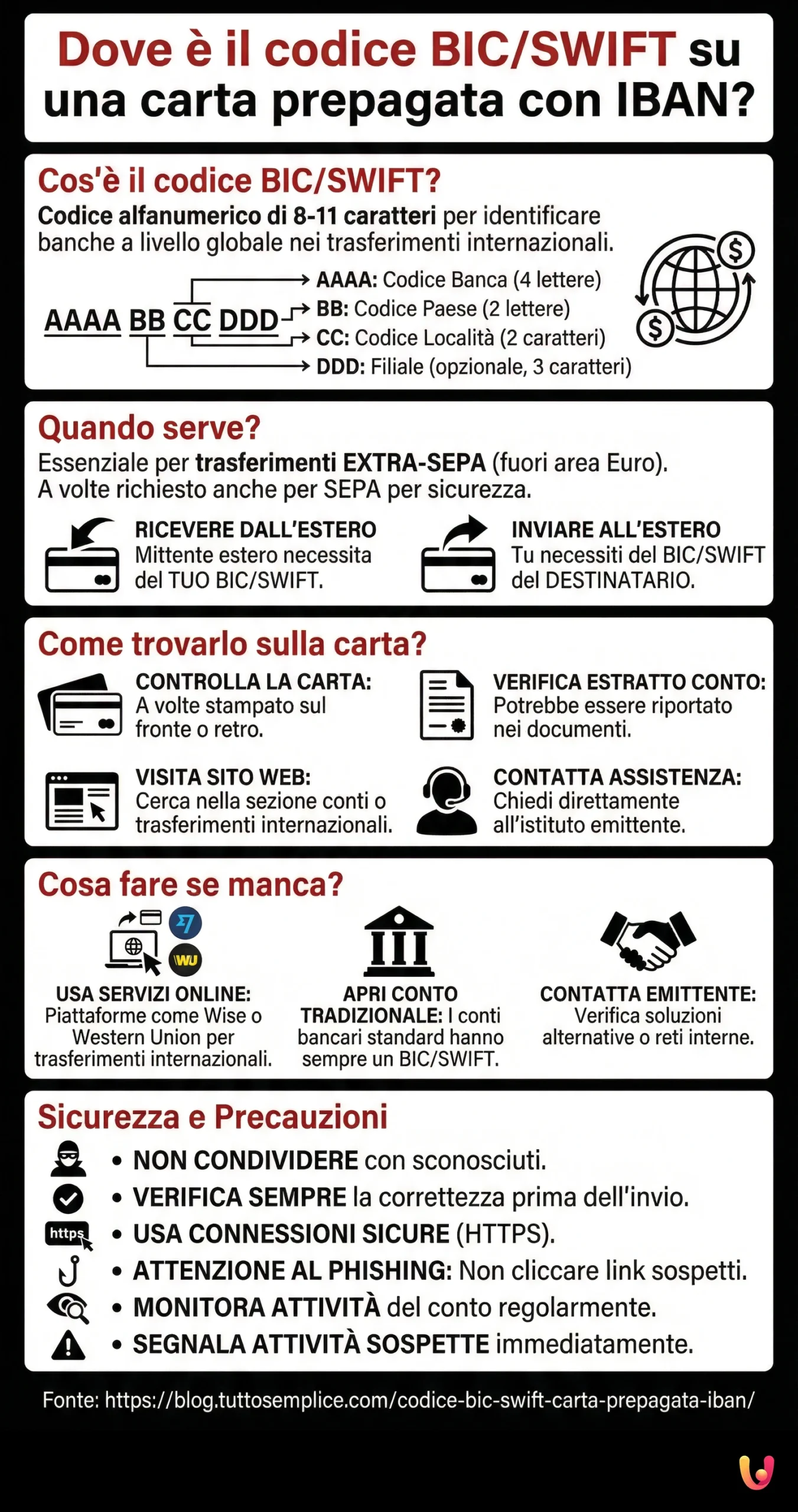

The BIC (Bank Identifier Code) or SWIFT (Society for Worldwide Interbank Financial Telecommunication) code is an alphanumeric code essential for international money transfers. It consists of 8-11 characters that uniquely identify a bank or financial institution globally. Think of it as a unique address that allows banks around the world to recognize each other and exchange money securely.

The format of the BIC/SWIFT code is standardized :

- AAAA: 4 letters representing the bank code (usually an abbreviated version of the bank’s name).

- BB: 2 letters representing the country code where the bank is located.

- CC: 2 characters (letters or numbers) representing the location code where the bank’s headquarters is situated.

- DDD: 3 optional characters specifying a particular branch. If the code is 8 characters long or if these last 3 characters are XXX, it refers to the bank’s headquarters.

Prepaid Cards with IBAN: An Overview

Prepaid cards with IBAN offer a convenient way to manage your finances. Unlike traditional credit or debit cards, they are not linked to a checking account, but to an electronic money account. This means you can only spend the balance available on the card, eliminating the risk of overdrafts.

The IBAN (International Bank Account Number) is an international code that identifies a specific bank account. The presence of an IBAN on a prepaid card makes it a versatile tool, usable for receiving salaries, paying bills, making online purchases, and withdrawing cash.

BIC/SWIFT Code and Prepaid Cards: When Is It Needed?

While the IBAN identifies your specific account, the BIC/SWIFT code identifies the bank holding your account. This is a fundamental distinction. Not all prepaid cards with IBAN have a BIC/SWIFT code. Its necessity depends on the issuing institution and the type of transactions you wish to perform.

In general, the BIC/SWIFT code is indispensable for money transfers outside the SEPA (Single Euro Payments Area). For transfers within SEPA, the IBAN is usually sufficient. However, some banks may require the BIC/SWIFT code even for SEPA payments to ensure greater security or speed up processing.

It is important to clarify when your prepaid card’s BIC/SWIFT code is needed:

- Receiving an international transfer: if someone needs to send you money from abroad to your prepaid card with IBAN, they will need your BIC/SWIFT code to complete the transaction.

- Sending an international transfer: if you need to send money to a prepaid card with IBAN abroad, you will need the BIC/SWIFT code associated with that card, not yours.

How to Find the BIC/SWIFT Code on a Prepaid Card

If your prepaid card with IBAN has a BIC/SWIFT code, you can find it by following these steps:

- Check the card: some institutions print the BIC/SWIFT code directly on the card, usually on the front or back.

- Check the statement: if your prepaid card provides a statement, the BIC/SWIFT code might be listed there.

- Visit the issuing institution’s website: most banks and financial institutions publish the BIC/SWIFT code on their website, in the section dedicated to accounts or international transfers.

- Contact customer support: if you cannot find the code any other way, contact the customer support of the institution that issued your card.

Before making a money transfer, it is crucial to verify the correctness of the BIC/SWIFT code with the recipient or the bank to avoid delays or errors in sending the money.

What to Do If the Prepaid Card Does Not Have a BIC/SWIFT Code?

If your prepaid card with IBAN does not have an associated BIC/SWIFT code, you may encounter difficulties in making international transfers. Here are some alternatives:

- Use an online money transfer service: platforms like Wise or Western Union offer international money transfer services, often with lower fees compared to traditional banks.

- Open a traditional bank account: traditional bank checking accounts come with a BIC/SWIFT code, simplifying international transfers.

- Contact your card issuer: some institutions might offer alternative solutions for international transfers even in the absence of a BIC/SWIFT code on the card.

- Check if your bank uses internal networks: some banks may have agreements or internal networks for international transfers, reducing reliance on SWIFT.

Security and Precautions

The BIC/SWIFT code is sensitive information that must be handled with care to avoid fraud. Here are some tips to protect your code:

- Do not share the code with untrusted people: although the BIC/SWIFT code does not allow withdrawals from your account, it is good practice not to share it with strangers.

- Always verify the correctness of the code: an error in the BIC/SWIFT code can cause delays or the money being sent to the wrong account.

- Use secure connections: when performing online banking operations, ensure you use an HTTPS connection to protect your data.

- Watch out for phishing: phishing attacks may aim to steal your banking credentials, including the BIC/SWIFT code. Do not click on suspicious links and always verify the authenticity of emails or messages requesting sensitive information.

- Monitor your account activity: regularly check your prepaid card statement to identify any unauthorized transactions.

- Report suspicious activity: if you notice unusual activity on your account, contact the issuing institution immediately.

Remember that cybersecurity is constantly evolving. Cybercriminals use increasingly sophisticated techniques to target banking systems. It is important to stay informed about the latest threats and adopt adequate security measures.

Conclusions

The presence or absence of the BIC/SWIFT code on a prepaid card with IBAN can affect the ability to make international transfers. If your card does not have a BIC/SWIFT code, you may need to resort to alternative solutions, such as online money transfer services or opening a traditional bank account.

Prepaid cards with IBAN offer numerous advantages, including simplified money management, budget control, and the ability to make online purchases and withdrawals worldwide. They are an ideal payment tool for those who want a more flexible and less demanding alternative to traditional checking accounts. However, it is crucial to fully understand the features of your card, particularly regarding international money transfers.

Ultimately, the choice of a prepaid card with IBAN depends on individual needs and spending habits. It is important to carefully evaluate the card’s features, costs, usage limits, and offered functionalities to choose the tool best suited to your needs. Remember that security is a fundamental aspect of financial management. Always protect your personal information and login credentials, monitor your account activity, and promptly report any anomalies to the issuing institution.

Frequently Asked Questions

The BIC/SWIFT code is a unique identification code for banks, used primarily for international transfers.

The IBAN identifies your bank account, while the SWIFT code identifies the bank. Both are necessary for international transfers.

You can find your bank’s SWIFT code on its website, on bank statements, or by using an online SWIFT code search engine.

Generally no, the SWIFT code is necessary for international transfers outside the SEPA area.

If your bank does not provide you with a BIC/SWIFT code, you may need to open an account with a different bank that offers one.

Did you find this article helpful? Is there another topic you'd like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.