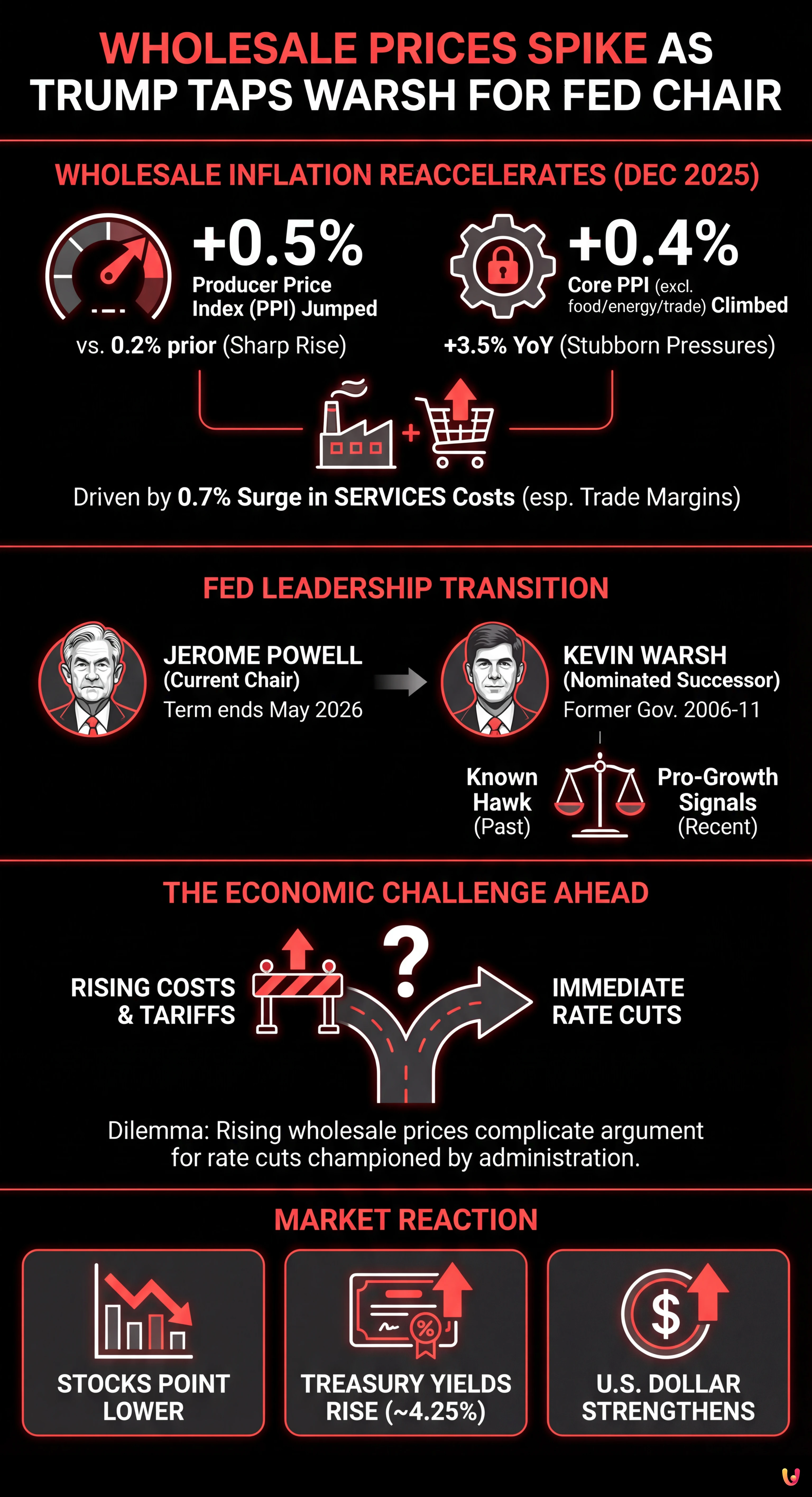

The battle against inflation in the United States appears far from over, as new government data released Friday reveals a sharp rise in wholesale prices at the end of 2025. The Producer Price Index (PPI), a key measure of inflation before it reaches consumers, jumped 0.5% in December, underscoring persistent price pressures that continue to challenge the U.S. economy. This resurgence in wholesale costs comes at a pivotal moment, coinciding with President Donald Trump’s announcement that he intends to nominate former Federal Reserve Governor Kevin Warsh as the next chairman of the central bank.

The timing of the report adds a layer of complexity to the economic landscape just as the Federal Reserve prepares for a leadership transition. With current Chair Jerome Powell’s term set to expire in May 2026, the incoming chairman will inherit an economy grappling with stubborn inflation that refuses to cool to the central bank’s 2% target. The latest figures suggest that the “last mile” of the inflation fight may prove to be the most difficult, potentially forcing the Fed to reconsider its monetary policy strategy in the coming months.

Market reaction was swift, with stock futures pointing lower and Treasury yields rising as investors digested the dual news of hotter-than-expected inflation and the nomination of a new Fed chief. As Wall Street adjusts to the prospect of a Warsh-led Fed, the immediate focus remains on the sticky price data that threatens to erode purchasing power and delay further interest rate cuts.

Wholesale Inflation Reaccelerates

According to the Bureau of Labor Statistics, the Producer Price Index for final demand rose 0.5% in December 2025, a significant acceleration from the unrevised 0.2% gain recorded in November. This increase exceeded the expectations of economists, who had forecast a more seeking 0.2% to 0.3% rise. On a year-over-year basis, the headline PPI held steady at 3.0%, signaling that wholesale inflation remains elevated well above the Federal Reserve’s comfort zone.

Even more concerning for policymakers was the rise in core wholesale prices, which exclude the volatile food, energy, and trade services sectors. The core index climbed 0.4% in December, pushing the 12-month increase in core prices to 3.5%—matching the highest rate seen in nearly a year. This metric is often viewed as a better predictor of underlying inflation trends, and its persistence suggests that inflationary pressures are becoming entrenched in the supply chain.

The report detailed that the surge was largely driven by a 0.7% increase in the cost of services, the sharpest rise in that category in several months. A substantial portion of this increase was attributed to a 1.7% jump in margins for final demand trade services, which measures the changes in margins received by wholesalers and retailers. Meanwhile, goods prices remained relatively flat, indicating that the service sector continues to be the primary engine of inflation in the current economic cycle.

Trump Nominates Kevin Warsh

Amidst these troubling economic signals, President Trump moved to reshape the leadership of the Federal Reserve. On Friday morning, the President announced via social media that he would nominate Kevin Warsh to succeed Jerome Powell. “I have known Kevin for a long period of time, and have no doubt that he will go down as one of the GREAT Fed Chairmen, maybe the best,” Trump wrote, praising Warsh’s background and alignment with his economic vision.

Kevin Warsh is no stranger to the central bank, having served as a Fed governor from 2006 to 2011. During his previous tenure, he was the youngest governor in the institution’s history and played a critical role as a liaison to Wall Street during the 2008 financial crisis. Historically known as a monetary hawk who favored tighter policy to combat inflation, Warsh has more recently signaled views that align with President Trump’s preference for lower interest rates to stimulate growth.

If confirmed by the Senate, Warsh will take the helm in May 2026. His nomination ends months of speculation regarding Powell’s successor. President Trump has frequently criticized Powell, whom he appointed during his first term, often referring to him as a “stubborn mule” for not cutting rates aggressively enough. The selection of Warsh suggests the administration is seeking a leader who may be more responsive to the White House’s desire for pro-growth monetary policy, though Warsh’s past record indicates he is deeply knowledgeable about the risks of runaway inflation.

The Economic Challenge Ahead

The incoming Fed chair will face a delicate balancing act. The December PPI report indicates that businesses are facing higher costs, which they are likely to pass on to consumers in the form of higher retail prices. This dynamic complicates the argument for immediate rate cuts, which the Trump administration has championed. If the Fed were to lower rates prematurely while wholesale prices are rising, it could risk reigniting a broader inflationary spiral.

Economists point to several factors contributing to the renewed price pressures. Recent tariff policies, which increased the effective tariff rate on imports to an estimated 11.7% as of January 2026, appear to be filtering through the supply chain. While businesses initially absorbed some of these costs, the sharp rise in trade services margins suggests that firms are now moving to protect their profitability by raising prices.

Furthermore, the Federal Reserve’s decision earlier this week to leave its benchmark interest rate unchanged in the 3.50%-3.75% range reflects the central bank’s caution. Policymakers noted that while economic activity remains solid, inflation is “somewhat elevated.” The new data validates that caution, providing ammunition for the “hawks” on the Federal Open Market Committee (FOMC) who argue that policy must remain restrictive to ensure inflation returns to the 2% target.

Market Reaction and Outlook

Financial markets reacted negatively to the double whammy of rising prices and leadership uncertainty. Major indices, including the Dow Jones Industrial Average and the S&P 500, trended lower in Friday trading. Investors are recalibrating their expectations for interest rates in 2026, with many now fearing that the Fed may be forced to hold rates higher for longer than previously anticipated.

In the bond market, the yield on the 10-year U.S. Treasury note ticked up to approximately 4.25%, reflecting the market’s assessment that inflation premiums need to rise. The U.S. dollar also saw strength, rebounding from recent lows, as higher-for-longer interest rate expectations tend to boost the currency’s value relative to peers.

The transition from Powell to Warsh will be scrutinized closely by global markets. While Warsh is respected for his intellect and experience, his recent pivot toward more dovish rhetoric has raised questions about how he will navigate the tension between political pressure and the Fed’s mandate for price stability. With wholesale inflation running at 3% and core pressures intensifying, the data suggests that the economic reality may force the new chairman to adopt a tougher stance than the administration might hope for.

In Brief (TL;DR)

The Producer Price Index jumped 0.5% in December, signaling persistent inflationary pressures that continue to challenge the economy.

President Trump announced his intention to nominate former Governor Kevin Warsh to replace Jerome Powell as Federal Reserve Chairman.

Incoming leadership faces a difficult landscape as stubborn wholesale costs complicate the path toward future interest rate cuts.

Conclusion

The sharp rise in wholesale prices in December 2025 serves as a stark reminder that the U.S. economy has not yet fully conquered inflation. As President Trump prepares to install Kevin Warsh as the next Chairman of the Federal Reserve, the central bank faces a critical test of its independence and resolve. The convergence of rising producer costs, tariff-induced price pressures, and a high-stakes leadership change creates a volatile environment for the year ahead. Whether the new leadership can engineer a soft landing while contending with these stubborn inflationary forces remains the defining economic question of 2026.

Frequently Asked Questions

Kevin Warsh is a former Federal Reserve Governor who served from 2006 to 2011 and was nominated by President Trump to succeed Jerome Powell. The President selected Warsh due to his extensive background in finance and his alignment with the administration economic vision. While Warsh was historically known as a monetary hawk, he has recently signaled support for lower interest rates to stimulate growth. If confirmed by the Senate, he will assume the role in May 2026.

The December 2025 Producer Price Index report, which showed a 0.5 percent jump in wholesale costs, complicates the case for immediate interest rate cuts. With inflation remaining stubborn and core prices rising to 3.5 percent annually, the Federal Reserve may be forced to keep interest rates higher for longer to ensure price stability. This data validates the caution of policymakers who argue that monetary policy must remain restrictive to bring inflation back to the 2 percent target.

Wholesale prices have reaccelerated primarily due to a sharp increase in the cost of services, particularly within trade services margins. Economists also attribute renewed price pressures to recent tariff policies that are filtering through the supply chain, increasing costs for businesses. While goods prices have remained relatively flat, the service sector has become the main driver of inflation, leading to higher costs that companies may eventually pass on to consumers.

Jerome Powell is scheduled to finish his term as Chairman of the Federal Reserve in May 2026. His departure will mark a significant transition for the central bank as it continues to fight inflation. President Trump has frequently criticized Powell for not cutting rates aggressively enough and has moved to replace him with Kevin Warsh, aiming for a leadership change that might be more responsive to pro-growth policies.

The outlook for 2026 remains uncertain as the economy faces a convergence of rising producer costs and tariff-induced pressures. With the headline PPI holding steady at 3.0 percent and core pressures intensifying, the last mile of the inflation fight appears difficult. The incoming Federal Reserve leadership will face the challenge of managing these stubborn inflationary forces while attempting to engineer a soft landing without reigniting a broader price spiral.

Did you find this article helpful? Is there another topic you'd like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.