In Brief (TL;DR)

Withdrawing cash with a credit card is possible, but involves high costs due to fees and interest.

The debit card, linked to the checking account, is the most economical option for withdrawals.

In case of need, evaluate alternatives like prepaid cards or wire transfers.

The devil is in the details. 👇 Keep reading to discover the critical steps and practical tips to avoid mistakes.

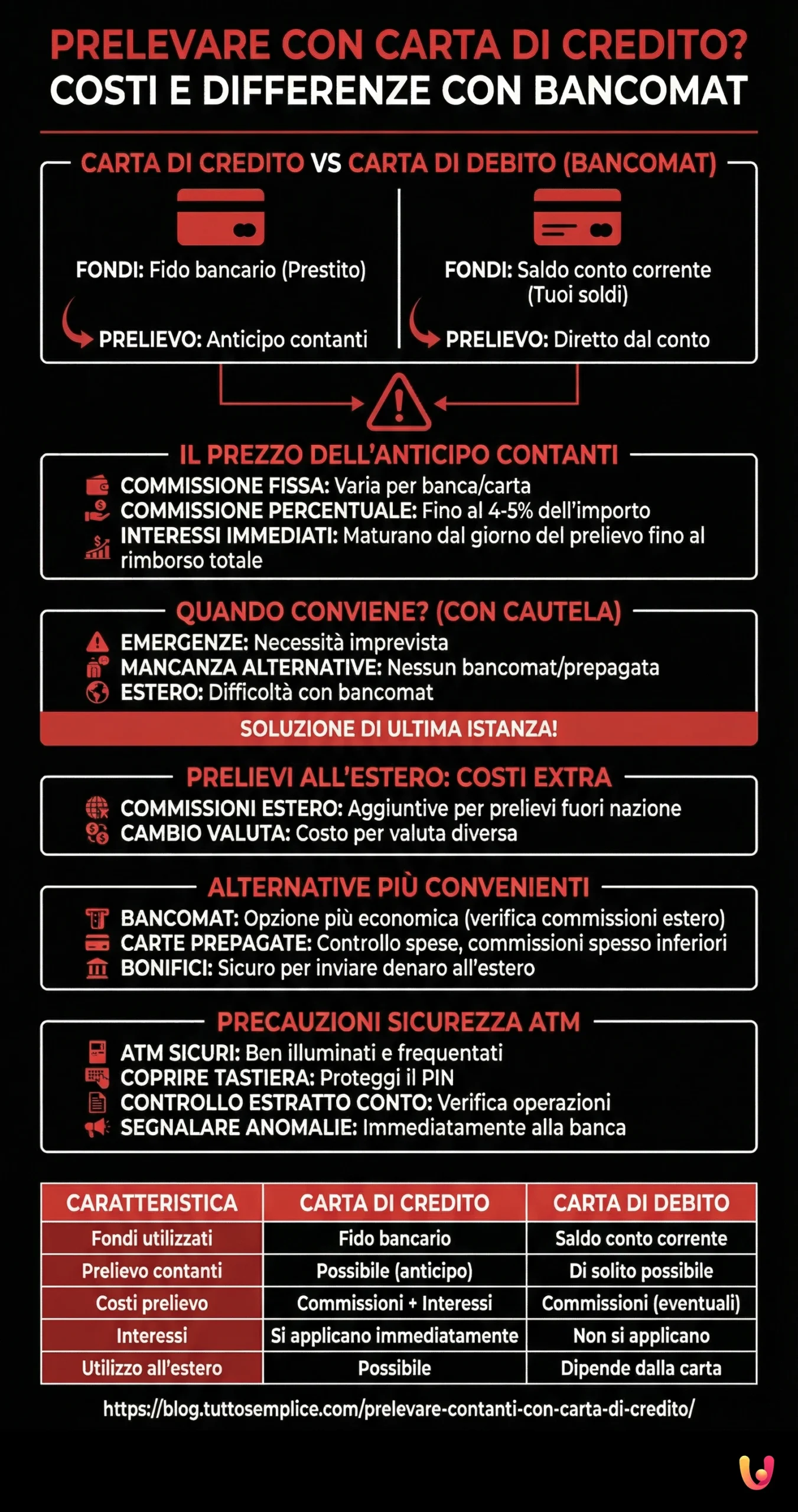

The credit card is a versatile payment tool that offers numerous advantages, but withdrawing cash with it can turn out to be an expensive operation. Although it is technically possible to withdraw cash with a credit card, it is fundamental to understand the financial implications of this choice. Unlike a debit card, which draws directly from the funds available in the checking account, a credit card uses a line of credit granted by the bank. This means that every withdrawal is considered a cash advance, subject to fees and interest that can significantly impact the cost of the transaction.

Withdrawing with a credit card: yes, but at what price?

The possibility to withdraw with a credit card may seem like a convenient solution in emergency situations, but it is important to be aware of the costs this choice entails. Every withdrawal is in fact considered a cash advance, a sort of short-term loan that the bank grants to the cardholder. This service, however, is not free.

The fees associated with cash advances are generally composed of:

- A fixed fee, which varies depending on the bank and the credit card used.

- A percentage fee on the withdrawn amount, which can reach up to 4-5% of the total.

- Interest on the withdrawn amount, which starts accumulating immediately from the moment of withdrawal and can reach very high rates.

It is important to emphasize that interest on cash advances begins to accrue from the very day of withdrawal and continues to accumulate until the full repayment of the amount due. This makes withdrawing with a credit card a rather expensive option, to be used only in cases of real necessity and with awareness of the financial implications.

Credit card vs. debit card: a question of funds

To fully understand the costs of credit card withdrawal, it is fundamental to know the substantial difference between a credit card and a debit card.

- The debit card (or ATM card) is directly linked to the holder’s checking account and allows payments or withdrawals within the limits of the available balance.

- The credit card, instead, draws on a line of credit (credit limit) granted by the bank, allowing expenses even in the absence of funds in the checking account. The reimbursement of expenses occurs at a later time, according to the methods provided by the contract.

This difference is also reflected in the use of the two cards for cash withdrawals. With the debit card, the withdrawal takes place by drawing directly from the funds available in the checking account, while with the credit card, the credit limit granted by the bank is used, generating a cash advance subject to fees and interest.

When is it worth withdrawing with a credit card?

Despite the high costs, there are situations where withdrawing with a credit card might be the only available or most convenient option:

- Emergencies: in case of unforeseen need for cash and in the absence of other solutions, the credit card can represent a lifeline.

- Lack of alternatives: if you do not have a debit card or a prepaid card enabled for withdrawals, the credit card may be the only option to obtain cash.

- Withdrawals abroad: in some countries, especially outside the Euro area, it might be difficult or impossible to withdraw with a debit card. In these cases, the credit card can guarantee access to necessary cash.

However, it is fundamental to remember that withdrawal with a credit card should be considered a last resort solution, to be used with moderation and only after carefully evaluating the costs and available alternatives.

Withdrawing abroad with a credit card: watch out for fees

The cash withdrawal abroad with a credit card requires particular attention, since in addition to cash advance fees, additional costs may apply:

- Foreign transaction fees: some banks apply an additional fee for withdrawals made outside the national territory.

- Currency exchange fees: if the withdrawal occurs in a currency different from that of the card, the bank might apply a fee for currency exchange, which further impacts the cost of the operation.

Before leaving for a trip abroad, it is advisable to check with your bank regarding the fees applied for withdrawals with the credit card and evaluate any alternatives, such as using a prepaid card or an international debit card, which might turn out to be more convenient.

Alternatives to withdrawing with a credit card

If you need cash, there are several alternatives to credit card withdrawal that might prove more convenient:

- Debit card: if you have a debit card linked to your checking account, this is certainly the cheapest option for withdrawing cash, both domestically and abroad (verifying any fees for foreign withdrawals).

- Prepaid cards: reloadable prepaid cards represent an excellent alternative for cash withdrawals, especially abroad. They are easy to manage, allow you to control expenses, and often offer lower fees compared to credit cards.

- Wire transfers: if you need to send money to someone abroad, a bank transfer can be a secure and convenient solution, although crediting times might be longer compared to other options.

The choice of the most suitable alternative depends on your specific needs and the situation you are in. Carefully evaluate the costs, times, and methods of each option before making a decision.

Credit cards with advantageous conditions for withdrawals

Although cash withdrawal with a credit card is generally an expensive operation, some cards offer more advantageous conditions compared to others. These cards might provide:

- Reduced fees on cash advances, both domestically and abroad

- Zero interest periods on the withdrawn amount, allowing you to repay the debt without paying additional interest

- Insurance covering any theft or loss of cash withdrawn with the card

If you plan to use the credit card to withdraw cash with some frequency, it might be worthwhile to evaluate the option of requesting a card with specific conditions for this type of operation. Compare the different offers available on the market and choose the one that best suits your needs.

Precautions for safe withdrawals at ATMs

Regardless of the type of card used, it is fundamental to adopt some precautions to avoid fraud or card cloning during withdrawals at ATMs:

- Choose well-lit and busy ATMs, avoiding isolated or unsafe ones

- Cover the keypad while entering the PIN, to prevent anyone from seeing it

- Periodically check the bank statement to identify any unauthorized transactions

- Immediately report to the bank any anomalies or suspicions of fraud

By following these simple tips, you can perform your cash withdrawals safely, protecting your personal data and your finances.

| Feature | Credit Card | Debit Card |

|---|---|---|

| Funds used | Bank credit line | Checking account balance |

| Cash withdrawal | Possible (cash advance) | Usually possible |

| Withdrawal costs | Fees + interest | Fees (if any) |

| Interest | Applies immediately | Does not apply |

| Use abroad | Possible | Depends on the card |

Conclusions

The possibility to withdraw cash with a credit card offers an emergency solution in situations where you do not have a debit card or a prepaid card enabled for withdrawals, or when you are abroad and need quick access to cash. However, it is fundamental to be aware of the high costs that this operation entails. Fixed fees, percentage fees, and interest can make withdrawing with a credit card a less convenient choice, especially when compared to using a debit card or a prepaid card.

Before resorting to credit card withdrawal, it is always advisable to carefully evaluate the available alternatives and, if possible, plan your cash needs in advance, especially when traveling abroad. Informing yourself about the fees applied by your bank and comparing different options can help you save and better manage your finances.

If you need further information or wish to compare the different options available to better manage your finances, do not hesitate to visit our dedicated page and request a personalized consultation. Our experts will be happy to assist you in choosing the solution best suited to your needs.

Frequently Asked Questions

Generally yes, but it is always better to verify any limitations or special conditions with your bank.

Costs vary depending on the bank and the card. Typically, they include a fixed fee, a percentage fee on the withdrawn amount, and interest that starts accumulating immediately.

Yes, every card has a daily and monthly maximum limit for cash withdrawals.

Yes, but in addition to cash advance fees, foreign transaction fees and currency exchange fees may apply.

The most convenient alternative is using the debit card linked to your checking account. If you do not have a debit card enabled for international use, consider using a prepaid card or a wire transfer.

Some credit cards offer zero interest periods on the withdrawn amount, but it is important to verify the conditions and terms of this promotion.

In case of non-repayment, interest will continue to accumulate and the bank may apply further penalties or report the delay to credit bureaus, compromising your creditworthiness.

Choose well-lit and busy ATMs, cover the keypad while entering the PIN, periodically check your bank statement, and immediately report any anomalies or suspicions of fraud to the bank.

Did you find this article helpful? Is there another topic you'd like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.