Imagine your home. The door has a lock—your password. Now, think about adding a security service that asks for an ID before letting anyone in. This is, in simple terms, Two-Factor Authentication (2FA). In Italy, where digital payments have surpassed cash to become part of our daily lives, protecting our finances online is no longer an option, but a necessity. Fraud is on the rise and increasingly sophisticated, making a single password vulnerable. This is where 2FA comes in, adding an essential layer of security to protect our savings.

This system isn’t a technological complication for a few experts, but a simple and fundamental habit for anyone who shops online, manages a bank account via an app, or uses a digital wallet. Just as we lock our front door without a second thought, enabling 2FA should become an automatic gesture for our digital security. In this article, we’ll explore why it’s so important, how it works, and how it seamlessly integrates into our culture, striking a balance between traditional Italian caution and the drive for digital innovation.

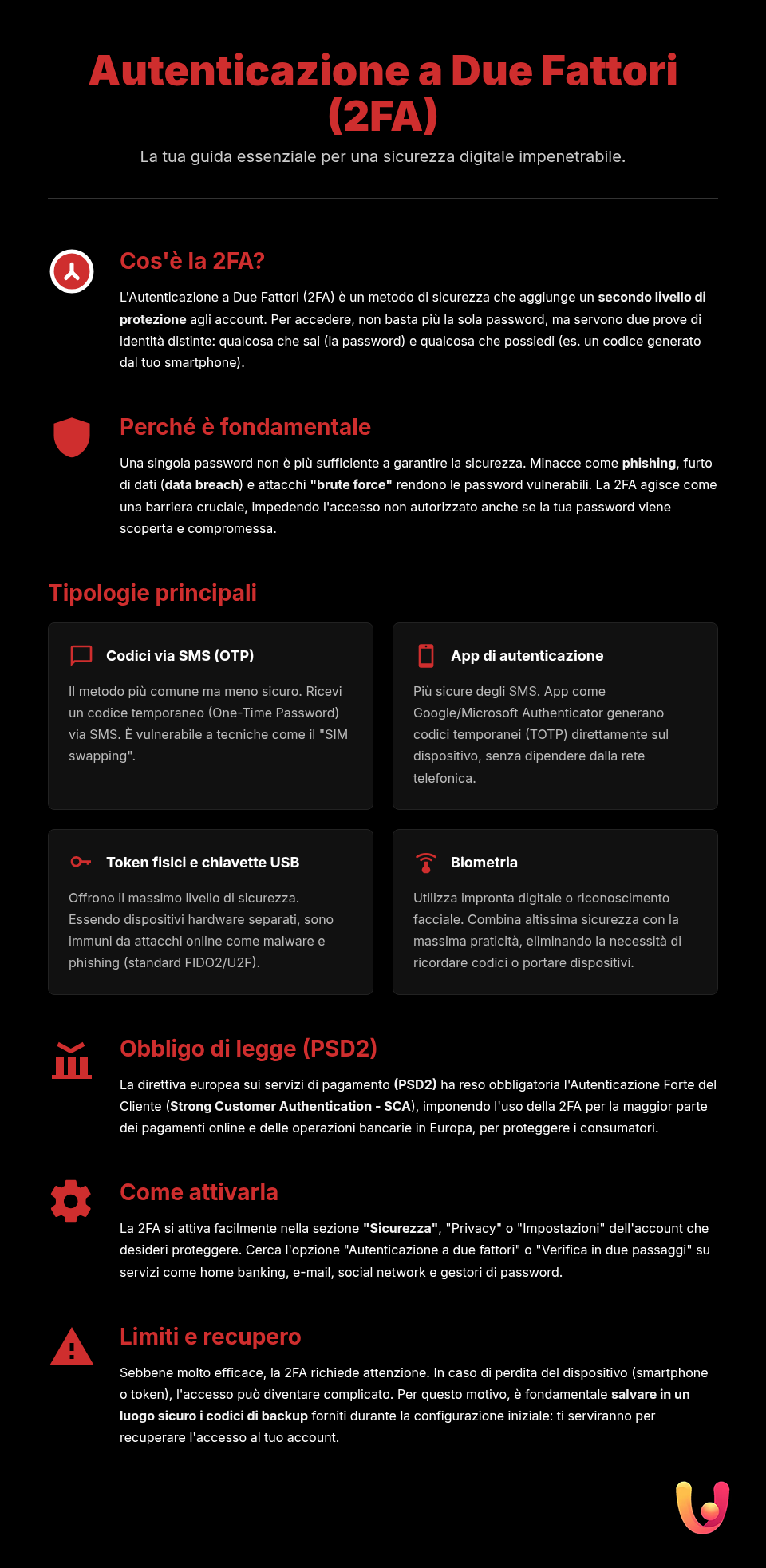

What Is Two-Factor Authentication (2FA)?

Two-Factor Authentication, or 2FA, is a security method that verifies your identity using two separate pieces of evidence. Think of it as a double lock for your digital accounts. The first “key” is something you know, like your password or a PIN. The second is something you have, like your smartphone, or something you are, like your fingerprint or facial recognition. Only by combining these two elements does the system grant you access. This way, even if a malicious actor manages to steal your password, they couldn’t get into your account without also having the second factor.

This approach makes unauthorized access much more difficult. A thief might be able to pick one lock, but they are unlikely to also have a copy of the key for the second one. The requirement for two different types of proof of identity is what defines “Strong Authentication,” in contrast to a simple password, which is now considered weak authentication and insufficient to guarantee adequate protection.

Why a Single Password Is No Longer Enough

In the digital age, relying solely on a password is like using a cardboard door to protect a treasure. Passwords, even complex ones, are inherently vulnerable. Cybercriminals use increasingly sophisticated techniques to steal them, such as phishing, where they trick you with fake emails or messages to get you to reveal your credentials. Other threats include data breaches, where large company databases are compromised and millions of passwords can end up on the dark web, and “brute force” attacks, where automated software tries thousands of combinations per second to guess your access key.

The real danger is that many people, for convenience, reuse the same password across multiple sites. This means a single breach can give a hacker access to dozens of your accounts, from email to social media, and even your bank account. The consequences can be devastating: from theft of money to credit card cloning and identity theft. 2FA neutralizes most of these risks because, even with the right password, access remains blocked without the second verification factor.

The Different Faces of 2FA: Which One to Choose?

Two-factor authentication is not a one-size-fits-all system; it comes in various forms, each with its own pros and cons. Choosing the right method depends on the desired level of security and ease of use. Knowing the available options allows you to protect your accounts in the way that best suits your needs, balancing innovation and established habits.

SMS Codes: Tradition at Your Fingertips

The most well-known and widespread method is sending a one-time numeric code (OTP, One-Time Password) via SMS to your phone number. After entering your password, the system will ask you to type in the code you received to complete the login. Its main advantage is simplicity: it doesn’t require installing additional apps and is a system almost everyone is used to. However, it’s not the most secure method. Hackers can intercept SMS messages or, in rarer but possible cases, resort to techniques like “SIM swapping,” cloning your phone’s SIM card to receive the codes instead of you.

Authenticator Apps: The Fortress on Your Smartphone

A more secure alternative to SMS are authenticator apps like Google Authenticator, Microsoft Authenticator, or Authy. These applications, installed on your smartphone, generate OTPs that change every 30-60 seconds. Unlike SMS, the codes are generated directly on the device and are not transmitted over a network, making them much harder to intercept. Some apps also offer push notifications: instead of a code, you receive an approval request that you can confirm with a simple tap. This method represents an excellent balance between high security and ease of use, ideal for protecting a secure digital wallet.

Physical Tokens and Keys: Security You Can Touch

For those seeking the highest level of protection, there are physical tokens. These are small hardware devices, similar to USB keys, that generate OTPs or require a physical touch to authorize access. These tokens, based on standards like FIDO U2F, are considered among the most secure methods because they are completely separate from the internet and therefore immune to phishing or malware attacks. Although they are less convenient to carry around than a smartphone, they are the ideal choice for protecting extremely sensitive accounts, such as corporate accounts or cryptocurrency wallets.

Biometrics: You Are the Key

The future of security is already here and lies in what makes us unique: our biometric data. Authentication via fingerprint, facial recognition, or iris scan is an example of the “something you are” factor. Now integrated into almost all modern smartphones, biometrics offer a seamless and nearly instantaneous user experience without sacrificing a high level of security. Many banking apps use it to authorize payments or logins, combining maximum convenience with robust protection. This method perfectly embodies the intersection of innovation and personal security, as explored in the field of biometric payments.

2FA in the European Context: The PSD2 Directive

In Europe, and therefore also in Italy, the use of 2FA for payments is not just a good practice but a legal requirement. This is thanks to the Payment Services Directive (PSD2), a European regulation introduced to make electronic transactions more secure and to promote innovation in the financial sector. A fundamental pillar of PSD2 is Strong Customer Authentication (SCA), which became fully operational in Italy on January 1, 2021.

SCA mandates that for most online payments and remote banking operations, the user’s identity must be verified with at least two of the three authentication factors we’ve discussed: knowledge, possession, and inherence. This means that when you make an online purchase or access your online banking, it’s no longer enough to just enter your card details or a password. The bank is required to ask you for a second verification step, such as a code via an app or your fingerprint. This measure aims to drastically reduce fraud and increase consumer confidence in digital payments.

Tradition and Innovation: 2FA in Daily Italian Life

Italian culture is a fascinating blend of attachment to tradition and a surprising ability to embrace innovation. This dualism is also reflected in the world of payments. While a certain attachment to cash persists, seen as tangible and secure, the adoption of digital and contactless payments has grown at a dizzying pace, especially after the pandemic. In this scenario, 2FA acts as a bridge, uniting traditional caution with digital convenience.

For many, especially for generations less accustomed to technology, the idea of dematerialized money can generate distrust. 2FA, with its concrete action—receiving an SMS, touching a sensor, approving a notification—restores a sense of tangible control and security to an otherwise abstract action. It’s the modern version of double-locking the door or signing an important document. At the same time, for digital natives, it’s a fluid and integrated mechanism that doesn’t hinder, but protects, their fast and smart shopping habits. 2FA, therefore, is not just a technical measure, but a cultural element that helps build trust in an increasingly digital Italy.

How to Enable 2FA: A Small Step for Great Security

Enabling two-factor authentication is a simple process that takes only a few minutes but exponentially increases the security of your accounts. The exact procedure may vary slightly depending on the service (bank, email, social network), but the fundamental steps are almost always the same. Generally, you need to go to the “Security” or “Account Settings” section of the service you want to protect. There, you will find an option called “Two-Factor Authentication,” “2-Step Verification,” or similar.

Once enabled, the system will guide you through setting up your preferred second factor. If you choose SMS, you will be asked to confirm your phone number. If you prefer an authenticator app, you will need to scan a QR code with the app to link the account. It is crucial to follow the instructions and, most importantly, to save the backup codes that many services provide in a safe place. These codes will allow you to access your account if you lose your smartphone. Taking the time for this setup, especially for sensitive accounts like those linked to Postepay or your bank account, is the best investment you can make for your digital peace of mind.

In Brief (TL;DR)

Two-factor authentication (2FA) is an essential security method that adds a second layer of protection to your accounts, making your online payments significantly more secure against fraud.

From SMS to physical tokens, let’s discover how the different types of 2FA work and which one to choose to lock down your accounts.

Explore the different types available, from SMS codes to authenticator apps, to choose the one that best suits your needs.

Conclusion

In a world where our financial lives are increasingly online, Two-Factor Authentication is no longer an option for tech experts but a fundamental pillar of personal security. It is a robust barrier against fraud, identity theft, and unauthorized access—problems that are unfortunately becoming more frequent. As we have seen, its effectiveness is such that even European legislation, with PSD2, has made it mandatory for most digital transactions, recognizing its crucial role in protecting consumers.

From SMS to authenticator apps to biometrics, there are solutions for every need, capable of blending the traditional quest for security with technological innovation. Enabling 2FA is a simple action that takes only a few minutes but offers lasting protection and great peace of mind in return. Don’t put it off: take a moment today to check the security settings of your bank accounts, email, and payment services. It’s a small gesture that makes a huge difference in the security of your savings.

Frequently Asked Questions

Losing the device used for two-factor authentication (2FA), like your smartphone, can be worrying, but there are solutions. When you first set up 2FA, many services provide single-use *recovery codes*. It is essential to save them in a safe place, separate from your primary device, for these emergencies. If you don’t have the codes, most services, including banks, have an account recovery process. This usually requires identity verification through documents or by answering security questions. For authenticator apps like Google Authenticator, it’s advisable to use the backup or cloud sync feature, if available, to restore codes on a new device. In any case, the first step is to contact the customer service of the platform in question to block access and start the recovery process.

Two-factor authentication (2FA) greatly increases an account’s security, but it is not 100% foolproof. It is extremely effective at blocking automated attacks and access attempts based solely on stolen passwords. However, there are advanced techniques that cybercriminals can use to bypass it. These include *phishing*, where the user is tricked with fake emails or websites into entering not only their password but also the 2FA code. Another technique is ‘SIM swapping,’ where a malicious actor takes control of the victim’s phone number to intercept codes sent via SMS. There are also ‘MFA fatigue’ attacks, where the attacker floods the user with approval notifications until, out of exhaustion, they accept one. For this reason, while 2FA is a fundamental defense tool, it must be accompanied by the user’s constant vigilance.

Two-factor authentication via SMS is the most common method due to its simplicity, but it is considered the least secure among the available options. Its main weakness is its vulnerability to ‘SIM swapping’: a criminal could convince a phone carrier to transfer your number to a new SIM, thereby intercepting your access codes. Additionally, SMS messages are not encrypted and could be intercepted by malware on the phone. Although receiving a code via SMS is much better than using only a password, it is preferable to opt for more robust methods when possible. Authenticator apps (like Google Authenticator or Microsoft Authenticator) generate codes directly on the device without going through the phone network, making them a more secure alternative. The use of physical tokens represents the highest level of security.

Yes, in most cases, the use of two-factor authentication is mandatory for electronic payments and for accessing online bank accounts in Europe. This requirement was introduced by the second European Payment Services Directive (PSD2), which made *Strong Customer Authentication* (SCA) binding. SCA requires that the user’s identity be verified using at least two of the following three elements: something the user knows (like a password or PIN), something they have (like a smartphone or a token), and something the user is (like a fingerprint or facial recognition). This regulation was created to increase the security of digital payments and protect consumers from fraud.

Enabling two-factor authentication (2FA) on your bank account is a crucial security step. The general procedure is similar for most banks and can usually be completed through the mobile banking app or the online banking website. The typical steps are: log in to your account, navigate to the ‘Security’ or ‘Profile Settings’ section, and look for the ‘Two-Factor Authentication,’ ‘Strong Authentication,’ or ‘OTP Generation’ option. At this point, the bank guides the user through the setup, which often involves linking their phone number to receive SMS messages or, more commonly, activating the code generation feature directly within the bank’s app. Once enabled, every transaction (like a wire transfer) or login from a new device will require entering the generated temporary code.

Still have doubts about 2FA: Your Digital Safe Against Online Fraud?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.