The American Express Gold Card is much more than just a credit card. It is a passport to a world of exclusive benefits, designed for those who love to travel in style, enjoy unique experiences, and accumulate reward points. But is it really the right card for you? In this complete review, we will explore every detail of the American Express Gold Card, from its benefits to costs, from insurance to loyalty programs. I will guide you through its main features, pros, and cons to help you make an informed decision.

What is the American Express Gold Card?

The American Express Gold Card is a premium credit card that offers a wide range of exclusive advantages and services to its cardholders. It is designed for a demanding audience seeking flexibility, convenience, and a touch of luxury in their payment experience.

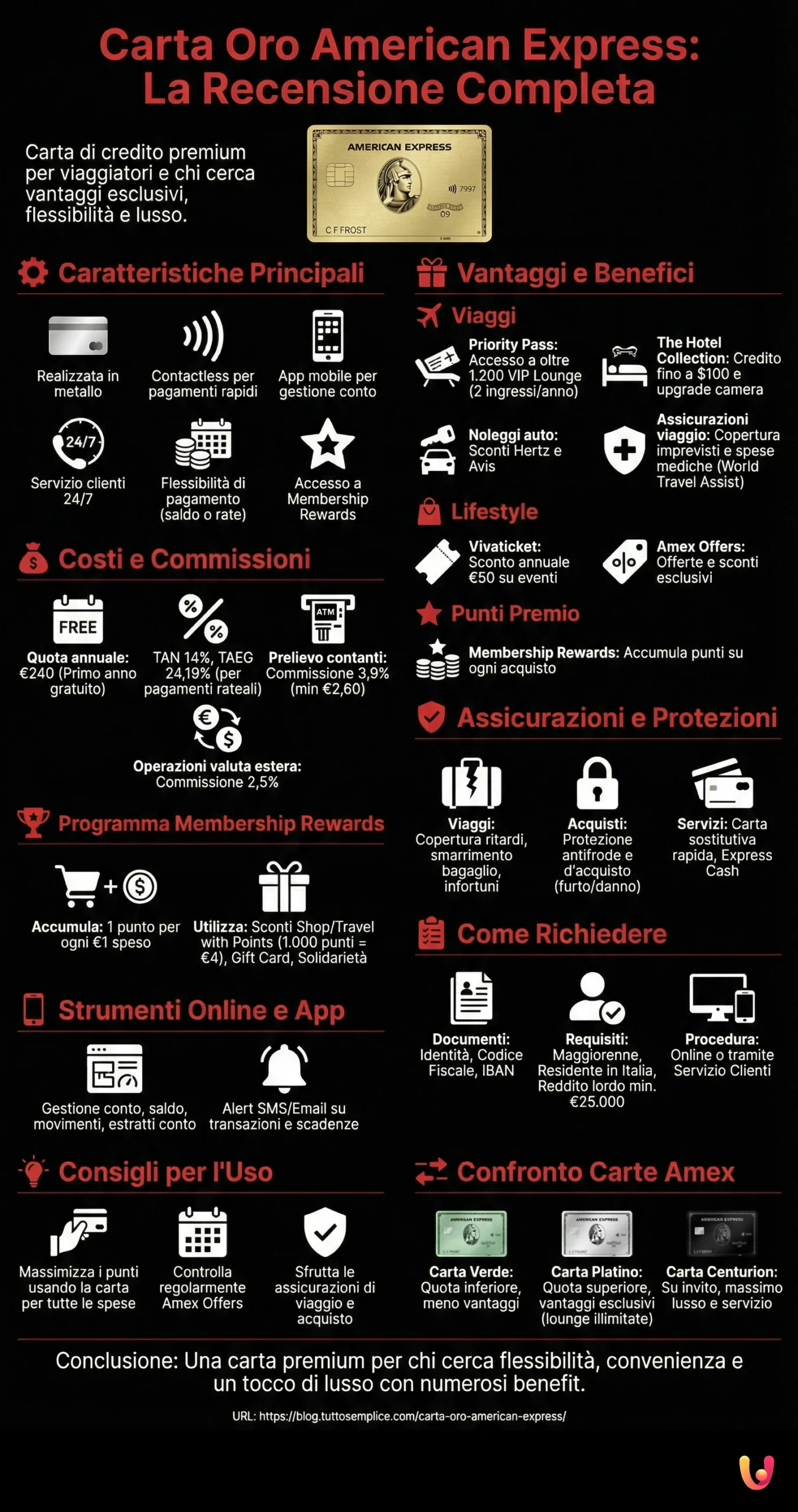

Key features:

- Made of metal

- Contactless for fast and secure payments

- Mobile app to manage the account simply and intuitively

- 24/7 Customer Service

- Payment flexibility: in full or in installments

- Access to the Membership Rewards loyalty program

With the Gold Card, you have a personalized credit line at your disposal, allowing you to manage your expenses flexibly. You can choose to pay your account balance at the end of the month, interest-free, or pay larger amounts in installments.

But the true strengths of the Gold Card are its exclusive benefits, ranging from travel to loyalty programs, from insurance to lifestyle experiences. In the following chapters, we will explore all these benefits in detail and help you understand if the Gold Card is the right choice for you.

Advantages and Benefits of the Gold Card

The American Express Gold Card stands out for its rich offering of advantages and benefits, designed to make your life simpler, safer, and more rewarding.

Travel

- Priority Pass: Access to over 1,200 VIP airport lounges worldwide, with two free entries every year.

- The Hotel Collection: Credit of up to $100 for ancillary hotel services and free room upgrade, upon availability.

- Car rentals: Discounts and benefits with Hertz and Avis.

- Travel insurance: Coverage against travel inconveniences and accidents, with World Travel Assist for medical expenses abroad.

Lifestyle

- Vivaticket: Annual discount of 50 euros for purchasing event tickets.

- Amex Offers: Exclusive offers and discounts at numerous shops and restaurants.

Reward Points

- Membership Rewards: You accumulate points with every purchase made with the Gold Card. You can use points to get discounts on travel, gift cards, and much more.

Security

- Fraud protection: You are not responsible in case of illicit use of your card by third parties.

- Purchase protection: Coverage in case of theft or damage to items purchased with the Gold Card.

- Express Cash Service: Cash withdrawals at ATMs.

- Replacement card: In case of theft or loss, you receive a replacement card quickly.

Services

- 24/7 Customer Service: Dedicated assistance at any time, wherever you are.

- Amex App: Manage your account, check expenses, and access offers directly from your smartphone.

- Apple Pay and Contactless: Fast and secure payments with a simple tap.

As you can see, the American Express Gold Card offers a wide range of benefits covering various areas of interest. In the next chapters, we will delve deeper into some of these aspects, such as costs, insurance, and loyalty programs, to give you a complete view of what this card has to offer.

Costs and Fees

Before applying for a credit card, it is fundamental to carefully evaluate the costs and fees associated with it. Here are the main costs to consider for the American Express Gold Card:

- Annual fee: The annual fee for the Gold Card is 240 euros. However, the first year is free.

- TAN and APR: The TAN (Nominal Annual Rate) is 14%, while the APR (Annual Percentage Rate) is 24.19%. These rates apply if you choose to pay your account balance in installments.

- Cash withdrawal fees: If you use the Gold Card to withdraw cash at ATMs, there is a commission of 3.9%, with a minimum of 2.60 euros.

- Foreign currency transaction fees: For purchases made in foreign currency, there is a commission of 2.5%.

It is important to emphasize that the APR may vary based on how you use the card. For example, if you choose to receive paper statements, the APR will be higher.

I recommend consulting the General Regulations for Optional Credit Cards on the American Express website to get a complete overview of all costs and fees.

Insurance and Protections

The American Express Gold Card offers a series of insurance policies and protections that guarantee peace of mind and security in various situations.

Travel

- Travel inconveniences and accidents: Coverage in case of flight delay, lost luggage, accidents during the trip, and other unpleasant situations.

- World Travel Assist: Medical and legal assistance abroad, with coverage up to 3,000 euros for medical expenses.

Purchases

- Fraud protection: You are not responsible in case of illicit use of your card by third parties.

- Purchase protection: Coverage in case of theft or damage to items purchased with the Gold Card.

Services

- Replacement card: In case of theft or loss, you receive a replacement card quickly, wherever you are.

- Express Cash Service: In case of emergency, you can withdraw cash at ATMs.

The insurance and protections offered by the Gold Card allow you to face unexpected events with serenity, knowing you have concrete support in various situations.

Loyalty Programs and Reward Points

One of the main advantages of the American Express Gold Card is the Membership Rewards loyalty program. This program allows you to accumulate points with every purchase made with the card.

How to accumulate points

- Purchases: You earn 1 Membership Rewards point for every euro spent with the Gold Card.

- Amex Offers: You can earn extra points by participating in offers and discounts dedicated to Gold Card members.

- Refer a friend: If a friend you referred becomes an American Express Cardmember, you can get up to 300,000 Membership Rewards points in a year.

How to use points

- Shop with Points discounts: You can use points to get statement credits on your purchases. 1,000 points equal 4 euros discount.

- Travel with Points discounts: You can use points to get discounts on travel booked through the American Express website. 1,000 points equal 4 euros discount.

- Gift cards: You can convert points into gift cards from numerous stores, such as Ikea, Amazon, and MediaWorld.

- Charity: You can donate points to support solidarity projects of American Express partners.

The Membership Rewards program offers you the possibility to transform your daily expenses into exclusive rewards and benefits.

How to Apply for the American Express Gold Card

Applying for the American Express Gold Card is simple and fast. You can do it online, through the American Express website, or by contacting customer service.

Required documents

- Valid identification document

- Tax Code (Codice Fiscale)

- IBAN of your bank or postal account

Requirements

- Be of legal age (18+)

- Be a resident of Italy

- Have a gross annual income of at least 25,000 euros

Online procedure

- Visit the American Express website and access the page dedicated to the Gold Card.

- Click on the “Apply now” button.

- Fill out the online form with your personal data and the requested information.

- Attach the necessary documentation.

- Submit the request and await evaluation by American Express.

Procedure via customer service

- Contact American Express customer service at the dedicated number.

- Provide your personal data and the requested information.

- Send the necessary documentation via fax or email.

- Await evaluation by American Express.

Before proceeding with the application, I recommend carefully reading the General Regulations and the Standard European Consumer Credit Information (SECCI), available on the American Express website.

Online Tools and Mobile App

American Express provides Gold Card members with a series of online tools and a mobile app to manage their account simply, quickly, and securely.

Online services

By accessing the American Express website with your credentials, you can:

- Check your account balance

- Verify movements and transactions

- Download statements

- Manage your preferences

- Activate online services, such as SMS or email alerts

Amex App

The Amex app allows you to manage your Gold Card account directly from your smartphone. With the app you can:

- Check balance and movements

- Make payments

- Freeze and unfreeze the card

- Access Amex Offers

- Find participating merchants

- Contact customer service

Alerts

The Alert service allows you to always be updated on the status of your account. You can choose to receive notifications via SMS or email for:

- Movements and transactions

- Payments due

- Reaching the credit limit

- Suspicious activity

Thanks to these tools, you have full control of your Gold Card account at any time and wherever you are.

Tips for Using the Gold Card

Here are some tips to make the most of your American Express Gold Card and maximize its benefits:

- Accumulate Membership Rewards points: Use the Gold Card for all your expenses, even daily ones, to accumulate as many points as possible.

- Participate in Amex Offers: Regularly check the offers and discounts dedicated to Gold Card members and take advantage of them to earn extra points.

- Use Membership Rewards points: Don’t let accumulated points expire. Use points to get travel discounts, gift cards, or to support charity projects.

- Take advantage of insurance and protections: Travel and shop in complete safety, knowing you are covered by the insurance and protections included in the Gold Card.

- Manage installment payments: If you choose to pay your account balance in installments, carefully plan your payments to avoid high interest and fees.

- Use online tools and the Amex app: Manage your account simply and intuitively, check expenses, and access offers directly from your smartphone or computer.

- Contact customer service if needed: American Express customer service is at your disposal 24/7 for any questions or problems.

By following these tips, you can make the most of the potential of your American Express Gold Card and enjoy all its advantages.

Comparison with Other Gold Cards

The American Express Gold Card is not the only Gold credit card on the market. Many banks and financial institutions offer Gold credit cards with similar benefits and features.

Here are some aspects to consider when comparing different cards:

- Costs: Annual fee, TAN, APR, cash withdrawal fees, and foreign currency transaction fees.

- Benefits: Loyalty programs, insurance, airport lounge access, exclusive discounts, and offers.

- Credit limit: Maximum amount you can spend with the card.

- Income requirements: Minimum income required to obtain the card.

- Services: Customer service, mobile app, online tools.

Before choosing a Gold credit card, I recommend carefully comparing the different options available and evaluating which card is best suited to your needs and lifestyle.

Comparison with other American Express credit cards

In addition to the Gold Card, American Express offers a range of credit cards with different features and benefits. Here is a brief comparison with some of the most popular cards:

American Express Green Card

- Lower annual fee

- Fewer advantages and benefits compared to the Gold Card

- Ideal for those looking for a credit card with good value for money

American Express Platinum Card

- Higher annual fee

- Exclusive advantages and benefits, such as unlimited access to airport lounges and a dedicated concierge

- Ideal for frequent travelers and those seeking maximum luxury and service

American Express Centurion Card

- Super exclusive credit card, available by invitation only

- Top-tier advantages and benefits, such as a dedicated personal assistant and access to exclusive events

- Ideal for the most demanding clients with high net worth

The choice of American Express credit card depends on your needs, your lifestyle, and your budget.

The History of the American Express Gold Card

The American Express Gold Card has a long and prestigious history, dating back to 1966. Initially, the card was available only to a selected clientele, but over the years it has become a symbol of status and access to a world of privileges.

Over the decades, the Gold Card has undergone several evolutions, adapting to market changes and customer needs. Today, the American Express Gold Card is a modern and versatile credit card offering a wide range of innovative benefits and services.

Customer Opinions and Reviews

Customer opinions and reviews of the American Express Gold Card are generally positive. Cardholders appreciate the numerous advantages and benefits offered by the card, such as access to airport lounges, travel insurance, and the Membership Rewards loyalty program.

However, some customers complain about the high annual fee and the commissions for cash withdrawals and foreign currency transactions.

Overall, the American Express Gold Card is a premium credit card that meets the needs of a demanding audience looking for flexibility, convenience, and a touch of luxury.

In Brief (TL;DR)

The American Express Gold Card is a premium credit card offering a wide range of exclusive perks and benefits, such as airport lounge access, travel insurance, and the Membership Rewards loyalty program.

The card has an annual fee of 240 euros, but the first year is free.

Before applying for the Gold Card, it is important to carefully evaluate the costs, benefits, and features of the card to understand if it is the right choice for you.

Conclusions

The American Express Gold Card is undoubtedly a prestigious product that opens the doors to a world of exclusive benefits and opportunities. If you are a frequent traveler, if you appreciate premium services, and if you want to accumulate reward points to get discounts and gifts, the Gold Card could be the ideal choice for you.

However, it is fundamental to carefully evaluate the costs and fees associated with the card to be sure it fits your budget and spending needs.

If you are interested in finding out more about credit cards and comparing the best offers on the market, I invite you to visit the dedicated section on our website.

Frequently Asked Questions

The credit limit of the Gold Card is personalized and is established by American Express based on your risk profile.

Yes, the Gold Card can be used worldwide, wherever the American Express network is accepted.

You earn Membership Rewards points with every purchase made with the Gold Card, by participating in Amex Offers, and by referring friends who become American Express Cardmembers.

Still have doubts about American Express Gold Card: The Complete Review?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.