Moving to Italy, whether for work, study, or to enjoy its Mediterranean culture, involves a series of fundamental practical steps. Among these, opening a bank account is one of the most important for managing daily life. Receiving your salary, paying rent and utilities, or simply buying groceries: an Italian bank account makes these operations much easier. Although the process may seem complex, especially due to bureaucracy, with the right information and the correct documents, it is an absolutely achievable goal. This guide is designed to walk you through the Italian banking world step by step, whether you are a European Union citizen or from a non-EU country.

Italy represents a unique market where tradition and innovation meet. On one hand, there are historic banks with a dense network of branches throughout the country; on the other, a growing number of digital banks and fintech companies offering agile, low-cost services. Understanding this context will help you choose the solution best suited to your needs, turning a bureaucratic necessity into an opportunity to better manage your finances in the Bel Paese. With this guide, you will have a clear checklist and practical advice to navigate with confidence.

Why Open a Bank Account in Italy

Having a local bank account is not just a matter of convenience, but a real necessity for those living in Italy. Many daily transactions require an Italian IBAN. For example, employers usually deposit salaries into a bank account, and many rental agreements require payment via bank transfer. Setting up direct debits for utilities like electricity, gas, and internet is also simpler and often cheaper when linked to an Italian account. Without one, managing these expenses would become complicated and potentially more costly.

Furthermore, an Italian account facilitates financial integration in the country. It allows you to make payments in stores, withdraw cash from ATMs, and use online banking services to monitor your finances wherever you are. Although it is possible to use accounts opened in other SEPA countries, having a local account eliminates any potential mistrust from merchants or institutions and ensures full, smooth operation, making daily life more fluid and stress-free.

The Key Distinction: Residents and Non-Residents

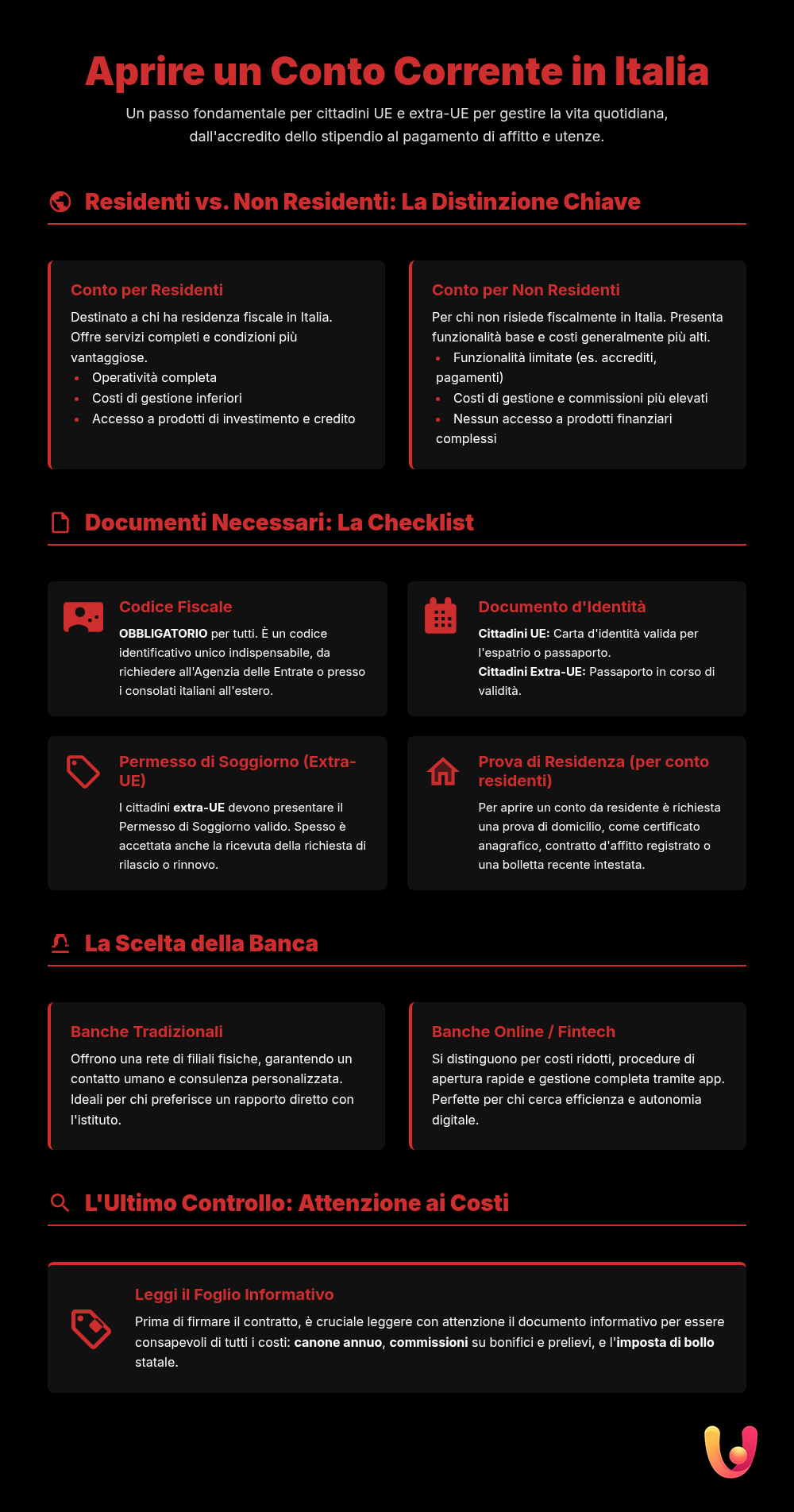

Before starting any procedure, it is crucial to understand the difference between an account for residents and one for non-residents, as the documentation and contractual conditions change significantly. The choice depends on your legal status in Italy. This distinction is the first fork in the road you will encounter on your journey to opening an account.

A non-resident account is designed for those who do not have tax residency in Italy, such as tourists, second-home owners, or foreign workers staying for short periods. This type of account, sometimes called an “international account,” offers basic features like deposits, withdrawals, and transfers, but often comes with higher management fees and more restrictions.

In contrast, a resident account is for those registered with the registry office (*anagrafe*) of an Italian municipality and who therefore have tax residency in the country. This type of account offers a full range of services, more favorable economic conditions, and access to additional financial products like credit cards, loans, and mortgages. Converting from a non-resident to a resident account is usually possible once you obtain a certificate of residence.

Essential Documents: The Complete Checklist

Gathering the correct documents is the most important step for a smooth account opening process. Italian banks are required to comply with strict anti-money laundering regulations, so the required documentation is standardized, although there may be slight variations between institutions. Having everything ready will save you time and make the process much more streamlined. Let’s look at what you’ll need in detail.

The Codice Fiscale: Your Key to Access

The Codice Fiscale is a unique alphanumeric code that identifies every individual in their dealings with Italian institutions. It is absolutely essential for almost every formal activity in Italy, including opening a bank account. Without it, the bank cannot proceed. You can request it for free at any *Agenzia delle Entrate* (Italian Revenue Agency) office by presenting an ID document. If you are still abroad, you can apply for it at the Italian consulate or embassy in your country of residence.

A Valid Identification Document

A valid identification document is a non-negotiable requirement. For European Union (EU) citizens, a national ID card valid for travel abroad or a passport is sufficient. For non-EU citizens, a passport is required. It is crucial that the document is not expired and that the personal data is clearly legible. The bank will make a copy to keep in its records as required by law.

Proof of Residence (or Domicile)

To open a resident account, you will need to prove that you live permanently in Italy. The most common documents accepted by banks include a certificate of residence (*certificato di residenza*) issued by your municipality, a registered rental agreement in your name, or a recent utility bill (electricity, gas, phone) addressed to you. For non-resident accounts, proof of address in your foreign country of residence is usually required. Some banks may be flexible and accept a declaration of domicile, but official residence (*residenza anagrafica*) is the standard requirement for regular accounts.

For Non-EU Citizens: The Residence Permit

If you come from a country outside the European Union, the Permesso di Soggiorno (residence permit) is a crucial document. It certifies the legality of your stay in Italy and, for most banks, is a mandatory requirement for opening a resident account. In some cases, especially for the “basic account” to which every legally residing citizen in the EU is entitled, it may be sufficient to present the receipt for the application or renewal of the permit. This receipt, which includes a photograph and a stamp, serves as a temporary document.

Choosing the Right Bank: Tradition vs. Innovation

The Italian banking landscape offers a wide range of choices, from large traditional banks to modern fintechs. The decision depends on your habits, needs, and the type of relationship you want with your credit institution. Imagine you’ve just arrived in Rome: would you prefer to walk into a majestic downtown branch to speak with an advisor, or manage everything from your smartphone while enjoying a coffee at a café? Both options have their pros and cons.

Traditional banks like UniCredit, Intesa Sanpaolo, or BNL offer a widespread network of branches, direct human interaction, and a wide range of products, from mortgages to investments. This option can be reassuring for those who prefer personal contact. However, they often come with higher management fees, slower procedures, and a certain bureaucratic rigidity. You might find it interesting to evaluate specific offers like some specific accounts like UniCredit’s My Genius, which try to combine tradition and flexibility.

On the other hand, online banks and fintechs like Revolut, Hype, or N26 are revolutionizing the sector. Their main strength is convenience: opening a bank account online is fast, costs are often zero or very low, and the apps are intuitive and packed with innovative features. The main drawback is the lack of physical branches, with customer support handled almost exclusively via chat or email, an aspect that may not appeal to everyone.

The Opening Process: Step by Step

Once you have chosen the bank and type of account, and after gathering all the necessary documents, you are ready to start the opening process. The procedure may vary slightly depending on whether you choose a physical or a digital bank, but the fundamental steps remain the same. The first step is to submit the application, which can be done in person at a branch or by filling out an online form. In both cases, you will be asked for your personal data and will need to provide the documents you have prepared.

Next, you will need to sign the contract. This is a crucial moment: take the time to carefully read all the clauses, especially the information sheet that summarizes the economic conditions. Pay attention to costs such as the annual fee, transfer fees, withdrawal costs at other institutions, and the stamp duty (*imposta di bollo*), a state tax applied to accounts with an average balance exceeding €5,000. Once the contract is signed and the identity verification is complete, the bank will proceed with activating the account. Within a few business days, you will receive your debit card and credentials to access online banking, ready to start your new financial life in Italy.

In Brief (TL;DR)

Opening a bank account in Italy for a foreign citizen, whether EU or non-EU, requires a series of essential documents, including the Codice Fiscale and the Permesso di Soggiorno (residence permit).

In this guide, we analyze the necessary documentation, from the Codice Fiscale to the Permesso di Soggiorno, distinguishing between EU and non-EU citizens.

We will analyze the necessary documentation, such as the Codice Fiscale and the residence permit, distinguishing between the requirements for EU and non-EU citizens.

Conclusion

Opening a bank account in Italy as a foreigner is a fundamental step to integrate and effectively manage your daily life. Although the process may seem daunting at first, proper preparation makes it decidedly simpler. The key to success lies in understanding the distinctions between resident and non-resident accounts and, above all, in gathering all the necessary documentation in advance: a valid ID, the Codice Fiscale, and, for non-EU citizens, the Permesso di Soggiorno.

The choice between a traditional and a digital bank will depend on your personal preferences, balancing the need for human contact with the convenience of low-cost online services. Regardless of your choice, being well-informed about costs and contractual conditions is essential to avoid surprises. By approaching this process in an orderly and informed manner, opening the account will become a simple bureaucratic step, opening the doors to a serene and autonomous financial management in the heart of the Mediterranean.

Frequently Asked Questions

Yes, absolutely. Both European Union and non-EU citizens can open a bank account in Italy. Italian law guarantees this right to anyone legally residing in the country, including students, workers, and even those who do not yet have tax residency, through specific accounts for non-residents.

For a European Union citizen, the procedure is quite streamlined. Usually, a valid ID document, such as an ID card or passport, and the Italian tax code (codice fiscale) are required. Some banks might also ask for proof of address in Italy.

For a citizen from a country outside the European Union, in addition to a passport and the tax code (codice fiscale), it is almost always necessary to present a residence permit (permesso di soggiorno) or, alternatively, the application receipt. This document certifies the legality of their stay in Italy and is essential for most credit institutions.

Yes, it’s possible. Many Italian banks offer a specific solution called a ‘non-resident account’. This type of account is designed for those who live abroad but need to conduct transactions in Italy. The required documents are similar to those for residents (ID and tax code), but the bank may also request proof of residence in your home country and the reasons for opening the account.

Yes, the tax code (codice fiscale) is an indispensable requirement for opening a bank account in Italy, for both residents and non-residents. It is used for the unique identification of the customer for tax and anti-money laundering purposes. It can be requested at any office of the Italian Revenue Agency (*Agenzia delle Entrate*) or, in some cases, through the Italian consulate in your home country.

Still have doubts about Bank Account for Foreigners in Italy: Documents and Complete Guide?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.