Living in a new country means rebuilding your daily life, a process in which access to financial services plays a crucial role. Having a checking account is now essential for operations like receiving your salary, paying bills, or safely managing your savings. In this context, financial inclusion is not just a practical necessity but a fundamental right that supports social and economic integration. To meet this need, European and Italian regulations have introduced the Basic Account (Conto di Base), a tool designed to guarantee all citizens, including foreigners, access to essential banking services.

This article explores in detail the regulations governing the Basic Account for foreigners in Italy, analyzing its role in the European market and its significance in a Mediterranean culture that balances tradition and innovation. It will provide practical information on how to apply for it, what documents are needed, and what to do if you encounter obstacles, with the goal of offering a comprehensive and accessible guide for anyone wishing to exercise their right to financial inclusion.

Financial Inclusion: A Fundamental Right in the European Context

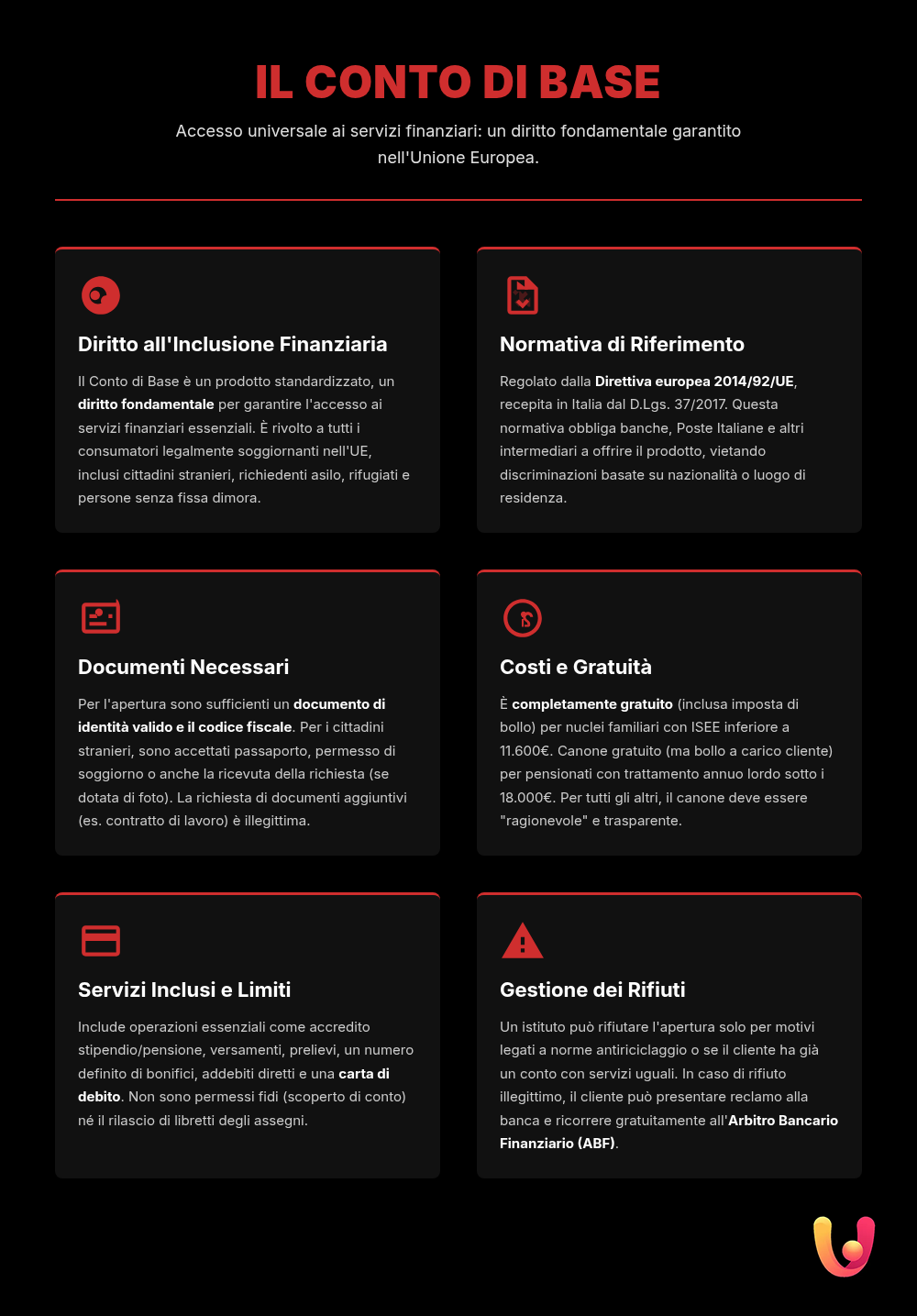

The right to a payment account is a pillar of social and financial inclusion in the European Union. Directive 2014/92/EU, also known as the PAD (Payment Accounts Directive), established a common regulatory framework to ensure that every consumer legally residing in the EU can open a “payment account with basic features.” This legislative action aims to eliminate barriers that prevent many people, including migrants, refugees, and homeless individuals, from accessing essential banking services. The goal is to create a more transparent, competitive, and inclusive market for financial services for everyone.

Italy transposed this directive with Legislative Decree No. 37 of March 15, 2017, which amended the Consolidated Banking Act (Testo Unico Bancario – TUB) by introducing specific provisions on the Basic Account. This regulation requires banks, Poste Italiane, and other payment service providers to offer this tool, actively promoting financial inclusion and combating the excessive use of cash. In this way, the legislature has recognized that access to an account is not a privilege, but a necessary right to fully participate in the country’s economic and social life.

What is the Basic Account and Who is it For?

The Basic Account is a standardized banking product designed to offer essential payment services at low or no cost. It is aimed at those with simple operational needs, such as receiving a salary or pension, making withdrawals, paying with a debit card, and arranging bank transfers. It is important to note that neither overdrafts nor checkbooks are granted with this type of account, as its purpose is purely transactional and not for investment or credit.

The Basic Account is not a concession, but a right established by law to guarantee everyone access to essential financial services, without discrimination.

The range of beneficiaries is very broad and includes all consumers legally residing in the European Union. This includes not only Italian and EU citizens but also third-country nationals, asylum seekers, refugees, and even homeless individuals. The law explicitly prohibits any form of discrimination based on nationality or place of residence. The only fundamental requirement is legal residence within the Union’s territory, making this tool a powerful vehicle for integration.

Italian Regulation: Legislative Decree 37/2017

Italian law, through Legislative Decree 37/2017 and the subsequent implementing decree from the Ministry of Economy and Finance (No. 70/2018), has precisely defined the features of the Basic Account. The law requires banks and other intermediaries to offer this product, which must include a predefined number of transactions within an all-inclusive annual fee. This fee must be “reasonable” and, in some specific cases, free of charge.

A central aspect of the regulation is the limitation on grounds for refusal. A credit institution can only deny the opening of a Basic Account in well-defined circumstances, such as a well-founded suspicion of its use for illegal purposes (e.g., money laundering or terrorist financing) or if the applicant already holds another account in Italy that allows them to use the same essential services. Any refusal must be communicated in writing, with reasons provided, within ten working days of the request. The Bank of Italy (Banca d’Italia) plays a supervisory role, ensuring that intermediaries comply with these provisions and protect customers.

Services Included and Costs of the Basic Account

The Basic Account guarantees access to a package of essential services for daily financial management. Although details may vary slightly between banks, the law establishes a core set of operations that must always be included. These include opening and closing the account, depositing and withdrawing cash, crediting a salary or pension, executing SEPA transfers (with a defined number of free transactions per year), and payments via direct debit. A debit card is also provided for payments in physical stores and online.

Regarding costs, the regulation provides for favorable conditions for specific categories. The account is completely free, including stamp duty, for households with an ISEE of less than €11,600. A free annual fee is also provided for pensioners receiving a gross annual pension of less than €18,000 (though stamp duty is payable by the customer, if due). For all other consumers, a fixed and transparent annual fee is applied. It is important to know that any extra transactions, beyond those included in the package, may incur additional costs, which must be clearly stated in the information sheet. To avoid surprises, it is always advisable to inquire about any hidden costs before signing the contract.

How to Open a Basic Account: Documents and Procedure

Opening a Basic Account is a process regulated to be simple and accessible. Understanding the steps and required documents is the first step to exercising this right. The procedure is designed to minimize bureaucracy, but it is crucial to arrive at the branch with everything needed to avoid delays or misunderstandings. In case of difficulties, there are specific protection tools that consumers can use.

Required Documents

To open a Basic Account, Italian law requires the presentation of two fundamental documents: a valid identification document and the tax identification number (codice fiscale). For foreign citizens, the ID can be a passport or another equivalent identification document, such as the residence permit (permesso di soggiorno). It is important to note that even the simple receipt for the residence permit application, if it includes a photograph, is considered valid for identification. Requesting additional documents, such as an employment contract or a certificate of residence, is unlawful. In fact, the right to a Basic Account is also guaranteed to those without a fixed abode. For a comprehensive overview, it is useful to consult our complete guide on documents for opening an account.

What to Do in Case of Refusal

Despite the clarity of the regulations, a bank or post office may unlawfully refuse to open a Basic Account. A refusal is legitimate only for reasons related to anti-money laundering rules or if the customer already has another account. If the institution objects without a valid justification, for example by requiring proof of residency from an asylum seeker, it is committing a discriminatory act. In this case, the first step is to file a formal complaint with the bank’s own complaints office. If you do not receive a response within 30 days or the response is unsatisfactory, you can turn to the Banking and Financial Arbitrator (ABF) for free, an impartial body that resolves disputes between customers and intermediaries. Its decisions, while not court judgments, are almost always respected by banks to avoid reputational damage. In complex situations, such as those involving problems with a blocked account, the assistance of consumer or migrant protection associations can be decisive.

Tradition and Innovation: The Mediterranean Approach to Inclusion

The introduction of the Basic Account in Italy is part of a unique cultural context, the Mediterranean one, where the tradition of hospitality and social networks confronts the need for innovation. Historically, Mediterranean communities have always relied on personal ties and mutual trust, even in economic matters. However, modern society, increasingly digitalized and globalized, requires formal tools to ensure equal opportunities for all. The Basic Account represents a synthesis of these two worlds: it is a regulatory and technological innovation that builds on a tradition of solidarity.

This tool can be seen as a modern bridge. If Mediterranean ports were once places for the exchange of goods and cultures, today a bank account becomes the gateway to the economy and society for those arriving in a new country. It allows them to overcome financial exclusion, which often translates into social exclusion, and to build an autonomous future. In this sense, the Italian and Mediterranean approach to financial inclusion is not limited to mere bureaucratic compliance but reflects a will to integrate new energies into the social and economic fabric, valuing the contribution that each person can offer.

In Brief (TL;DR)

The Basic Account is a fundamental right that guarantees financial inclusion, allowing foreign citizens and refugees to access essential banking services in accordance with European regulations.

We will explore the regulations that govern it and the necessary steps to open one, ensuring access to essential banking services even with limited documentation.

Discover how regulations protect the right to financial inclusion and what the practical steps are to open your account, even with limited documentation.

Conclusions

The Basic Account represents a fundamental achievement on the path to full financial and social inclusion for foreign citizens in Italy and Europe. It is not just a low-cost banking option, but a right established by law, designed to break down barriers that prevent access to essential services. From the European directive to its implementation in Italy, the regulation is clear: every person legally residing in the EU, including asylum seekers and homeless individuals, is entitled to this tool.

Knowing your rights is the first step to being able to exercise them. Knowing what documents are needed, what services are included, and how to act in case of an unjustified refusal, confers power and autonomy. The Basic Account is not just a means to receive a salary or pay a bill; it is a key that opens the doors to economic participation, personal dignity, and real integration into society. In an increasingly interconnected world, guaranteeing everyone a fair starting point is an investment in a more just and prosperous community for all.

Frequently Asked Questions

The Basic Account is a bank account with reduced or no costs, designed to guarantee access to essential banking services. It is a right for all consumers legally residing in the European Union, including foreigners, asylum seekers, and homeless individuals, provided they do not already hold a similar account in Italy.

To open a Basic Account, a foreigner must present a valid identification document and their tax identification number (codice fiscale). It’s important to note that a residence permit (or the application receipt with a photograph) is considered sufficient identification, and additional documents like an employment contract cannot be required.

No, a refusal is unlawful and considered a discriminatory act. All consumers legally residing in the EU, including asylum seekers, have the right to open a Basic Account. In case of refusal, you can report it to the Italian Banking Association (ABI), UNAR, or associations like ASGI.

Not always. The account has a reduced annual fee that includes a set number of transactions. However, it becomes free and exempt from stamp duty for socially disadvantaged groups, specifically those with an ISEE below €11,600. It is also free for pensioners with a gross annual income below €18,000, although in this case, stamp duty is still due.

With a Basic Account, you can perform essential operations like receiving your salary or pension, making and receiving bank transfers, setting up direct debits for bills, and using a debit card to pay and withdraw cash. However, there are limits: you cannot have an overdraft (no credit facilities are granted), you do not get a checkbook, and you cannot link a securities account for investments.

Still have doubts about Basic Bank Account for Foreigners: Your Right and a Guide to Opening One?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.