In Brief (TL;DR)

Contrary to popular belief, a prepaid card with an IBAN is garnishable, almost in the same way as a bank account. This comprehensive guide analyzes when and how the law allows for the garnishment of these financial instruments, explaining the specific limits for salaries and pensions and the substantial differences compared to a traditional account.

We analyze in detail the garnishability limits, the key differences compared to a bank account, and the protections provided for salaries and pensions.

We delve into the legal limits, the protections for salaries and pensions, and the substantial differences compared to the garnishment of a bank account.

The devil is in the details. 👇 Keep reading to discover the critical steps and practical tips to avoid mistakes.

In recent years, prepaid cards with an IBAN have become an increasingly popular financial tool, representing a middle ground between the convenience of a rechargeable card and the basic functionalities of a bank account. Many choose them for their flexibility, low costs, and ease of management, making them ideal for receiving a salary, managing daily expenses, or making online purchases. However, a crucial question naturally arises among cardholders: are these cards safe from creditors? The short answer is no. Understanding their legal nature and the rules on garnishability is essential to use these tools with full awareness.

This article offers a complete and clear legal guide on the garnishability of prepaid cards with an IBAN within the Italian regulatory context. We will analyze in detail how and when a creditor can seize the deposited funds, what limits are imposed by law to protect salaries and pensions, and what differences, if any, exist compared to the garnishment of a traditional bank account. The goal is to debunk false myths and provide accurate information for anyone who uses or intends to use these modern payment instruments.

Prepaid Card with an IBAN: What It Is and How It Works

A prepaid card with an IBAN is a hybrid payment instrument that combines the simplicity of a rechargeable card with one of the key features of a bank account: the IBAN code. This alphanumeric code allows the card to receive and make SEPA transfers, have a salary or pension credited, and set up direct debits for utilities. Unlike a traditional bank account, it usually does not offer complex services like checkbooks or bank overdrafts. Its operation is based on a “pay before” model: you can only spend the money previously loaded onto it, offering direct control over your spending.

This nature makes it particularly attractive in a financial market moving towards innovation and digitalization. Tools like Postepay Evolution, Hype, or N26 are examples of how traditional banking is adapting to new consumer needs, offering agile and low-cost solutions. However, it is precisely the presence of the IBAN that makes them, in the eyes of the law, a traceable financial relationship and, consequently, seizable by creditors. For a complete overview of its features, it may be useful to consult the guide on Postepay Evolution, transfers, IBAN, and recurring payments.

The Law Is Clear: The Garnishability of Cards with an IBAN

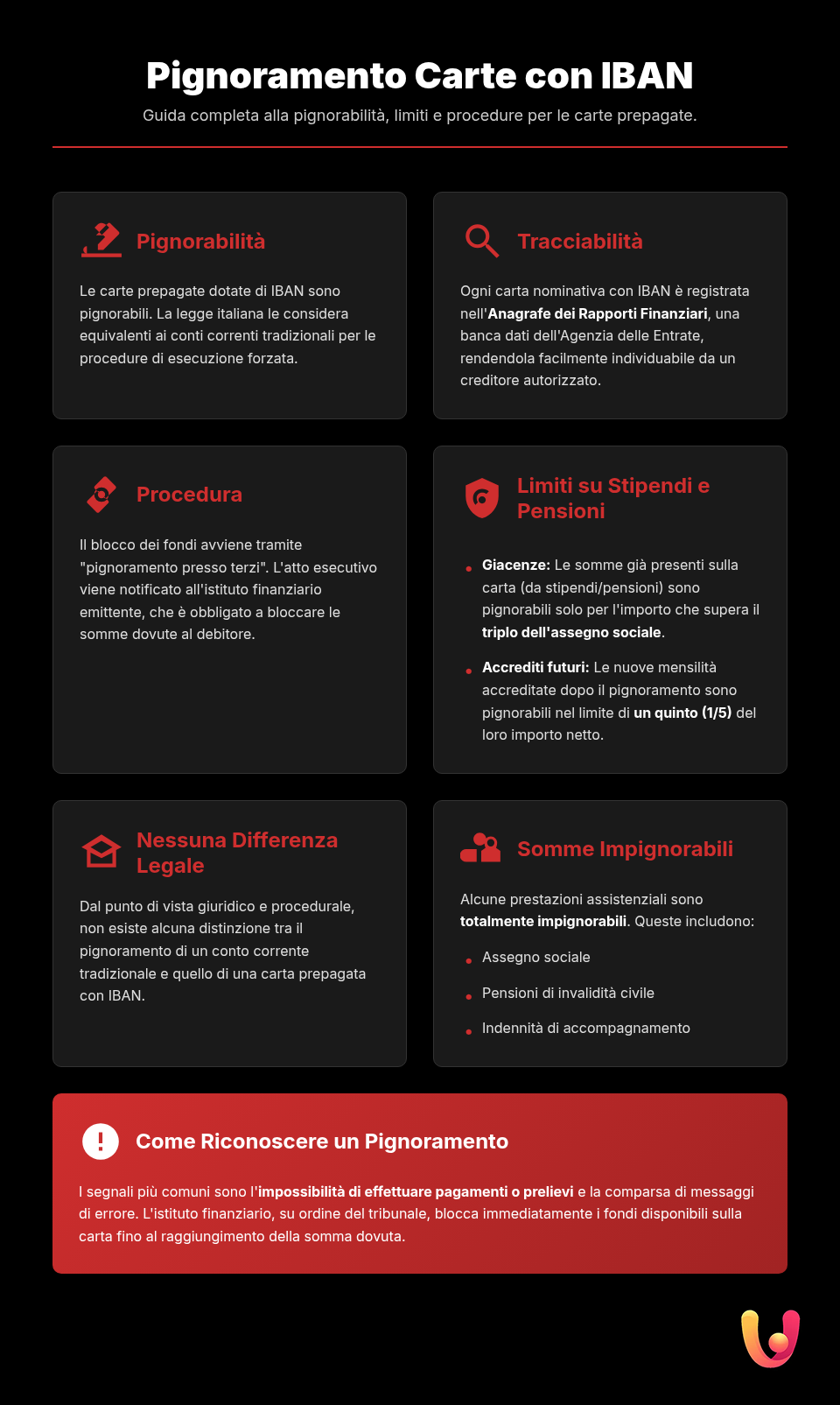

The central question finds a clear answer in Italian law: yes, prepaid cards with an IBAN are garnishable. The law, in fact, does not distinguish between a traditional bank account and a card with an IBAN when it comes to enforcement. The deposit of money on a registered card constitutes a credit that the cardholder has with the issuing institution, just like funds deposited in an account. Therefore, this credit can be subject to seizure by a creditor holding an enforceable title.

Any registered card with an IBAN is, for all intents and purposes, equivalent to a bank account. Consequently, it is perfectly traceable and seizable by creditors.

The mechanism that makes this possible is the Financial Records Registry (Anagrafe dei Rapporti Finanziari), a massive database managed by the Italian Revenue Agency (Agenzia delle Entrate). Financial institutions are required to periodically report all ongoing relationships, including bank accounts and cards with an IBAN, linking them to the holder’s tax identification number. This means the idea of a card being “invisible” to tax authorities or creditors is a dangerous myth. Through an electronic search, a creditor can easily discover the existence of such cards and initiate the garnishment procedure.

The Garnishment Process: A Step-by-Step Guide

The garnishment of a card with an IBAN follows the procedure of third-party garnishment (pignoramento presso terzi), a legal mechanism involving three parties: the creditor, the debtor, and a third party (in this case, the financial institution that issued the card). The object of the garnishment is not the physical card, but the funds deposited on it. The process is divided into well-defined phases, governed by the Code of Civil Procedure.

The Preliminary Phase: Enforceable Title and Formal Payment Demand

Before any asset can be garnished, the creditor must have an enforceable title. This is a document that officially certifies their right to obtain payment. Common examples include a court judgment, an unopposed payment order, or a protested check. Once the title is obtained, the creditor must serve the debtor with a formal payment demand (atto di precetto), which is a formal notice to pay the debt within a period of not less than 10 days, warning that failure to do so will result in enforcement proceedings.

The Writ of Third-Party Garnishment

If the debt is not paid after the formal demand is served, the creditor can initiate the actual garnishment. The bailiff serves the writ of garnishment on both the debtor and the financial institution (the “third-party garnishee”). It is important to note that the writ is often generic: the creditor does not need to specify the card number, but simply indicating the credit institution is sufficient. From the moment of service, the institution is obligated to freeze the funds on the card up to an amount equal to the demanded debt, plus half to cover interest and legal fees.

The Court Hearing and Assignment of Funds

After service, a court hearing is held. During the hearing, the judge verifies the regularity of the procedure and the statement of the third party (the financial institution), which must confirm the existence of the relationship and the amount of the frozen funds. If everything is in order, the judge issues an assignment order, with which they order the institution to pay the garnished funds directly to the creditor, thus extinguishing the debt in whole or in part. If your card is blocked, it might be helpful to consult the guide on what to do in case of a garnished Postepay.

Limits on Garnishment: When Your Money Is Safe

Although cards with an IBAN are garnishable, Italian law sets specific limits to protect the debtor’s “minimum subsistence level,” ensuring they have the necessary means to live with dignity. These protections are particularly strict when salaries, pensions, or other similar benefits are credited to the card. The rules are primarily established by Article 545 of the Code of Civil Procedure and vary depending on when the funds are credited relative to the date of garnishment.

Garnishment of Salary or Pension

When a card with an IBAN is used to receive a salary or pension, specific limits apply. A distinction must be made between two scenarios:

- Funds on deposit before garnishment: If the salary or pension was credited before the date the garnishment was served, the funds already on the card can only be garnished for the amount exceeding three times the social allowance (assegno sociale). For 2025, considering a social allowance value of about €538, this non-garnishable threshold is approximately €1,616. For example, with a balance of €2,000 from past salaries, the creditor can only garnish the excess amount, about €384.

- Future deposits: Monthly salary or pension payments credited after the garnishment notice are garnishable according to specific fractions. For private creditors, the limit is generally one-fifth (1/5) of the net salary. For debts to the Italian Revenue Agency-Collection (Agenzia delle Entrate-Riscossione), the limits are more favorable to the debtor and vary by amount: 1/10 for salaries up to €2,500, 1/7 for salaries between €2,501 and €5,000, and 1/5 for salaries over €5,000.

Funds Exempt from Garnishment by Law

There are some types of credits that are considered absolutely exempt from garnishment due to their social and welfare function. Even if credited to a card with an IBAN, these funds cannot be touched by creditors. The main ones include:

- The social allowance itself.

- Civil disability pensions.

- The attendance allowance.

- Child support payments.

- Annuities from life insurance policies.

If both garnishable funds (like a salary) and exempt funds (like a disability pension) are deposited onto the card, the debtor has the right to prove the nature of the funds to assert the protection provided by law.

Differences Between Garnishing a Bank Account and a Card with an IBAN

From a strictly legal and procedural standpoint, there is no substantial difference between garnishing a bank account and a prepaid card with an IBAN. In both cases, the third-party garnishment procedure applies, and the same garnishability limits for salaries and pensions are valid. The idea that a card offers greater protection is one of the biggest and most dangerous financial misunderstandings. Both products are traceable financial relationships reported to the Tax Registry, making them equally visible to creditors.

The equivalence between cards with an IBAN and bank accounts is total for garnishment purposes. The presence of the IBAN nullifies any practical distinction, exposing the deposited funds to the same enforcement procedure.

The only subtle difference lies in perception and use. Many see the card as a “lighter,” less formal tool, almost like a digital wallet. This perception can lead to a false sense of security. Imagine the story of Luca, a young professional who, to separate his work finances from his personal ones, decides to have his fees credited to a card with an IBAN, thinking he is protecting them from an old debt. When he receives the garnishment notice, he is surprised to find that, in the eyes of the law, that “digital piggy bank” is as vulnerable as any bank account. This story illustrates how the convenience of a tool should never be confused with a legal immunity that, in fact, does not exist.

How to Know if Your Card Has Been Garnished

Discovering that your card has been garnished can be an unpleasant experience, often happening without immediate warning. The most common signs are the inability to make payments, withdraw cash at an ATM, or the appearance of error messages during online transactions. In practice, the card stops working because the issuing institution has frozen the funds in compliance with the garnishment order. Another clear indicator can be an unusual delay in your salary deposit, although there could be many causes for this.

Legally, the debtor must always receive formal notification of the writ of garnishment. However, delays in postal delivery or mishaps can occur, leading the debtor to discover the freeze only when trying to use the card. If you suspect a garnishment, the first step is to immediately contact the customer service of the institution that issued the card. The representative can confirm the presence of a legal hold on the funds. Afterward, it is crucial to consult a lawyer or legal advisor to analyze the writ of garnishment, verify its legitimacy, and evaluate possible actions, such as an opposition to enforcement if there are formal or substantive defects.

Tradition and Innovation in the European Financial Market

The phenomenon of the garnishability of cards with an IBAN is part of a broader context where legal tradition and financial innovation meet and, at times, clash. On one hand, we have tradition, represented by age-old principles of civil law, such as the debtor’s patrimonial liability (Article 2740 of the Civil Code), which states that one is responsible for their debts with all their present and future assets. Garnishment is the ultimate expression of this principle, an established tool for protecting credit.

On the other hand, there is innovation, embodied by fintech and tools like cards with an IBAN. These solutions were created to meet the needs of an increasingly integrated European market (the SEPA area) and a culture, like the Mediterranean one, that values flexibility and agile management of daily finances. Cards with an IBAN offer a middle ground between cash, which is still deeply rooted, and the complexity of a traditional bank account. However, this innovation does not operate in a regulatory vacuum. The law adapts, extending traditional rules to these new instruments to ensure fairness and protect the rights of both debtors and creditors. The traceability required by European anti-money laundering and tax regulations has made it inevitable that these innovative tools also fall fully within the scope of enforcement procedures.

Conclusions

In conclusion, prepaid cards with an IBAN, while representing a convenient and flexible financial innovation, offer no immunity from garnishment. Italian law equates them, for all intents and purposes, to traditional bank accounts, making the funds deposited on them fully seizable by creditors. The process follows the third-party garnishment procedure, and the existence of such cards is easily discoverable thanks to the Financial Records Registry.

It is essential to remember that there are specific legal limits to protect the debtor, especially regarding the deposit of salaries and pensions, which ensure the safeguarding of a “minimum subsistence level.” Debunking the myth of the non-garnishability of these instruments is the first step toward conscious financial management. Those in a debt situation should avoid relying on supposed “safe havens” and instead seek qualified legal advice to address the problem in a structured and law-abiding manner.

Frequently Asked Questions

Yes, a prepaid card with an IBAN is fully garnishable. The presence of the IBAN makes it traceable through the Financial Records Registry, effectively equating it to a bank account for the purposes of enforcement procedures. A creditor can therefore identify it and garnish the deposited funds.

Yes, but there are specific legal limits to protect the debtor. For funds already on the card at the time of garnishment, derived from salaries or pensions, the portion up to three times the social allowance (assegno sociale) cannot be garnished. For future deposits, garnishment can only affect a portion of the salary or pension, generally one-fifth, safeguarding the minimum subsistence level.

The only cards that escape garnishment are anonymous, ‘disposable’ cards without an IBAN, which are now rare due to anti-money laundering regulations. Any registered card, especially one with an IBAN, is traceable and therefore garnishable. Transferring funds to a prepaid card with an IBAN does not protect them from creditors.

Once a creditor obtains an enforceable title (like a payment order), they can request authorization to access the Financial Records Registry. This database, managed by the Italian Revenue Agency, contains a list of all financial relationships held by a person, including prepaid cards with an IBAN, allowing the creditor to identify them to initiate garnishment.

From a legal procedure standpoint (third-party garnishment), there are no substantial differences. Both a bank account and a card with an IBAN are considered seizable financial relationships. The garnishment limits applied to salaries and pensions are also the same for both instruments. The real difference lies in the product’s features and costs, not in its garnishability.

Did you find this article helpful? Is there another topic you'd like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.