Arriving in a new country like Italy means facing many challenges, including navigating the financial system. The first need is almost always the same: having a tool to manage your money, receive payments, and make purchases. The two main options are the card account and the checking account. Although they may seem similar, they meet different needs, especially for those still settling into a cultural context that balances tradition and innovation. Understanding which solution is best is a fundamental step toward a smooth economic and social integration.

This guide is designed to clarify things by analyzing the features, advantages, and disadvantages of both solutions. The goal is to provide the necessary information for an informed choice that takes into account your personal and work situation, and how quickly you need to be up and running. Whether you are a student, a worker, or simply someone waiting to complete bureaucratic procedures, the right choice can significantly simplify your daily life.

What Is a Card Account? Flexibility at Your Fingertips

The card account, also known as a prepaid card with an IBAN, is a hybrid payment instrument. Think of it as a digital wallet: it works like a regular prepaid card but with the added benefit of an associated IBAN code. This means you can not only spend the money you’ve previously loaded but also receive bank transfers, like your salary, and make them yourself. Its “prepaid” nature means you can’t spend more than the available balance, eliminating the risk of going overdrawn. This feature makes it an excellent tool for those who want strict control over their finances, combining the convenience of a card with the basic functionality of an account.

What Is a Checking Account? The Center of Your Financial Life

The checking account is the most traditional and comprehensive banking product. Unlike a card account, it’s not a standalone instrument but the core of a relationship with a credit institution. It offers a much wider range of services: it allows you to deposit cash without the balance limits typical of cards, issue and cash checks, apply for credit cards, access loans and mortgages, and set up investment plans. It is the tool designed for 360-degree financial management, essential for those with a stable economic and work situation who need advanced banking services. Opening a checking account means becoming a full-fledged bank customer, with all the rights and responsibilities that entails.

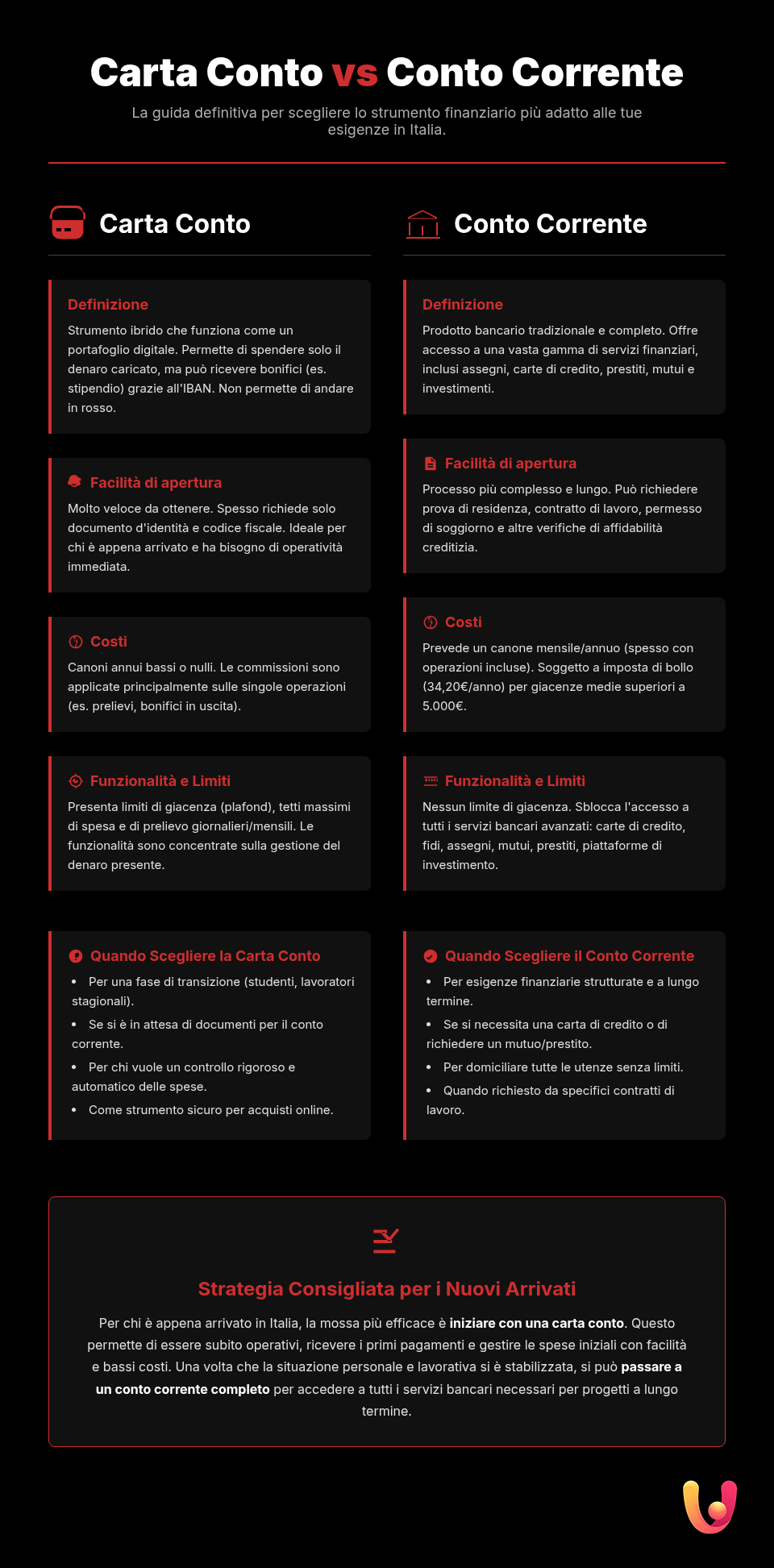

Card Account vs. Checking Account: A Head-to-Head Comparison

Choosing between a card account and a checking account depends on three key factors: the documentation you have, the costs you are willing to bear, and the services you actually need.

Opening an Account and Required Documentation

For those who have just arrived in Italy, the ease of opening an account is a decisive factor. The card account wins on agility: a valid ID and a tax code (codice fiscale) are often sufficient. The process is quick and can sometimes be completed online. In contrast, opening a traditional checking account can be more complex. Banks usually require, in addition to basic documents, proof of residence (like a rental agreement) and, in some cases, an employment contract. For non-EU citizens, a residence permit (permesso di soggiorno) is almost always an essential requirement. If you need an immediate solution, the card account is unbeatable; for a complete overview of the documents needed for a foreigner to open an account, it’s helpful to get informed in advance.

Costs and Fees

The cost structures of the two products are very different. A card account generally has a low or no annual fee, but may have higher fees for individual transactions like withdrawals at other banks’ ATMs, bank transfers, or cash top-ups. A checking account, especially a traditional one, has a monthly fee that includes a package of free transactions (transfers, withdrawals). Many digital banks now offer zero-fee accounts, but it’s important to read the terms and conditions carefully to avoid surprises, like the costs the bank doesn’t always disclose. The state stamp duty (imposta di bollo) of €34.20 per year applies only to checking accounts with an average balance over €5,000, a cost that doesn’t apply to card accounts.

Functionality and Operational Limits

The most significant difference lies in the services offered. A card account allows you to: receive and make bank transfers, have your salary deposited, set up direct debits for some utilities, and pay online or in stores. However, it has limits, such as a maximum balance (plafond) (e.g., €30,000 or €50,000) and daily or monthly caps on withdrawals and payments. A checking account has virtually no balance limits and unlocks access to all banking operations: checkbooks, credit cards (with a credit line), loans, mortgages, and investments. For complex transactions or for those who plan to manage large sums of money, a checking account is the only viable option.

When Is a Card Account a Good Idea?

A card account is the ideal solution for those looking for flexibility and speed. It’s perfect for those in a transitional phase: students, seasonal workers, or people waiting to obtain residency or other documents. For students, there are specific solutions like a zero-fee account for foreign students, which are often based on card accounts. It’s also an excellent choice for those who want to separate daily spending from main savings, or for those who want a secure tool for online shopping, limiting the risk in case of fraud to the loaded amount. In short, it’s an excellent first step into the Italian financial system, easy to get and manage.

When Is a Checking Account Essential?

A checking account becomes essential when your financial needs become more complex and structured. It is a fundamental requirement for those with a permanent employment contract, as many companies require a traditional checking account for salary deposits. It is also necessary for setting up direct debits for all utilities (RID/SDD), applying for a mortgage to buy a home, getting a credit card with a spending limit, or starting a business as a freelancer. The digital age has simplified things greatly, and today, opening a checking account online is an increasingly common procedure, combining the completeness of a traditional account with the convenience of remote management.

In Brief (TL;DR)

Choosing between a card account and a checking account is one of the first and most important financial decisions to make when settling in a new country.

We will analyze the pros and cons of both options to help you choose the one that best suits your needs as a new resident.

We will evaluate costs, benefits, and ease of access to guide you toward the right choice for your needs.

Conclusion

Ultimately, there is no single answer to the question “card account or checking account?”. The best choice depends entirely on your specific situation. For those who have just arrived in Italy and need an agile tool for their initial needs, a card account with an IBAN is a practical, affordable, and quickly activated solution. It allows you to be operational right away without dealing with excessive bureaucracy. As your situation stabilizes—with residency, a steady job, and the need for more complex financial services—switching to a full checking account becomes a natural and necessary evolution. The wisest strategy might be to start with a card account and then open a checking account later, ensuring a smooth and stress-free transition into your new life in Italy.

Frequently Asked Questions

To open a card account or a checking account, you usually need a valid ID, such as a passport, and an Italian tax code (codice fiscale). For non-EU citizens, the bank or issuing institution may also require a residence permit (permesso di soggiorno) or a document proving the application. The exact documentation can vary, so it’s always advisable to check directly with the chosen institution.

Yes, you can. Card accounts, like Postepay Evolution, come with an IBAN code that allows you to receive bank transfers, including salary or pension deposits. This feature makes them a valid tool for basic operational needs, similar to a traditional checking account.

Generally, a card account has a lower annual fee than a traditional checking account. However, the total cost depends on how you use it. Checking accounts, especially online ones, may offer unlimited free transactions, while card accounts might charge fees for withdrawals or transfers. It’s important to evaluate your operational habits to figure out which solution is more cost-effective.

Typically, no. A card account does not allow you to access complex financial products like loans, mortgages, or traditional credit cards. These services require a creditworthiness assessment that is linked to a full bank checking account, through which a financial history is built. The exception is some small-amount micro-loans offered by certain institutions.

Getting a card account is almost always faster and requires less bureaucracy. It’s often possible to activate it the same day at post offices or authorized tobacconists. Opening a bank checking account, on the other hand, can take several days, sometimes even 15-20, as the bank needs to perform more thorough checks on the documentation and complete the registration procedures.

Still have doubts about Card Account or Checking Account? A Guide for Newcomers?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.