In the digital age, the financial education of young people is of crucial importance. Prepaid cards with an IBAN for minors are establishing themselves as a fundamental tool in this journey, a bridge between the traditional “allowance” and the independent management of money. This article offers a comprehensive overview of the Italian and European market for 2026, analyzing the best solutions that combine technological innovation and security, without overlooking the influence of Mediterranean culture, which values family control and guidance.

The goal is to provide parents and teens with a clear guide to navigate an ever-expanding range of options. Various options will be examined, highlighting costs, parental control features, and educational tools. The analysis will focus on valid alternatives to already well-known products to offer a broad and detailed comparison that can meet the diverse needs of modern families, in a context where money management becomes digital from a young age.

The Context: Financial Education and Digital Payments Among Young People

The relationship young people have with money is changing rapidly, driven by the digitalization of payments. However, financial literacy is not always keeping pace. According to a 2023 survey by the Bank of Italy, only 35% of young people between 18 and 34 demonstrate a full understanding of basic financial concepts like inflation and risk diversification. This figure highlights an educational urgency that cards with an IBAN for minors can help address, transforming them from a simple payment tool into a true financial education lab.

In Italy, awareness of this gap is growing. A survey by Skuola.net reveals that over half of those under 30 want to improve their economic skills. The new generations, digital natives, show a strong preference for innovative tools and mobile apps to learn and manage their finances. This trend fits into a European market where Gen Z is becoming a key player, influencing the development of new payment solutions with their purchasing habits. Cards for minors meet this need by offering intuitive and secure platforms.

Tradition and Innovation: A Mediterranean Approach

In the Italian and Mediterranean cultural context, the family plays a central role in the upbringing of young people. Money management is no exception. Prepaid cards for minors represent a meeting point between the tradition of parental control and the innovation of digital tools. They allow parents to supervise spending, set limits, and intervene when necessary, maintaining the guidance role typical of Italian family culture. At the same time, they offer young people gradual and responsible autonomy.

The balance between supervision and independence is the key to the success of these tools. It’s not just about giving a card, but about starting a constructive dialogue about the value and management of money—a lesson that lasts a lifetime.

This dynamic reflects an approach that values both security, a pillar of tradition, and openness to new technologies. For example, parents can schedule the automatic sending of an allowance, turning an established habit into a digital, traceable, and educational operation. Innovation, therefore, does not replace tradition but enhances it, offering new ways to transmit established values. To delve deeper into the importance of a conscious use of digital tools, reading a secure guide for parents on digital payments can be helpful.

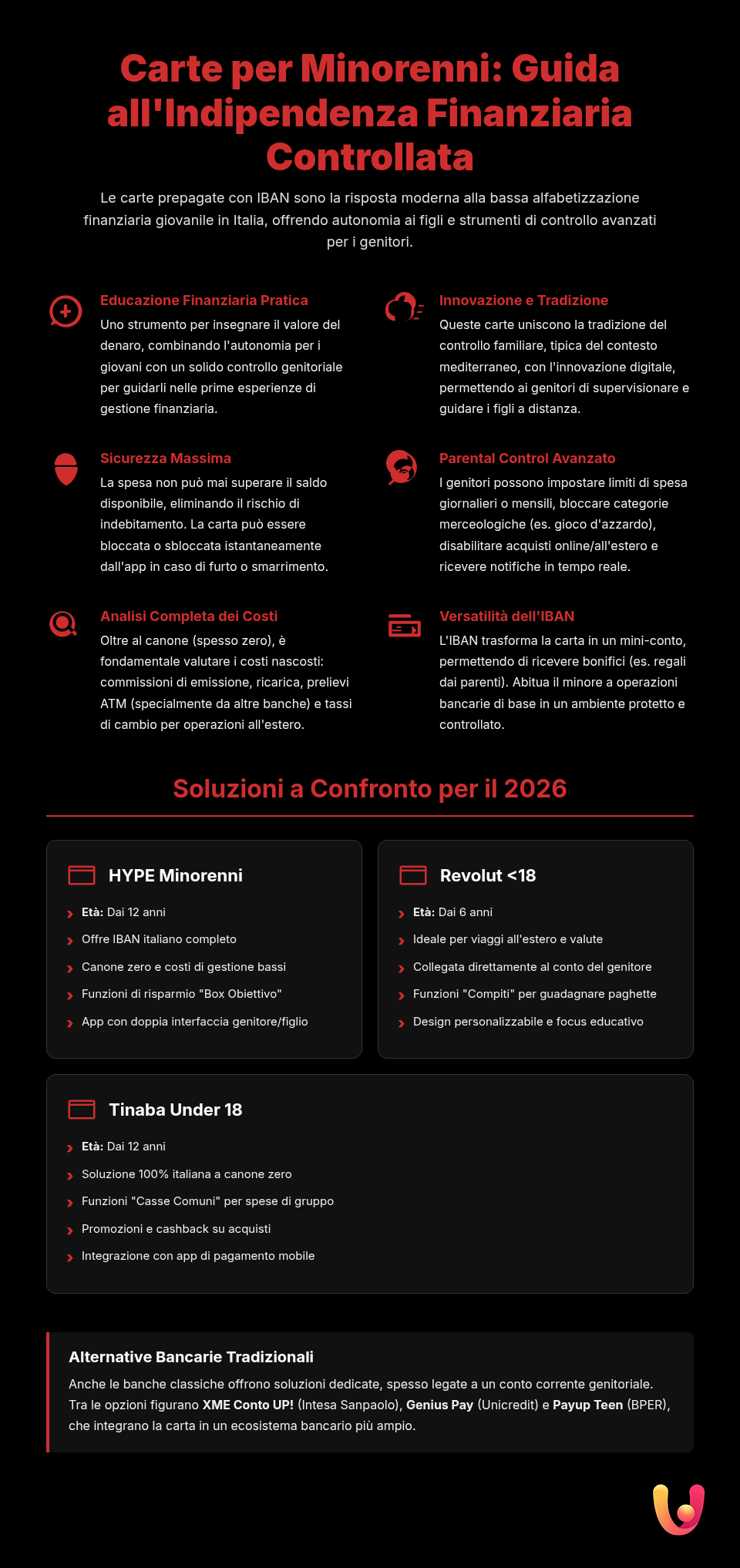

Comparison of the Best Cards for Minors 2026

The market offers numerous alternatives to the well-known Postepay Green and Pixpay. The choice depends on the specific needs of the family, the minor’s age, and the level of autonomy you intend to grant. Below is an analysis of some of the most competitive solutions expected for 2026, with a focus on costs, security, and parental control features.

HYPE for Minors

HYPE remains one of the most popular solutions for young people aged 12 and up. It offers a card with an Italian IBAN, managed through an intuitive app with a dual interface for parent and child. There is generally no monthly fee, although there is an issuance cost for the physical card. Strengths include free wire transfers, the ability to create “savings boxes” to achieve specific goals, and a cashback section. The parent can monitor all transactions, receive monthly summaries, and instantly pause the card. Upon turning 18, the account automatically converts to a standard HYPE account, keeping the same IBAN.

Revolut <18

Revolut <18 is designed for a very wide age range, from 6 to 17 years old, and stands out for its strong international focus. The card, linked to a parent’s account, has no monthly fee in its standard plan and allows payments in foreign currency with favorable fees, making it ideal for those who travel. The app offers educational features like creating savings goals (“Pockets”) and challenges set by parents. The physical card can be customized, and teens can instantly exchange money with friends who use Revolut. Spending and withdrawal limits are clear and manageable by the parent, who maintains full control.

Tinaba Under 18

Available from age 12 with a parent’s consent, Tinaba Under 18, in partnership with Banca Profilo, presents itself as a zero-fee solution. It offers a Mastercard with an IBAN, free top-ups, and wire transfers. One of its distinctive features is the ability to create “group funds” to split expenses with friends, a very useful function for group outings. Parents can set up push notifications to be alerted when spending exceeds certain thresholds and monitor transactions. The fact that many operations are free makes it a very attractive economic choice for families.

Other Solutions to Consider

In addition to the main options, the traditional banking landscape offers valid alternatives. XME Conto UP! by Intesa Sanpaolo is a free digital account until age 18, with an included prepaid card and free withdrawals. It offers solid parental controls and a bonus upon reaching the age of majority. Unicredit offers Genius Pay for minors (from age 11), a rechargeable card with an IBAN and no monthly fee, manageable via app and with complete parental control functions. The Payup Teen Prepaid Card from BPER Banca also presents itself as an option with zero fixed costs, suitable for a first approach to money management.

Key Features: Security and Parental Controls

Security is the top priority when it comes to financial tools for minors. Modern prepaid cards integrate multiple levels of protection, for both the parent and the child. The most important feature is that it’s impossible to go “into the red”: you can only spend the amount loaded onto the card. Additionally, the apps allow you to instantly lock and unlock the card in case of loss or theft, providing priceless peace of mind. In case of issues, such as an unexpected card block, support procedures are generally quick and accessible.

Parental control is at the heart of these offers. Parents can set daily, weekly, or monthly spending limits and define maximum withdrawal caps. Many platforms also allow blocking entire merchant categories, such as gambling sites or liquor stores, and disabling online or international purchases. Real-time notifications for each transaction complete the picture, offering constant and non-invasive monitoring that educates the minor on the conscious and transparent use of their budget. For even more advanced protection, it is crucial to understand the risks associated with malware and keyloggers.

Costs and Fees: What to Consider

Carefully analyzing the cost structure is essential to choose the most suitable card and avoid surprises. The items to consider are varied and can significantly affect the value of a product. Many cards for minors offer a free monthly or annual fee, but it’s important to check for activation or physical card issuance costs. For example, HYPE has an issuance fee, while Revolut may charge for customization and shipping.

Fees on daily transactions are another crucial factor. It’s essential to check top-up costs, which can vary depending on the chosen method (wire transfer, another card, cash). ATM withdrawals may also have fees, often after exceeding a certain free monthly threshold or if made at non-partner banks. Finally, for those planning to use the card abroad, it’s wise to inquire about the fees applied to payments and withdrawals in currencies other than the euro.

In Brief (TL;DR)

In this comprehensive 2026 guide, we analyze the best prepaid cards with an IBAN for minors, comparing them based on costs, security, and parental control options.

In this comprehensive guide, we analyze the best alternatives on the market, evaluating costs, security, and parental control features to help you choose the most suitable solution.

We will analyze costs, security, and parental control features in detail to help you choose the card best suited to your child’s needs in 2026.

Conclusions

The landscape of prepaid cards with an IBAN for minors in 2026 is rich and diverse, offering solutions capable of meeting an increasingly felt need: to combine financial education with security and parental control. The choice of the ideal tool goes beyond a simple cost comparison and must take into account the child’s age, family habits, and the educational goals you intend to achieve. Solutions like HYPE, Revolut <18, and Tinaba Under 18, along with offerings from the traditional banking world, demonstrate how innovation can serve to strengthen tradition, providing parents with effective supervision tools and young people with gradual autonomy. In an increasingly digital world, equipping a minor with a card is not just a convenience, but an investment in their future economic awareness.

These tools represent a first, fundamental step towards financial independence, teaching concepts like budgeting, saving, and conscious spending in a hands-on way. The presence of an IBAN adds a layer of versatility, allowing them to receive wire transfers and become familiar with basic banking operations in a protected environment. The real challenge for parents will not only be choosing the right card but also accompanying their children on this journey, turning every transaction into an opportunity for dialogue and growth. Technology provides the means, but the value of the teaching remains an irreplaceable family heritage.

Frequently Asked Questions

<!– wp:yoast/faq-block {“questions”:[{“id”:”faq-question-a41b03c9″,”question”:”What are the best prepaid cards with an IBAN for minors in Italy, excluding the most well-known ones?”,”answer”:[“Besides the most famous options, there are valid alternatives like HYPE for Minors, Revolut <18, and Tinaba Under 18. HYPE is available from age 12, offers a zero-fee account with an Italian IBAN and free withdrawals, with an app for parental control. Revolut <18, available from as young as 6, links to a parent’s account and allows setting spending limits and savings goals. Tinaba, in partnership with Banca Profilo, is for teens aged 12 and up and combines a free account with a Mastercard, parental controls, and shared savings features.”]},{“id”:”faq-question-6cfc7b4d”,”question”:”How much does it cost to maintain a prepaid card for a minor child?”,”answer”:[“The costs vary greatly. Several solutions, like HYPE for Minors and the standard plan of Revolut <18, offer a free annual fee. However, you need to consider additional costs: the issuance of the physical card may have a fee (e.g., €9.90 for HYPE), as can withdrawals beyond a certain monthly threshold or abroad. Other cards may have a small monthly fee, often justified by additional services. It is essential to read the information sheets carefully to avoid surprises.”]},{“id”:”faq-question-17c21797″,”question”:”What kind of control can I have as a parent over these cards?”,”answer”:[“Parental control is the main strength of these cards. Through dedicated apps, a parent can monitor all spending in real time, receive notifications for every transaction, and set daily or monthly spending limits. It is also possible to block certain merchant categories, such as gambling sites, or inhibit online purchases and withdrawals. In case of loss, the card can be instantly paused or blocked from the app, ensuring a high level of security.”]},{“id”:”faq-question-8731b7c5″,”question”:”What is the purpose of an IBAN on a card for minors? Can it receive wire transfers from grandparents?”,”answer”:[“Absolutely. The presence of an IBAN turns the card into a small account, capable of receiving wire transfers from anyone, not just parents. This makes it perfect for receiving monetary gifts from relatives like grandparents, or for crediting the first earnings from a summer job. The IBAN also facilitates top-ups by parents, who can simply arrange a wire transfer from their own bank account.”]},{“id”:”faq-question-75be576f”,”question”:”At what age can you apply for a prepaid card with an IBAN for a child?”,”answer”:[“The minimum age varies depending on the offer. Solutions like Revolut

Besides the most famous options, there are valid alternatives like HYPE for Minors, Revolut <18, and Tinaba Under 18. HYPE is available from age 12, offers a zero-fee account with an Italian IBAN and free withdrawals, with an app for parental control. Revolut <18, available from as young as 6, links to a parent’s account and allows setting spending limits and savings goals. Tinaba, in partnership with Banca Profilo, is for teens aged 12 and up and combines a free account with a Mastercard, parental controls, and shared savings features.

The costs vary greatly. Several solutions, like HYPE for Minors and the standard plan of Revolut <18, offer a free annual fee. However, you need to consider additional costs: the issuance of the physical card may have a fee (e.g., €9.90 for HYPE), as can withdrawals beyond a certain monthly threshold or abroad. Other cards may have a small monthly fee, often justified by additional services. It is essential to read the information sheets carefully to avoid surprises.

Parental control is the main strength of these cards. Through dedicated apps, a parent can monitor all spending in real time, receive notifications for every transaction, and set daily or monthly spending limits. It is also possible to block certain merchant categories, such as gambling sites, or inhibit online purchases and withdrawals. In case of loss, the card can be instantly paused or blocked from the app, ensuring a high level of security.

Absolutely. The presence of an IBAN turns the card into a small account, capable of receiving wire transfers from anyone, not just parents. This makes it perfect for receiving monetary gifts from relatives like grandparents, or for crediting the first earnings from a summer job. The IBAN also facilitates top-ups by parents, who can simply arrange a wire transfer from their own bank account.

The minimum age varies depending on the offer. Solutions like Revolut <18 are available from as young as 6 years old, with the parent creating a sub-account from their own app. Other very popular cards, like HYPE for Minors and Tinaba, require the child to be at least 12 years old. In any case, until the age of 18, the authorization and supervision of a parent or legal guardian are always required to complete the activation.

Still have doubts about Cards with IBAN for Minors 2026: A Guide to the Best?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.