The charge card represents one of the most widespread and consolidated payment instruments in the Italian and European financial landscape. In a world moving fast towards digitization, this instrument maintains a strong link with banking tradition, offering both security and flexibility. It works like a small line of credit granted by the bank: it allows you to make purchases and payments by postponing the debit. All expenses incurred in a month are settled in a single payment on a pre-established date the following month, usually without the application of interest. This mechanism makes it a practical choice for managing daily finances, combining the convenience of digital with the solidity of a classic financial product.

Its popularity in Italy and the Mediterranean context is explained by the growing trust in electronic payments, combined with a culture that is still prudent in debt management. Unlike other solutions, the charge card promotes rigorous control of outflows, since the entire amount spent must be repaid in the short term. According to recent data, the use of credit cards in Italy is constantly growing, with a significant increase in digital transactions. This tool adapts to a wide range of users, from young professionals to families, who seek a balance between technological innovation and responsible and transparent financial management.

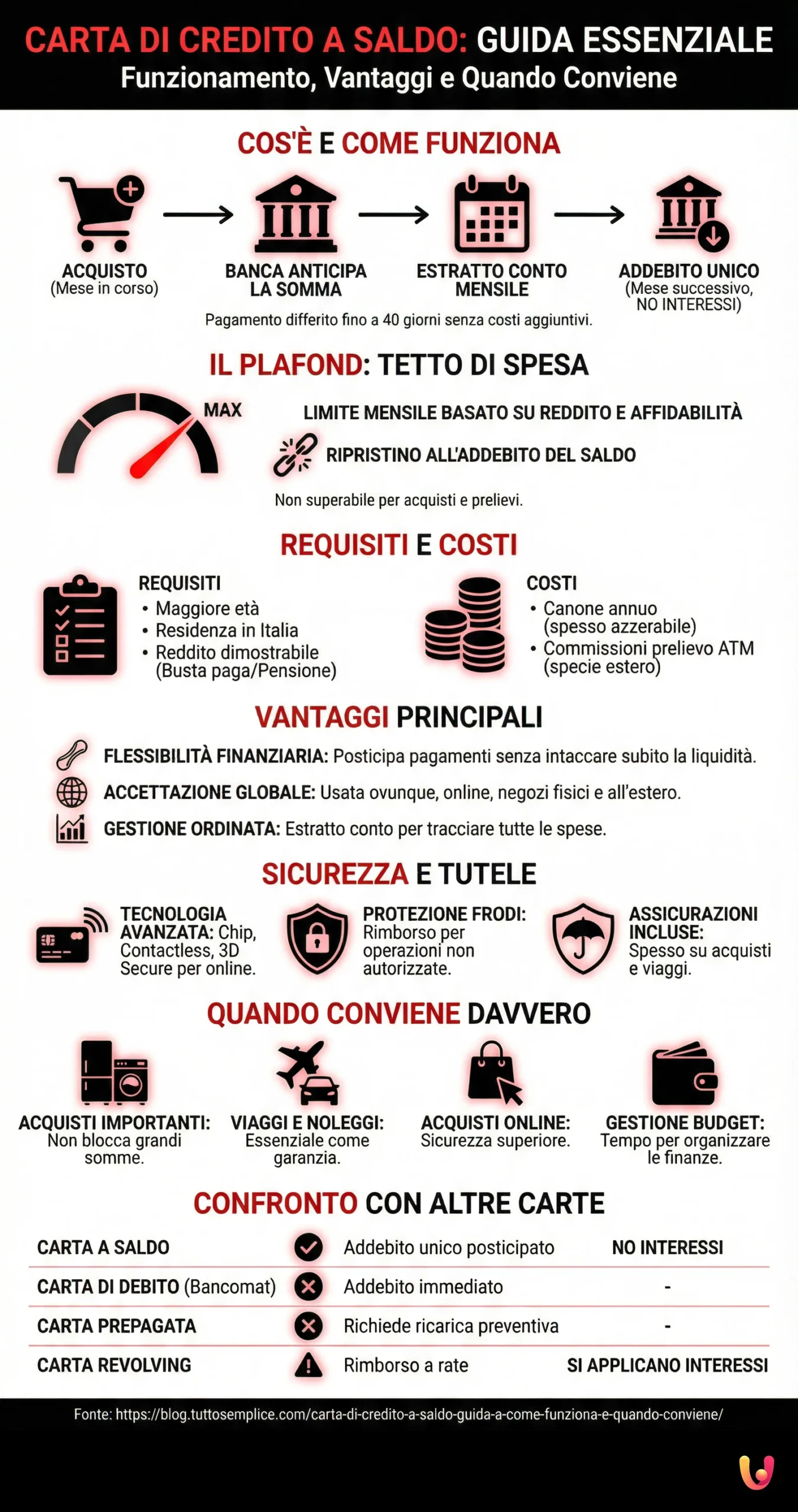

How the charge card works

The operation of the charge card is simple and is based on a deferred payment principle. When the card is used for a purchase, online or in a physical store, the issuing bank advances the sum to the merchant. The amount is not debited immediately from the holder’s checking account but is added to all other expenses incurred during the month. The credit institution then sends a monthly statement summarizing all operations, and the total amount is debited from the linked checking account in a single payment, usually by the middle of the following month. This allows a payment deferral of up to 40 days without additional costs or interest.

The credit limit: the maximum spending cap

Every charge card comes with a credit limit (plafond), which is a maximum monthly spending limit. This amount is established by the bank at the time the card is issued, based on the applicant’s creditworthiness and income. The limit represents the “ceiling” that cannot be exceeded with purchases and withdrawals. Once reached, it will not be possible to make further transactions until availability is restored, which happens with the debit of the monthly balance. It is possible to request an increase in the limit, for example, to face an unexpected expense or for a trip, but the request will be subject to a new evaluation by the bank. Conscious management of the limit is fundamental for the correct use of the instrument. For this reason, it is useful to choose a credit card with a credit limit suitable for your spending habits.

Requirements and costs to consider

To obtain a charge card, certain minimum requirements must be met. Generally, banks require majority age, residence in Italy, and demonstrable income, such as a paycheck, tax return for self-employed workers, or pension slip. The institution will also evaluate the customer’s creditworthiness to determine the approval and the relative credit limit. The costs associated with a charge card can vary: the most common is an annual fee, which can be waived by some promotions or based on spending volume. Other costs may include commissions for cash withdrawals at ATM counters, especially abroad, and expenses for sending the paper statement, although many banks now offer the online service for free.

Main advantages of the charge card

One of the main advantages of the charge card is the financial flexibility it offers. It allows payments to be postponed, offering a time window that can reach up to 40 days before the amount is actually debited from the account. This feature proves particularly useful for managing unexpected expenses or for important purchases without immediately affecting available liquidity. Furthermore, the charge card is an almost universally accepted payment instrument, both in Italy and abroad, for purchases in physical stores, online, and for services such as car rental, where it is often required as a guarantee. Another aspect not to be underestimated is the possibility of keeping track of all expenses in an orderly manner thanks to the monthly statement, facilitating the management of the family or personal budget.

Security and consumer protection

Security is another strong point. Modern credit cards are equipped with advanced technologies such as the chip and contactless, which reduce fraud risks. Online payments are protected by systems like 3D Secure, which requires additional authentication to authorize the transaction. In case of fraudulent use, such as following cloning, theft, or loss, the holder is protected. It is sufficient to block the card immediately to limit losses. European regulations offer a high level of protection, providing refunds for unauthorized operations. Many cards also include free insurance packages covering purchases, travel, and accidents, adding an extra layer of peace of mind.

When it really pays to use a charge card

The charge card proves particularly convenient in various situations. It is ideal for high-amount purchases, such as appliances or travel packages, because it allows you not to tie up a large sum of money immediately. The possibility of paying the following month offers the necessary time to organize one’s finances. It is also the perfect tool for travelers, both for vast international acceptance and for the convenience of not having to carry large amounts of cash or exchange currency. Furthermore, for renting a car, a credit card is almost always an indispensable requirement for the security deposit. Finally, for online purchases, it offers a superior level of security compared to other payment methods, thanks to fraud protections and insurance often included.

A comparison with other cards

To fully understand its utility, it is useful to compare it with other types of cards. The main difference with the debit card (the common ATM card) is that the latter debits expenses immediately from the checking account. The prepaid card, on the other hand, only works if it has been previously loaded with a sum of money. Compared to the revolving card, the difference is substantial: while the charge card involves the total reimbursement of the amount spent without interest, the revolving one allows repaying the debt in installments, but paying interest, often high. The charge card is therefore the choice for those looking for the convenience of deferred payment without wanting to resort to an expensive form of financing.

In Brief (TL;DR)

Discover how the charge card works, when it is worth requesting, and what the main advantages and requirements are.

Let’s see in detail how it works, what advantages it offers, and what the requirements are to request it.

Discover the advantages, costs, and requirements necessary to request it and evaluate if it is the right choice for you.

Conclusions

The charge card confirms itself as a solid, versatile, and secure financial instrument, capable of combining the tradition of a consolidated banking product with the needs of an increasingly digital world. Its strength lies in the balance it offers between payment flexibility and spending control, making it suitable for a vast and diverse audience. If used with awareness, knowing how it works, the costs, and the advantages, it becomes a precious ally in everyday financial management. In a context like the Italian and European one, where both innovation and financial prudence are appreciated, the charge card represents an effective synthesis, offering convenience for major expenses, security for online purchases, and control for the monthly budget.

Frequently Asked Questions

The main difference lies in the timing of the debit. When you use a debit card (like an ATM card), the expense is deducted immediately from your checking account. With a charge card, however, the bank advances the sum for you: all expenses incurred in a month are accumulated and debited in a single payment from your account the following month, usually without interest.

To obtain a charge card, it is necessary to be of legal age, a resident in Italy, and a holder of a checking account. Since the bank grants a line of credit, it will evaluate your financial reliability. For this reason, a demonstrable income is almost always required, such as a salary, a pension, or documentable self-employment income. The bank might also verify that you are not flagged as a «bad payer» in systems like CRIF.

The charge card is particularly useful for managing finances better by postponing outflows to the following month. It is ideal for online purchases, where it offers greater fraud protection, and for renting cars or booking hotels, services for which it is often required as a guarantee. Furthermore, it allows you to face an important and sudden expense, spreading its impact on the family budget without resorting to financing.

If you do not pay the entire balance by the due date, the bank will apply default interest on the amount due, which is generally very high. Failure to pay can lead to negative consequences, such as the blocking of the card and reporting to Credit Information Systems (SIC), such as CRIF. This reporting makes it more difficult to obtain future loans or other credit cards.

In addition to the annual fee, which can sometimes be waived, there are other costs to consider. Among these are commissions for cash withdrawals (generally not recommended), costs for operations in foreign currency, and stamp duty. In Italy, a stamp duty of 2 euros is paid for each monthly statement whose balance exceeds 77.47 euros.

Still have doubts about Charge cards: guide on how they work and when they are worth it?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.