Italy, a country where tradition intertwines with innovation, is experiencing a silent but unstoppable transformation in the world of payments. The gesture of handing over a card or bringing a smartphone close to the POS terminal has become a daily occurrence, a habit that unites historic artisan workshops with the most modern startups. For small merchants, this evolution is not just a matter of modernity, but a strategic lever to grow and remain competitive. Embracing contactless payments means responding to new consumer needs, optimizing cash flows, and opening doors to an increasingly digitized and international market. This guide explores the concrete benefits and analyzes the costs of POS terminals, offering a compass to navigate a now consolidated cultural and economic change.

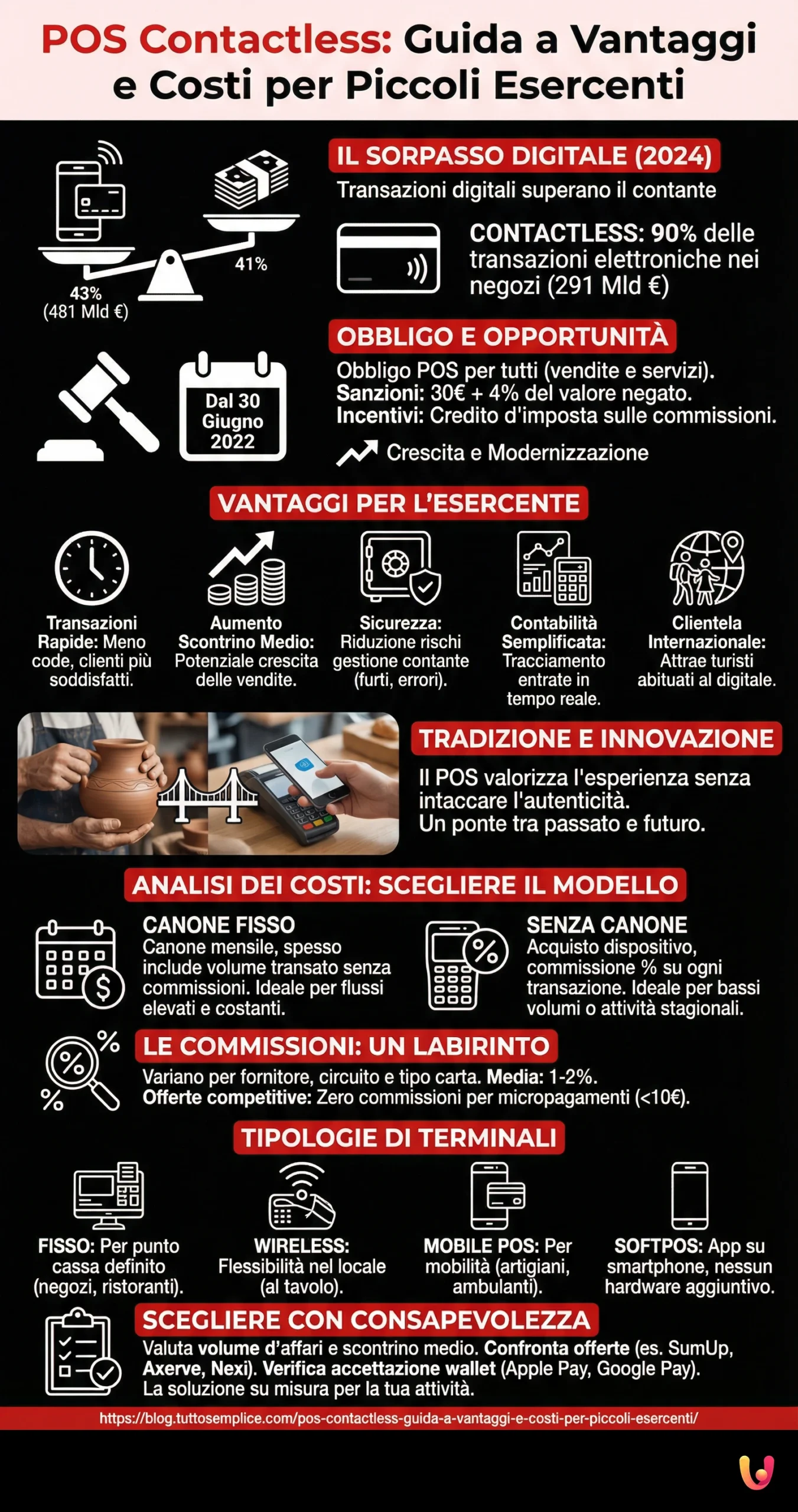

In 2024, for the first time, the value of digital transactions in Italy surpassed that of cash payments. This historic overtaking, certified by the Innovative Payments Observatory of the Politecnico di Milano, marks a point of no return. Electronic payments reached 481 billion euros, representing 43% of total consumption against 41% for cash. A leading role in this revolution is played by contactless technology, which now constitutes almost 90% of electronic transactions carried out in physical stores, for a value of 291 billion euros. This change was driven not only by consumers but also by a new awareness among merchants. An Ipsos survey reveals that over 53% of small Italian merchants now prefer card payments, recognizing their strategic importance.

The contactless revolution: an opportunity for small businesses

The introduction of the obligation to accept electronic payments represented a turning point for the Italian commercial fabric. Since June 30, 2022, all subjects carrying out sales of products and provision of services, including artisans and professionals, are required to have a POS terminal. The legislation provides for specific sanctions for those who do not comply: a fixed fine of 30 euros, to which 4% of the value of the denied transaction is added. This obligation applies to any amount, eliminating the old 5-euro threshold and effectively making digital payments a consumer right. The goal is twofold: to increase transaction traceability to combat tax evasion and to modernize the payment system, aligning Italy with European standards. This regulatory push, combined with incentives such as tax credits on commissions, has accelerated the adoption of POS terminals, transforming an obligation into a growth opportunity.

Tangible benefits for the merchant

Adopting a contactless payment system goes far beyond simply complying with the law. For a small merchant, the benefits are concrete and immediate. First, the customer experience is improved: payments become faster and smoother, reducing queues at the checkout and increasing general satisfaction. This translates into a higher likelihood of loyalty and a potential increase in the average ticket. Furthermore, risks and costs associated with cash management, such as errors in change, theft, or bank deposits, are reduced. The digitization of collections also offers a clear and real-time view of revenues, simplifying accounting and financial planning. Finally, accepting electronic payments, including those from smartphones and smartwatches, opens doors to a wider and international clientele, such as tourists, who are increasingly accustomed to using digital tools.

Tradition and innovation: a winning combination

In a cultural context like the Mediterranean one, where personal relationships and tradition have inestimable value, technological innovation may seem like a threat. However, the contactless POS can become a bridge between the past and the future. Let’s imagine an artisan workshop in the historic center of an art city. The customer, perhaps a foreign tourist, admires a handmade product, the fruit of ancient wisdom. At the moment of payment, the possibility of using a contactless card or their smartphone does not diminish the authenticity of the experience but makes it more convenient and accessible. The merchant, for their part, does not have to give up their identity. They can continue to tell the story of their product and nurture the relationship with the customer, simply integrating a tool that meets a modern need. Innovation, in this case, does not replace tradition but supports it, allowing it to prosper in a global market.

Cost analysis: how to choose the right POS

Choosing the POS terminal is a crucial step and must be weighed based on the specific needs of the business. The costs to consider are not limited to transaction fees but include several items. There are mainly two offer models: those with a fixed monthly fee, which often includes a certain volume of transactions without commissions, and those without a fee, which involve purchasing the device and applying a percentage commission on each payment. It is essential to evaluate your business volume, the average value of transactions, and the type of clientele to determine which solution is most advantageous. A business with many small transactions could benefit from a zero-fee offer with competitive commissions, while a store with a higher and constant flow of collections might find a fixed fee more convenient.

Commissions: a maze to decipher

Commissions often represent the main concern for merchants. These can vary significantly depending on the service provider, the payment circuit (such as Bancomat, Visa, or Mastercard), and the type of card used (credit, debit, corporate). On average, the cost for the merchant is around 1% to 2% of the transacted value. However, the market is increasingly competitive, with new fintech operators offering innovative and transparent solutions. Some offers provide zero commissions for micropayments, for example, under 10 euros, to encourage the use of electronic money even for small purchases. It is important to read contracts carefully and compare different proposals, paying attention not only to the commission percentage but also to any hidden costs or contractual constraints.

Types of terminals: from fixed to mobile

Technology today offers a wide range of POS terminals, suitable for every type of business. The fixed POS is the traditional model, connected via cable to the telephone line or the internet, ideal for those with a defined checkout point like shops or restaurants. The wireless POS offers greater flexibility, allowing the terminal to be brought to the customer’s table or inside the store. For those working on the move, such as artisans, freelancers, or street vendors, the perfect solution is the Mobile POS. These are small card readers that connect via Bluetooth to a smartphone or tablet, transforming them into a complete, economical, and portable collection system. Finally, Software POS (SoftPOS) solutions represent the frontier of innovation, allowing the acceptance of contactless payments directly on an enabled smartphone, without the need for any additional hardware.

Choosing with awareness: the POS tailored for you

There is no absolute “best” POS, but there is the solution most suitable for your business reality. For a professional who receives few electronic payments per month, an economical device without a monthly fee, like those offered by SumUp or myPOS, may be the ideal choice, paying a commission only on actual usage. For a bar or a small shop with a constant flow of customers, an offer like Axerve’s with a fixed fee could be more convenient, eliminating commissions up to a certain collection threshold. Nexi’s solutions, on the other hand, offer complete packages that include additional services for business management. It is essential to analyze your business model: a restaurant will have different needs than a plumber, and a fashion boutique different from a tobacconist. The choice must be based on concrete data and a realistic projection of your collections. Consider the possibility of accepting payments via smartphone wallets, such as Apple Pay and Google Pay, a feature now standard on most modern terminals.

In Brief (TL;DR)

This guide analyzes the benefits and costs of contactless POS terminals, helping small merchants and professionals choose the best solution for their business.

Discover how electronic payments can grow your business and what real costs to consider for a POS terminal.

Finally, we examine the costs associated with POS terminals, guiding you in choosing the most suitable and convenient solution.

Conclusions

The adoption of contactless payments is no longer a choice, but a strategic necessity for small merchants in Italy. The evolution of the market and consumer habits, increasingly oriented towards digital solutions, make the integration of a POS terminal essential. Beyond the regulatory obligation, the advantages in terms of efficiency, security, and customer satisfaction are undeniable. Although costs represent an important variable, today’s market offers a wide range of flexible and competitive solutions, capable of adapting to the needs of every single activity, from the freelancer to the historic shop. Choosing the right POS, informing oneself, and comparing offers means investing in the future of one’s business, combining the richness of Italian tradition with the opportunities offered by digital innovation. A fundamental step to remain competitive and to continue growing in a constantly changing world. For greater security, it is also useful to know how to disable contactless on your personal cards if necessary.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.