In Brief (TL;DR)

Adopting engineering-derived controllers allows managing corporate treasury as a stable and reactive dynamic system.

The PID algorithm simultaneously analyzes the past, present, and future of cash flow to calculate the ideal financial corrective action.

This mathematical approach minimizes volatility and prevents liquidity crises by automating strategic decisions on cash flows.

The devil is in the details. 👇 Keep reading to discover the critical steps and practical tips to avoid mistakes.

In the financial landscape of 2026, corporate treasury management is no longer just a matter of accounting or linear forecasting on spreadsheets. With the advent of accessible Computational Finance, CFOs and tech entrepreneurs are adopting tools derived from electronic engineering to solve complex liquidity problems. In this article, we will explore a frontier approach: the application of PID (Proportional-Integral-Derivative) Controllers to cash flow management.

This is not a method based on intuition, but a negative feedback loop system designed to mathematically guarantee financial stability, minimizing volatility and preventing liquidity crises (undershoot) or excesses of immobilized capital (overshoot).

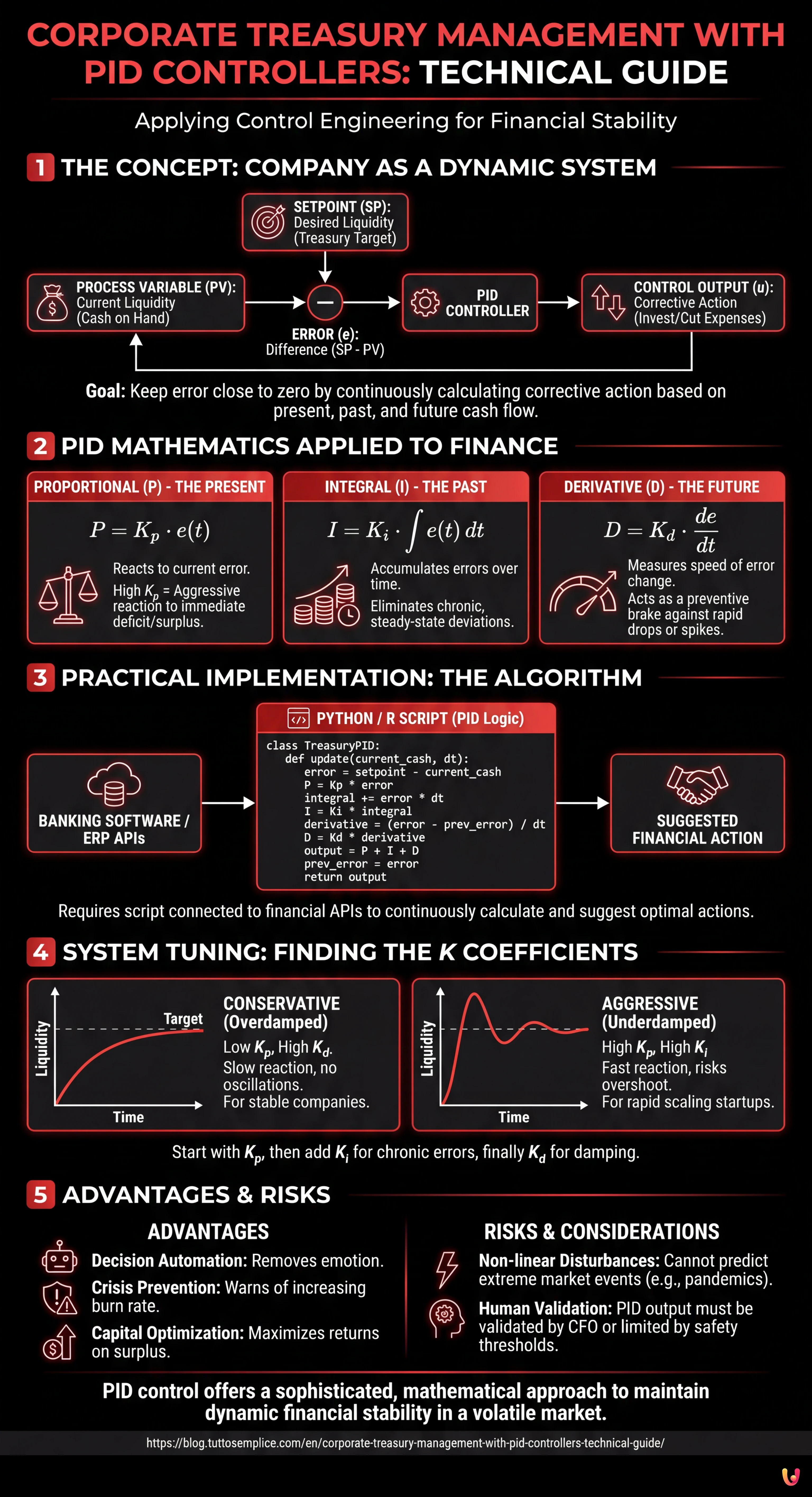

1. The Concept: The Company as a Dynamic System

In control engineering, a system (like an engine or a thermostat) must maintain a variable at a desired level. In corporate finance, the analogy is perfect:

- Process Variable (PV): Current available liquidity (Cash on Hand).

- Setpoint (SP): The desired liquidity level (Treasury Target).

- Error (e): The difference between the Setpoint and the Process Variable ($e(t) = SP – PV$).

- Control Output (u): The corrective action to take (e.g., investing excess, cutting operating expenses, activating credit lines).

The goal of proper corporate treasury management via PID is to calculate the corrective action $u(t)$ continuously to keep the error close to zero, reacting not only to the current state but also to the past history and future trend of cash flow.

2. Mathematics of PID Applied to Finance

The PID algorithm calculates the corrective action by summing three distinct terms. Let’s see how they translate into the CFO’s language.

The Proportional Term ($P$)

The proportional term looks at the present. The formula is $P = K_p cdot e(t)$.

If liquidity is below the warning level of €10,000, the system suggests an immediate corrective action proportional to that deficit. A high $K_p$ means an aggressive reaction (e.g., immediate freeze of non-essential payments). If $K_p$ is too low, the company reacts too slowly to the crisis.

The Integral Term ($I$)

The integral term looks at the past. The formula is $I = K_i cdot int e(t) dt$.

This component sums errors over time. If your corporate treasury management shows that you have been consistently under budget for the last 3 months, the Proportional term might not be enough. The Integral term “accumulates” this mathematical frustration and increases the corrective action until the error is zeroed out. It is fundamental for eliminating steady-state error, i.e., those chronic liquidity discrepancies that managers tend to ignore.

The Derivative Term ($D$)

The derivative term looks at the future. The formula is $D = K_d cdot frac{de}{dt}$.

This is the real magic for stability. The $D$ term measures the speed at which the error changes. If liquidity is plummeting rapidly, even if you are still above the Setpoint, the Derivative term detects the negative slope and applies a preventive “brake” (corrective action). This prevents undershoot (going into the red) before it happens. Conversely, if liquidity rises too fast, it brakes to avoid excessive overshoot which would entail opportunity costs.

3. Practical Implementation: The Algorithm

To implement this system, you don’t need dedicated hardware, but a script (Python or R) connected to your banking software or ERP APIs. Here is a logical representation of the code for a treasury control system.

class TreasuryPID:

def __init__(self, Kp, Ki, Kd, setpoint):

self.Kp = Kp # Proportional Gain

self.Ki = Ki # Integral Gain

self.Kd = Kd # Derivative Gain

self.setpoint = setpoint

self.prev_error = 0

self.integral = 0

def update(self, current_cash, dt):

# Error calculation (Target - Current)

error = self.setpoint - current_cash

# Proportional Term

P = self.Kp * error

# Integral Term

self.integral += error * dt

I = self.Ki * self.integral

# Derivative Term

derivative = (error - self.prev_error) / dt

D = self.Kd * derivative

# Control Output (Suggested financial action)

# Positive = Need for liquidity (Divest/Credit)

# Negative = Excess liquidity (Invest/Pay debts)

output = P + I + D

# State update

self.prev_error = error

return output

4. System Tuning: Finding the $K$ Coefficients

The most delicate part of algorithmic corporate treasury management is “tuning”, i.e., choosing the values $K_p, K_i, K_d$. Incorrect tuning can lead to instability (violent oscillations between excess cash and debt).

- Conservative Approach (Overdamped): Use a low $K_p$ and a high $K_d$. The system reacts slowly but avoids oscillations. Ideal for stable companies that want to avoid risks.

- Aggressive Approach (Underdamped): Use high $K_p$ and $K_i$. The system brings liquidity back to the target quickly but risks exceeding it (overshoot), forcing opposite corrections later. Suitable for startups in a rapid scaling phase where liquidity is “fuel” burned quickly.

According to financial engineering practice, it is recommended to start with $K_i$ and $K_d$ at zero, increasing $K_p$ until the system responds in reasonable times, then introducing $K_i$ to correct chronic deviations and finally $K_d$ to dampen volatility.

5. Advantages and Risks of PID Control in Finance

Advantages

- Decision Automation: Removes emotion from spending or investment decisions.

- Crisis Prevention: Thanks to the Derivative component, the system warns of danger when the burn rate increases, not when the money is already gone.

- Capital Optimization: Keeps liquidity exactly where it is needed, maximizing returns on surplus investments.

Risks and Considerations

Unlike an electric motor, the market is not a perfect physical system. There are non-linear “disturbances” (a pandemic, a market crash, a client who doesn’t pay). Therefore, the PID output must always be validated by a human CFO or limited by safety thresholds (saturation limits) to prevent the algorithm from suggesting impossible actions, such as asking for an infinite instant loan.

Conclusions

Applying PID controllers to corporate treasury management represents a qualitative leap from static accounting to system dynamics. It allows companies to navigate economic uncertainty with the same precision with which an autopilot maintains an airplane’s course. To start, we recommend simulating this model on historical data from the last year (backtesting) to calibrate the coefficients before entrusting it with real capital.

Frequently Asked Questions

It is an innovative approach that applies electronic engineering principles to corporate finance. Instead of relying on simple static spreadsheets, the system uses a negative feedback mechanism to keep corporate liquidity close to a set target, minimizing volatility and dynamically reacting to deviations between available capital and the desired target.

The derivative component is fundamental for stability because it looks to the future by analyzing the speed at which the liquidity error changes. If cash flow starts to drop rapidly, the system detects the negative slope and suggests a preventive corrective action before a critical threshold is even reached, acting as an automatic brake against the risk of going into the red.

The difference lies in the choice of K coefficients. A conservative approach uses a low proportional gain and a high derivative gain to react slowly but avoid oscillations, ideal for stable companies. Conversely, aggressive tuning employs high values for the proportional and integral terms, bringing liquidity back to the target quickly but with the risk of exceeding it, a strategy more suitable for rapidly growing startups.

Dedicated hardware is not necessary, but the ability to write scripts in languages like Python or R that interface with banking software or ERP APIs is required. The code must constantly calculate the error between current and desired liquidity, processing the output via the sum of proportional, integral, and derivative terms to suggest the optimal financial action.

Although the algorithm is excellent for maintaining dynamic stability, it cannot predict extreme non-linear disturbances such as pandemics or sudden market crashes. For this reason, the PID output must never be applied blindly but must be validated by a human CFO or limited by preset safety thresholds to avoid unfeasible financial decisions.

Did you find this article helpful? Is there another topic you'd like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.