In the world of digital payments, the credit card has established itself as an essential tool for managing personal and family finances. However, technical terms like “plafond” (credit limit) can often cause confusion. Fully understanding the meaning of a credit card limit is the first step toward using this financial instrument consciously and strategically. Simply put, it is the maximum spending limit that the issuing financial institution grants the cardholder, usually on a monthly basis. This threshold is not random but is defined through a careful evaluation that balances trust and security.

Managing the credit limit is a crucial aspect of everyday financial life, much like a craftsman who knows his tools inside out. Knowing how to manage it means having control over your expenses, avoiding the risk of over-indebtedness, and making the most of your card’s potential. In a context like Italy’s, where the tradition of saving meets the growing innovation of digital payments, mastering concepts like the credit limit becomes a fundamental skill for navigating the European financial landscape with confidence, reconciling daily spending needs with long-term planning.

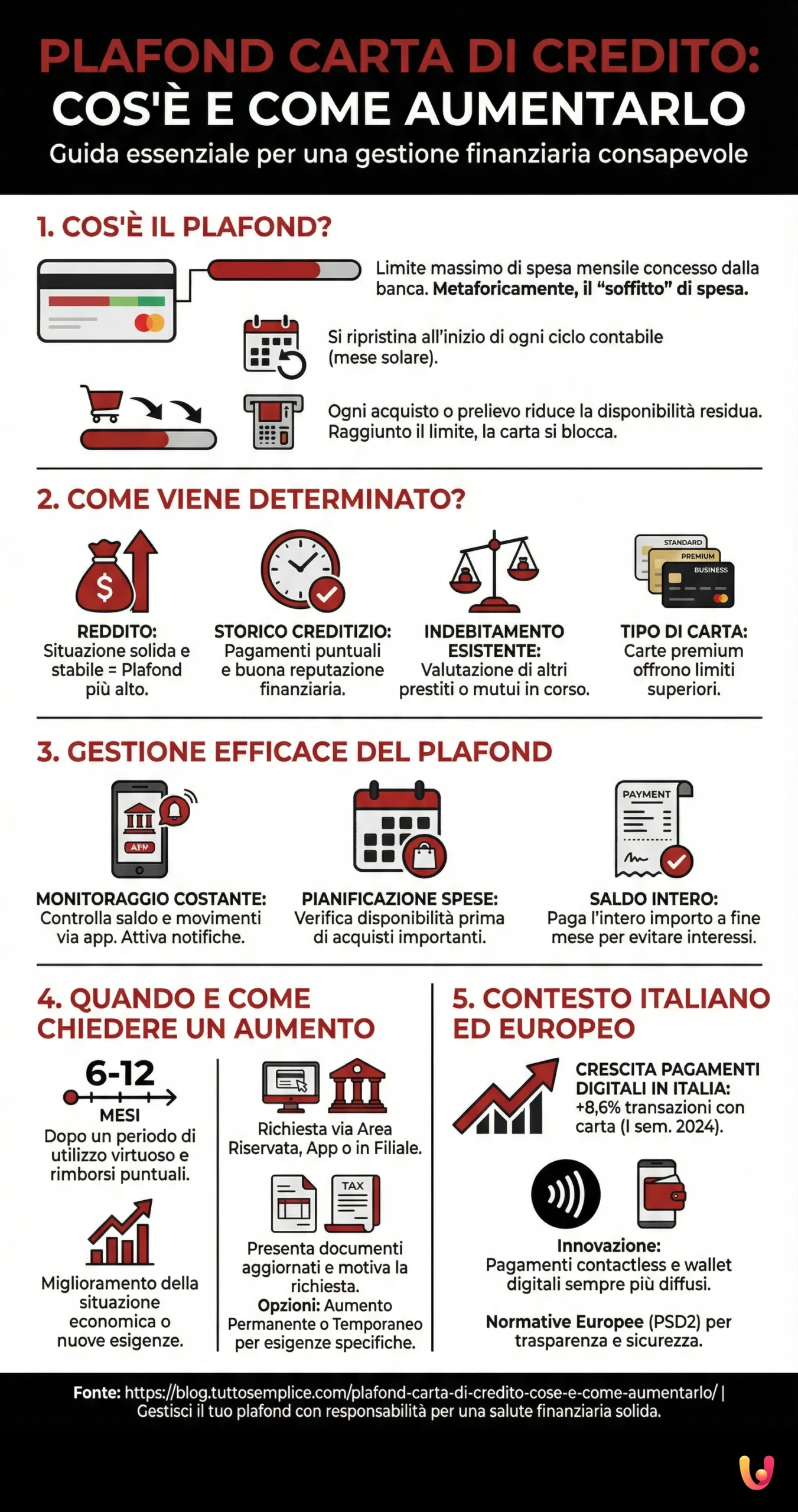

What the Credit Limit Is and How It Works

The term plafond (often referred to as the credit limit or credit line), borrowed from the French language where it means “ceiling”, metaphorically indicates the maximum monthly spending cap granted on a credit card. This amount represents the line of credit that the bank makes available to the customer and is normally restored at the beginning of each accounting cycle, usually the calendar month, after the statement is charged. Every transaction made, whether a purchase in a physical store, online, or a cash withdrawal at an ATM, contributes to reducing the residual availability of the credit limit. Once this limit is reached, the card cannot be used for further operations until it is restored.

It is important to distinguish between the general credit limit for purchases and specific limits that may apply to certain operations. For example, a card might have a monthly credit limit of 2,000 euros for expenses, but a significantly lower daily or monthly limit for cash withdrawals. These conditions are always specified in the contract signed with the issuer and summarized in the annual summary document. Knowing these details is essential to avoid unexpected blocks and manage your finances smoothly. For those approaching this instrument, a guide to choosing a card can be an excellent starting point.

How the Credit Limit Is Determined by the Bank

The definition of the credit limit is not an arbitrary process but the result of an in-depth analysis of the applicant’s profile. The credit institution evaluates various factors to establish the customer’s financial reliability and their ability to repay the granted credit. The first element considered is **income**: a solid and stable income situation allows access to a higher credit limit. Equally crucial is **credit history**, or the customer’s financial “reputation”. Always punctual payments and responsible management of past debts play in favor of obtaining a more generous spending limit.

The bank also examines the applicant’s **existing debt**, such as other loans or mortgages in progress, to ensure that the new commitment is sustainable. Finally, the type of card requested and the financial institution’s internal policies also influence the decision. Standard cards, for example, usually have a credit limit around 1,500-2,000 euros, while premium or corporate cards can offer significantly higher limits. This evaluation process aims to protect both the bank and the customer, preventing situations of excessive indebtedness.

Strategies for Effective Credit Limit Management

Careful management of the credit card limit is fundamental to maintaining financial health and building good creditworthiness. The first rule is **constant monitoring** of expenses. Today, most banks offer mobile banking applications that allow you to check the balance and movements in real-time, often with push notifications that warn you when you are approaching the limit. This helps maintain awareness of your residual spending capacity and avoid inadvertently exceeding the threshold. Exceeding the credit limit, in fact, involves the immediate blocking of the card until the following month.

Another key strategy is to **plan major expenses**. If you anticipate a purchase that could significantly impact the credit limit, it is wise to check the residual availability and, if necessary, act accordingly. Furthermore, it is a good habit to pay off the entire amount due at the end of the month to avoid the accumulation of passive interest, a crucial aspect especially for those using a revolving card. Responsible management not only prevents problems but demonstrates your reliability to the bank, opening the doors to better conditions in the future.

When and How to Request a Credit Limit Increase

Financial needs can change over time. An important trip, an unexpected expense, or simply an improvement in your economic situation may make the current credit limit insufficient. In these cases, it is possible to request a **spending limit increase**. Generally, banks consider such requests after a period of card usage (often six months or a year), during which the customer has demonstrated virtuous behavior, with always punctual repayments. The request can be submitted via the online reserved area, the bank’s app, or by going directly to a branch.

To approve the increase, the bank will perform a new creditworthiness assessment, requesting updated documents such as a pay slip or tax return. It is important to **justify the request**, explaining the new needs. A positive outcome not only offers greater flexibility but can also improve your credit rating. As an alternative to a permanent increase, for specific and time-limited needs, you can request a **temporary increase** of the credit limit, an agile solution to cover exceptional expenses without changing long-term contractual conditions.

The Italian and European Context: Tradition and Innovation

In Italy, the relationship with payment instruments is in full evolution. While a strong link to the tradition of cash persists, the adoption of digital payments is constantly growing. Recent data show a significant increase in card transactions: in the first six months of 2024, the value reached 223 billion euros, marking an +8.6% increase compared to the previous year. This trend indicates a cultural shift, where the convenience and security of cards are becoming increasingly appreciated, even for small amounts. In this scenario, understanding how the credit limit works is essential for a growing number of citizens.

At the European level, legislation aims to create a single, competitive, and secure payments market. Regulations such as the Payment Services Directive (PSD2) and the regulation on interchange fees aim to increase transparency and competition, to the benefit of consumers. Innovation, driven by solutions like digital wallets and contactless payments, is redefining the shopping experience. In Italy today, almost 9 out of 10 in-store payments take place in contactless mode, demonstrating how the Mediterranean culture is embracing innovation, integrating new financial tools into daily habits. Correct management of the credit limit fits into this path of financial education, combining traditional prudence with modern flexibility.

In Brief (TL;DR)

The credit card limit is the maximum monthly spending cap: discover in detail what it is, how it works, and how you can request an increase.

Discover how to request an increase from your bank and what requirements are necessary to obtain it.

Finally, discover the requirements and steps to follow to request an increase in your spending limit.

Conclusions

The credit card limit is much more than a simple spending cap; it is a financial management tool that, if understood and used correctly, offers flexibility and security. It represents a pact of trust between the customer and the bank, based on a careful assessment of creditworthiness. Learning to monitor your outflows, plan purchases, and know when and how to request a change in the credit limit are key skills for anyone using this instrument, from the young professional to the family planning expenses. Conscious management allows not only avoiding the risk of debt but also building a solid financial reputation. For those needing flexible payment options, it may also be useful to explore the features of a charge card.

In an Italy moving between tradition and digital innovation, mastery of financial instruments is a fundamental step towards greater economic autonomy and awareness. The credit card limit, with its rules and opportunities, is a central element of this new financial landscape. Managing it intelligently means transforming a potential limit into an effective lever for achieving your goals, ensuring peace of mind and control over your daily finances.

Frequently Asked Questions

The credit limit (often called ’plafond’ in Europe) is the maximum amount you can spend with your credit card in a given period, usually a month. It works like a line of credit granted by the bank: every purchase or withdrawal reduces your available limit. This limit is fully restored at the beginning of the next accounting cycle, normally after expenses are charged to the current account.

To increase the limit, you must submit a formal request to the bank or institution that issued the card. The bank will evaluate your reliability based on factors such as income, punctuality in payments, and your credit history. It may be necessary to provide updated documents, such as the latest pay slip or tax return, to justify the request.

In most cases, if you attempt to make a purchase that exceeds the remaining limit, the transaction will be declined. There are no direct penalties, but exceeding the limit is not a recommended practice. The card will become fully usable again only when the balance falls back below the limit, usually with the start of the new monthly cycle.

Yes, in almost all cases, credit card limits are calculated on a monthly basis. This means the maximum spending cap refers to a cycle of about 30 days. There are also daily limits, especially for cash withdrawals at ATMs, which still contribute to reaching the overall monthly limit.

The bank establishes the initial limit by analyzing various factors to assess your repayment capacity. The main elements considered are your demonstrable income (salary, pension), your credit history (if you are a punctual payer and if you have other debts), and the average balance on your current account. For new customers or those with unstable income, the initial limit tends to be more prudent and contained.

Still have doubts about Credit Card Limit: What It Is and How to Increase It?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.