A credit card statement is not just a summary of your monthly expenses, but a crucial document for your financial security. In a world where digital payments are the norm, learning to read it carefully is the first line of defense against errors, unwanted charges, and outright fraud. Many people file it away without a thorough check, but dedicating a few minutes to this review can make all the difference, protecting your savings and your peace of mind. It used to arrive by mail, but today it’s almost always digital and just a click away: one more reason to turn a neglected habit into an act of awareness.

This periodic check is a cornerstone of good financial management. It allows you to get a clear picture of your spending habits, identify recurring payments you may have forgotten about, and, most importantly, act quickly in case of suspicious activity. Statistics show an increase in payment card fraud, making this practice no longer an option, but a necessity. Approaching this document with the right mindset, combining the tradition of meticulous review with the innovation of digital tools, is the key to a secure and peaceful financial life.

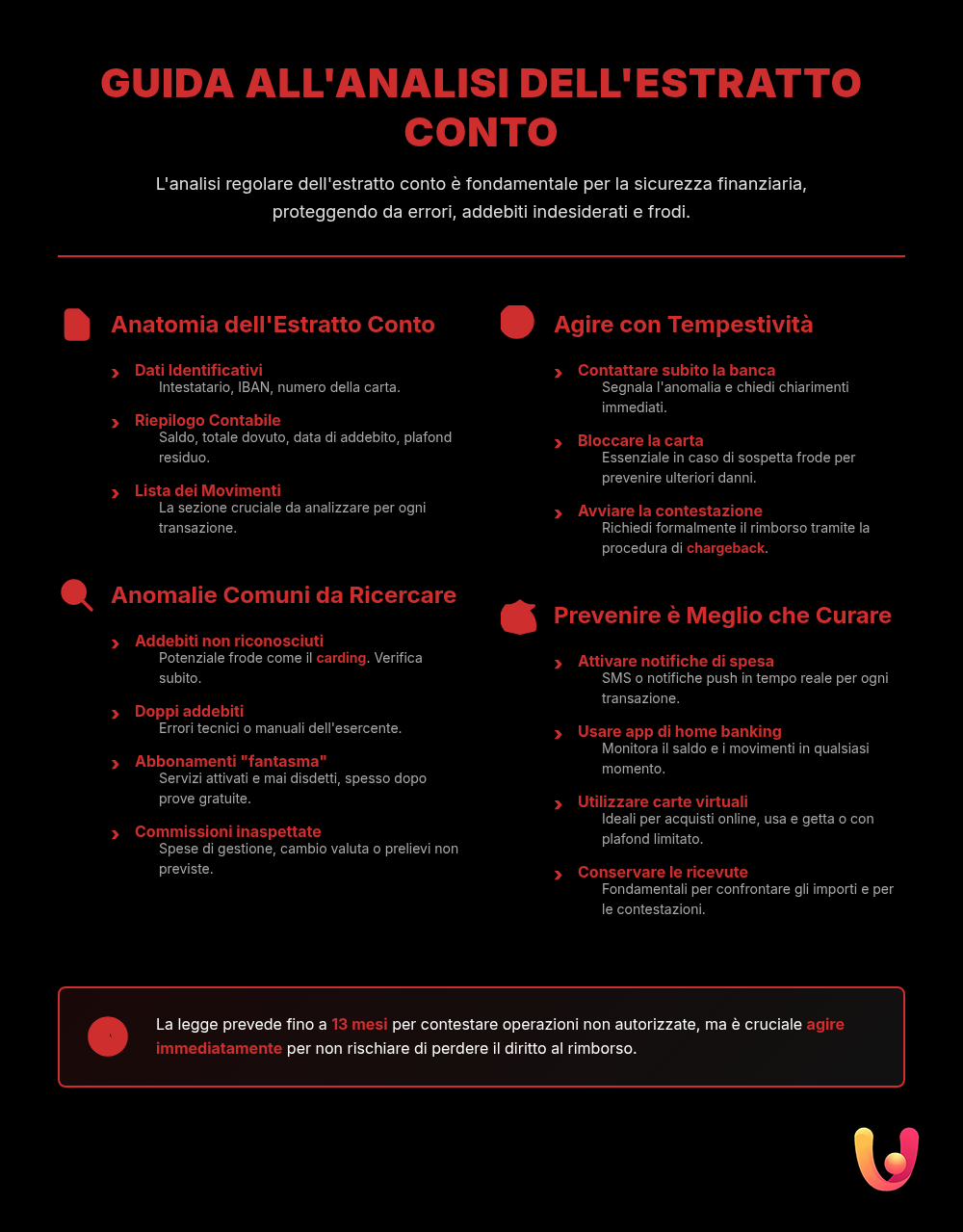

Decoding Your Statement: The Key Sections

At first glance, a statement can seem like a complex document, full of numbers and acronyms. In reality, its structure is logical and designed to provide a complete overview in just a few pages. The first information you’ll find is the identifying information: the cardholder’s name, the card number (usually partially hidden for security), and the statement period, which is typically monthly. Immediately after, you’ll find the account summary, a section that highlights the most important figures: the previous balance, the total of all charges and credits, and the new balance due. This section also includes two crucial pieces of data: the payment due date, which is the day the amount will be withdrawn from your bank account, and the total amount due. Finally, the card’s credit limit, which is the monthly spending limit, and the available credit are often listed.

The Transaction List: The Heart of Your Review

The most important section of the statement is undoubtedly the transaction list. Here, all transactions made during the statement period are listed in chronological order. Each line corresponds to an operation and provides essential details for your review. The main columns include the transaction date (when the purchase was made), the posting date (when the transaction was officially recorded by the bank), and the transaction description. The latter is crucial: it should clearly indicate the name of the merchant where the purchase was made. Sometimes, descriptions can be cryptic or show the company’s legal name instead of the store name, but a quick online search usually clears up any confusion. Next to the description, you’ll find the amount, which will appear in a column for charges and another for credits (like refunds).

Common Discrepancies and How to Spot Them

A careful review of the transaction list can reveal several discrepancies. The most alarming is an unrecognized charge, which is a charge for a purchase you never made. Sometimes, fraudsters test the validity of a stolen card with small trial transactions before moving on to larger amounts, a technique known as carding. Another common issue is a duplicate charge, where the same transaction is mistakenly recorded twice, often due to an error with the POS terminal or payment system. You should also watch out for phantom subscriptions: online services that may have been activated during a free trial and never canceled, which turn into recurring payments. Finally, it’s wise to check for unexpected fees, such as those for cash advances or unfavorable exchange rates during travel. Paying attention to these items is the first step in protecting yourself.

What to Do Immediately if You Find a Discrepancy

When you spot a discrepancy, timing is everything. The first thing to do is immediately contact your bank or card issuer’s customer service to report the suspicious transaction. If you have a strong reason to believe your card has been compromised—for example, it was cloned or its data was stolen—it’s essential to request an immediate block on the card to prevent further fraudulent transactions. Next, you must formally start the dispute process for the charge. This process, known as a chargeback, is a consumer right protected by European regulations and allows you to request a refund for unauthorized transactions. The law provides a maximum period of 13 months to file a dispute, but it’s crucial to act as soon as possible. It’s helpful to collect and keep any supporting evidence, such as receipts, confirmation emails, or a police report filed in case of theft.

Prevention: Fewer Risks, More Control

‘An ounce of prevention is worth a pound of cure’ is a saying that applies perfectly to credit card security. Adopting a few simple habits can drastically reduce the risk of fraud and simplify expense tracking. A key step is to enable SMS or push notifications for every transaction. This alert system gives you total real-time control and allows you to instantly identify any unauthorized activity. Using home banking apps is just as crucial, as they allow for constant monitoring and immediate access to digital statements. For online shopping, one of the safest practices is using disposable virtual cards, which generate a temporary card number for a single transaction, making it impossible for it to be fraudulently reused. Lastly, keeping purchase receipts, both physical and digital, helps you compare them with your statement and makes it easier to dispute any discrepancies.

In Brief (TL;DR)

Carefully analyzing your monthly statement is the first step to protecting yourself from errors and fraud, allowing you to take prompt action.

Learn to recognize suspicious charges, duplicate charges, or unwanted subscriptions, and discover how to act quickly to dispute them.

Learn the correct steps to analyze every expense and act promptly to dispute any discrepancy.

Conclusion

Reading your credit card statement is not a task to be postponed or underestimated. It’s an essential habit that blends traditional prudence with the opportunities offered by technology. Dedicating a few minutes each month to this review means taking an active role in protecting your finances. Understanding the document’s sections, analyzing the transaction list, and knowing how to recognize discrepancies are skills within everyone’s reach, but they are invaluable. In a world where digital threats are constantly evolving, being an informed and proactive consumer is not just a wise choice—it’s the best guarantee for a secure and peaceful financial future. If you suspect more complex fraud, such as credit card cloning, it is crucial to act even more quickly.

Frequently Asked Questions

If you notice a charge you don’t recognize, the first thing to do is contact your bank or card issuer immediately. Explain the situation and request to dispute the transaction. Banks often provide online forms to speed up the process. In cases of suspected fraud, like card cloning, it’s also essential to file a report with the relevant authorities.

Under European regulation (PSD2), you have up to 13 months from the charge date to report an unauthorized transaction. However, it’s crucial to act “without undue delay,” meaning as soon as possible after noticing the discrepancy, so you don’t lose your right to a refund. For other issues, like a duplicate charge or undelivered goods, the time limits set by card networks (like Visa or Mastercard) are generally shorter, often between 60 and 120 days.

First, try to cancel the subscription directly through the provider’s website or customer service. If you can’t resolve the issue or charges continue, contact your bank. You can ask them to block future payments to that specific merchant. Always keep proof of your communications, like emails or screenshots, to show your bank.

A duplicate charge occurs when you are charged twice for the same amount for a single purchase, often due to a technical error with the POS terminal or system. The first step is to contact the merchant to request a reversal of the duplicate transaction. If the seller doesn’t resolve the problem, you can turn to your bank and initiate a formal dispute process, also known as a chargeback, by providing proof of purchase.

The most common signs of fraud include small test charges from unknown merchants, transactions made in places you’ve never been, online purchases you didn’t make, or suspicious emails and text messages asking for your card details (phishing). Regularly checking your statement is the best defense to promptly identify these discrepancies and act immediately.

Still have doubts about Credit Card Statement: A Guide to Spotting Discrepancies?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.