In almost every Italian’s wallet, there is at least one payment card, but not everyone knows the substantial differences between the various types available. Debit, credit, or prepaid card: which tool best fits your spending habits and lifestyle? The choice is not trivial and impacts daily money management, purchase security, and financial flexibility. In a world where digital payments are surpassing cash, understanding the characteristics of each card is the first step toward conscious and efficient financial management.

This complete guide analyzes the three main families of payment cards in detail. We will explore how they work, their advantages and disadvantages, associated costs, and ideal usage scenarios. The goal is to provide a clear and practical framework to help you identify the perfect solution, whether you are a student dealing with first expenses, a traveling professional, or a family managing a monthly budget. A journey between tradition and innovation to master the tools that are reshaping our economic habits.

The Italian Context: Tradition and Innovation in Payments

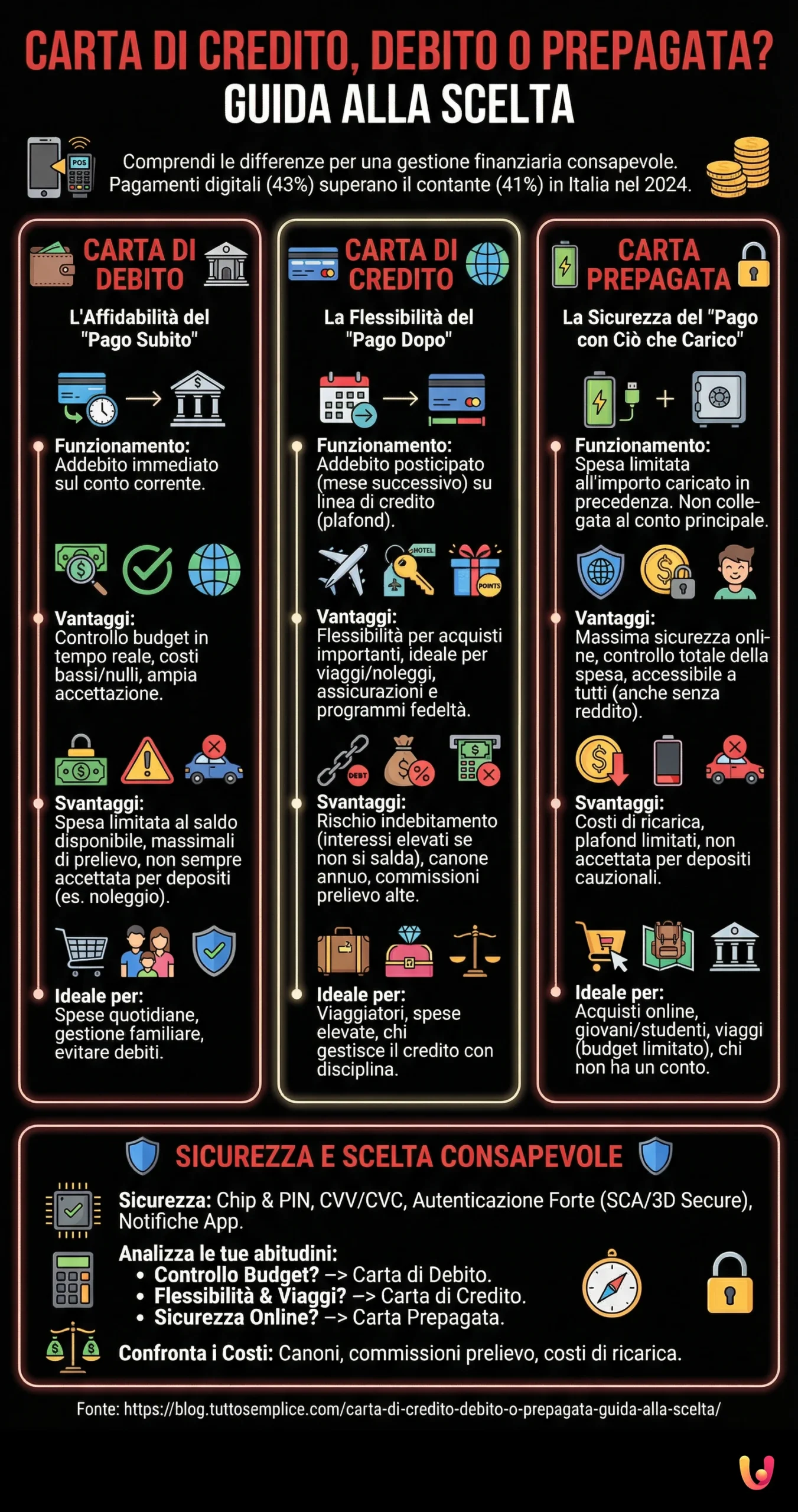

Italy is experiencing a phase of profound transformation in payment habits, a path that balances a cultural attachment to cash with a rapid acceleration toward digital. According to data from the Innovative Payments Observatory, in 2024 digital payments accounted for 43% of consumption, surpassing cash—stuck at 41%—for the first time. This historic overtaking is the result of years of evolution, driven by technological innovation and a shift in the preferences of consumers and merchants. Today, almost 9 out of 10 card payments in stores take place in contactless mode, testifying to a growing familiarity with “tap & go” solutions.

Despite this growth, our country still shows a lag compared to the European average, where the number of per capita transactions with alternative instruments to cash is higher. However, the trend is unequivocal: card usage, even for small amounts, is constantly increasing, with the average ticket size dropping. This dynamic reflects greater trust in electronic tools, supported by European regulations like PSD2 that strengthen online transaction security. The Italian market is thus moving on a double track: on one side, innovation driven by smartphones and wearables; on the other, the need to continue educating and reassuring that part of the population still tied to traditional payment methods.

The Debit Card: The Reliability of “Pay Now”

The debit card, often erroneously called “Bancomat” after the main national circuit, is the most widespread payment tool and is directly linked to a checking account. Its operating principle is simple and transparent: every time a payment or withdrawal is made, the amount is debited immediately and in real-time from the account, deducting directly from the available balance. This feature makes it an excellent tool for those who wish to have precise and constant control over their finances, avoiding spending more than they possess.

Main Advantages

The most evident advantage of the debit card is budget control. Since expenses are debited instantly, the holder has a clear and updated view of their economic availability, preventing the risk of debt. Generally, management costs are very low or zero, often included in the checking account fee. Its acceptance is extremely vast, both in physical stores via POS and for cash withdrawals at ATMs. Modern debit cards, operating on international circuits like Visa Debit or Mastercard Debit, are also usable for online purchases and abroad with great ease.

Disadvantages and Limits

The main limit of the debit card is its direct dependence on the checking account balance: it is not possible to spend more than the available figure. This can represent an obstacle for unexpected expenses or large amounts. Furthermore, debit cards have daily and monthly spending and withdrawal limits (ceilings), which might not be adequate for every need. Another significant disadvantage concerns certain specific transactions, such as car rentals or hotel bookings, where a credit card is often required as a guarantee for the security deposit.

Who It Is Recommended For

The debit card is the ideal choice for managing daily expenses: grocery shopping, refueling, store purchases. It is perfect for families who need to carefully monitor the monthly budget, for young people starting to manage their own finances, and for anyone who prefers a prudent approach to spending without resorting to forms of credit. Its simplicity and low costs make it a basic financial tool, indispensable for everyday operations and for anyone wanting to avoid accumulating debt.

The Credit Card: The Flexibility of “Pay Later”

Unlike the debit card, the credit card does not debit expenses immediately from the checking account. Instead, it works thanks to a line of credit, known as a credit limit (or plafond), granted by the bank. This amount represents the maximum monthly spending limit. All transactions made in the month are accumulated and debited in a single solution at a later date, usually the following month. This “pay later” mechanism offers considerable flexibility, allowing purchases even when liquidity in the account is momentarily low.

Exclusive Advantages

The credit card offers a series of unique advantages. It is the tool of choice for travel and high-amount purchases, being universally accepted for car rentals and hotel reservations. Many cards include free insurance packages for travel, lost luggage, and purchase protection. Another great advantage lies in cashback and loyalty programs, which allow you to accumulate points, air miles, or obtain discounts on every euro spent. This financial flexibility, combined with additional services, makes it a powerful tool for those who can manage it responsibly.

Costs and Disadvantages

Flexibility comes at a cost. Credit cards often have an annual fee, although this can sometimes be waived upon reaching certain spending thresholds. Commissions for cash withdrawals are generally higher compared to those of debit cards. The main risk, however, is that of debt. If the full amount is not paid off by the due date, the “revolving” mechanism activates, applying very high interest rates on the residual sums, turning an advantage into a significant cost. Obtaining a credit card also requires a creditworthiness assessment by the bank.

Who It Is Recommended For

The credit card is particularly indicated for workers with stable income, professionals, and frequent travelers. It is almost indispensable for those who often make online reservations or rent vehicles. Thanks to its monthly credit limit, it adapts well to those who need to sustain significant expenses, planning repayment the following month. It is also a useful tool for those who want to benefit from exclusive services like insurance and reward programs. However, it requires careful and disciplined management to avoid falling into the trap of interest and over-indebtedness.

The Prepaid Card: The Security of “Pay with What I Load”

The prepaid, or reloadable, card represents a smart compromise between the practicality of digital and the security of controlled spending. Its operation is similar to that of a prepaid phone SIM: you can only spend the amount that has been previously loaded onto the card. This makes it intrinsically secure, as it is not directly linked to a bank checking account. In case of theft or fraud, the risk is limited exclusively to the balance loaded on the card, protecting the holder’s main savings.

Types of Prepaid Cards: With and Without IBAN

There are two macro-categories of prepaid cards. “Pure” prepaid cards are simple tools, ideal for online purchases and travel, but they do not allow for complex banking operations. Prepaid cards with IBAN, also called “account cards” (carte conto), offer functionalities very similar to those of a checking account. With a card like the Postepay Evolution or similar ones, it is possible to receive and send bank transfers, credit salaries, and set up direct debits for utilities, representing a valid alternative to the traditional account for certain categories of users.

Undeniable Advantages

The main advantage is security, especially for internet purchases. Not being linked to an account, the prepaid card minimizes fraud risks. This makes it perfect for those wary of entering their main card details online. Another solution to increase protection is disposable virtual cards, generated for a single transaction. The prepaid card is also an excellent tool for budget control: it is impossible to spend more than what is loaded. It is accessible to everyone, including minors and those who do not meet the requirements for a credit card, as it does not require income verification.

Limits to Consider

Prepaid cards also present some limits. Reload costs can add up, especially if frequent operations of small amounts are made. There are also maximum loading and spending limits that might not be adequate for large purchases. As with debit cards, prepaid cards might not be accepted for blocking security deposits, for example in the car rental sector. Finally, costs for cash withdrawals, especially abroad, can be significant, so it is good to check before leaving.

Who It Is Recommended For

The prepaid card is the ideal solution for various categories of people. It is perfect for young people and students, who can thus manage their allowance in a safe and modern way. It is the preferred tool for online shopping lovers, who use it as a shield to protect their main account. It is also a wise choice for travelers, loading only the amount necessary for the vacation. Finally, account cards with IBAN are an excellent option for those who do not have a traditional checking account but need a tool to manage basic payments and collections.

Security: A Decisive Factor in the Choice

In the digital era, payment security is an absolute priority. All modern cards are equipped with standard technologies like the microchip and PIN code, which guarantee a high level of protection for physical transactions. For online purchases, the three-digit security code (CVV or CVC) located on the back of the card represents a first, fundamental level of verification. Furthermore, European regulations have introduced Strong Customer Authentication (SCA), often implemented via protocols like 3D Secure, which requires a second confirmation of the payment via app or SMS. This makes online fraud significantly more difficult.

The choice of card can also depend on one’s risk profile. A prepaid card offers maximum protection for online transactions, limiting potential damage to only the loaded amount. Credit cards, on the other hand, often include anti-fraud protection systems and insurance that reimburse the user in case of unauthorized transactions. Regardless of the chosen card, it is fundamental to adopt good practices: never share your codes, regularly check the bank statement, and know how to act promptly. In case of problems, it is essential to know how to immediately block a lost or stolen card to prevent illicit use.

- Analyze your spending habits

Evaluate if you prefer an immediate debit to control the budget or if you need flexibility to pay the following month. Define your financial profile.

- Evaluate the Debit Card for daily expenses

Choose this option if you want to spend only what you have in your account. It is ideal for family management, groceries, and avoiding the accumulation of unexpected debt.

- Consider the Credit Card for travel and extras

Opt for “pay later” if you travel often, need to rent cars, or book hotels. Check annual costs and use the credit limit with discipline to avoid high interest.

- Choose the Prepaid Card for online security

Use a reloadable card for internet purchases or for children. It offers maximum security since the risk is limited to the loaded amount, protecting the main account.

- Compare management costs and commissions

Check annual fees, reload costs, and withdrawal commissions. Credit cards can be more expensive, while prepaid cards have variable reload costs.

- Verify security and protection systems

Ensure the card supports technologies like 3D Secure and in-app notifications. For online use, prepaid or virtual cards offer an additional shield against fraud.

In Brief (TL;DR)

Understanding the differences between credit, debit, and prepaid cards is the first step to choosing the payment tool best suited to your financial needs.

We analyze the characteristics, advantages, and disadvantages of each option to guide you toward the most conscious choice for your finances.

We analyze the characteristics of each to guide you toward the choice best suited to your needs.

Conclusions

The choice between debit, credit, and prepaid cards is not resolved with a single answer but depends strictly on personal needs, spending habits, and one’s financial situation. There is no absolute “best” card, but there is the “right” card for you. The debit card is the ally of everyday life, perfect for those seeking control and simplicity, debiting every expense in real-time. The credit card offers flexibility and additional services, ideal for travelers and major expenses, but requires discipline to avoid credit costs. Finally, the prepaid card stands out as the champion of security for online purchases and an educational tool for younger people, guaranteeing spending never exceeds the pre-loaded budget. Analyzing your habits is the fundamental step to making an informed choice and making the most of the potential of the digital payment world.

Frequently Asked Questions

The fundamental distinction concerns the timing of the debit on the checking account. With the debit card, the sum is deducted immediately from the available balance (pay now), allowing constant control of finances. Conversely, the credit card postpones payment to the following month (pay later) using a credit limit granted by the bank, offering greater flexibility but requiring discipline to avoid interest.

For services like car rentals or certain hotel reservations, a traditional credit card is almost always required. Companies need a guarantee for the security deposit, which is temporarily blocked on the card’s credit limit. Debit cards and prepaid cards are often refused in these contexts as they do not offer the same deferred coverage guarantees.

The prepaid card offers a superior level of security for e-commerce because it is not directly linked to the main checking account. In case of fraud or data theft, the economic risk is limited exclusively to the amount loaded on the card at that moment. It is therefore the ideal choice for those who want to protect their main savings while operating digitally on websites.

While the debit card usually has zero management costs or costs included in the account fee, the credit card often involves a specific annual fee. Furthermore, attention must be paid to cash withdrawal commissions, which are higher compared to debit, and potential passive interest if one chooses the installment repayment mode (revolving) instead of the full balance payment.

The prepaid card with IBAN, or account card, is the ideal solution for young people, students, or those who do not need a complex checking account. It allows essential banking operations to be carried out, such as receiving bank transfers, crediting salaries, and setting up direct debits for utilities, while maintaining low costs and the impossibility of going into overdraft, typical of reloadable cards.

Still have doubts about Credit, Debit, or Prepaid Card? A Guide to Choosing?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.