Waiting for your salary is a crucial moment for millions of workers in Italy. When you choose to have it credited to a Postepay Evolution, you expect punctuality and a smooth process. However, the deposit might be delayed, causing anxiety and worry. This tool, born from the union of Poste Italiane’s widespread tradition and the innovation of a card with an IBAN, has become a go-to for many. Understanding the reasons for a potential delay and knowing how to act is essential to manage the situation without stress. In this article, we will analyze the most common causes of delays and provide a practical step-by-step guide to solving the problem.

Postepay Evolution is a solution chosen by a wide range of people, from young people in their first job to retirees, for its simplicity and low costs. Precisely because of its widespread use, problems related to salary deposits are particularly significant. Delays are almost never random but depend on a series of technical and procedural factors that are useful to know. We will address every possible cause, from human error to banking timelines, to give you a complete picture and help you prevent or quickly resolve any issues.

Postepay Evolution: A Hybrid of Tradition and Innovation

The Postepay Evolution is not just a simple prepaid card. Thanks to its IBAN code, it functions for all intents and purposes as a simplified checking account, capable of receiving and making bank transfers, setting up direct debits, and, of course, receiving a salary or pension. This hybrid nature has made it extremely popular in Italy, a country where trust in the physical post office counter is combined with the growing need for digital and versatile payment tools. It is Poste Italiane’s answer to modernity, a product that fits perfectly into the Mediterranean culture, where money management still combines traditional habits and new technologies.

Its ease of use and management costs, which are generally lower than a traditional checking account, have sealed its success. For many, it represents the first step towards financial independence without the burdens and complexity of a classic banking relationship. It allows you to manage your finances via app, online, or at the traditional post office, offering a range of options that adapt to different needs and age groups. The choice to receive a salary on this card is therefore logical for those seeking convenience and direct control over their income.

Why Hasn’t My Salary Arrived? The Most Common Causes

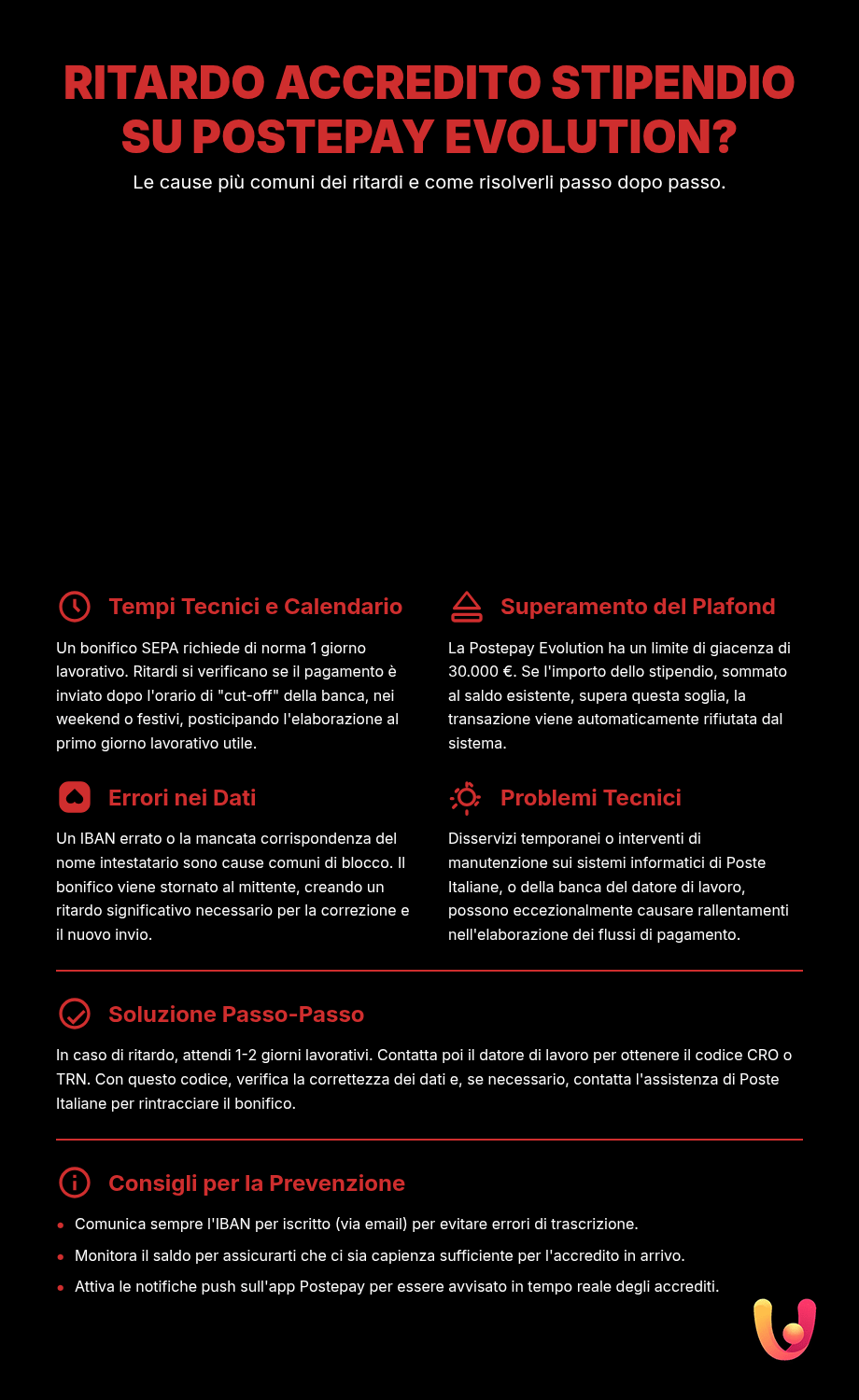

When your salary deposit is late, it’s easy to think the worst. In reality, the causes are often technical or administrative and easily identifiable. Understanding these mechanisms is the first step to solving the problem. Let’s analyze in detail the most frequent reasons that can cause a payment delay.

SEPA Transfer Processing Times

Salaries are deposited via a SEPA (Single Euro Payments Area) transfer, the European standard for money transfers. By law, a standard SEPA transfer must be credited within one business day following the date the employer’s bank executed the order. However, it’s crucial to consider the cut-off time: this is the deadline set by each bank to process same-day transactions. If your employer sends the transfer after this time, the transaction will be considered as executed on the next business day, consequently shifting the deposit time.

The Calendar: Holidays and Weekends

An often-underestimated factor is the calendar. Banks and payment systems do not process transactions on weekends and public holidays (national and European). If your payday falls on a Friday and the transfer is initiated in the afternoon, the actual deposit will likely occur on the following Monday or Tuesday. For example, a transfer ordered on Friday evening will only be processed by the sender’s bank on Monday morning, and consequently, the funds will not be available on your Postepay Evolution before Tuesday. It’s always good to keep this rule in mind to avoid unnecessary alarm.

Human Error: Incorrect Data Entry

One of the most common causes of a failed deposit is simple human error. Providing an incorrect IBAN to your employer, even if only one digit or letter is wrong, is enough to block the entire transaction. In these cases, the sender’s bank cannot find the destination account, the transfer is reversed, and the funds are returned to the employer. This process can take several days, causing a significant delay. It is also important that the cardholder’s name matches exactly the one entered in the transfer order.

Technical Issues or System Maintenance

Sometimes, the problem may lie in temporary technical disruptions. Both the employer’s bank systems and those of Poste Italiane can be subject to scheduled maintenance or unexpected outages. These events can cause slowdowns or temporary blocks in transaction processing. In these cases, it’s useful to check Poste Italiane’s official communication channels or monitoring sites like Downdetector to see if other users are experiencing the same problem accessing services. Usually, these disruptions are resolved within a few hours.

Exceeding the Card’s Limit

The Postepay Evolution, like any prepaid card, has a plafond, or a maximum amount of money it can hold. For the Postepay Evolution, this limit is set at €30,000. If the salary deposit, added to the existing balance on the card, were to exceed this threshold, the transaction would be rejected. Although this is a less common scenario for a salary, it can occur in the case of bonuses, severance pay, or if the card already has a high balance. Checking your balance and card limits before payday is a good habit. A block on the spending limit could also occur for other reasons, which is worth checking.

What to Do When Your Salary Is Late

Discovering that your salary hasn’t been deposited can be frustrating. However, acting methodically and calmly is the best strategy. Follow these steps to understand the source of the problem and find a solution.

Step 1: Stay Calm and Check the Calendar

The first step is not to panic. Check the date and the day of the week. As explained, if payday falls on a Friday or before a holiday, a delay of one or two business days is completely normal. Consider the bank processing times before getting alarmed. Wait at least until the afternoon of the business day following the expected deposit date.

Step 2: Contact Your Employer

If the funds are still not available after a reasonable wait, the next step is to contact your company’s HR or administration office. Ask for confirmation that the transfer was actually initiated and, most importantly, request the payment receipt. This document is crucial because it contains the CRO (Codice di Riferimento Operazione) or, for more recent SEPA transfers, the TRN (Transaction Reference Number). These codes uniquely identify the transaction and are essential for tracking it.

Step 3: Verify the Deposit Details

Once you have the receipt, check all the details very carefully. Compare the IBAN and the beneficiary name on the receipt with the correct ones for your Postepay Evolution. A small typo is enough to block everything. If you find a discrepancy, the cause of the delay has been identified. Your employer will have to wait for the funds to be returned and then issue a new, correct transfer.

Step 4: Contact Poste Italiane Customer Support

If your employer confirms that all the details are correct and at least two business days have passed since the transfer execution date, it’s time to contact Poste Italiane’s customer support. Have the CRO or TRN code handy. By providing this code to the agent, they will be able to track the transfer within the system and check if it is being processed, if it has been rejected for some reason, or if there are other technical problems. This is the most effective way to get a definitive answer on the status of your deposit.

Prevention Is Better Than Cure: Useful Tips

Although problems can always occur, adopting a few good habits can drastically reduce the risk of salary deposit delays. Prevention is the key to serene financial management. A little initial effort can save you time and stress in the future.

First, when you provide your IBAN to your employer, double-check it several times. A practical tip is to send it via email or written message, rather than verbally, to avoid misunderstandings. Keep a copy of the communication. Also, always monitor your card’s balance and limit, especially in the days leading up to payday, to ensure there is enough capacity for the deposit. Finally, enable push notifications through the Postepay app: you will receive a real-time alert as soon as the transfer is credited. If you notice that the notifications are not arriving, check your phone and app settings.

In Brief (TL;DR)

Discover the most common causes of salary deposit delays on Postepay Evolution and the quick solutions to solve the problem.

We analyze the most common causes of these delays and discover together the quickest solutions to solve the problem.

Learn how to check the status of the bank transfer and what actions to take to resolve the issue.

Conclusion

A delay in your salary deposit on Postepay Evolution, while a source of concern, is almost always a solvable problem. The most frequent causes, such as banking timelines, data errors, or card limits, are easily identifiable. Tackling the situation with a methodical approach—first checking the timelines, then contacting your employer for the tracking code (CRO/TRN), and finally, if necessary, contacting Poste Italiane support—is the most effective path. The Postepay Evolution proves to be a valid and versatile tool, a bridge between the tradition of Poste and the needs of a digital economy, and with the right knowledge of its mechanisms, it’s possible to manage even these rare inconveniences effectively.

Frequently Asked Questions

The causes of a delay can vary. SEPA transfers, like those for salaries, generally take one business day to be credited. If the payment is initiated over the weekend or on a public holiday, the deposit is postponed to the next business day. Other causes could be an error in providing the IBAN to the employer or internal delays in payment processing by the company.

A standard SEPA transfer is credited within one business day from when the order is processed by the sender’s bank. If the transfer is made after 10:30 PM or during the weekend, the times are extended, and the deposit will occur on the following business day. Instant transfers also exist, arriving in a few seconds, but not all companies use them for salary payments.

It’s not possible to track a bank transfer like a package. The most effective check is to monitor your card’s balance and transaction history. You can do this through the Postepay app, the Poste Italiane website, or at any Postamat ATM. If the delay persists, contact your employer to request the TRN (Transaction Reference Number) of the transfer, which proves it was sent.

If the provided IBAN is non-existent, the transaction is rejected, and the funds are automatically returned to the company within a few days. If, however, the IBAN is valid but belongs to another person, the situation is more complex because the money is credited to the wrong account, and recovery is not immediate. It is crucial to notify your employer immediately to try to block the transaction or find a solution.

Yes, the Postepay Evolution has a maximum plafond, which is the total amount the card can hold, set at €30,000. If the salary deposit would cause this threshold to be exceeded, the transfer would be rejected. It is good practice to check your available balance before the deposit date to ensure you have sufficient capacity.

Still have doubts about Delayed Salary on Postepay: Causes and Quick Solutions?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.