In the digital age, where electronic payments are the norm, the secure management of our payment cards once they expire is a crucial and often underestimated aspect. In a context like Italy’s, where a culture of security is intertwined with established habits and growing technological adoption, simply throwing an old credit or debit card in the trash is no longer a safe option. This seemingly harmless act can expose us to significant risks such as identity theft and financial fraud. It is therefore essential to adopt an approach that combines traditional prudence with the effectiveness of new security awareness.

Data, even on an expired card, can still be attractive to malicious actors. The magnetic stripe and the chip, although deactivated for transactions, may contain information that can be recovered with the right technology. The CRIF Mister Credit Observatory has highlighted a worrying increase in credit fraud related to identity theft in Italy, with over 17,100 cases in the first half of 2023, marking a +10.8% increase compared to the previous year. These numbers show that the threat is real and growing, making the proper physical destruction of the card essential to protect our privacy and finances.

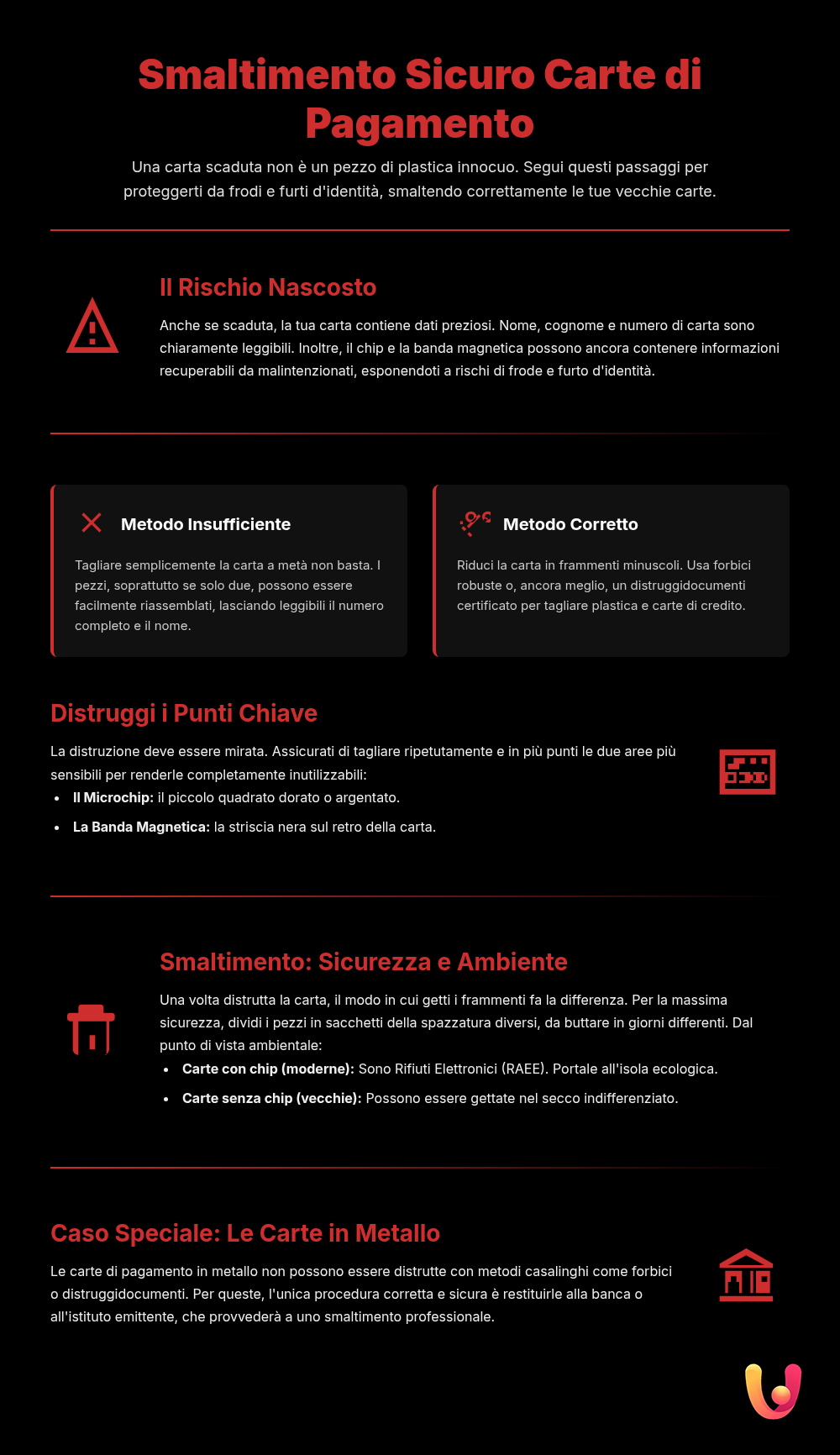

Why an Expired Card Is Still a Risk

Many people believe that once a payment card passes its expiration date, it becomes an inert piece of plastic. This belief is dangerous. Even if the card is no longer valid for making purchases or withdrawals, the data printed on it—the cardholder’s name, the card number (PAN), and the expiration date—remain perfectly legible. This information, if combined with other data obtained from different sources, can be used to commit online fraud or for targeted phishing attempts. Identity theft is a real risk and often begins with the recovery of details we consider outdated.

In addition to the visible data, the chip and magnetic stripe represent another point of vulnerability. Although the data they contain is often encrypted, it cannot be ruled out that skilled criminals might attempt to decode it. The simple deactivation by the bank does not physically eliminate the stored information. Therefore, leaving these components intact means offering a potential gateway to your personal and financial data. Prudence dictates that every old card should be treated as a sensitive document until its complete and irretrievable destruction.

Secure Destruction Methods: A Practical Approach

The destruction of an old payment card must be a methodical process aimed at making every part of it unreadable and unrecoverable. The most recommended approach is physical destruction, which ensures the permanent elimination of sensitive information. Simply cutting it in half is not enough, as the two parts could easily be reassembled. Instead, it is essential to cut the card into many small fragments, using sturdy scissors or, even better, a shredder capable of shredding plastic.

Destroying the Chip and Magnetic Stripe

The core of security lies in the targeted destruction of the chip and the magnetic stripe. These two elements are the main repositories of our data. It is essential to ensure that the scissors or shredder cut repeatedly through these two parts. An additional precaution is to vigorously scratch the surface of the magnetic stripe with a sharp object before cutting, to damage it further. For the chip, it is crucial that it is shattered or cut in multiple places to render it completely unusable.

Smart Disposal of the Fragments

Once the card has been cut into small pieces, security is not yet complete. Throwing all the fragments into the same trash bag could, in theory, allow a patient malicious actor to attempt a reconstruction. For maximum security, it is advisable to split the pieces into different bags and dispose of them on different days. This simple precaution, which combines traditional wisdom with modern paranoia, makes recovering the information virtually impossible, ensuring almost absolute protection against “dumpster diving” (the practice of searching through trash for information).

Tradition and Innovation in Financial Security

In Mediterranean culture, and particularly in Italy, money management has always been an act imbued with prudence and confidentiality. This traditional approach, based on discretion and the protection of one’s assets, finds a new dimension in the digital age. The care with which cash was kept at home now translates into the need to protect digital data with the same meticulousness. Destroying a payment card is not just a technical operation, but a true rite of passage that marks the secure closing of a financial chapter, in line with a cultural heritage that values personal security.

Technological innovation, which has provided us with tools like secure digital payments and biometrics, must be accompanied by a parallel evolution in our security habits. Awareness of risks related to cybercrime, such as card fraud, pushes us to adopt virtuous behaviors. Properly destroying a card is a perfect example of how innovation (knowledge of digital risks) can reinforce a traditional practice (prudence). It is the balance between adopting new technologies and maintaining a healthy skepticism that constitutes the best defense in the current financial landscape.

The Regulatory Context and Eco-Friendly Disposal

The protection of personal data is a fundamental right enshrined at the European level by the GDPR (General Data Protection Regulation). Although a payment card contains financial data and not “sensitive” data according to the strictest classification, its breach can have serious repercussions on individuals’ lives. Institutions like the Italian Data Protection Authority (Garante per la Protezione dei Dati Personali) and the Bank of Italy emphasize the importance of carefully managing any information that could lead to the identification of an individual and their assets. Destroying a card, therefore, also means acting in accordance with the spirit of privacy regulations, which require minimizing the risks of data loss or illicit dissemination.

An often-overlooked aspect is the environmental impact. Payment cards are made of PVC and contain a microchip, thus falling into the category of Waste Electrical and Electronic Equipment (WEEE). Therefore, proper disposal should not be in the plastic recycling bin nor always in general waste. After destroying it for security reasons, the ideal solution would be to take the fragments to a recycling center or a WEEE collection center. Some banks also offer a service for collecting and disposing of old cards, a practical solution that combines security and environmental responsibility.

In Brief (TL;DR)

Even when expired, a payment card still contains sensitive data: that’s why it’s crucial to destroy it correctly to avoid falling victim to scams and identity theft.

This simple act protects you from the risk of malicious actors recovering data from the chip and magnetic stripe to commit fraud in your name.

There are simple and effective methods to make the chip and magnetic stripe unreadable, ensuring your security.

Conclusions

In conclusion, properly destroying an old payment card is a fundamental act of responsibility in the modern world. It is not an excess of zeal, but a necessary security measure to protect oneself from fraud and identity theft, phenomena that are unfortunately on the constant rise. The act of physically cutting the card, with particular attention to the chip and magnetic stripe, and disposing of the fragments separately, represents the most effective barrier against the fraudulent recovery of data. This behavior combines the prudence rooted in our culture with the awareness required by digital innovation. Adopting these simple but crucial precautions means actively protecting one’s financial identity and contributing to a more secure payment ecosystem for everyone, honoring a principle of caution that never goes out of style.

Frequently Asked Questions

Even if a card is expired, it still holds sensitive data like your name and account number (PAN). Often, the number on the new card you receive is identical to the old one. A malicious person could retrieve this information from the trash and attempt to use it for identity theft or online fraud, exploiting payment systems with less stringent controls. Destroying it is a simple step to protect your financial identity.

No, cutting a card into just two pieces is not a secure method. The fragments can be easily put back together to read the data. The recommended practice is to cut the card into many small pieces using sturdy scissors or, even better, a cross-cut shredder. It is crucial that both the chip and the magnetic stripe are completely destroyed and made unreadable.

No, payment cards should not be thrown in the plastic recycling because they are not packaging. The correct destination depends on the type: cards with a microchip are considered electronic waste (WEEE) and should be taken to a recycling center. Older cards without a chip, however, go into general waste. For extra security, it’s recommended to dispose of the pieces in different bags or on different days.

These two components are the most important to render unusable. For the *chip*, use sturdy scissors to shatter it into as many pieces as possible. For the *magnetic stripe*, the best thing to do is make numerous vertical cuts along its entire length. This way, the recorded magnetic information is interrupted at multiple points, making it impossible to read.

Metal cards cannot be destroyed with regular scissors or common shredders. The safest and recommended method is to contact your bank. Many financial institutions provide a pre-paid envelope to return the old metal card, ensuring its professional and secure destruction. Alternatively, you can take it directly to a physical branch of your institution.

Still have doubts about Expired Card: How to Destroy It to Avoid Scams?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.