In Brief (TL;DR)

Modernizing legacy platforms towards microservices is vital to compete effectively in the dynamic credit and fintech sector.

A strategy based on Domain-Driven Design and Saga pattern resolves complexities related to decomposition and data consistency.

Using Kubernetes and resilience protocols ensures scalability and operational reliability in critical integrations with banking systems.

The devil is in the details. 👇 Keep reading to discover the critical steps and practical tips to avoid mistakes.

The transition from monolith to microservices represents the most critical architectural challenge today for companies in the fintech and credit brokerage sector. In 2026, modernizing legacy platforms is no longer just a matter of technical efficiency, but a survival imperative to compete in a market dominated by Open Finance and rapidly evolving regulations. This strategic and technical guide explores how to decompose a monolithic application while managing the complexity of transactional data, the resilience of banking integrations, and infrastructure automation.

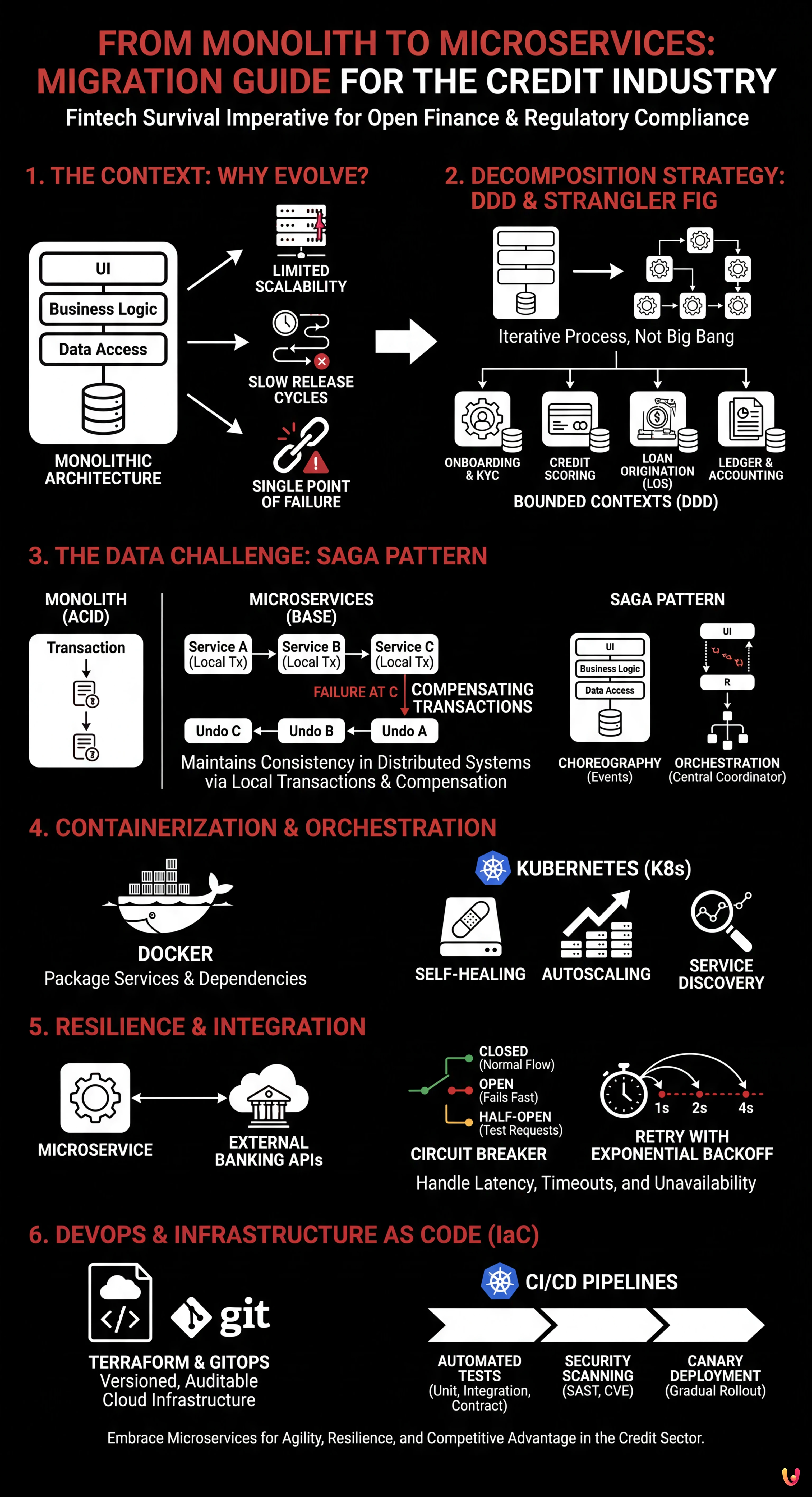

1. The Context: Why the Credit Sector Must Evolve

Credit management platforms often originate as monolithic architectures: a single block of code where the user interface, business logic (scoring, processing, disbursement), and data access are tightly coupled. Although this approach initially guarantees development simplicity and native ACID (Atomicity, Consistency, Isolation, Durability) transactions thanks to a single relational database, it becomes a bottleneck in the long run.

The main problems we face in the credit sector are:

- Limited scalability: Impossible to scale only the “Installment Calculation” module without replicating the entire application.

- Slow release cycles: A regulatory change on APR calculation requires redeploying the entire system, increasing the risk of regressions.

- Single Point of Failure: An error in the PDF generation module can block the entire loan application portal.

2. Decomposition Strategy: Domain-Driven Design (DDD)

The migration from monolith to microservices must never be a “Big Bang” (simultaneous total rewrite), but an iterative process based on the Strangler Fig pattern, as theorized by Martin Fowler. The first step is not writing code, but defining boundaries.

Identifying Bounded Contexts

Using Domain-Driven Design (DDD) principles, we must map the functional subdomains. In credit, natural boundaries (Bounded Contexts) could be:

- Onboarding & KYC: Registry management and anti-money laundering.

- Credit Scoring: Decision engine and Credit Bureau/Experian queries.

- Loan Origination System (LOS): Application workflow.

- Ledger & Accounting: Management of accounting movements.

Each microservice must possess its own database (Database-per-Service pattern) to ensure decoupling. This introduces the biggest technical challenge: data consistency.

3. The Data Challenge: ACID vs BASE in a Distributed Environment

In a banking monolith, transferring funds and updating the application status happens in a single database transaction. In a microservices architecture, these operations occur on different services. We cannot use classic distributed transactions (Two-Phase Commit) due to latency and resource locking.

Implementing the Saga Pattern

To maintain consistency, we adopt the Saga Pattern. A Saga is a sequence of local transactions. If a transaction fails, the Saga executes a series of compensating transactions to undo previous changes.

There are two main approaches:

- Choreography: Services exchange events (e.g., via Kafka or RabbitMQ). The Scoring service emits the

ScoringCompletedevent, which is listened to by the Origination service. - Orchestration: A central service (Orchestrator) commands others what to do. In the credit context, where workflows are complex and regulated, orchestration is often preferable to have visibility on the application status.

4. Containerization and Orchestration: Docker and Kubernetes

Once services are defined, the enabling technology is containerization. Docker allows packaging each microservice with its dependencies (libraries, runtime), ensuring the development environment is identical to production.

To manage tens or hundreds of containers, Kubernetes (K8s) is the de facto standard. K8s offers:

- Self-healing: Automatically restarts containers that fail (e.g., a quoting service crashing due to insufficient memory).

- Autoscaling: Increases pod replicas during traffic spikes (e.g., Black Friday marketing campaigns).

- Service Discovery: Manages internal traffic routing between microservices without hard-coding IPs.

5. Resilience and Integration with External Banking APIs

A credit intermediary must interact with multiple external APIs (Banks, PSD2 Gateways, Credit Bureaus). These APIs are subject to latency, timeouts, or temporary unavailability. A microservices architecture must be designed for failure.

Circuit Breaker Pattern

It is essential to implement the Circuit Breaker pattern (using libraries like Resilience4j or Service Mesh features like Istio). It works like an electrical switch:

- Closed: Traffic flows normally.

- Open: If the number of errors exceeds a threshold (e.g., 5 consecutive timeouts towards Bank X’s API), the circuit opens and calls fail immediately without waiting for the timeout, preserving system resources.

- Half-Open: After a period of time, the system lets a few test requests pass to check if the external service is back online.

Retry with Exponential Backoff

For transient errors, we implement intelligent Retry policies. Do not retry immediately, but wait for increasing times (e.g., 1s, 2s, 4s) to avoid overloading a system already in distress (Exponential Backoff).

6. DevOps and Infrastructure as Code (IaC)

The operational complexity of microservices requires a mature DevOps approach. Managing infrastructure manually is unthinkable.

Terraform and GitOps

We use Terraform to define infrastructure as code (IaC). This allows versioning the cloud architecture (AWS/Azure/GCP) on Git, ensuring auditability and reproducibility, fundamental requirements for inspections by the Bank of Italy or ECB.

CI/CD Pipelines

Continuous Integration and Continuous Deployment pipelines must include:

- Automated Tests: Unit tests, Integration tests, and Contract tests (to verify that APIs haven’t broken compatibility).

- Security Scanning: Static code analysis (SAST) and Docker image scanning for known vulnerabilities (CVE).

- Canary Deployment: Releasing the new microservice version only to a small percentage of users to verify stability before full rollout.

Conclusions

Migrating from monolith to microservices in the credit sector is not a simple technological update, but a profound restructuring of operational processes. It requires rigorous data consistency management via patterns like Saga, proactive resilience via Circuit Breaker, and total automation via DevOps. Only in this way can technological innovation translate into business speed, allowing new financial products to be launched in days rather than months, while maintaining the robustness and security required by the regulator.

Frequently Asked Questions

Migration to microservices is necessary to overcome scalability limits and slow releases typical of monolithic architectures. In fintech, this step is crucial to adapt quickly to regulations, such as changes in APR calculation, and to compete in the Open Finance market, allowing individual modules to be updated without risking blocking the entire platform.

In a microservices environment, where classic ACID transactions cannot be used on a single database, the Saga Pattern is adopted. This method manages consistency through a sequence of local transactions coordinated via orchestration or choreography. If a step fails, the system automatically executes compensating transactions to undo previous changes and maintain financial data integrity.

The most effective approach avoids simultaneous total rewriting, known as Big Bang, favoring instead an iterative process based on the Strangler Fig pattern. Using Domain-Driven Design, functional boundaries or Bounded Contexts, such as Credit Scoring or Onboarding, are identified to extract and progressively modernize individual parts of the system, reducing operational risks.

They are fundamental mechanisms to ensure resilience when communicating with unstable external APIs. The Circuit Breaker interrupts calls to a service returning repeated errors, preventing internal resource blocking. Retry policies with Exponential Backoff, on the other hand, manage new connection attempts by waiting for increasing time intervals, avoiding overloading external systems already in difficulty.

Kubernetes is essential for managing container complexity in production, offering critical features like self-healing, which automatically restarts crashing services, and autoscaling. The latter allows the infrastructure to dynamically adapt to load peaks, ensuring operational continuity during critical moments like marketing campaigns or tax deadlines.

Did you find this article helpful? Is there another topic you'd like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.