How to block a credit card? In this article, we will guide you through the process of blocking your stolen or lost credit card, an essential action to protect your finances and prevent fraudulent use.

The first step is to immediately contact your credit card issuer to report the loss or theft. This step ensures the card is blocked quickly, preventing unauthorized transactions.

Furthermore, we will explain how to file a formal report with the competent authorities, an important step to further protect your rights and potentially recover your card or lost funds.

We will also provide practical advice on how to monitor your banking activity and adopt preventive measures to safeguard your financial information, reducing the risk of future inconveniences.

So let’s not wait any longer and discover how to block a credit card!

The Severity of a Stolen or Lost Credit Card

Having a stolen or lost credit card is not just an inconvenience, but represents a serious threat to the cardholder’s financial security.

In an increasingly digitized world, credit card information can be exploited quickly by malicious actors to make unauthorized purchases or commit identity theft.

These illicit acts not only expose the cardholder to potential financial losses, but can also have a negative and lasting impact on credit history.

It is therefore essential to understand the magnitude of this risk and protect your financial resources.

Acting Quickly Is Crucial

In the event of theft or loss of the credit card, acting quickly is of vital importance. From the moment the loss occurs, every minute that passes can increase the risk of fraudulent use of the card.

Contacting the issuer immediately to block the card is the first step to take to prevent malicious actors from exploiting it, thus limiting potential financial losses.

Additionally, promptly reporting the incident to the competent authorities and carefully monitoring your bank statements to identify any suspicious transactions are fundamental actions to keep the situation under control.

Blocking the Credit Card Quickly and Efficiently

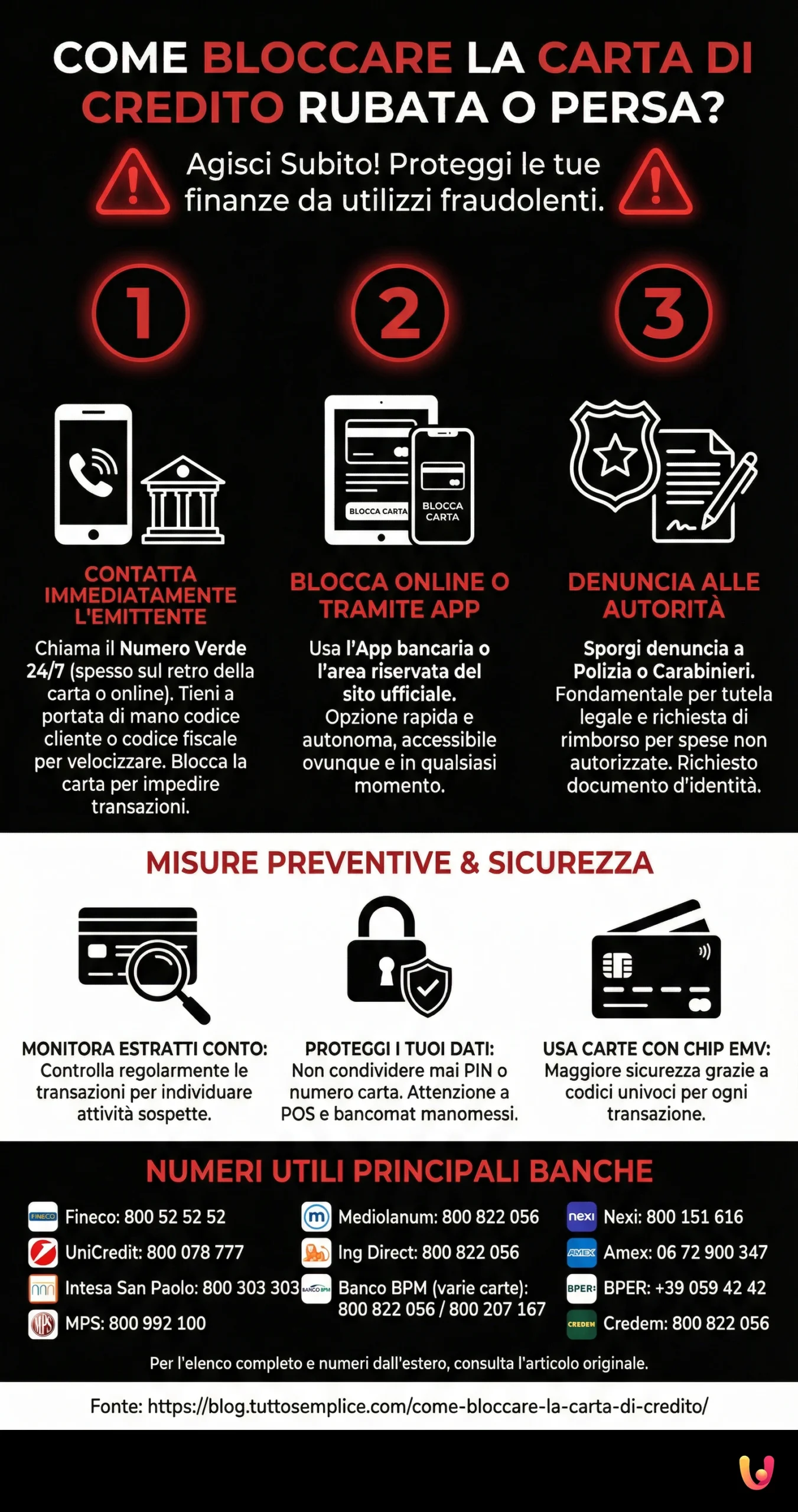

Let’s now look at the steps to take to block the credit card quickly and efficiently, so as to immediately protect ourselves from potential scams and financial losses.

Contact the Card Issuer

The first step to take is to contact the credit card issuer. Most banks and credit institutions provide a toll-free number active 24 hours a day, 7 days a week, specifically dedicated to emergencies, such as card theft or loss.

It is essential to have this toll-free number on hand to report the theft or loss of the credit card.

Usually, the toll-free number to contact in case of theft or loss is indicated on the back of the card.

Failing this, knowing your customer code or tax ID code could greatly speed up the identification and card blocking procedures.

Visiting the bank’s official website or using the dedicated app can offer further details on how to proceed and specific support hours.

Blocking the Card Online or via App

Many banks now offer the possibility to block the card directly online or through the use of a dedicated app.

This option allows you to act quickly and autonomously. Usually, in the customer reserved area, there is a section dedicated to card management, where you can select the card in question and proceed with the block.

This operation can be performed at any time and from anywhere.

Reporting Theft or Loss to Authorities

It is equally important to report the theft or loss of the credit card to the competent authorities, such as the police.

This not only offers additional legal protection but may also be a requirement by many banks to proceed with the cancellation of any fraudulent transactions that may have occurred after the theft or loss and thus easily obtain a refund of the spent funds.

For the report, it is necessary to provide a valid ID and, if possible, the card number or at least the issuing bank or financial institution.

The authorities will provide a police report that must be kept and shown to the bank during the request for reimbursement of any unauthorized charges.

Preventive Measures to Avoid Future Fraud

Monitor Bank Statements and Transactions

It is fundamental to regularly monitor bank statements and transactions of the credit card to promptly identify any suspicious activity.

This allows you to act quickly should you notice unauthorized operations. In such an event, it is important to immediately report the situation to the card issuer, providing all necessary details to allow for an accurate investigation.

Most banks offer online services and dedicated apps that facilitate the review of transactions in real-time, thus enhancing the control measures available to users.

Protect Personal Data

Personal data protection is another crucial aspect in fraud prevention. It is essential to keep sensitive information such as the PIN and credit card number safe, avoiding sharing them online or with untrusted people.

It is also advisable to pay attention when using ATMs or POS terminals, checking that there are no suspicious devices attached and covering the keypad while typing the PIN.

Use Credit Cards with EMV Chips

Adopting credit cards equipped with EMV chips represents a highly effective preventive measure.

This technology offers a higher level of security against fraud, thanks to the generation of a unique code for each transaction, making it much more difficult for malicious actors to clone the card or make unauthorized purchases.

It is therefore recommended to prefer the use of cards with EMV chips, when available, for all types of financial operations.

Useful Phone Numbers to Block Credit Cards

- Fineco Bank

- Toll-free Number 800 52 52 52 from landlines in Italy

- +39 02 2899 2899 from abroad and from mobile phones

- UniCredit

- Toll-free Number 800 078 777 from landlines in Italy

- +39 045 80 64 686 from abroad and from mobile phones

- Intesa San Paolo

- Toll-free Number 800 303 303 from landlines in Italy

- +39 02 87 109 001 from mobile phones or from abroad

- Banca Monte dei Paschi di Siena

- Toll-free Number 800 992 100 from landlines in Italy

- +39 02 349 801 76 from mobile phones or from abroad

- Banca Mediolanum

- Toll-free Number 800 822 056 from landlines in Italy

- +39 02 6084 3768 from mobile phones and from abroad

- Ing Direct

- Toll-free Number 800 822 056 from landlines in Italy

- +39 02 6084 3768 from abroad and from mobile phones

- Banco BPM

- Carte Ja@ns, KJe@ns, KJe@n Black, KDue, KDue White, YouCard, YouCard Business

- 800 822 056 from Italy

- +39 0260843760 from abroad

- Carte Be1, Business Prepaid

- 800 207 167 from Italy

- +39 0432 744 106 from abroad

- Cartimpronta

- 800 207 167 from Italy

- +39 043 274 41 06 from abroad

- Nexi

- 800 151 616 from Italy

- +39 02 349 800 20 from abroad

- Toll-free Number 1 800 473 6896 from USA

- Amex

- 06 72 900 347 from Italy

- 011 800 263 922 79 from APEC countries

- 018 001 231 690 from Mexico

- +39 800 263 922 79 from the rest of the world

- Carte Ja@ns, KJe@ns, KJe@n Black, KDue, KDue White, YouCard, YouCard Business

- MedioBanca Premier

- Toll-free Number 800 15 16 16 from Italy

- +39 02 349 800 20 from abroad (Classic Credit Card, Nexi Card, Nexi Business Credit Card)

- +39 02 349 800 28 from abroad (Prestige, Excellence or Black Credit Card)

- Toll-free Number +1 800 473 6896 from USA

- BPER Banca

- +39 059 42 42 from Italy and from abroad

- Credem

- Toll-free Number 800 822 056 from Italy

- +39 02 608 43 768 from abroad

- Banco di Sardegna

- +39 059 4242 from Italy and from abroad

- Banco Popolare di Sondrio

- Toll-free Number 800 822 056 from Italy

- +39 02 608 437 68 from abroad

In Brief (TL;DR)

In case of theft or loss of the credit card, contact the card issuer immediately to block it.

Report the theft or loss to the competent authorities.

Adopt preventive measures to protect your finances and prevent unauthorized use of your credit card.

Conclusions

In conclusion, credit card security is a topic of fundamental importance in the digital age in which we live.

Adopting preventive measures, such as vigilance in online and physical card usage, personal data protection, and the use of advanced technologies like the EMV chip, represent the main ways to effectively defend against fraud.

It is essential to always be informed and aware of the dangers, acting with prudence when it comes to financial operations.

Remember to immediately contact your card issuer in case of theft or loss and report the incident to the competent authorities.

Protecting your financial security is a task that requires attention and dedication.

By following the advice and practices recommended in this article, you will be able to act in the world of financial transactions with greater security and peace of mind.

Frequently Asked Questions

Contact the card issuer immediately to block it. Toll-free numbers and instructions for blocking online or via app are available on your bank’s website or app.

Report the theft to the competent authorities at the nearest police station. Bring an ID and, if possible, the card report number.

Monitor bank statements to identify any unauthorized transactions and report them immediately to the bank.

Follow the same instructions for blocking the card as in the case of theft.

Search for the card carefully before reporting it lost. You may have simply misplaced it at home or in a place you frequent.

If you cannot find the card, contact the bank to request a new one.

Never share the PIN or card number with anyone.

Pay attention to bank statements and report any suspicious transaction immediately.

Use credit cards with EMV chips which offer greater security.

Avoid using the credit card on insecure websites.

Install an antivirus and firewall on your computer to protect against malware.

The time required to block a credit card may vary depending on the card issuer. Generally, the block can be performed immediately via phone, app, or website.

Your blocked card can no longer be used to make transactions.

You will receive a new card with a new number within a few days.

You will need to update your payment details for any service or subscription set on your old card.

Some banks may charge a small fee for blocking and replacing the credit card. It is advisable to contact your bank for specific information on fees.

No, once blocked, your credit card can no longer be used to make transactions. You will need to request a new card with a new number.

Contact your bank immediately to inform them that you have found the card. It may be necessary to reactivate it or request a new card for security reasons.

Contact your bank immediately to report the fraudulent transaction. Provide the bank with all transaction details, including the amount, date, and location.

If you are not satisfied with the service received from your bank, you can file a complaint with the relevant banking authority.

Still have doubts about How to Block a Stolen or Lost Credit Card? Read Now!?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.