Access to credit in Italy is undergoing a profound transformation. On one hand, European banking regulations impose increasingly strict solvency criteria; on the other, Mediterranean culture, historically based on trust and family support networks, is seeking new ways to obtain liquidity. In this complex scenario, individuals such as the self-employed, temporary workers, or those with past financial difficulties often find themselves excluded from traditional channels.

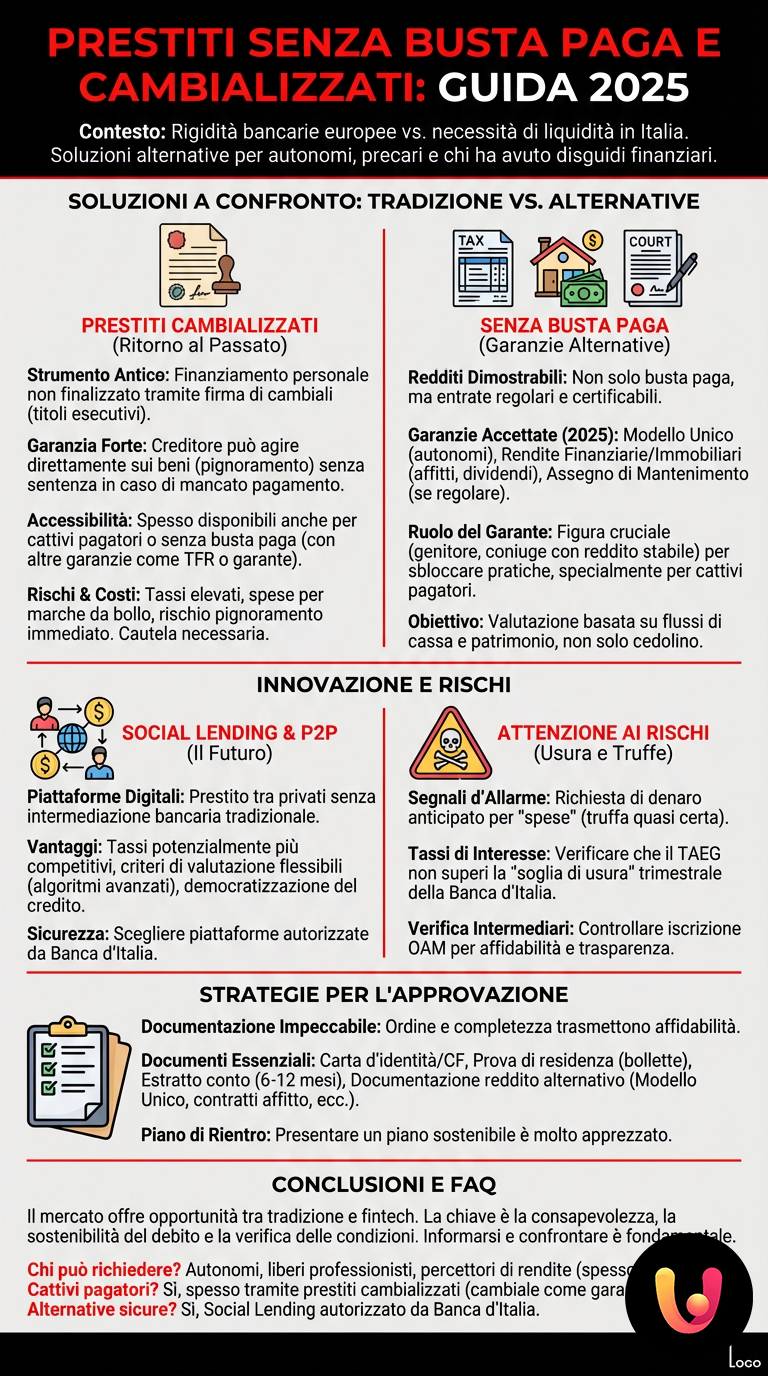

Necessity is the mother of invention, and the market is responding with tools that range from ancient tradition to digital innovation. We are talking about bill of exchange loans, which dust off old enforceable instruments, and loans without a paycheck, which leverage alternative guarantees. Understanding how these products work is essential to navigate a sector where the risk of high interest rates or scams is real.

This guide provides a detailed analysis of the opportunities available in 2025 for those who do not have the classic guarantees required by credit institutions. We will explore the dynamics of a market that is adapting to new forms of work, offering concrete solutions to obtain the necessary liquidity to carry out personal projects or overcome difficult times.

The Italian Credit Landscape: Between Rigidity and Flexibility

The credit market in Italy is experiencing a clear dichotomy. Large banks, bound by Basel parameters and ECB directives, require impeccable income documentation. A permanent employment paycheck remains the preferred “passport” to obtain money. However, the Italian economic fabric is largely composed of freelancers, artisans, and non-standard contracts, who often struggle to meet these standards.

Specialized financial companies and new digital platforms are stepping into this gap. The goal is to assess creditworthiness not just based on a monthly payslip, but through the analysis of cash flows, assets, or real guarantees. This is where the tradition of the “I.O.U.” meets the modernity of scoring algorithms.

The lack of a paycheck does not equate to a lack of income. The modern financial system is learning to distinguish between job insecurity and actual repayment capacity.

For those seeking small amounts, the solutions have multiplied. Today, small loans without a paycheck represent a vital resource for dealing with unexpected expenses, proving that solvency can be demonstrated even through unconventional channels.

Bill of Exchange Loans: The Return of Tradition

The bill of exchange loan is perhaps the most striking example of how an ancient instrument can become relevant again in times of crisis. It is a non-purpose personal loan where repayment of installments is made by signing bills of exchange. These are not just pieces of paper, but enforceable instruments that offer the creditor a very strong guarantee.

In case of non-payment, the creditor can act directly on the debtor’s assets (seizure) without having to wait for a court ruling. Precisely because of their coercive nature, bill of exchange loans are often accessible even to those who have been reported as bad credit borrowers or who do not have a paycheck, provided they can offer other guarantees (such as accrued severance pay or a guarantor’s signature).

However, it is crucial to approach this instrument with extreme caution. The costs are generally higher than the market average. In addition to interest, you must consider the cost of purchasing the tax stamps required to validate the bills of exchange. To delve deeper into the mechanics of this tool, it is useful to consult a specific guide on the bill of exchange loan, to fully understand the legal obligations it entails.

No Paycheck: What Are the Alternative Guarantees?

Obtaining credit without an employment contract is difficult, but not impossible. Banks and financial institutions require “demonstrable income.” This concept is much broader than just a paycheck. It includes any regular and verifiable income that can ensure the payment of the monthly installment.

The main alternative guarantees accepted in 2025 include:

- Modello Unico for the Self-Employed: A solid and continuous tax return over the years is the foundation for professionals and entrepreneurs.

- Financial or Real Estate Income: Rent received from a owned property or consistent stock dividends are considered excellent indicators of solvency.

- Alimony Payments: If established by a judge and received regularly, it can contribute to the calculation of disposable income.

The role of a guarantor is crucial. In Mediterranean culture, family support has always been a social safety net. The signature of a parent or spouse with a stable job position can unlock applications that would otherwise be rejected. Those who have had problems in the past, such as bad credit borrowers, often find that the endorsement of a third person is the only way to regain access to credit.

The Innovation of Social and P2P Lending

If the bill of exchange represents the past, Social Lending (or peer-to-peer lending) represents the future and innovation. These digital platforms directly connect people who need money with private investors willing to lend it, eliminating traditional banking intermediation. This system often allows for more competitive rates and more flexible evaluation criteria.

Peer-to-Peer (P2P) lending platforms use advanced algorithms to assess risk, taking into account data that traditional banks might ignore. It is a form of credit “democratization” that is also gaining ground in Italy, offering a valid alternative to those rejected by classic bank counters.

Technological innovation in the fintech sector has made it possible to create a more inclusive credit market, where digital reputation is beginning to count as much as financial reputation.

For those interested in understanding how this mechanism works and which platforms are authorized by the Bank of Italy, it is advisable to read an in-depth analysis of social lending and peer-to-peer loans.

Beware of Risks: Usury and Online Scams

The search for “loans without guarantees” or “cash now” inevitably exposes you to high risks. The parallel and unregulated market is unfortunately thriving. An unequivocal warning sign is the request for money upfront: no serious financial company asks for wire transfers for “processing fees” or “insurance” before disbursing the loan. If you are asked to pay before you receive, it is almost certainly a scam.

Another critical aspect is the interest rate. Loans granted to at-risk individuals (without a paycheck or with a history of non-payment) physiologically have higher rates (APR) to cover the risk of default. However, these rates must never exceed the “usury threshold” set quarterly by the Bank of Italy. It is the consumer’s duty to verify that the proposed conditions fall within legal limits.

Always verify that the intermediary or financial company is duly registered in the OAM (Organismo Agenti e Mediatori) lists. Transparency is the first indicator of reliability. Be wary of ads on social networks or private messaging that promise large sums of capital without any verification.

Documentation and Strategies for Approval

To maximize the chances of success, the application must be impeccable. Even without a paycheck, orderly and complete documentation conveys reliability to the lending institution. Preparing a complete file reduces processing times and demonstrates seriousness.

The essential documents to submit include:

- Identification documents: Valid ID card and Social Security Number (Codice Fiscale).

- Proof of residence: Recent utility bills or certificate of residence.

- Bank statement: The last 6-12 months of transactions are essential to demonstrate income and spending habits.

- Alternative income documentation: Rental agreements, tax returns (Modello Unico), proof of investment income.

In some cases, it may be useful to present a sustainable repayment plan, proactively showing how you intend to manage the monthly installment in relation to your income and expenses. This pragmatic approach is highly valued by financial advisors.

In Brief (TL;DR)

Discover alternative financing opportunities available in 2025 with our complete guide to bill of exchange loans and loans without a paycheck, dedicated to those who need liquidity despite not having the standard guarantees required by credit institutions.

Explore alternative credit options for those who do not have the standard guarantees required by institutions.

Learn about alternative and secure credit opportunities for those who lack the standard guarantees required by banks.

Conclusions

The landscape of special loans in Italy in 2025 is a varied ecosystem that combines historical instruments like the bill of exchange with modern fintech technologies. Obtaining liquidity without a paycheck is a complex challenge that requires awareness and caution. The key lies in understanding that the absence of a permanent contract does not preclude access to credit, but shifts the focus to other forms of guarantee, whether they are real, personal, or reputation-based.

Whether you choose the traditional path of a bill of exchange loan or the innovative one of social lending, the golden rule remains sustainability. Carefully evaluating your household budget, avoiding over-indebtedness, and being wary of solutions that are too easy are the pillars of sound financial management. Getting properly informed, comparing different offers, and reading the contractual clauses is the only way to turn a need for liquidity into an opportunity for growth, without falling into market traps.

Frequently Asked Questions

Self-employed individuals, freelancers, or people who receive demonstrable income (rent, alimony) can apply. Often, the signature of a guarantor with a solid income or pension is required.

Yes, bill of exchange loans are often the only option for those reported to CRIF (the Italian credit bureau) as bad credit borrowers. The bill of exchange acts as an enforceable guarantee, allowing the credit institution to overlook reservations about the applicant’s credit history.

The main risk is the immediate seizure of assets in case of non-payment of even a single installment. Furthermore, the interest rates and ancillary costs (tax stamps) are generally much higher than those of traditional loans.

Yes, Social Lending (peer-to-peer loans) is a regulated and safe alternative. Platforms authorized by the Bank of Italy connect applicants and private investors, often offering better conditions for those with good creditworthiness but a non-standard job.

You need to consult the Average Overall Effective Rate (TEGM) tables published every three months by the Bank of Italy. If the APR of the proposed loan exceeds the usury threshold indicated for that category of financing, the offer is illegal.

Still have doubts about Loans Without a Paycheck and Bill of Exchange Loans: A 2025 Guide?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.