In the digital age, the contactless card has become a natural extension of our wallet. A quick, almost automatic gesture that combines the tradition of value exchange with the most modern technological innovation. But what happens when this small but powerful tool disappears? The initial panic is understandable: the fear that someone might access our savings is real. However, acting quickly and consciously is the key to turning a potential disaster into a simple setback. This guide is designed to accompany you, step by step, through the actions to take to secure your money and resolve the situation without stress, within the Italian and European context.

The spread of “contactless” payments has simplified daily life but has also introduced new risk dynamics. A thief no longer needs a PIN to make small purchases, making the first few minutes after theft or loss absolutely decisive. Fortunately, banks and financial institutions have developed security procedures that are just as fast and effective. Knowing these mechanisms means having control of the situation, protecting the fruit of your labor, and maintaining trust in a technology that, if used correctly, remains safe and advantageous.

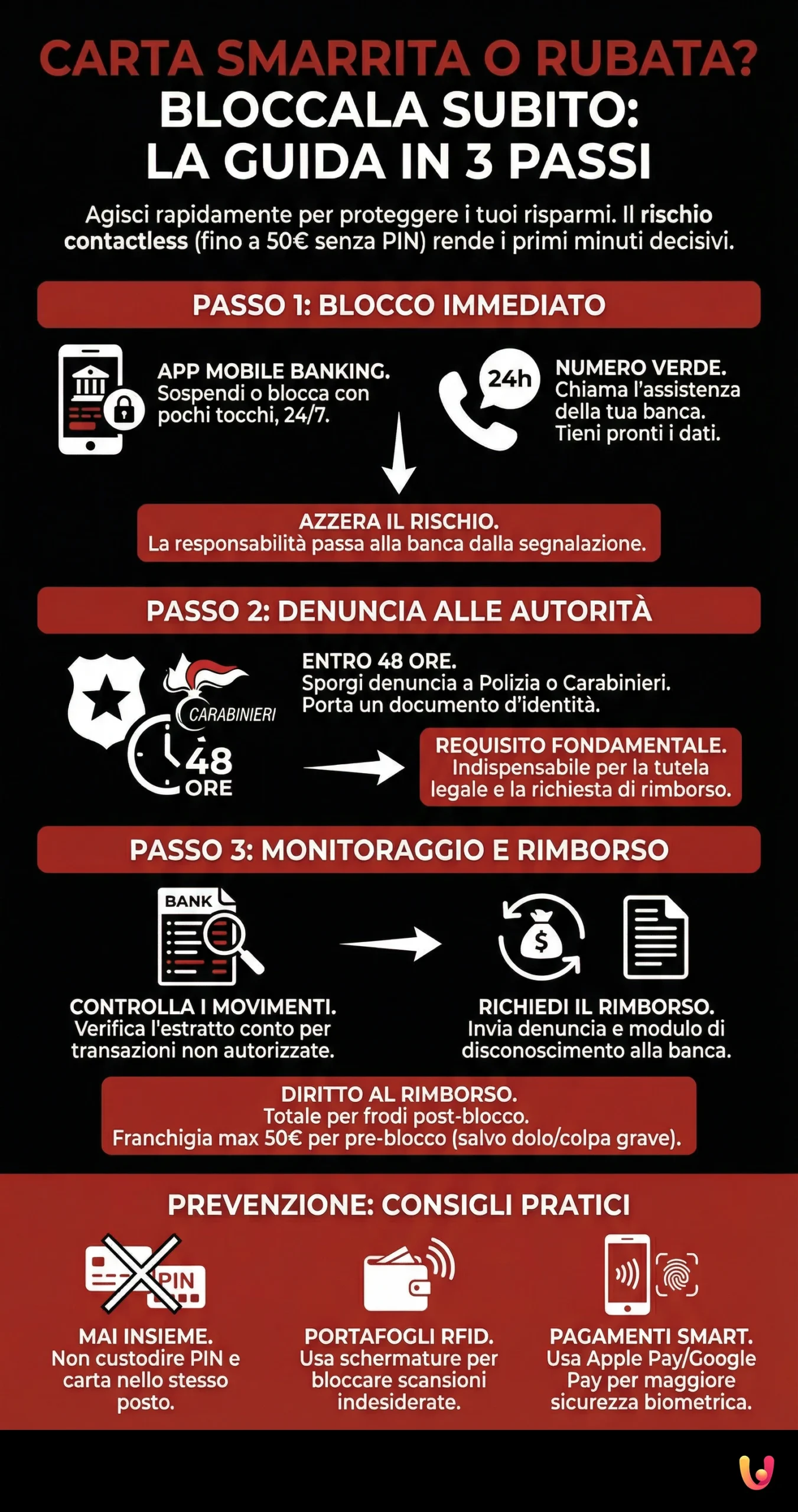

The First Crucial Step: Immediate Card Blocking

The first action to take, without hesitation, is to block the card. This operation makes it immediately unusable for any transaction, eliminating the risk of fraudulent charges. From the moment of the report, liability for any illicit use passes to your credit institution. Every moment is precious, especially with contactless cards, which allow purchases under a certain threshold without requiring a PIN code. In Italy and much of Europe, this limit is set at 50 euros. Although there are further security measures, such as a cumulative maximum cap of 150 euros or a maximum number of 5 consecutive operations without a PIN, a malicious actor could still make several small purchases in a short time.

To block the card, there are mainly two channels, both active 24 hours a day, 7 days a week. The most modern and fastest method is through your institution’s mobile banking app. With a few taps on the screen, you can suspend or permanently block the card. Alternatively, you can call the specific toll-free number for card blocking provided by your bank. It is a good habit to save this number in your phone book and also write it down separately, just in case. When you call, keep your personal data and, if possible, the card number handy. The operator will guide you through the procedure and provide you with a blocking code for reference.

Reporting to Authorities: When and Why It Is Necessary

After blocking the card, the second fundamental step is to file a report with law enforcement (Police or Carabinieri). This step is crucial, especially in cases of theft, but it is strongly recommended even in cases of loss. The report must be filed within 48 hours of discovering the event. This official document has a dual value: on the one hand, it legally protects you from any crimes committed with your card; on the other, it is an indispensable requirement requested by most banks to start the reimbursement process for any sums stolen illicitly before the block. Without a copy of the report, you may encounter difficulties in obtaining the compensation you are entitled to.

Showing up at the nearest Police or Carabinieri station with a valid ID is all that is needed. You will have to recount the dynamics of the facts, specifying whether it is theft or loss and providing, if you know them, the details of the card. At the end, you will be issued a copy of the police report. This document must be sent to your bank, usually via registered mail with return receipt, via email, or by delivering it directly to the branch, together with a form for disavowing fraudulent operations. The report is therefore a formal act that strengthens your position and accelerates protection procedures.

Monitoring and Refund Request: Protecting Your Money

Once the card is blocked and the report filed, it is time to check the bank statement. Carefully check the list of movements following the theft or loss to identify any unauthorized transactions. Thanks to the activation of notification services via SMS or app, many people notice suspicious operations almost in real-time, a factor that allows acting with maximum timeliness. If you identify fraudulent charges, you must formally disavow them with your bank. The European regulation on payment services, known as PSD2, widely protects consumers in these situations.

According to the law, you are entitled to a full refund of the stolen sums, unless the bank proves that you acted with fraud or gross negligence (for example, keeping the PIN together with the card). For operations that occurred before the blocking notification, a deductible may be applied at your expense, which by law cannot exceed 50 euros (previously 150 euros). All fraudulent transactions made after your report must be fully reimbursed by the credit institution. The bank is required to re-credit the disputed sums without delay, usually by the end of the business day following the notification.

Prevention Is Better Than Cure: Practical Safety Tips

Living the convenience of digital payments with peace of mind is possible by adopting some simple but effective habits. The first rule is careful custody: never leave the card unattended and do not keep it together with the PIN code. It seems like banal advice, but it is the first line of defense. For technological protection, consider using wallets with RFID shielding (Radio-Frequency Identification). These special wallets contain a thin metal layer that blocks electromagnetic signals, preventing malicious actors equipped with portable POS readers from making illicit transactions simply by getting close to you.

Another winning strategy is to use innovation to your advantage. Modern payments with smartphones or smartwatches offer a superior level of security. Services like Apple Pay, Google Pay, or Samsung Pay use tokenization, a process that replaces your card’s real data with a unique virtual code for each transaction. Furthermore, every payment must be authorized via biometric recognition (fingerprint or face) or with the device unlock code, making money theft extremely more complex. Evaluating these alternatives means embracing a future of payments that is even safer and more personal. For those concerned about risks, it is useful to delve into whether contactless is safe or risky to make an informed choice.

Tradition and Innovation: Payment Security in the Mediterranean Context

In a cultural context like the Italian and Mediterranean one, where the tradition of cash has deep roots, the adoption of payment cards has represented a real revolution. Initially welcomed with some mistrust, electronic money has progressively established itself thanks to its undeniable practicality. Contactless innovation has further accelerated this transition, merging the speed of a daily gesture with technology. However, the perception of security remains a central theme. Frauds, although declining regarding physical cloning, have evolved, moving towards the digital world.

Precisely to respond to this challenge, technology today offers increasingly sophisticated solutions. In addition to the aforementioned tokenization, artificial intelligence systems constantly monitor transactions to identify anomalies and potential frauds. European legislation, with PSD2, has imposed higher security standards, such as Strong Customer Authentication (SCA), which requires multiple verification factors for online operations. This combination of a robust regulatory framework and constant technological innovation is the best guarantee for consumers, allowing trust, a traditional value, to be combined with the efficiency of modern payment tools. If you have experienced the theft of a Postepay Evolution, you can find out what to do in our dedicated guide.

- Block the card immediately

Access your bank’s app immediately or call the toll-free number active 24/7 to suspend the card. This action blocks transactions and transfers liability to the institution.

- File a report with authorities

Go to the Police or Carabinieri within 48 hours of the event equipped with an ID document. The police report is an indispensable requirement for obtaining a refund.

- Check bank movements

Check your bank statement to identify any unauthorized transactions. Thanks to notifications or home banking, you can quickly intercept suspicious charges.

- Request a refund from the bank

Send the copy of the report and the transaction disavowal form to the bank. You are entitled to a re-credit of the sums, subject to a maximum deductible of 50 euros pre-block.

- Adopt prevention measures

For the future, avoid keeping the PIN with the card. Consider using RFID shielded wallets or digital payments via smartphone to increase security.

In Brief (TL;DR)

In case of theft or loss of your contactless card, the first fundamental action to take is immediate blocking to prevent any fraudulent use.

Discover the essential steps to block it immediately, via app or toll-free number, and secure yourself against possible frauds.

In this guide, we explain the 3 fundamental steps to block it and keep yourself safe.

Conclusions

Losing your contactless card or having it stolen can be a stressful experience, but it doesn’t have to turn into a financial problem. The key lies in the readiness of reaction and knowledge of the correct procedures. To recap, the three fundamental steps are: block the card immediately via app or toll-free number, file a report with law enforcement within 48 hours, and finally, monitor the bank statement to disavow any fraudulent charges. Following this path not only limits damages but also activates the protections provided by law, guaranteeing you the refund of sums unduly stolen.

Technology, while introducing new risk scenarios on the one hand, provides increasingly powerful protection tools on the other. The adoption of shielded wallets and, above all, the use of digital wallets on smartphones and smartwatches represent a significant evolution in payment security. Being an informed consumer means having full control of your finances, transforming fear into awareness and uncertainty into action. In this way, we can continue to benefit from the extraordinary convenience of digital payments, confident that, even in case of an unexpected event, we know exactly how to move.

Frequently Asked Questions

You should immediately use your banking app to suspend the card or call the toll-free number provided by your bank, which is active 24/7. This action prevents further fraudulent transactions and shifts the liability for illicit use from you to the credit institution.

Yes, European PSD2 regulations generally entitle you to a full refund of stolen sums unless the bank proves fraud or gross negligence on your part. While a deductible of up to 50 euros may apply for pre-block charges, all fraudulent operations occurring after your report must be fully reimbursed.

Filing a report with law enforcement within 48 hours is highly recommended and often mandatory for reimbursement purposes, even in cases of simple loss. This official document serves as a legal protection against crimes committed with your instrument and is usually required by banks to process refund claims.

Thieves can make small purchases without a PIN, typically under a 50 euro threshold in Europe, which makes immediate action vital. However, banks implement safety caps, such as a cumulative limit of 150 euros or a maximum number of consecutive transactions, to limit potential losses before the PIN is requested again.

To enhance security, consider using RFID-shielded wallets that block signals from portable scanners used by malicious actors. Additionally, adopting mobile payment systems like Google Pay or Apple Pay increases safety through tokenization and biometric authentication, making it much harder for thieves to use your funds.

Still have doubts about Lost or Stolen Card? Block It Immediately: The 3-Step Guide?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.