Moving to a new country like Italy comes with many challenges, including opening a bank account to manage daily finances. Fortunately, the Italian banking landscape has evolved, offering a wide range of digital solutions that simplify life for new residents. This article explores the best online banking and financial app options, analyzing how they combine technological innovation with the needs of a market that, while future-oriented, remains tied to a strong Mediterranean and traditional culture.

Arriving in Italy requires quickly getting familiar with bureaucratic and financial practices. For a new resident, choosing the right banking partner is a crucial step for receiving a salary, paying rent, and managing expenses. Digital banks and fintech companies have established themselves as agile and affordable alternatives to traditional institutions, thanks to more streamlined account opening procedures—often entirely online—and lower management costs. These solutions are particularly suitable for those seeking efficiency and immediacy without sacrificing security.

Tradition and Innovation: The Italian Banking Context

The Italian banking system is undergoing a profound transformation. Alongside historic institutions with an extensive network of branches, a vibrant ecosystem of 100% digital banks and neobanks has developed. This duality reflects an interesting cultural divide: on one hand, the attachment to personal relationships and face-to-face advice typical of the Mediterranean tradition; on the other, a growing demand for fast, low-cost services accessible via smartphone, driven by new generations and an increasingly digitized public. For a new resident, this evolution translates into greater choice, allowing them to opt for the model that best suits their needs and comfort level with technology.

According to recent data, mobile banking adoption in Italy is constantly growing, with millions of users managing their finances through apps. This trend highlights that digital innovation is no longer a niche but a consolidated component of the national financial sector.

Digital Banks vs. Traditional Banks: Which to Choose?

The choice between a digital and a traditional bank depends on several personal factors. Traditional banks, such as Intesa Sanpaolo, UniCredit, or BPER, offer the advantage of a physical branch network, useful for operations like depositing cash or checks and for those who prefer a direct relationship with an advisor. Many have also developed comprehensive online banking platforms, trying to combine the best of both worlds. However, they often have higher management costs, with annual fees that can vary significantly and commissions on individual transactions.

Digital banks, on the other hand, operate primarily or exclusively online, eliminating the costs associated with physical branches and, consequently, offering reduced or zero monthly fees. The account opening process takes just a few minutes via an app, with identity verification through a webcam or selfie, and daily management is designed to be intuitive and immediate. This option is ideal for those seeking affordability, speed, and who don’t need to visit a branch in person. For a new resident, being able to complete the entire process online, without complex language barriers and with documents at hand, is a significant advantage.

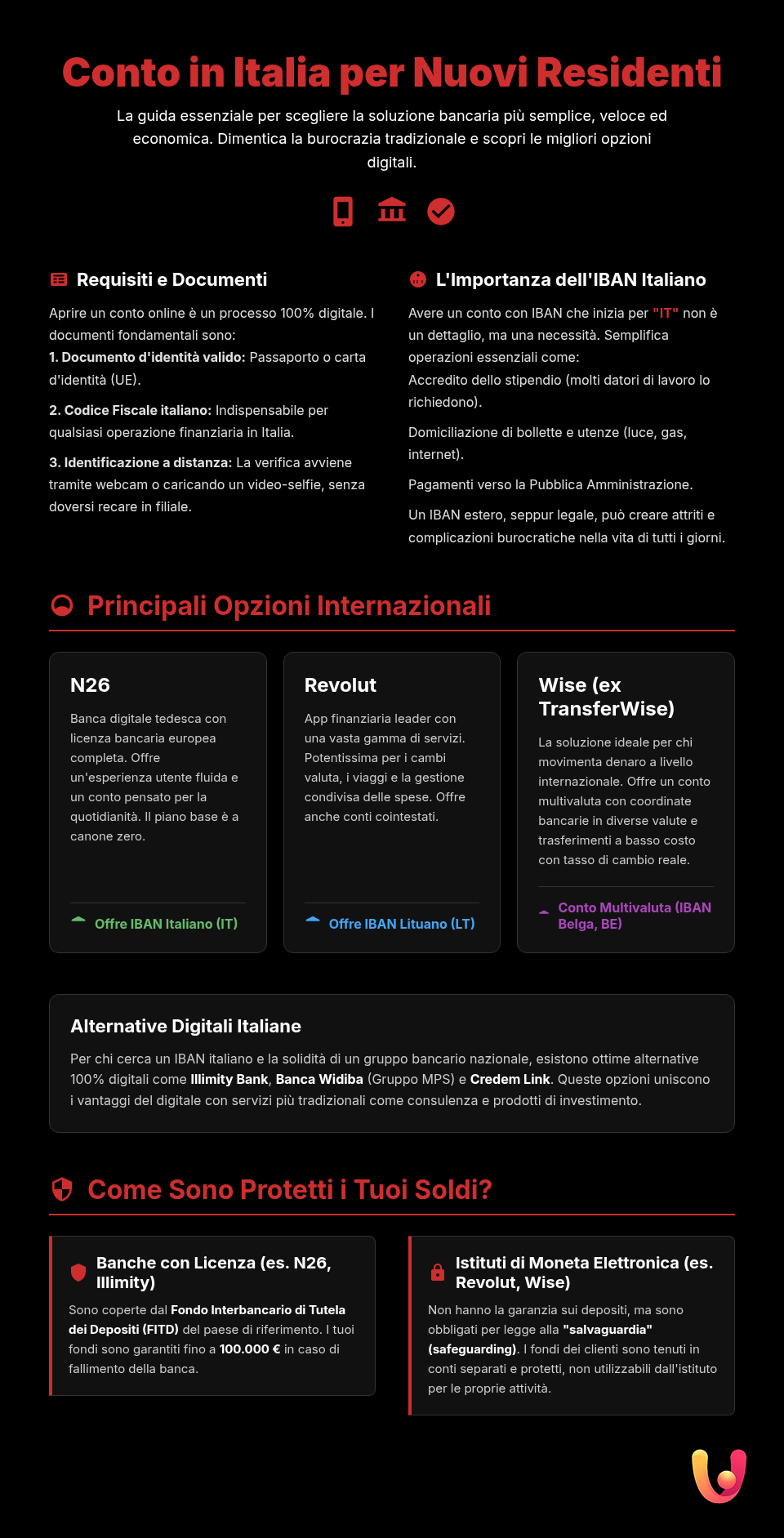

Opening an Online Bank Account: Documents and Requirements

To open a bank account in Italy, even online, a few essential documents are required. Regardless of the bank you choose, you will be asked to provide a valid ID document (such as a passport or an EU country’s identity card) and your Italian tax code (codice fiscale). The latter is an indispensable identifier for any financial transaction and can be requested from the Italian Revenue Agency (Agenzia delle Entrate), even by those who do not yet have official residency. Some banks may also require proof of address in Italy, such as a rental contract or a utility bill. For non-EU citizens, a valid residence permit is often also required.

The online opening procedure is generally guided and requires you to fill in your personal details, upload photos of your documents, and complete the identification process. This is usually done via a video selfie or a short video call with an operator, a solution that ensures security and compliance with anti-money laundering regulations. It’s important to check the specific requirements of each bank, as they can vary slightly. If you encounter difficulties, remember that there are specific resources, like complete guides for opening an account for foreigners that can help you step by step.

The Best Online Banks and Fintechs for New Residents

The market offers several excellent solutions for those who have just moved to Italy. The choice depends on your spending habits, the need to operate with foreign currencies, and the additional services you desire. Here is a selection of the most interesting options.

N26

N26 is a 100% digital German bank with a European banking license, very popular in Italy. It offers a bank account with an Italian IBAN that can be opened in minutes directly from your smartphone. The basic plan, N26 Standard, has no monthly fee and includes a free virtual debit card, which can be used for online payments and with wallets like Google Pay and Apple Pay. Card payments in any currency are free, making it an excellent option for those who travel or make international purchases. To open the account, you need residency in Italy, an ID document, and a tax code (codice fiscale).

Revolut

Revolut positions itself as a “financial super app” and offers an account with a European IBAN (Lithuanian). It is particularly valued for its multi-currency features, which allow you to hold and exchange money in different currencies at competitive exchange rates. The Standard plan is free and offers a debit card, free SEPA transfers, and the ability to invest in cryptocurrencies and commodities. Unlike N26, Revolut also offers joint accounts, a useful feature for families or roommates. Its flexibility makes it ideal for those with financial ties abroad. Consider learning more about the different Revolut payment plans to choose the one that’s right for you.

Wise (formerly TransferWise)

Originally a service for low-cost international money transfers, Wise now offers a complete multi-currency account. It allows you to hold money in over 50 currencies and get local bank details (including a European IBAN, US routing number, UK sort code, etc.), making it easy to receive payments from around the world like a local. Its fee structure is transparent and based on the real exchange rate. Wise is an excellent choice for professionals, digital nomads, and anyone who needs to manage international money flows efficiently and affordably.

Other Italian Digital Options

In addition to the big international names, the Italian landscape also offers solid alternatives.

- Illimity Bank: an Italian digital bank that stands out for its savings accounts with competitive returns and a comprehensive offering that includes checking accounts, cards, and loans.

- Banca Widiba: the online bank of the Monte dei Paschi di Siena group, which combines the stability of a major banking group with the agility of a digital offering. It offers accounts with no monthly fee (under certain conditions) and a financial advisory service.

- Credem Link: the online account from Credem Banca, which offers no monthly fee, a debit card, and the option of having a dedicated advisor both in-branch and remotely, thus combining a human touch with a digital service.

- Illimity Bank: an Italian digital bank that stands out for its savings accounts with competitive returns and a comprehensive offering that includes checking accounts, cards, and loans.

- Banca Widiba: the online bank of the Monte dei Paschi di Siena group, which combines the stability of a major banking group with the agility of a digital offering. It offers accounts with no monthly fee (under certain conditions) and a financial advisory service.

- Credem Link: the online account from Credem Banca, which offers no monthly fee, a debit card, and the option of having a dedicated advisor both in-branch and remotely, thus combining a human touch with a digital service.

These solutions with an Italian IBAN can simplify tasks like receiving your salary or setting up direct debits for utilities.

- Illimity Bank: an Italian digital bank that stands out for its savings accounts with competitive returns and a comprehensive offering that includes checking accounts, cards, and loans.

- Banca Widiba: the online bank of the Monte dei Paschi di Siena group, which combines the stability of a major banking group with the agility of a digital offering. It offers accounts with no monthly fee (under certain conditions) and a financial advisory service.

- Credem Link: the online account from Credem Banca, which offers no monthly fee, a debit card, and the option of having a dedicated advisor both in-branch and remotely, thus combining a human touch with a digital service.

These solutions with an Italian IBAN can simplify tasks like receiving your salary or setting up direct debits for utilities.

Financial Apps for Daily Management

In addition to bank accounts, there are apps that can further simplify the financial lives of new residents. One example is MoneyMize, a free application developed to support non-EU citizens with financial education. The app helps plan expenses, manage a personal or family budget, and understand how financial products work, starting from the user’s concrete needs. Another interesting initiative is the Extrabanca app, a bank specializing in serving foreign customers in Italy, which offers multilingual services and targeted advice.

Financial inclusion is a crucial issue. According to a 2024 survey, the financial literacy index of non-EU citizens in Italy is significantly lower than that of Italians. Tools like MoneyMize are created precisely to bridge this gap, promoting greater awareness in money management.

Security and Reliability: A Decisive Factor

When choosing an online bank, security is a top priority. It is essential to verify that the institution is regulated by a reliable financial authority, such as the European Central Bank (BCE) or the national central bank of the country where it is based. Banks with a banking license, like N26 and Revolut Bank UAB, adhere to deposit protection schemes, which guarantee depositors’ funds up to €100,000 per depositor in the event of the bank’s failure. Fintechs like Wise, although not banks, are also subject to strict regulations and adopt measures to safeguard customer funds. Always check that the app or website uses advanced security systems, such as two-factor authentication and data encryption. If you are concerned about the security of your account, learn how to recognize and defend yourself against bank account scams.

In Brief (TL;DR)

This complete 2025 guide compares the best online banks and financial apps for new residents in Italy, ideal for opening an account remotely in a simple, secure, and fast way.

We will evaluate key aspects such as the ease of opening an account remotely, security, and webcam identification procedures.

We will evaluate the safest and simplest options, with a focus on remote identification procedures via webcam or SPID.

Conclusions

For a new resident in Italy, the world of online banks and financial apps offers unprecedented opportunities for simple, affordable, and secure money management. The choice between an international operator like N26, Revolut, or Wise and a solid Italian digital bank like Illimity or Widiba depends on individual needs: from the necessity of operating in multiple currencies to the preference for an Italian IBAN and local customer service. The important thing is to get informed about the costs, required documents, and security guarantees offered. Digital innovation has made the banking system more accessible, breaking down many traditional barriers and allowing anyone to integrate financially into their new country with just a few simple clicks.

Frequently Asked Questions

No, it’s not difficult today. Thanks to online banks and financial apps, a new resident can open a bank account in minutes, often using just their smartphone. The identification process is done via webcam or by uploading a video, making the process much simpler than with traditional banks, which may require a visit to a branch. Digital options are designed to be fast and accessible.

Generally, to open an online account as a new resident in Italy, only a few documents are needed. The main ones are a valid ID, such as a passport or an EU country’s identity card, and the Italian tax code (codice fiscale). Some institutions may also require proof of address, such as a rental contract or a utility bill. Digital banks have greatly simplified the collection of these documents, allowing you to upload them directly through the app.

Having an Italian IBAN (which starts with ‘IT’) is essential for daily life in Italy. It simplifies crucial tasks like receiving your salary, setting up direct debits for utilities (electricity, gas, internet), and paying taxes or subscriptions. Although IBAN discrimination is illegal in Europe, in practice, a foreign IBAN can still face resistance from employers or companies, causing delays and complications.

The main difference lies in the license and the services offered. N26 is a full-fledged bank with a German banking license, offering a bank account with an Italian IBAN and deposit protection up to €100,000. Revolut and Wise started as electronic money institutions (although Revolut has obtained a banking license in Lithuania), specializing in low-cost international transfers and multi-currency management. Revolut is great for managing multiple currencies and travel, while Wise is unbeatable for its transparency and low fees on foreign transfers.

Yes, the funds are protected, but through different mechanisms. Digital banks with a European banking license, like N26, adhere to a national deposit guarantee scheme (German in its case) that protects accounts up to €100,000. Electronic money institutions like Wise and Revolut, on the other hand, do not offer this guarantee but are required by law to keep customer funds separate from their own, in safeguarding accounts at partner banks. This ensures that customer money is protected even if the institution faces financial difficulties.

Still have doubts about Online Banks for New Residents: A Complete 2025 Guide?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.