Every time you use your credit card at a restaurant, in a store, or for an online purchase, you are making an act of trust. You entrust your data to a system that, in most cases, works invisibly and flawlessly. But what ensures that 16-digit number, expiration date, and security code remain protected? The answer lies in a fundamental acronym for the digital economy: PCI DSS. This standard is the shield that protects card transactions, a pillar of cybersecurity that affects everyone, from small merchants to large multinational corporations.

In a context like Italy and Europe, where the culture of digital payments intertwines with established habits, understanding the role of PCI DSS is essential. It’s not just a technical issue for insiders, but a mechanism that builds and maintains consumer trust. This standard represents the meeting point between the tradition of commerce and the innovation of electronic payments, ensuring that every transaction, from a coffee at the bar to the purchase of a car, is handled in a secure environment.

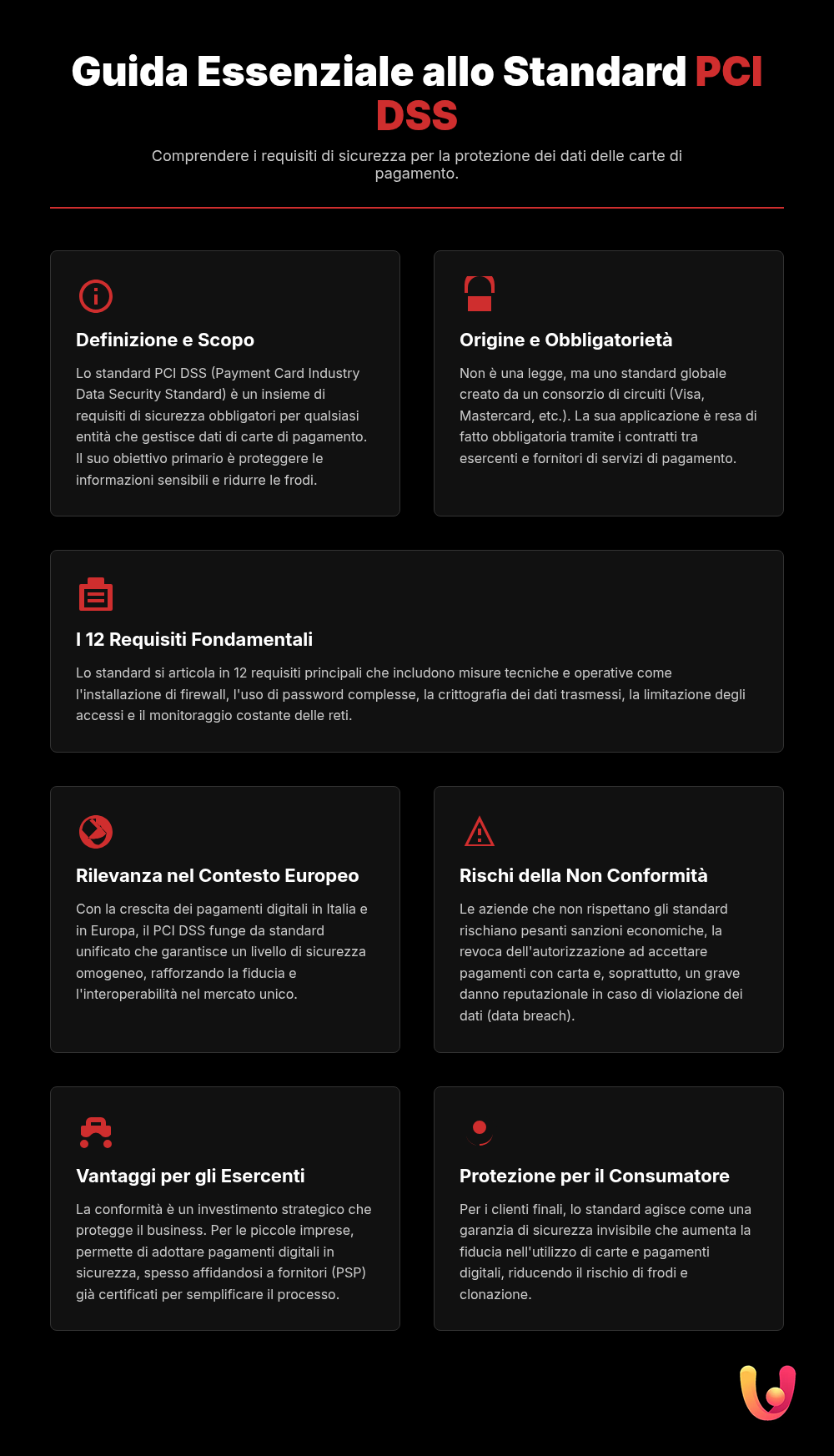

What is the PCI DSS Standard

The acronym PCI DSS stands for Payment Card Industry Data Security Standard. It is a set of security requirements created in 2004 by a consortium that includes major payment card brands like Visa, Mastercard, American Express, Discover, and JCB. The primary goal is simple but crucial: to protect cardholder data and reduce fraud. This standard is not a law, but it is effectively mandatory for any organization that accepts, processes, stores, or transmits credit or debit card information.

In practice, PCI DSS establishes the rules of the game for maintaining a secure payment environment. It applies to everyone, regardless of size or number of transactions: from the small craft shop using a POS (Point-of-Sale) terminal to the large e-commerce platform processing millions of payments. Compliance with these standards is a fundamental requirement to continue accepting card payments, and its violation can lead to severe penalties.

Why It’s Crucial for Italy and Europe

Italy, like the rest of Europe, is undergoing a rapid transition to digital payments. Although cash retains an important cultural role, the use of cards, smartphones, and digital wallets is constantly growing. In 2024, digital payments in Italy surpassed cash in value for the first time. This shift makes data security a top priority. The PCI DSS standard acts as a common language for security, ensuring that a merchant in Rome and one in Berlin follow the same rigorous procedures to protect customer information.

In a single market like Europe’s, interoperability and trust are essential. PCI DSS ensures that, regardless of where a card is issued or used, the data is protected according to a single global standard. This not only protects consumers but also strengthens the entire payment ecosystem, allowing businesses to operate more securely and expand their business across national borders, while reducing the risk of costly data breaches.

The 12 Requirements: The Data Fortress

The PCI DSS standard is based on 12 fundamental requirements, grouped into six core objectives, which together create a veritable fortress to defend data. These requirements are not mere suggestions but precise technical and operational controls. The goal is to build a secure network, protect cardholder data, manage vulnerabilities, implement strong access control measures, regularly monitor and test networks, and maintain an information security policy.

Among the most important measures are installing and maintaining a firewall to protect data, using complex and unique passwords, and encrypting data transmitted over public networks. Another key point is the protection of stored data. Technologies like tokenization, which replaces sensitive card data with a unique code, are a practical example of how this requirement is implemented to minimize risks. Additionally, it is mandatory to restrict access to data to authorized personnel only and to track and monitor all access to network resources.

Tradition and Innovation: A Mediterranean Challenge

Mediterranean culture, and Italian culture in particular, is rich with small businesses, family-run restaurants, and artisan shops that represent the beating heart of the economy. For a long time, these businesses were tied to cash, but today innovation is knocking at their doors. The adoption of POS terminals, including mobile versions via smartphones (SoftPOS), and contactless payments has become a necessity to meet customer demands.

In this scenario, PCI DSS acts as a bridge between tradition and innovation. It allows the small restaurant owner, who has always managed accounts in a notebook, to accept card payments with the same peace of mind as a large retail chain. The standard provides a clear framework, simplifying the transition to digital and ensuring that security is not a luxury for the few. Adopting these standards means embracing innovation without sacrificing trust and security, fundamental values in the customer relationship.

The Risks of Non-Compliance

Ignoring PCI DSS standards is not an option. The consequences of non-compliance can be devastating for any business. First, there are the financial penalties, which can be imposed by the payment card brands and reach very high figures, from tens to hundreds of thousands of euros. In addition to fines, the company could lose the right to accept card payments, a severe blow in an increasingly cashless economy.

The most serious damage, however, is often reputational. A data breach erodes customer trust in an almost irreparable way. News of data theft spreads quickly and can lead to direct financial losses, legal action, and long-term damage to the brand’s image. In Italy, in 2024, fraud related to electronic cards caused damages of over 880 million euros, a figure that highlights the real threat posed by fraud. PCI DSS compliance is therefore not just an obligation, but an investment to protect one’s business.

The Consumer’s Role: How You Are Protected

From the consumer’s perspective, the PCI DSS standard is a silent but powerful guarantee. When you pay with your card, you trust that the merchant is handling your data responsibly. This trust is possible precisely because standards like PCI DSS exist, obliging companies to implement rigorous security measures. The protection offered is not abstract but translates into concrete actions that drastically reduce the risk of fraud and card cloning.

Knowing that a global framework for payment security exists increases the peace of mind with which digital tools are used. This encourages the adoption of new technologies and supports the growth of the digital economy. A company’s compliance with PCI DSS is a sign of professionalism and customer care. It is a commitment to protect not just a transaction, but the relationship of trust that binds consumer and seller, ensuring a secure shopping experience from start to finish.

In Brief (TL;DR)

The PCI-DSS security standards are a set of fundamental requirements for all companies that handle payment card data, essential for protecting sensitive information and maintaining consumer trust.

These standards are crucial for every merchant who handles card data, aiming to create a secure payment ecosystem and protect consumers from fraud.

These standards provide a robust framework for protecting sensitive data, ensuring secure transactions and maintaining consumer trust.

Conclusions

The PCI DSS standard is much more than just a set of technical rules; it is the foundation upon which trust in the entire digital payment ecosystem is built. In a context like Italy and Europe, balanced between deep-rooted traditions and a constant push for innovation, this standard plays a crucial role. It ensures that the neighborhood trattoria and the large international chain speak the same language when it comes to security, protecting consumer data and preserving the integrity of the system.

For merchants, compliance should not be seen as a cost or a bureaucratic burden, but as a strategic investment to protect their business and reputation. For consumers, it is an invisible guarantee that allows them to use payment cards with peace of mind. In a world where cyber threats are constantly evolving, PCI DSS represents a dynamic shield, continuously updated to face new challenges and to ensure that the future of payments is not only simpler and faster, but above all, more secure for everyone.

Frequently Asked Questions

The PCI-DSS (Payment Card Industry Data Security Standard) are a set of security rules created for anyone who handles credit card data. Even if you don’t own a business, they affect you directly: when you shop online or in a store, these standards ensure that your payment data is handled in a protected environment, reducing the risk of fraud. In practice, they are a guarantee for the security of your daily transactions.

Yes, any business that accepts, processes, or transmits payment card data is required to comply with PCI-DSS standards, regardless of its size. However, the specific requirements vary based on the annual transaction volume. There are different levels of compliance that make the obligations scalable even for small businesses, like a neighborhood store or a small e-commerce site.

Non-compliance can have very serious consequences. Companies risk heavy financial penalties imposed by credit card companies, which can range from thousands to tens of thousands of euros per month. In addition to fines, they may have their ability to accept card payments suspended and suffer severe reputational damage, which can undermine customer trust.

For a small merchant, the easiest and most cost-effective way to be compliant is to rely on payment service providers (PSPs) that are already PCI-DSS certified. These providers handle most of the technical aspects of payment security. Furthermore, for smaller businesses, compliance can often be managed through a Self-Assessment Questionnaire (SAQ), a guided process that simplifies the verification of requirements.

The PCI-DSS standards are not a government law, but a global security standard. They were created and are managed by the PCI Security Standards Council, a consortium founded by the world’s major payment card brands, such as Visa, Mastercard, American Express, Discover, and JCB. Their application is made mandatory through the contracts that merchants sign with banks and payment service providers.

Still have doubts about PCI DSS: Protect Your Data with Security Standards?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.