Prepaid cards with an IBAN have become an increasingly popular financial tool in Italy and across Europe, valued for their flexibility and low management costs. Created as an innovative alternative to traditional checking accounts, these cards combine the convenience of a payment card with the functionality of an account, allowing users to receive wire transfers, direct deposit their salaries, and set up automatic bill payments. This evolution, however, has specific tax implications that every cardholder must be aware of. Their management, in fact, is not limited to simple use for purchases and withdrawals but requires attention to reporting obligations for ISEE purposes and tax monitoring, especially when holding cards issued by foreign institutions. Understanding these dynamics is crucial to avoid errors and penalties.

In a Mediterranean cultural context, where managing family savings is a cornerstone of daily life, tools like cards with an IBAN represent a bridge between tradition and innovation. They allow for direct and simplified expense tracking, meeting the need for practicality typical of our culture, while also projecting the user into a world of digital payments and paperless banking. This guide aims to clarify the tax aspects related to owning such cards, offering a clear and detailed path for citizens of all ages and professions, helping them navigate securely through calculating the average balance, filling out the DSU, and meeting monitoring obligations for capital held abroad.

Prepaid Cards with an IBAN: What They Are and How They Work

A prepaid card with an IBAN, also known as a carta conto (card account), is a reloadable payment instrument that, unlike a standard prepaid card, is associated with an IBAN (International Bank Account Number). This feature makes it similar to a checking account while retaining its nature as an “electronic wallet.” It works simply: you load a sum of money onto the card, which can then be used for purchases, withdrawals, and other transactions until the credit is depleted. The presence of the IBAN, however, unlocks advanced features, transforming it into a much more versatile tool.

Thanks to the IBAN, a prepaid card allows you to perform basic banking operations without needing to open a traditional checking account, combining expense control with operational flexibility.

The main operations allowed by a card with an IBAN include receiving wire transfers, such as salary or pension deposits, and sending payments to other accounts. It is also possible to set up automatic bill payments, pay bills, and, in some cases, manage direct debits. Although they offer many of the services of a checking account, cards with an IBAN have some limitations: they usually do not allow you to issue checks, access lines of credit, or make complex investments. Their popularity stems from the balance between low costs and a wide range of services, making them ideal for young people, students, and anyone who wants an agile tool for daily financial management.

Tax Differences Between a Card with an IBAN and a Checking Account

Although a card with an IBAN emulates many features of a checking account, from a tax perspective, there are substantial similarities, especially regarding ISEE declaration and monitoring. The Italian Revenue Agency (Agenzia delle Entrate) equates prepaid cards with an IBAN to checking accounts, making them traceable and subject to the same reporting obligations. Both financial instruments must be included in the Single Substitute Declaration (DSU) for the ISEE calculation, indicating the balance as of December 31 and the average annual balance. This assimilation is crucial to ensure a correct assessment of the household’s liquid assets.

A significant difference concerns the stamp duty (imposta di bollo). For checking accounts held by individuals, the tax is a fixed €34.20 per year if the average balance exceeds €5,000. For cards with an IBAN, however, the rules can vary, and issuers often cover this cost, making them cheaper to maintain. However, the funds deposited on these cards are also subject to scrutiny by the tax authorities. Any transaction, such as a cash deposit or a received wire transfer, can be subject to verification to prevent tax evasion. Therefore, the supposed “invisibility” of these instruments is a myth: all financial relationships are recorded in the Central Register of Financial Accounts (Anagrafe dei Conti Correnti).

The ISEE Declaration: A Requirement for All Cards

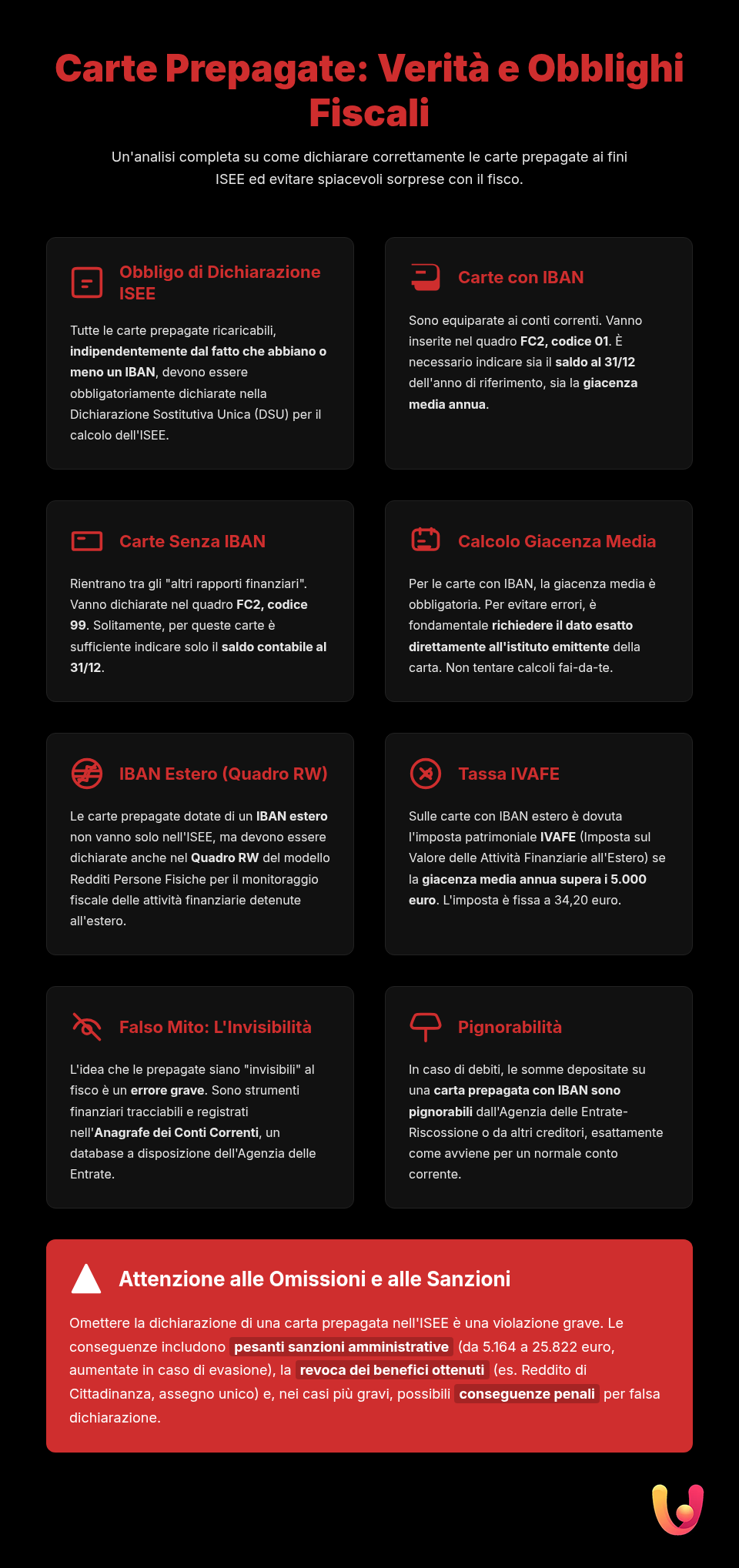

All prepaid cards, regardless of whether they have an IBAN, must be declared for ISEE (Equivalent Economic Situation Indicator) purposes. This indicator is essential for accessing subsidized social benefits, such as scholarships, discounts on university tuition, or social bonuses. Failing to declare a card, even one with a minimal balance, is a violation that can lead to penalties and the revocation of any benefits received. The INPS (Italian National Social Security Institute), through cross-checks with the Tax Registry, can detect any omissions or discrepancies in the declared data.

Filling out the Single Substitute Declaration (DSU) requires including all asset components of the household. For prepaid cards, the declaration procedure varies slightly:

- Prepaid cards with an IBAN are treated like checking accounts and must be entered in section FC2, part I, using code 01. For these, you must indicate both the balance as of December 31 of the reference year and the average annual balance.

- Prepaid cards without an IBAN must be declared in section FC2, part II, with code 99, which covers “other financial relationships.” For these cards, usually only the balance as of December 31 is required.

It is crucial to remember that the ISEE must include all cards held by each member of the household, as defined for registry purposes. The correct and complete declaration of these instruments is a crucial step to ensure the accuracy of one’s economic and financial situation.

How to Calculate the Average Balance

The average annual balance (giacenza media annua) is essential data for correctly filling out the DSU for ISEE purposes for prepaid cards with an IBAN. This value represents the average amount of funds credited to the cardholder during the reference calendar year. It is calculated by summing the daily balances for all 365 days of the year and dividing the result by 365. The daily balance is simply the available balance on the card at the end of each day.

The easiest and safest way to obtain the average balance is to request it directly from the institution that issued the card. This data is certified and prevents self-calculation errors that could invalidate the declaration.

Generally, the financial institution makes this data available in the annual statement or through a specific document downloadable from online banking or the mobile app. For example, Poste Italiane provides a certification for ISEE purposes that summarizes the balance and average balance for all financial products, including Postepay Evolution cards. If you have multiple cards or accounts, even joint ones, you must sum the average balances of each relationship. In the case of joint accounts, the value must be divided by the number of account holders (e.g., 50% for an account with two holders). Omitting this data or providing an incorrect one can lead to significant penalties.

Tax Monitoring and Form RW for Foreign Cards

Owning a prepaid card with a foreign IBAN entails specific tax obligations related to tax monitoring. Taxpayers residing in Italy who hold financial assets abroad, including card accounts, must declare them in Form RW of the “Redditi Persone Fisiche” tax return model. This requirement serves two main purposes: to monitor capital held across the border and to calculate any wealth taxes due, such as IVAFE (Tax on the Value of Financial Assets Held Abroad).

The obligation to fill out Form RW is triggered when the maximum amount of the deposit during the year exceeds €15,000, even for a single day. However, IVAFE is due if the average annual balance exceeds €5,000. It is important to note that even those who only have the authority to operate on a foreign account are required to fill out the form. A card with a foreign IBAN, like those offered by many European fintech companies, is considered a foreign financial asset in every respect and is subject to these rules. Ignoring these obligations can lead to heavy penalties, ranging from a percentage of the undeclared value to criminal consequences in the most serious cases of evasion.

Anti-Money Laundering and Usage Limits

European regulations, particularly through anti-money laundering directives, have imposed increasingly stringent rules on the use of prepaid cards to prevent money laundering and the financing of terrorism. The 5th Anti-Money Laundering Directive (EU 2018/843) significantly reduced the thresholds for using anonymous prepaid cards without customer identification. The limit for monthly transactions with anonymous reloadable cards was lowered to €150, down from the previous €250.

Furthermore, EU Regulation 2018/1672 expanded the definition of “cash” for cross-border controls to include non-personalized prepaid cards. This means that anyone traveling with such cards must include their value when calculating the maximum threshold of cash that can be carried without declaration. The legislation aims to ensure maximum traceability of financial flows, effectively equating cards with an IBAN to checking accounts in terms of controls. These measures, while introducing more checks for users, strengthen the security of the European financial system, combating illegality and protecting consumers from fraudulent use of these instruments.

Seizability of Cards with an IBAN

A crucial aspect to consider is that prepaid cards, especially those with an IBAN, are seizable. Contrary to a common belief, these cards do not offer a shield against creditors’ enforcement actions. The seizure does not concern the physical object (the card) but the funds deposited on it. The legal equivalence between a card with an IBAN and a checking account makes the available balance subject to seizure through a third-party garnishment order served on the issuing institution.

The procedure is the same as that applied to checking accounts: the creditor, once an enforceable title is obtained, can request the seizure of the funds held by the debtor at the financial institution. Some limitations exist, for example, if a salary or pension is deposited onto the card, but the general rule is that the funds are exposed. The only cards that could escape this rule in the past were the so-called “disposable” cards, which are now obsolete. Even cards with a foreign IBAN can be subject to seizure, although the procedure may be more complex. Therefore, it is important to be aware that using a seizable card with an IBAN does not protect you from potential debts.

In Brief (TL;DR)

Learn about the tax management of prepaid cards with an IBAN, from correctly filling out the DSU for ISEE purposes to tax monitoring.

We will delve into the correct methods for calculating the average balance for the ISEE and the requirements for tax monitoring.

Finally, it explores the obligations related to tax monitoring and filling out Form RW for cards held abroad.

Conclusions

The tax management of prepaid cards with an IBAN is a topic that intertwines financial innovation and regulatory obligations. These instruments, rooted in a Mediterranean culture that values control and simplicity, offer undeniable flexibility but require precise awareness of their tax implications. Their equivalence to checking accounts for ISEE and tax monitoring purposes underscores the need for accurate and complete declaration. Correctly calculating the average balance, distinguishing between cards with and without an IBAN in the DSU, and filling out Form RW for foreign cards are not mere formalities but acts of fiscal responsibility that prevent penalties and ensure access to rights and benefits.

Understanding that no card is “invisible” to the tax authorities and that even deposited funds are seizable is fundamental for mature and informed use. In an increasingly integrated European market, transparency is a non-negotiable value. Approaching the management of these tools with due diligence allows one to fully exploit their advantages, reconciling the tradition of family savings with the opportunities offered by digital finance. For parents exploring options for their children, consulting a guide on cards with an IBAN for minors is useful, while for those concerned about security, learning about credit card cloning is a prudent step.

Frequently Asked Questions

Do all prepaid cards need to be declared in the ISEE?

Yes, all prepaid cards, both those with and without an IBAN, must be included in the Single Substitute Declaration (DSU) for the ISEE calculation. Cards with an IBAN are treated like checking accounts (code 01) and require indicating the balance and average balance. Those without an IBAN fall under “other financial relationships” (code 99) and generally only require the balance as of December 31.

What are the risks if I don’t declare a prepaid card in my ISEE?

Failing to declare a prepaid card in the ISEE is considered a false declaration and can result in administrative fines ranging from €5,164 to €25,822. Additionally, you risk the revocation of social benefits unduly received and, in more serious cases, criminal charges. The INPS and the Italian Revenue Agency conduct cross-checks to detect such omissions.

Do I have to declare a prepaid card with a foreign IBAN?

Yes, if you are a taxpayer residing in Italy, you are required to declare prepaid cards with a foreign IBAN in Form RW of your tax return. This fulfillment is necessary for tax monitoring. If the average annual balance exceeds €5,000, IVAFE (Tax on the Value of Financial Assets Held Abroad) is also due.

Is the average balance mandatory for all prepaid cards?

No, the average annual balance is data required specifically for prepaid cards with an IBAN, as they are treated like checking accounts for ISEE purposes. For prepaid cards that do not have an IBAN, it is generally sufficient to declare the balance as of December 31 of the reference year.

Can a prepaid card with an IBAN be seized?

Yes, prepaid cards with an IBAN are seizable, just like checking accounts. The funds deposited on the card can be targeted by creditors through a third-party garnishment procedure served on the financial institution that issued the card. Therefore, they do not serve as a tool to protect your funds from enforcement actions.

Frequently Asked Questions

Yes, it is mandatory. Prepaid cards with an IBAN are, for all intents and purposes, equivalent to a checking account and, as such, must be included in the Single Substitute Declaration (DSU) for ISEE purposes. You must indicate both the balance as of December 31 of the reference year and the average annual balance. Omitting this data can lead to penalties and the loss of any benefits.

The average balance is the average of the amounts credited to the card throughout the year. It is calculated by summing the daily balances and dividing the total by 365 days. You don’t need to do the calculation manually: the institution that issued the card provides an official document, usually in the year-end statement, with the exact average balance value to be used for the ISEE.

Yes, prepaid cards without an IBAN must also be declared as part of your liquid assets for ISEE purposes. Unlike those with an IBAN, which are treated as checking accounts (code 01), these fall into the ‘Other financial relationships’ category (code 99). For these cards, you generally only need to report the balance as of December 31 of the reference year.

A card with a foreign IBAN must always be declared, both in the ISEE and in your tax return. For the ISEE, you include the balance and average balance just as you would for an Italian card. Additionally, you are required to fill out Form RW of your tax return for tax monitoring purposes. If the average balance exceeds €5,000, you also have to pay a tax called IVAFE.

Forgetting to declare a prepaid card, even one with a zero balance, is equivalent to a false declaration. The INPS and the Italian Revenue Agency conduct cross-checks and can detect the omission. The risks include being required to return any benefits received improperly and administrative penalties ranging from approximately €5,000 to over €25,000.

Still have doubts about Prepaid Cards: A Guide to ISEE and Tax Monitoring?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.