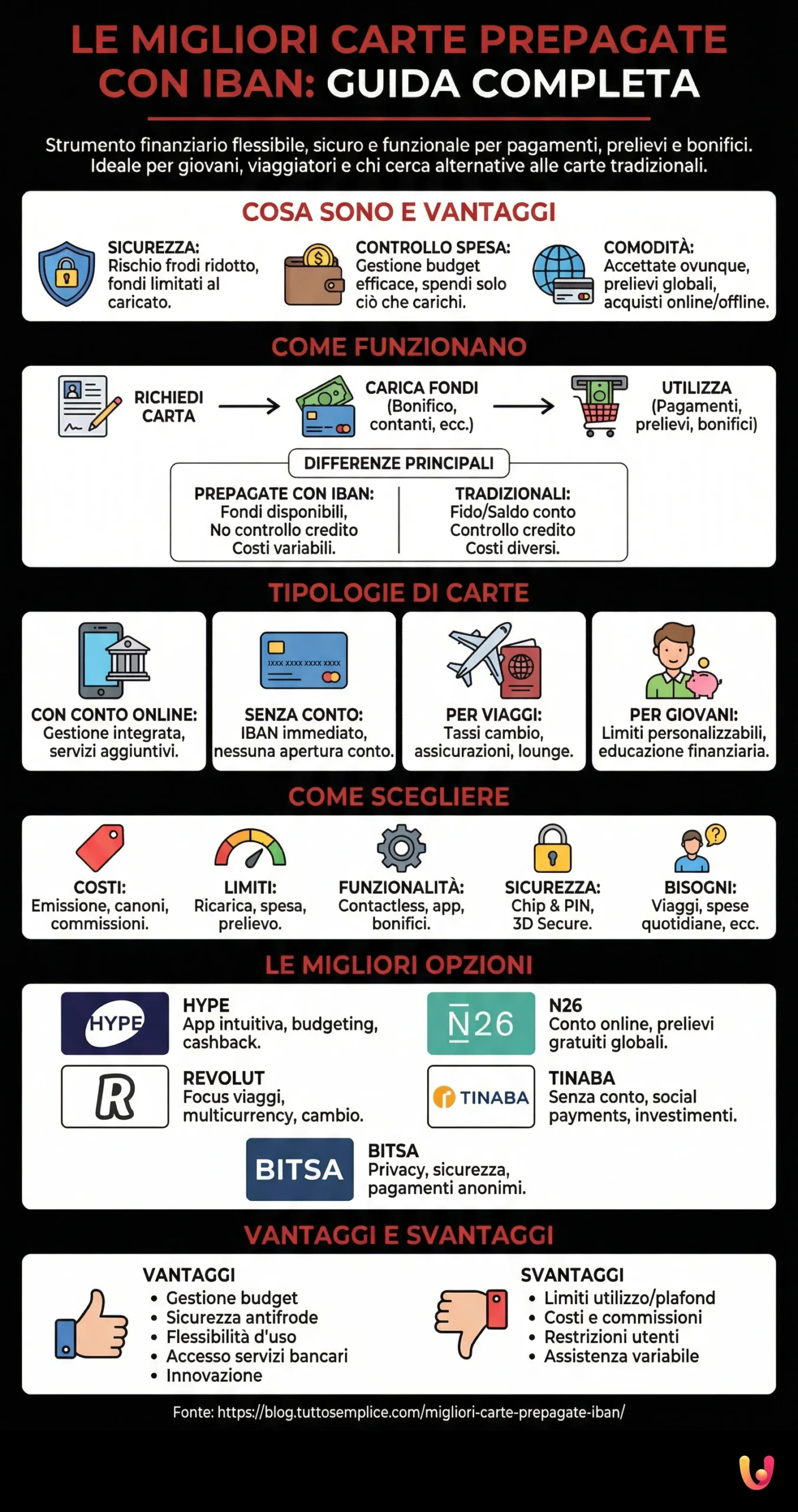

Prepaid cards with IBAN have become an increasingly popular financial tool, offering a combination of flexibility, security, and functionality. Whether you are a young person looking for a simple way to manage your finances, a frequent traveler wanting a practical solution for payments abroad, or simply someone seeking an alternative to traditional credit and debit cards, a prepaid card with IBAN could be the ideal choice. In this complete guide, we will take you on a journey to discover the world of prepaid cards with IBAN, exploring their features, benefits, and the best options available on the market. We will provide you with all the information necessary to make an informed decision and choose the card best suited to your needs.

What Are Prepaid Cards with IBAN

A prepaid card with IBAN is essentially a payment card that can be used to make purchases, withdrawals, and money transfers, just like a traditional debit card. The main difference lies in the fact that a prepaid card must be loaded with funds before it can be used, whereas a debit card is linked to a bank checking account. The IBAN (International Bank Account Number) is an international identification code that allows for sending and receiving bank transfers, making the prepaid card even more versatile and functional.

Prepaid cards with IBAN offer numerous advantages, including:

- Security: Since the card is not directly linked to your main bank account, the risk of fraud and identity theft is reduced. In the event of loss or theft of the card, the available funds are limited to the amount loaded onto the card.

- Spending Control: Prepaid cards help you manage your budget effectively, as you can only spend the amount you have previously loaded. This can be particularly useful for young people or for those who tend to overspend.

- Convenience: Prepaid cards with IBAN are accepted in a wide range of shops, online and offline, and can be used to withdraw cash at ATMs worldwide.

Examples of using prepaid cards with IBAN include:

- Online Shopping: Make secure and fast payments on websites and apps.

- In-Store Payments: Use the card to pay for goods and services in physical stores.

- Money Transfers: Send and receive money from friends and family simply and quickly.

- Travel Expense Management: Use the card to withdraw cash, pay for hotels, and restaurants abroad.

- Controlling Children’s Spending: Provide your children with a prepaid card with a predefined spending limit.

How Prepaid Cards with IBAN Work

The operation of a prepaid card with IBAN is relatively simple. First, you need to request the card from a financial institution or payment service provider. Once the card is received, it must be loaded with funds via bank transfer, cash deposit, or other available top-up methods.

Once the card has been loaded, you can use it to make payments, withdrawals, and money transfers, just like a regular debit card. It is important to keep track of the available balance on the card to avoid exceeding the spending limit.

The main differences between prepaid cards with IBAN and traditional credit/debit cards are:

- Available Funds: Prepaid cards can only be used up to the amount loaded onto the card, while credit/debit cards allow spending based on the granted credit line or the balance available in the checking account.

- Credit Check: Prepaid cards do not require a credit check, unlike credit/debit cards.

- Costs: Prepaid cards may have issuance fees, monthly or annual fees, and commissions for withdrawals and payments. It is important to compare different options to find the most cost-effective card.

Regarding security, prepaid cards with IBAN are equipped with several protection measures, including:

- Chip and PIN Technology: The card is equipped with a microchip that makes it difficult to clone and a PIN code that must be entered to authorize transactions.

- 3D Secure: This security protocol adds an extra layer of protection for online purchases, requiring the entry of a security code or authentication via a mobile app.

- Spending Limits: You can set daily or monthly spending limits to reduce the risk of fraud.

Types of Prepaid Cards with IBAN

There are different types of prepaid cards with IBAN, each with specific features and functionalities:

- Prepaid cards with IBAN linked to an online account: These cards are connected to an online bank account, offering integrated finance management and access to additional banking services, such as wire transfers, direct debits, and investments.

- Prepaid cards with IBAN without a bank account: These cards offer the convenience of an IBAN without the need to open a bank account. They are ideal for those looking for a simple and immediate solution to manage their finances.

- Prepaid cards with IBAN for travel: These cards are designed for frequent travelers, offering benefits such as favorable exchange rates, travel insurance, and access to airport lounges.

- Prepaid cards with IBAN for young people: These cards are designed for young people who wish to learn how to manage their money responsibly, offering features such as customizable spending limits and budget control tools.

How to Choose the Right Prepaid Card with IBAN

Choosing the prepaid card with IBAN best suited to your needs depends on several factors:

- Costs: Evaluate issuance fees, monthly or annual fees, and commissions for withdrawals, payments, and transfers.

- Usage Limits: Check the limits for topping up, spending, and withdrawing.

- Features: Consider the features offered by the card, such as contactless payments, online purchases, money transfers, and access to additional banking services.

- Security: Ensure the card offers adequate security measures, such as chip and PIN, 3D Secure, and customizable spending limits.

- Individual Needs: Assess your specific needs, such as travel, online shopping, or personal/family finance management.

It is important to compare the different options available on the market to find the prepaid card with IBAN that best fits your profile and needs. A comparison table can be useful for evaluating the different features and costs of the cards.

The Best Prepaid Cards with IBAN

The market offers a wide range of prepaid cards with IBAN. Here are some of the best options available:

- Hype: A prepaid card with IBAN offered by Banca Sella, featuring an intuitive mobile app, budgeting features, and the ability to make contactless payments, online purchases, and money transfers.

- N26: A prepaid card with IBAN associated with an online bank account, featuring a comprehensive mobile app, advanced budgeting features, and the ability to withdraw cash for free at ATMs worldwide.

- Revolut: A prepaid card with IBAN with a focus on travel, offering favorable exchange rates, travel insurance, and the ability to manage multiple currencies.

- Tinaba: A prepaid card with IBAN without a bank account, featuring a simple and intuitive mobile app, the ability to make contactless payments, online purchases, and money transfers.

- Bitsa: A prepaid card with IBAN with a focus on privacy and security, offering the possibility to make anonymous payments and manage finances discreetly.

Each of these cards has its strengths and weaknesses. It is important to carefully evaluate your needs and compare the different options to find the most suitable card.

Comparative Table of the Best Prepaid Cards with IBAN

| Card | Issuance Cost | Monthly Fee | ATM Withdrawal Fees | Transfer Fees |

|---|---|---|---|---|

| Hype | € 9.90 | Free | € 2.50 in Italy and EU | Free |

| N26 | Free | Free | Free in Italy and EU (first 3 withdrawals) | Free |

| Revolut | Free | Free | 2% for withdrawals over € 200 monthly | Free (1 international transfer per month) |

| Tinaba | Free | Free | € 2 in Italy and EU (after the first 12 withdrawals) | € 0.49 (after the first 4 transfers) |

| Bitsa | Free | Free | Variable based on ATM | 1% (minimum € 0.50) |

Advantages of Prepaid Cards with IBAN

Prepaid cards with IBAN offer numerous advantages that make them an attractive solution for a wide range of users:

- Budget Management and Expense Control: Prepaid cards allow you to set spending limits and monitor your transactions simply and intuitively, helping you manage your budget effectively and avoid excessive spending.

- Security and Fraud Protection: Prepaid cards offer a high level of security thanks to technologies like chip and PIN, 3D Secure, and customizable spending limits. In case of loss or theft of the card, available funds are limited to the amount loaded onto the card, reducing the risk of fraud.

- Flexibility and Ease of Use: Prepaid cards with IBAN are accepted in a wide range of shops, online and offline, and can be used to withdraw cash at ATMs worldwide. They offer a practical and versatile solution for managing daily finances.

- Access to Essential Banking Services: Many prepaid cards with IBAN offer access to essential banking services, such as transfers, direct debits, and bill payments, making them a valid alternative to traditional checking accounts.

- Innovation and New Features: Prepaid cards with IBAN are often at the forefront of innovation, offering features such as contactless payments, mobile apps with advanced budgeting functionalities, and integration with online payment platforms.

Disadvantages of Prepaid Cards with IBAN

Despite the numerous advantages, prepaid cards with IBAN also present some disadvantages that are important to consider:

- Usage Limits and Ceilings: Prepaid cards have top-up, spending, and withdrawal limits that may vary depending on the card and the provider. These limits can be restrictive for some users.

- Costs and Commissions: Prepaid cards may have issuance fees, monthly or annual fees, and commissions for withdrawals, payments, and transfers. It is important to compare different options to find the most cost-effective card.

- Restrictions for Certain User Categories: Some prepaid cards with IBAN may have restrictions for certain categories of users, such as minors or people with a low credit score.

- Customer Service and Technical Support: Customer service and technical support offered by prepaid card providers may vary in terms of quality and availability. It is important to choose a reliable provider with good customer service.

In Brief (TL;DR)

Prepaid cards with IBAN offer a flexible and secure solution for managing finances, making payments, and transferring money.

Choosing the most suitable card depends on your needs and your spending profile.

It is important to compare the different options available on the market, evaluating the costs, usage limits, features, and security offered by each card.

Conclusions

Ultimately, prepaid cards with IBAN represent a versatile and constantly evolving financial tool that adapts to the needs of an increasingly broad audience. Their spread is a clear signal of how the world of money is changing, becoming increasingly digital, accessible, and personalized.

If you are looking for a solution to manage your finances simply, securely, and flexibly, a prepaid card with IBAN could be the right choice for you. Compare the different offers available on TuttoSemplice.com and find the card that best fits your needs.

Frequently Asked Questions

In case of loss or theft of the card, it is fundamental to block the card immediately by contacting the provider’s customer service. In this way, you will prevent third parties from using your card and the funds available on it.

Yes, most prepaid cards with IBAN can be used abroad to make payments and withdrawals. However, it is important to check for any commissions applied to international transactions.

The spending limit varies depending on the card and the provider. In general, prepaid cards have a daily or monthly spending limit that can be customized according to your needs.

Yes, many prepaid cards with IBAN allow you to credit your salary or other types of income. This feature can be useful for those who do not have a bank checking account or for those who wish to manage their finances separately.

Top-up methods vary depending on the card and the provider. Generally, it is possible to top up the card via bank transfer, cash deposit at affiliated points of sale, or other online top-up methods.

Some prepaid cards with IBAN are also available for minors, but restrictions may apply or parental consent may be required.

Yes, prepaid cards with IBAN are equipped with various security measures, such as chip and PIN, 3D Secure, and customizable spending limits, making them as safe as traditional credit/debit cards.

Prepaid cards with IBAN for travel offer benefits such as favorable exchange rates, travel insurance, and access to airport lounges, making them an ideal solution for frequent travelers.

Choosing the most suitable prepaid card with IBAN depends on your needs and spending profile. It is important to compare the different options available on the market, evaluating the costs, usage limits, features, and security offered by each card.

You can find more information on prepaid cards with IBAN on the TuttoSemplice.com website, where you can compare different offers and choose the card best suited to your needs.

Still have doubts about The Best Prepaid Cards with IBAN: Complete Guide?

Type your specific question here to instantly find the official reply from Google.

Sources and Further Reading

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.