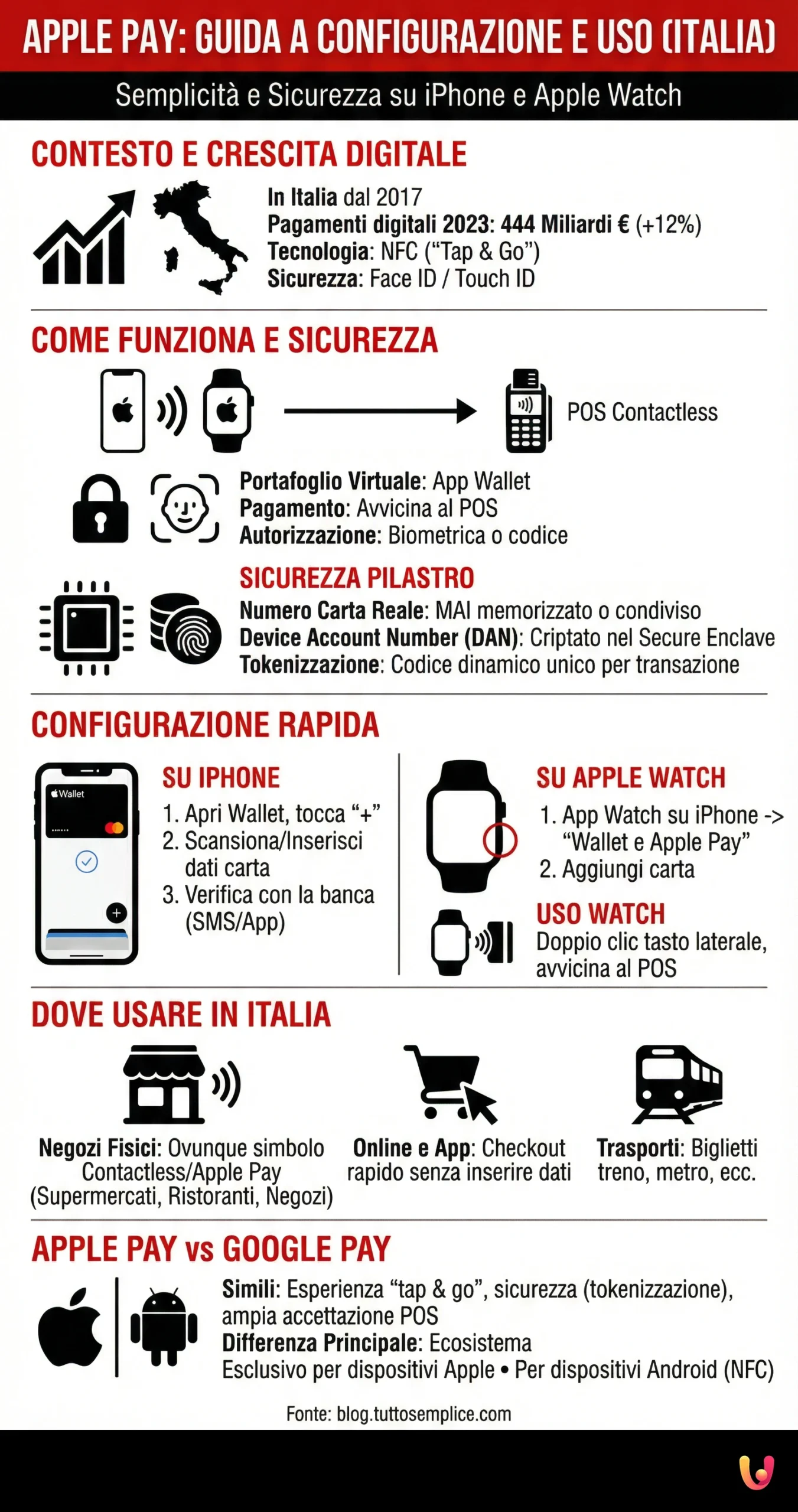

In Italy, where culinary and cultural tradition meets a growing drive towards innovation, payment methods are evolving to offer simplicity and security. Apple Pay, introduced in Italy in 2017, represents one of the most significant innovations in the field of digital payments, transforming iPhone and Apple Watch into true virtual wallets. This system allows for rapid and protected purchases, combining technology with the daily need for fast transactions. The adoption of digital payments in our country is constantly increasing, with a value reaching 444 billion euros in 2023, marking a +12% increase compared to the previous year. This trend highlights how Italians are increasingly open to solutions that simplify life without sacrificing security.

The beauty of Apple Pay lies in its ability to integrate perfectly into the Apple ecosystem, offering a fluid and intuitive user experience. Whether paying for a coffee at the local café or shopping online, the convenience of not having to search for a physical card in your wallet is undeniable. The system leverages Near Field Communication (NFC) technology for contactless payments, while ensuring data protection thanks to biometric authentication systems like Face ID and Touch ID. This combination of innovation and security perfectly meets the needs of the modern consumer, who seeks practical yet reliable solutions in a market where almost eight out of ten digital in-store transactions now take place in “tap & go” mode.

What is Apple Pay and How It Works

Apple Pay is a mobile payment service and digital wallet developed by Apple, first launched in 2014 and available in Italy since 2017. It allows users to make payments using compatible Apple devices, such as iPhone, Apple Watch, iPad, and Mac, both in physical stores and online or within apps. The heart of the system is the Wallet app, pre-installed on iOS devices, where users can securely store their credit, debit, and prepaid cards. The operation is simple: in stores, just hold the device near a payment terminal (POS) that supports contactless technology. The transaction is authorized via biometric recognition, Face ID or Touch ID, or via the device passcode, ensuring a high level of security.

Security is one of the pillars of Apple Pay. During a transaction, the physical card number is never stored on the device nor shared with the merchant. Instead, a unique number specific to the device (called Device Account Number) is used, which is encrypted and securely stored in the Secure Enclave, a dedicated chip inside the device. Each payment generates a dynamic and unique transaction code. This process, known as tokenization, makes card data unusable by third parties in case of interception, offering significantly greater protection compared to using a physical card. Furthermore, there are no specific amount limits for transactions with Apple Pay, other than those provided by your card.

How to Set Up Apple Pay on iPhone

Configuring Apple Pay on your iPhone is a quick and intuitive process that takes just a few minutes. To start, you need a compatible iPhone model (iPhone 6 or later) with the latest version of iOS and a debit, credit, or prepaid card issued by a bank or financial institution that supports the service. Most major Italian banks, such as Intesa Sanpaolo, UniCredit, Fineco, and many others, as well as circuits like PagoBANCOMAT, Visa, and Mastercard, are compatible. The first step is to open the Wallet app, already present on the device. Inside the app, tap the “+” symbol at the top right to start the procedure of adding a new card.

At this point, the iPhone offers the possibility to scan the card with the camera to automatically capture data, such as the number and expiration date. Alternatively, you can enter the information manually. After entering the security code (CVV) as well, the bank or card issuer will proceed with a verification to confirm the user’s identity, usually via a code sent by SMS, email, or through the bank’s own app. Once verification is complete, the card is added to the Wallet and becomes immediately available for making payments. You can add multiple cards and choose which one to use as the default for transactions. Card management is centralized and secure, allowing complete control directly from your smartphone.

How to Set Up and Use Apple Pay on Apple Watch

Using Apple Pay with the Apple Watch offers an even higher level of convenience, allowing you to pay without even having to take your iPhone out of your pocket or bag. Configuration is just as simple and is managed via the Watch app on the paired iPhone. To start, open the Watch app, scroll down, and select “Wallet & Apple Pay”. From here, you can add payment cards. If you already have cards configured on your iPhone, the app will suggest adding them to the watch as well. Alternatively, you can tap “Add Card” to register a new one, following a procedure similar to that for the iPhone, which includes data entry and verification by the bank.

Once configured, paying with the Apple Watch is an almost instant gesture. To make a purchase in a store, simply double-press the side button of the watch. The default card will appear on the display; if you have more than one, you can swipe to select the desired one. At this point, just hold the Apple Watch display near the contactless reader of the POS. A gentle tap and a beep will confirm that the payment was successful. This mode is particularly useful when your hands are full or you want to make a transaction in the quickest and most discreet way possible, maintaining the same high security standards guaranteed by the Apple ecosystem.

Where to Use Apple Pay in Italy

Acceptance of Apple Pay in Italy is extremely widespread, thanks to the extensive presence of contactless POS terminals. You can use this payment method practically anywhere you see the contactless payment symbol or the Apple Pay logo. This includes a wide range of commercial establishments, from large supermarkets like Esselunga and Carrefour to restaurant chains like McDonald’s, passing through clothing stores, pharmacies, and small neighborhood shops. The growing adoption of contactless payments, which in 2023 represented almost 80% of digital in-store transactions, has made Apple Pay a daily tool for millions of Italians.

In addition to physical stores, Apple Pay is a convenient and secure payment method for online purchases and within apps. Many e-commerce sites and applications offer Apple Pay as a checkout option. By selecting it, there is no need to manually enter card details and shipping address. The payment is confirmed with a simple touch or a glance, using Face ID or Touch ID on iPhone, iPad, or Mac. This not only simplifies and speeds up the purchasing process but also increases security, as card data is never shared with the seller’s site or app. Its versatility also extends to the transport sector, for paying for train and metro tickets, and other digital services.

Security and Privacy: The Heart of Apple Pay

Security and privacy are fundamental elements that distinguish Apple Pay from other payment methods. The platform is designed to protect users’ personal and financial information at every stage of the transaction. When adding a card to Wallet, its data is stored neither on the device nor on Apple servers. Instead, a unique and encrypted Device Account Number (DAN) is created, which is stored in the Secure Enclave, a specialized hardware chip isolated from the rest of the operating system. This architecture prevents any software or third parties from accessing sensitive card information.

Every transaction requires biometric authentication via Face ID or Touch ID, or the entry of the device passcode. This ensures that only the device owner can authorize a payment. During the purchase, neither Apple nor the merchant receives the actual credit or debit card number. Instead, the DAN is transmitted along with a dynamic security code, valid only for that specific transaction. Furthermore, Apple does not keep transaction history in a way that can be linked back to the user, ensuring an additional level of privacy. This combination of hardware and software security makes Apple Pay one of the safest methods to pay with your smartphone.

Apple Pay vs. Google Pay: A Comparison in the Italian Context

In the Italian mobile payment landscape, Apple Pay and Google Pay represent the two main solutions, each tied to its own ecosystem. The fundamental difference lies in device compatibility: Apple Pay is exclusive to iPhone, Apple Watch, iPad, and Mac, while Google Pay (integrated into Google Wallet) is available for all Android devices equipped with NFC technology. Both services offer a similar user experience, based on the simplicity and security of contactless payments. They use tokenization to protect card data and require authentication to authorize transactions, making them much safer alternatives compared to the traditional physical contactless card.

From the perspective of diffusion and acceptance, both services are widely usable in Italy, as they work on all POS terminals that support contactless payments. The choice between the two essentially depends on the operating system of your smartphone. Apple users benefit from deep integration of the service within the ecosystem, with fluid management across various devices. Google Pay, on the other hand, offers greater flexibility by being compatible with a wide range of smartphones from different manufacturers. Both systems have contributed significantly to the growth of digital payments in Italy, educating consumers on the benefits of “tap & go” technology and pushing the country towards a society increasingly less dependent on cash.

In Brief (TL;DR)

A complete guide to setting up and using Apple Pay on iPhone and Apple Watch, for simple, fast, and secure payments.

Discover the procedure to add your cards to Wallet and how to pay securely and quickly with your device, using Face ID or Touch ID.

Leverage the security of Face ID or Touch ID to authorize every payment simply and immediately.

Conclusions

Apple Pay has established itself in Italy as a payment tool that perfectly embodies the balance between tradition and innovation. It has successfully integrated into the daily habits of Italians, offering a solution that not only simplifies purchases but also elevates the level of security and privacy. The ease of configuration on iPhone and Apple Watch, combined with an intuitive interface and wide national acceptance, makes it a preferred choice for those who own an Apple device. The underlying technology, based on tokenization and biometric authentication, meets the growing need for data protection in an increasingly digitized world. The adoption of Apple Pay, along with other mobile wallet solutions, is accelerating Italy’s transition towards a modern and efficient payment culture, demonstrating how technology can concretely improve everyday life, from coffee at the bar to major purchases.

Frequently Asked Questions

Using Apple Pay is completely free. Apple does not charge any fees for payments made in stores, online, or in apps. Similarly, banks generally do not apply additional costs for using their cards with the service. However, it is always advisable to check the specific conditions of your financial institution.

Yes, Apple Pay is considered safer than using a physical card. During a purchase, your card number is never stored on the device or Apple servers, nor shared with the merchant. Instead, a unique code is used for the transaction. Furthermore, every payment must be authorized via Face ID, Touch ID, or your device passcode, adding a level of biometric security.

Apple Pay supports most credit, debit, and prepaid cards from major circuits like PagoBANCOMAT®, Mastercard, and Visa, issued by the most important Italian banks. To be certain that your bank is affiliated, you can consult the official and updated list available on the Apple website, which lists all partner institutions in Italy.

You can pay with Apple Pay in all stores, restaurants, supermarkets, and gas stations that display the contactless payment symbol or the Apple Pay logo. It is a widely accepted payment method not only in Italy but throughout Europe. Additionally, you can use it for fast and secure purchases within apps and on websites that support it as a checkout option.

In case of loss or theft of the device, security is guaranteed by the fact that every purchase requires your authentication (Face ID, Touch ID, or passcode). For greater peace of mind, you can use the «Find My» app to immediately suspend or remove cards from Apple Pay on that device, even if it is not connected to a network. Alternatively, you can contact your bank directly to block the cards associated with the service.

Still have doubts about Apple Pay: Guide to Setup and Use on iPhone and Apple Watch?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.