Withdrawing cash from an automated teller machine (ATM) is a daily task, almost second nature in our hectic lives. We insert our card, enter our PIN, and retrieve the cash. Yet, behind this simple routine lurks an increasingly sophisticated technological threat: skimming. This silent and nearly invisible fraud aims to clone our card and steal our secret code, turning a transaction that takes just a few seconds into a potential financial nightmare. In a world that balances the tradition of cash with the innovation of digital payments, awareness becomes the first line of defense.

Understanding how skimming works, learning to recognize the signs of a tampered ATM, and adopting a few, but crucial, security habits is essential to protect your savings. This article provides a comprehensive guide to navigating the world of ATM withdrawals safely, offering practical tools and clear advice to protect yourself from this invisible threat. The goal is to turn every citizen, regardless of age or profession, into an aware and prepared user.

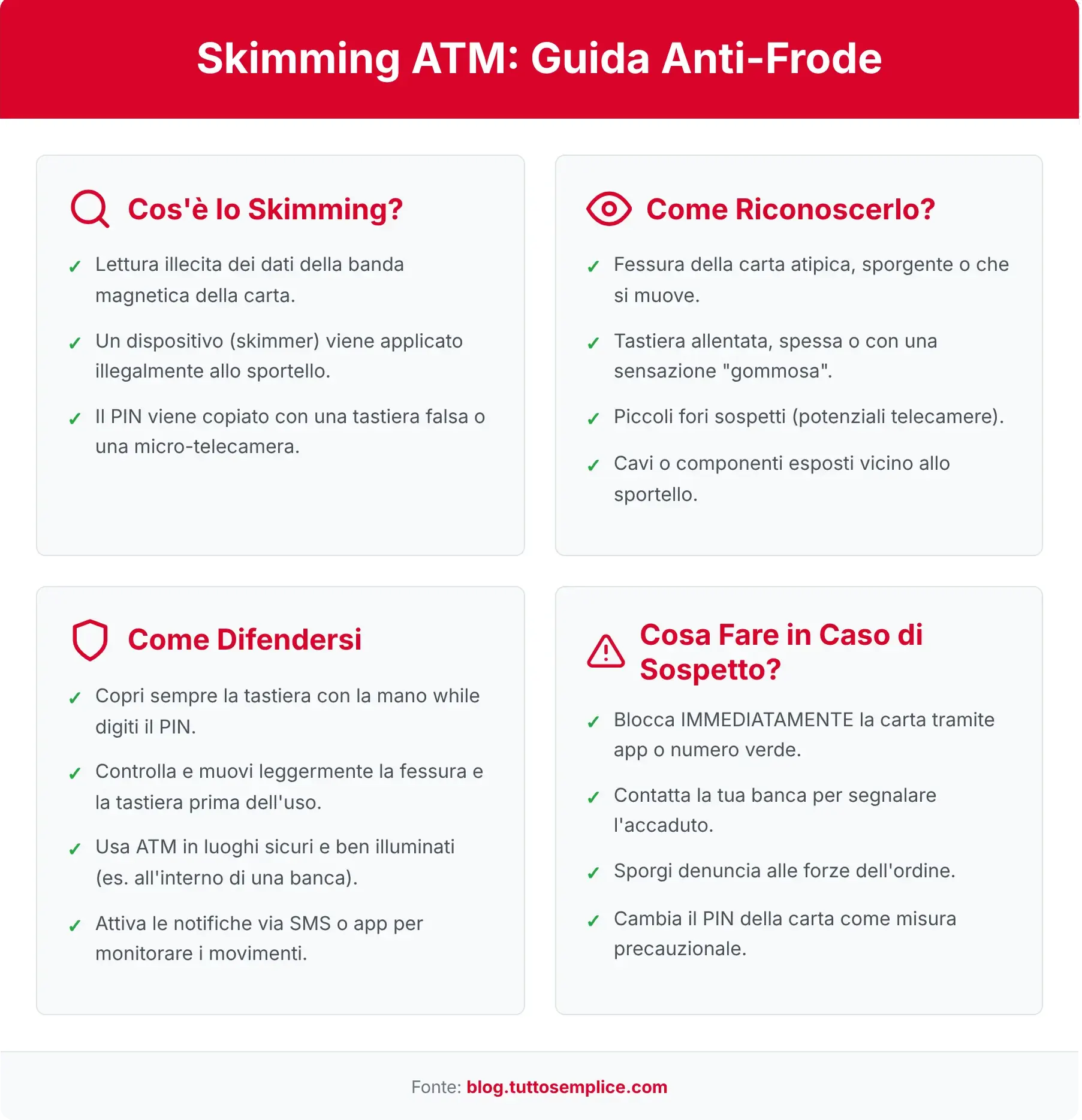

What Is Skimming and How Does It Work

Skimming is a type of cyber fraud that happens in the physical world. Criminals install illegal electronic devices on ATMs to steal the information on your card and your PIN. The attack takes place in two parallel but equally important phases: cloning the card and capturing the PIN. Only by combining these two elements can scammers create a fully functional clone card and access your bank account. This technique is particularly insidious because, if well-executed, it leaves no obvious traces, and the victim only realizes the theft when they check their bank statement and notice unauthorized withdrawals.

Card Cloning

The heart of the scam is a device called a skimmer. This is a custom-made card reader, often built with remarkable skill to blend in, which is placed over or inside the ATM’s original card slot where you insert your card. When you insert your debit or credit card, it first passes through the skimmer, which reads and stores the data from the magnetic stripe. The operation is instantaneous and completely transparent to the user, who proceeds with their withdrawal without noticing a thing. The stolen data is later retrieved by the criminals to be written onto a blank card.

Capturing the PIN

Obtaining the magnetic stripe data is useless without the PIN. To steal it, scammers primarily use two methods. The most common is the installation of a hidden micro-camera, so small it can be concealed in a fake panel, a cleverly placed brochure holder, or even in a plastic strip above the keypad. This camera has a single purpose: to get a view of the keypad and record the PIN being entered. An alternative, more complex but equally effective, is the use of a fake keypad (pin pad overlay), a thin membrane that fits over the original one and records the keystrokes.

Executing the Fraud

Once the criminals have both the magnetic stripe data and the PIN, the job is done. They retrieve the skimmer and the micro-camera (or the fake keypad) and download the collected information. The card data is used to create a “clone,” a card physically identical to the original but under their control. At this point, they can use the cloned card and the stolen PIN to make fraudulent withdrawals from any ATM in the world, often draining the victim’s account in a matter of hours. Alternatively, the data can be sold on the dark web to other criminal groups.

The Most Common Skimming Techniques

Criminals are constantly evolving their techniques to make skimming devices smaller, more effective, and harder to detect. Knowing the different types of attacks is the first step in being able to recognize them. The methods range from add-on devices that are visible, though well-camouflaged, to micro-devices that are nearly impossible to spot with the naked eye. The choice of technique depends on the scammer’s skill and the type of ATM being targeted. It’s crucial to pay attention not only to the card slot but to the entire appearance of the machine.

Traditional Skimmers (Overlays)

The most common form of skimmer is the overlay, a fake card reader made of plastic or resin designed to resemble the original part of the ATM. It is glued or snapped on over the card insertion slot. Although scammers try to replicate the color and shape, you can often spot small imperfections: a slightly different shade of color, an unusual protrusion, or the presence of glue or double-sided tape. These devices are the “easiest” to spot with a careful inspection, as they physically alter the ATM’s appearance. A good tip is to compare the ATM with nearby ones, if any are present.

Deep-Insert Skimmers and Shimming

A much more insidious threat is posed by deep-insert skimmers. These are ultra-thin, flexible, and nearly invisible devices that are inserted directly inside the card reader. Unlike overlays, they are not detectable from the outside. An even more advanced variation is shimming, which targets chip cards. A device shaped like a very thin foil, called a shim, is inserted into the slot to read the microchip data. Although chip data cannot be used to create a clone card with a chip, it can be exploited to produce a card with only a magnetic stripe or to commit online fraud.

Fake Keypads (PIN Pad Overlays)

As mentioned earlier, to capture the PIN, criminals can use a fake keypad that fits over the legitimate one. These devices are designed to look identical to the original, but they may feel slightly “rubbery” or thicker than normal to the touch. When you type your PIN, the fake keypad records the sequence of numbers. Again, a physical check can make a difference: trying to gently wiggle the edges of the keypad can reveal if a cover has been applied. The State Police (Polizia di Stato) always advises paying close attention to any anomaly on the machine.

Hidden Micro-Cameras

Micro-cameras remain the most common method for spying on PINs. Their small size allows them to be hidden almost anywhere. The most common spots include: fake plastic bars attached above the monitor, brochure holders added to the sides of the machine, or small holes drilled into panels adjacent to the keypad. It’s a good practice to inspect the area around the keypad for anything that seems out of place or has a small, suspicious hole. The criminals’ goal is to get a clear view of the keypad, so any added object nearby should arouse suspicion.

How to Recognize a Tampered ATM

Protecting yourself from skimming doesn’t require advanced technical skills, but rather an approach based on attention, caution, and a quick inspection before each transaction. Scammers count on our haste and distraction. Taking a few seconds for a visual and tactile check of the ATM can make the difference between a safe withdrawal and a drained account. The golden rule is simple: if something looks strange, out of place, or suspicious, it’s better not to use that machine and find another one. Prevention is the best weapon at our disposal.

Visual and Tactile Inspection

Before inserting your card, take a moment to look at and touch the key components of the ATM.

- Card reader: Try to wiggle it gently. An ATM’s original components are securely fixed. If the reader moves, is loose, or looks like an add-on, it might have been tampered with. Also, check for glue residue or adhesive tape on the edges.

- Keypad: Run your fingers over the edges and surface. A fake keypad might feel thicker or spongier to the touch. If the keys seem unusually hard or, conversely, too soft, it’s a red flag.

- Overall appearance: Look for discrepancies in color, material, or alignment among the various parts of the machine. Skimming devices, no matter how well-made, are rarely a 100% perfect match for the original components.

- Card reader: Try to wiggle it gently. An ATM’s original components are securely fixed. If the reader moves, is loose, or looks like an add-on, it might have been tampered with. Also, check for glue residue or adhesive tape on the edges.

- Keypad: Run your fingers over the edges and surface. A fake keypad might feel thicker or spongier to the touch. If the keys seem unusually hard or, conversely, too soft, it’s a red flag.

- Overall appearance: Look for discrepancies in color, material, or alignment among the various parts of the machine. Skimming devices, no matter how well-made, are rarely a 100% perfect match for the original components.

- Card reader: Try to wiggle it gently. An ATM’s original components are securely fixed. If the reader moves, is loose, or looks like an add-on, it might have been tampered with. Also, check for glue residue or adhesive tape on the edges.

- Keypad: Run your fingers over the edges and surface. A fake keypad might feel thicker or spongier to the touch. If the keys seem unusually hard or, conversely, too soft, it’s a red flag.

- Overall appearance: Look for discrepancies in color, material, or alignment among the various parts of the machine. Skimming devices, no matter how well-made, are rarely a 100% perfect match for the original components.

Pay Attention to Unusual Details

Criminals often add elements to the machine to hide micro-cameras. Pay attention to objects that seem superfluous or strangely positioned. A brochure holder where there usually isn’t one, a plastic strip above the screen, or even a small mirror can be used to hide a camera. Look for tiny holes, no bigger than a pinprick, aimed at the keypad. Any element that appears to have been recently ‘added’ or doesn’t blend seamlessly with the machine’s design deserves a closer look. If you have any doubts, trust your gut and use a different ATM.

Always Cover the Keypad

This is perhaps the simplest and most effective rule for protecting yourself. Regardless of how secure the ATM may seem, always cover the hand you use to enter your PIN with your other hand, your wallet, or a piece of paper. This simple gesture prevents any hidden micro-camera from recording your secret code. Even if criminals manage to clone your card with a skimmer, they can’t make withdrawals without the PIN. Making this action a solid habit is the most powerful form of self-protection against skimming.

The Golden Rules for a Safe Withdrawal

In addition to inspecting the machine, there are other good habits that drastically increase your level of security during withdrawals. These are a series of prudent behaviors concerning the choice of ATM, PIN management, and monitoring your account. Adopting these golden rules means building a multi-layered defense system, making life much more difficult for scammers. Indeed, security is not a single act, but a set of small, consistent precautions.

Choose Your ATM Carefully

Not all ATMs are equal in terms of security. It is always preferable to use ATMs located inside bank branches or post offices, as they are more supervised and less accessible to criminals. If you must withdraw outside, choose machines in well-lit, crowded areas covered by video surveillance cameras. Avoid isolated ATMs in dark or sparsely populated areas, especially at night or on weekends, which are times when criminals are more active. Even choosing a Pizzo post office for your transactions can offer a greater sense of security compared to an isolated machine.

Protecting Your PIN is Crucial

The PIN is the key to your bank account and must be protected at all costs. As already emphasized, covering the keypad while you enter the code is an essential habit. Furthermore, never reveal your PIN to anyone, not even to supposed bank officials or law enforcement. Memorize it and don’t write it down on notes kept in your wallet. If you suspect someone may have seen your PIN, change it as soon as possible. Remember that the combination of a cloned card and a PIN is what enables the fraud: by making one of the two elements inaccessible, the scam fails.

Check Your Bank Statement

Timeliness is crucial in case of fraud. Regularly check your bank account activity, ideally through your mobile banking app which provides real-time notifications. Many banks offer an SMS alert service that notifies you of every withdrawal or payment made with your card. Enabling these notifications allows you to immediately spot any unauthorized transaction and take action by blocking the card. If you notice a suspicious charge, even a small one, contact your bank immediately.

What to Do if Your Card Gets Stuck

Sometimes criminals use a technique called the “Lebanese loop” to steal the physical card. They insert a small plastic loop into the slot that prevents the card from coming out after the transaction. At that point, an accomplice approaches offering help and, under the pretext of solving the problem, spies on the PIN as the victim tries to re-enter it. If your card gets stuck, do not accept help from strangers. Cancel the transaction, if possible, and immediately call your bank’s toll-free number to block the card, even if it means stepping away from the machine for a moment. It’s important to make the report from a safe place, like a post office in Verona Centro or another bank branch.

What to Do in Case of Skimming Fraud

If, despite all precautions, you realize you’ve been a victim of skimming fraud, it’s crucial to act quickly and methodically. A swift reaction can limit the financial damage and increase the chances of getting a full refund. The steps to follow are clear and must be performed in the correct order to ensure maximum effectiveness. Staying calm and proceeding systematically is the best strategy to manage the situation and assert your rights.

Block the Card Immediately

The first and most urgent action to take is to block the card. As soon as you notice a suspicious transaction or realize your card has been cloned, call the toll-free card-blocking number provided by your bank. This number is available 24/7 and is printed on the back of the card itself, on the bank’s website, and in the mobile banking app. It’s a good idea to save it in your phone’s contacts in advance. By providing your details to the operator, the card will be blocked instantly, preventing criminals from making any further transactions.

Report to the Authorities

After blocking the card, the next step is to file a report with law enforcement. You can go to the nearest Carabinieri station or an office of the Polizia Postale e delle Comunicazioni (Postal and Communications Police), which is the department specializing in cybercrime. Provide all the details you have: the list of unauthorized transactions, the location and time of the last withdrawal you made, and any other useful information. The police report is an essential document for initiating the refund process with your bank. Filing a report is a crucial step, both for your own protection and to help authorities combat the phenomenon, often coordinating with essential services like those offered by a post office in Tropea to achieve widespread territorial coverage.

Dispute the Charge and Request a Refund

With the copy of the police report in hand, go to your bank branch or contact customer service to formally dispute the fraudulent transactions and start the refund request process. The European Payment Services Directive (PSD2), adopted in Italy, broadly protects consumers. Except in cases of fraud or gross negligence on the part of the customer (which the bank has the burden of proving), the financial institution is required to refund the stolen funds. The procedure involves filling out a dispute form where you list the unauthorized charges. Once the bank receives the complete documentation, it will start its own investigation and proceed with the refund according to the timelines established by law.

In Brief (TL;DR)

This guide teaches you how to recognize illegal skimming devices installed on ATMs and adopt best practices to protect your card and PIN.

We will delve into strategies for inspecting an ATM and habits to adopt to ensure the security of your transactions.

Discover the countermeasures and good habits to adopt to withdraw cash in total safety and protect your finances.

Conclusion

ATM skimming is a real and constantly evolving threat that combines criminal engineering with the psychology of distraction. However, it’s not a losing battle. As we’ve seen, awareness and the adoption of simple but strict security habits can build an effective barrier against this type of fraud. The visual and tactile inspection of the machine, the systematic protection of the PIN, and constant monitoring of your bank account are actions that take only a few seconds but offer an invaluable level of protection.

In a cultural context like Italy’s, where the tradition of cash withdrawals coexists with the growing digitization of payments, financial security education is fundamental. Technology offers convenience, but it also requires responsibility. Being an informed user doesn’t mean living in fear, but acting with caution, turning knowledge into a powerful shield. Remember: the first and most important security system is you. Every time you approach an ATM, take a moment for your own protection. It’s always worth it.

Frequently Asked Questions

Before inserting your card, carefully inspect the machine. Check the card insertion slot and the numeric keypad. Try to wiggle these parts gently: if they seem unstable, like an add-on, or are a different color from the rest of the ATM, they may have been tampered with. Also, look for small holes or suspicious elements nearby, which could hide a micro-camera used to record your PIN. When in doubt, don’t use that machine and report the situation to the bank.

The first and most important action is to block the card. You can do this immediately through your bank’s app or by calling the dedicated toll-free number, which is available 24/7. Next, contact your bank to dispute the fraudulent transactions and start the refund request process. It is also essential to file a report with the Postal Police (Polizia Postale) or the Carabinieri, and attach a copy of it to the refund request you send to the bank.

Criminals mainly use two methods to steal the PIN. The first is to install a hidden micro-camera, often in a fake plastic bar above the keypad or in a side brochure holder, which records you typing the keys. The second method involves placing a fake keypad (keypad overlay) over the original one, which records the numbers entered. For this reason, it’s a good habit to always cover the keypad with your other hand while entering your secret code.

Yes, generally, European and Italian regulations require the bank to refund a customer who is a victim of cloning, unless it can prove gross negligence on the part of the cardholder (such as failure to safeguard the PIN). The burden of proof that the transaction was authorized by the customer lies with the financial institution. To facilitate a refund, it is essential to block the card and report the incident as soon as possible.

Yes, against traditional skimming that occurs at ATMs, contactless technology offers greater security. Since the card is not physically inserted into the tampered reader, the magnetic stripe data cannot be copied by the skimmer. Payments via smartphones and smartwatches, which use NFC technology, are also considered more secure for the same reason and often require additional biometric authorization. However, it’s important to remember that other types of cyber fraud exist, so vigilance remains important.

Still have doubts about ATM Skimming: A Guide to Recognizing It and Protecting Yourself?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.