Moving to Italy, the heart of the Mediterranean, means immersing yourself in a culture rich in history, but also tackling fundamental practical aspects like managing your finances. Opening a bank account is one of the first and most important steps for anyone wishing to settle in the Bel Paese, whether for work, study, or to enjoy life. This process, which once might have seemed like a bureaucratic maze, has now become more accessible thanks to a banking system that balances the tradition of physical branches with the efficiency of digital solutions. Whether you are a European or non-EU citizen, this guide will provide you with all the necessary information to navigate the Italian banking landscape with confidence.

Having an Italian bank account is essential for daily life. It allows you to receive your salary, pay rent and bills, manage taxes, and make online purchases easily and securely. In a country where many daily transactions go through the banking system, having a local account is not just a convenience but a real necessity to fully integrate into the economic and social fabric. This guide will walk you through step by step, from choosing a bank to gathering documents, all the way to the daily management of your new account.

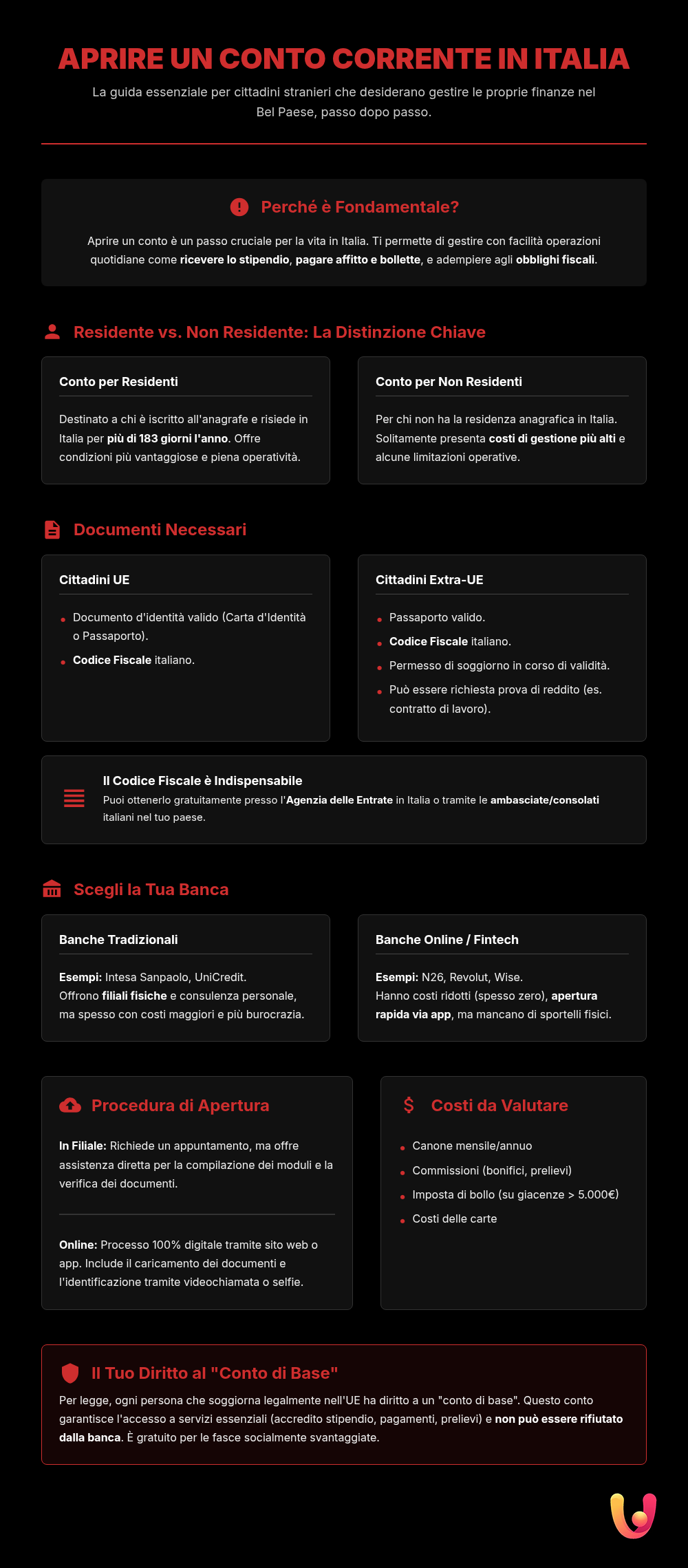

Why Open a Bank Account in Italy?

The decision to open a bank account in Italy goes beyond the simple need to deposit money. It is the passport to financial autonomy and integration. Without an Italian account, basic activities like receiving your salary, setting up direct debits for utilities like electricity and gas, or paying rent become complex. Furthermore, a bank account is essential for managing taxes and accessing financial services such as loans or mortgages. In a cultural context where the relationship with one’s bank still holds value, having a local financial point of reference can significantly simplify life, offering security and complete control over your finances.

Resident vs. Non-Resident: The Key Distinction

Before starting any procedure, it is crucial to understand the distinction between a resident account and a non-resident account, as the required documentation, costs, and accessible services depend on this. The bank will ask you to declare your status when opening the account. Generally, you are considered a tax resident in Italy if you are registered with the resident population registry (anagrafe) for more than 183 days a year (184 in leap years). This distinction is crucial because it directly affects the contractual conditions offered by credit institutions.

The main difference between a resident and a non-resident account lies in the costs and anti-money laundering regulations. Non-resident accounts often have higher fees and some operational limitations.

The Resident Account

The resident account is intended for those who have established their habitual residence in Italy and are registered with the municipal registry (anagrafe). This type of account usually offers more favorable economic conditions, with reduced or waived monthly fees and full functionality. To open one, in addition to the basic documents, you must prove your legal residence in Italy. This status allows access to a wider range of financial products, including investments, personal loans, and mortgages for purchasing a home, making it the ideal choice for those with a long-term life plan in the country.

The Non-Resident Account

The non-resident account is designed for those who live abroad but have financial interests in Italy, such as owning a property, or for those in a transitional phase of their move. This type of account generally has higher management costs and may have limitations on certain operations to comply with anti-money laundering regulations. Despite this, it allows you to perform essential operations such as receiving and making bank transfers, paying bills, and managing current expenses. It is a flexible solution for those who do not stay in Italy for more than six consecutive months a year.

Required Documents: Italian Bureaucracy

Preparing the correct documentation in advance is the secret to a quick and smooth account opening. Italian banks are required to verify the identity and tax status of every customer. Although requirements may vary slightly from one institution to another, there are some fundamental documents required of all foreign citizens. Having everything on hand demonstrates seriousness and facilitates the bank clerk’s work, turning a potential bureaucratic obstacle into a simple formality.

For EU Citizens

Citizens from a European Union country benefit from a simplified procedure. To open a bank account, only two documents are generally required: a valid identity document (passport or national ID card) and an Italian tax code (codice fiscale). The ‘codice fiscale’ is an alphanumeric code essential for any interaction with public administration and for financial transactions in Italy. Obtaining it is an indispensable preliminary step before going to the bank.

For Non-EU Citizens

For citizens of countries not belonging to the European Union, the list of documents is slightly longer. In addition to a valid passport and the ‘codice fiscale’ (tax code), a residence permit (permesso di soggiorno) is almost always required. This document certifies the legality of your stay in Italy and is a fundamental requirement for most banks. In some cases, especially for opening standard accounts, the bank may also request proof of income, such as a payslip or an employment contract.

How to Get the ‘Codice Fiscale’

The ‘codice fiscale’ (tax code) is the key to accessing numerous services in Italy, including opening a bank account. It can be requested for free at any office of the Italian Revenue Agency (Agenzia delle Entrate) within the national territory. For those still abroad, the request can be submitted through the Italian consulate or embassy in your country of residence. The procedure is relatively simple: you just need to fill out a form (model AA4/8) and present a valid identity document. Once obtained, this code will remain valid forever.

Choosing the Right Bank: Tradition or Innovation?

The Italian banking market offers a wide choice, ranging from large traditional banks with an extensive network of branches to modern online banks and fintechs. The decision largely depends on your personal needs, your comfort level with technology, and the importance you place on human interaction. Evaluating the pros and cons of each option is essential to find the financial partner best suited to your lifestyle.

Traditional Banks

Institutions like Intesa Sanpaolo, UniCredit, and Banco BPM represent the backbone of the Italian banking system. Their strength is their physical presence throughout the country: having a reference branch and a personal advisor to turn to can be reassuring, especially for those new to the country. This traditional approach, however, often involves higher management costs, limited opening hours, and more bureaucracy for transactions. They are the ideal choice for those seeking personalized service and who prefer direct human contact.

Online Banks and Fintechs

In recent years, digital banks like Fineco, N26, Revolut, and Wise have gained great popularity. They offer quick online bank account opening processes, very competitive costs (often with no monthly fee), and intuitive, multilingual mobile apps. This solution is perfect for digital nomads, students, and anyone who prefers to manage their finances independently via smartphone. The main disadvantage is the absence of physical branches, which can make operations like depositing cash and getting direct assistance in case of problems more complex.

The Opening Procedure: Step by Step

Once you have chosen the bank and gathered the documents, you can proceed with the actual opening of the account. The process can take place in a branch or entirely online, depending on the chosen institution. Both methods have their specifics, but the goal is the same: to activate the account as quickly as possible. Generally, the minimum age to open an account in Italy is 18.

Opening in a Branch

Opening an account in a branch is the classic method. Usually, you make an appointment, go to the counter with all the necessary documents, and a clerk guides you through filling out and signing the contracts. Although it may take more time, this method allows you to immediately clarify any doubts and establish a first personal contact with the bank. For non-resident accounts, some traditional banks mandatorily require physical presence in the branch to complete the procedure.

Opening Online

The online procedure is the fastest and most convenient, now offered by most digital banks and also by many traditional ones. The process takes place entirely via web or app: you fill out the online forms, upload photos of the required documents, and complete the identification via a video-selfie or a short video call with an operator. This option is particularly advantageous for those not yet physically in Italy or for those whose schedules do not align with branch hours.

Costs and Features to Consider

Before signing any contract, it is essential to carefully analyze the cost information sheet. Bank accounts can have various expense items, some obvious, others less so. Paying attention to these details helps avoid surprises and choose a truly cost-effective product. The costs of a bank account for foreigners can vary significantly depending on whether you are a resident or not.

The costs of a non-resident account are generally higher due to greater regulatory requirements. The fee can range from 8 to 25 euros per month, with additional commissions for transfers and withdrawals.

The main cost items to check are:

- Annual or monthly fee: the fixed cost for account management. Many online accounts offer it for free.

- Transaction fees: costs applied to transfers (SEPA and international), withdrawals at other banks’ ATMs, and other over-the-counter operations.

- Stamp duty (Imposta di bollo): a state tax applied to accounts with an average balance exceeding 5,000 euros.

- Card costs: annual fee for the debit or credit card.

The Right to a Basic Account

It’s important to know that, according to a European directive adopted in Italy, anyone legally residing in the European Union has the right to open a “basic account.” This right also extends to asylum seekers and people without a fixed address. The basic account is a financial inclusion tool that guarantees access to essential services: crediting of funds, withdrawals, payments, and a debit card. For socially disadvantaged groups (with an ISEE under 11,600 euros) and for some pensioners, the basic account is completely free. Banks cannot refuse to open a basic account if the applicant meets the legal requirements.

Managing Your Account and Finances in Italy

Once the account is open, daily management is mainly done through home banking services and mobile banking apps. These tools allow you to check your balance, make transfers, pay bills (like MAV and RAV), and manage your cards with complete autonomy. It is essential to familiarize yourself with the IBAN (International Bank Account Number), the code that uniquely identifies your account and which must be provided to receive payments. In case of problems, such as an unauthorized charge or a blocked account, it is important to contact your bank immediately. There are specific procedures to protect account holders, even in the case of a blocked account for a foreign citizen.

In Brief (TL;DR)

From choosing the bank that best suits your needs to navigating the bureaucracy, this complete guide walks you step-by-step through opening your bank account in Italy as a foreign citizen.

We will explore the required documents, bureaucratic procedures, and the differences between resident and non-resident accounts.

Finally, we will provide you with practical tips for daily account management and for making international payments efficiently and securely.

Conclusions

Opening a bank account in Italy as a foreign citizen is a fundamental step towards full economic and social integration. Although the process may seem complex, proper preparation and knowledge of the available options can make it simple and straightforward. Whether you choose the stability of a traditional bank or the agility of a fintech solution, the important thing is to carefully evaluate your needs and compare costs and services. Armed with the right information, newcomers can face the bureaucracy with confidence and start their Italian adventure on the right foot, managing their finances securely and efficiently in the heart of the European market.

Frequently Asked Questions

Yes, it’s possible. Many Italian banks offer a specific product called a ‘non-resident account’ (‘conto per non residenti’). This type of account is designed for those who are not tax residents in Italy but need to perform banking operations in the country, such as receiving payments or managing expenses. The requirements and costs may differ from a resident account, and often only basic operations are allowed. To open one, you will need an ID, an Italian tax code (‘codice fiscale’), and proof of address in your country of residence.

The three fundamental documents required by most banks are: a valid identity document (passport for non-EU citizens, ID card for EU citizens), an Italian tax code (‘codice fiscale’), and proof of address. For non-EU citizens, a residence permit (‘permesso di soggiorno’) or a valid visa is also almost always necessary. Some institutions may request additional documentation, such as proof of employment or income (payslip, employment contract). It is always advisable to check the specific requirements with your chosen bank.

Opening an account from abroad is complex with traditional banks, which usually require physical presence in a branch for identification and signing contracts. However, several online banks and fintechs offer fully digital opening procedures. These allow you to register, upload documents, and complete the identification process via video call or app, making it possible to open the account even before arriving in Italy. However, you must verify that the chosen bank offers accounts to those not yet physically present in the country.

Costs vary greatly between traditional and online banks. Online accounts often have a zero or very low monthly fee (from about 0 to 5 euros) for basic operations. Traditional banks can have monthly fees ranging from 5 to 20 euros, plus commissions for specific operations like international transfers or withdrawals at other banks’ ATMs. Non-resident accounts tend to have higher management costs due to the increased checks required. In addition to these costs, there is the state stamp duty (‘imposta di bollo’), legally required on average balances exceeding 5,000 euros.

The choice depends on your needs. A traditional bank offers the advantage of physical branches and a personal advisor, which is useful for those who prefer a direct relationship and need complex services. An online bank is often cheaper, quicker to open, and more efficient for daily management via an app and for low-cost international transfers. For a newcomer to the Italian system, an online solution can significantly simplify the initial bureaucracy, while a traditional bank can provide more security for those planning to make investments or apply for loans.

Still have doubts about Bank Account in Italy for Foreigners: A Complete Guide to Opening One in 2025?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.