In the era of digital payments, the convenience of “tap & go” has transformed the way we shop. Contactless cards, thanks to RFID technology, have become a standard in Italy and Europe, symbolizing an innovation that embraces the speed of modern life. However, with their spread, concern for the security of our data has also grown. Many wonder if wallets and sleeves with RFID shielding are a real necessity or an excessive precaution. This article analyzes how these technologies work, the concrete risks, and the actual utility of protection solutions, offering a clear picture to navigate between tradition and innovation in managing your money.

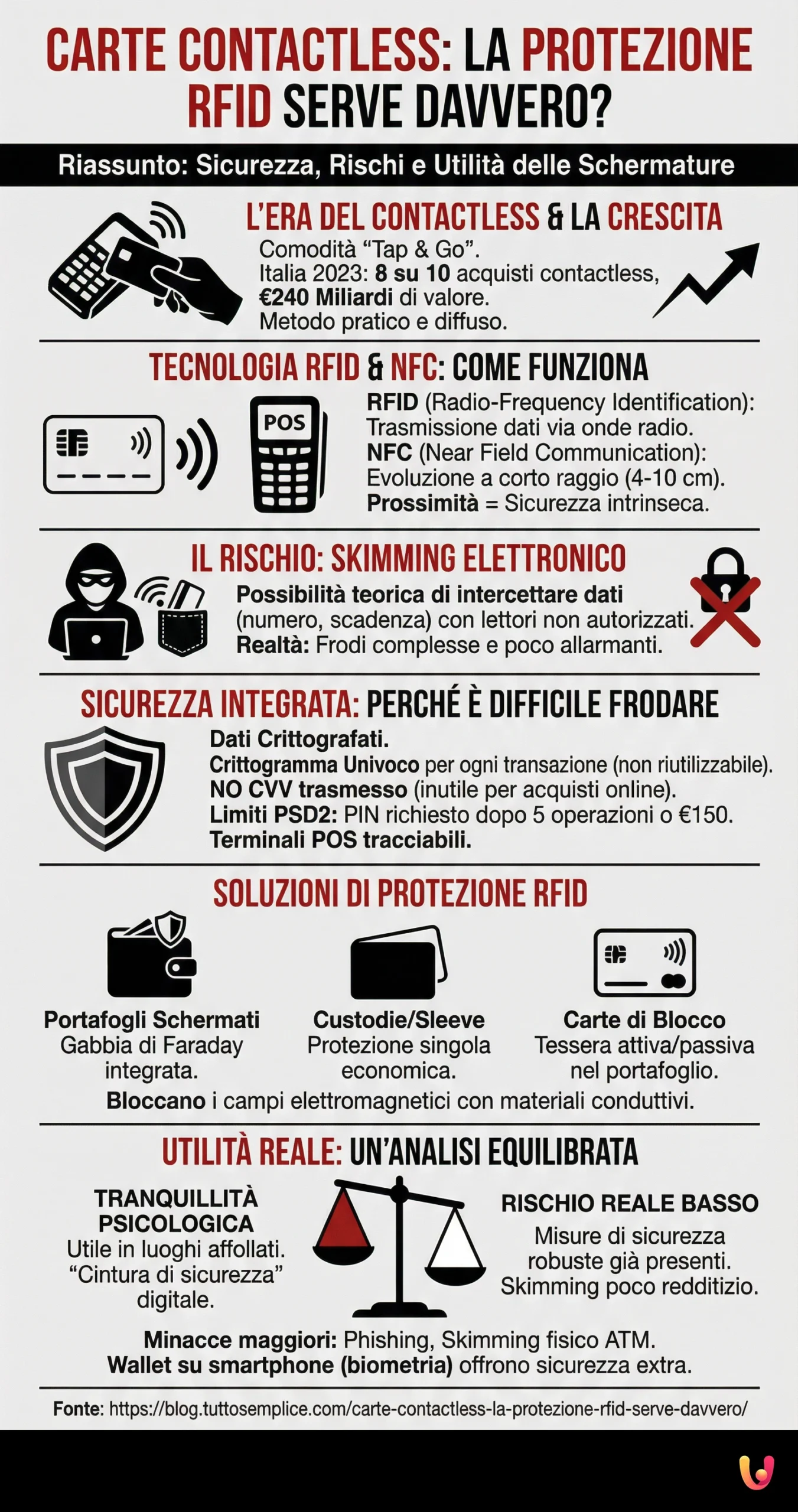

Growing trust in contactless payments is a fact. In 2023, in Italy, about eight out of ten purchases were made in contactless mode, for a total value of 240 billion euros. This demonstrates how consumers appreciate a method considered not only practical but also safe for everyday transactions. Despite this, the debate on security remains open, fueling a market of accessories designed to block any attempts at remote data theft.

How RFID and NFC technologies work

To understand the risks, it is fundamental to understand the technology behind a contactless card. The acronym RFID (Radio-Frequency Identification) refers to a system that allows for automatic identification and data transmission via radio waves. A contactless payment card contains a microchip (or tag) and a small antenna. When the card is brought close to a POS (Point of Sale) reader, the electromagnetic field emitted by the terminal powers the chip, which in turn transmits the information necessary to complete the transaction.

NFC (Near Field Communication) technology is a direct evolution of RFID and operates at a specific frequency (13.56 MHz). Its main characteristic is the extremely short communication range, usually not exceeding 4-10 centimeters (1.5-4 inches). This proximity is an intrinsic security measure, as it makes intercepting data from a distance difficult. While RFID can be unidirectional, NFC allows for bidirectional communication between two devices, as happens when using a smartphone to pay via digital wallets like Apple Pay or Google Pay.

The risk of contactless cloning: reality or myth?

The main concern linked to contactless cards is so-called electronic skimming, which is the possibility that a malicious actor, equipped with a portable RFID reader, could read and copy card data simply by passing close by. Technically, it is possible for an unauthorized reader to intercept the card number and expiration date. However, the reality of contactless fraud is more complex and less alarming than one might think.

Modern payment systems integrate multiple layers of security. During a contactless transaction, the transmitted data is encrypted and, most importantly, a unique security code (cryptogram) is generated for that specific operation. This code cannot be reused for other transactions, effectively rendering the simple cloning of intercepted data useless. Furthermore, the transmitted data is not sufficient to make online purchases, where the CVV code (the 3 or 4 digit number on the back of the card) is required, which is never transmitted via RFID.

Even if unauthorized charges were to occur, European PSD2 regulations introduce further protections, such as the requirement to enter the PIN after a certain number of consecutive operations (maximum 5) or upon reaching a cumulative amount (150 euros). This significantly limits potential damages. Finally, every POS terminal is registered and traceable, making it difficult for a scammer to act anonymously.

RFID protection solutions: how they work and which to choose

Despite the robust integrated security measures, many people choose to use additional protection. RFID blocking solutions work by creating a sort of “Faraday cage” around the cards. These products contain a layer of conductive material, such as aluminum, which blocks electromagnetic fields, preventing readers from communicating with the card chips.

There are different types of products with RFID shielding:

- Shielded wallets: These are traditional wallets made of leather or other materials, with a protective layer sewn inside. They offer an integrated and convenient solution for those who wish to protect all their cards.

- Protective sleeves: These are small pouches in which to insert cards individually. They are an economical and flexible solution to insert into any wallet.

- Blocking cards: These are cards the same size as a credit card, which are inserted into the wallet together with the others. Some work passively by blocking signals, others actively by emitting a jamming signal to confuse readers.

The choice depends on personal needs. A shielded wallet is ideal for those looking for an “all-in-one” solution. Single sleeves are perfect for protecting only specific cards, while blocking cards represent a versatile and low-cost alternative.

The real utility of RFID protection: a balanced analysis

The anti-RFID product industry is booming, but their real necessity is a subject of debate among security experts. On one hand, they offer undeniable psychological peace of mind, especially in crowded places like public transport or shopping malls, where the perceived risk of skimming is higher. They are an additional layer of protection, a sort of digital “seatbelt”.

On the other hand, several experts argue that the risk of suffering fraud via contactless skimming is extremely low, almost negligible, thanks to the security measures already in place. Encryption, tokenization (which replaces real data with a unique code), and spending limits make this type of attack unprofitable and easily traceable. Fraud statistics, although increasing in the general digital context, do not indicate contactless skimming as the main threat. Much more common and dangerous are scams like phishing or physical skimming at tampered ATMs. For those who want even greater security, using smartphone wallets adds biometric authentication (fingerprint or facial recognition), almost entirely eliminating risks.

In Brief (TL;DR)

With the spread of contactless cards, interest in RFID shielding is growing: in this article, we analyze how it works and its actual utility to understand if it is really a necessary protection.

We delve into the functioning of RFID shielding and evaluate if it is truly indispensable for defending against fraud, considering the security levels already present in cards.

We deepen the effectiveness of shielded wallets and sleeves to understand if they represent a real necessity or a superfluous precaution.

Conclusions

Contactless cards represent a perfect balance between the tradition of physical possession and the innovation of rapid payments. The technology that supports them, while introducing new dynamics, was designed with solid security safeguards like encryption and one-time codes. The risk of being robbed via electronic skimming, although technically possible, is very low in daily practice. The most common frauds occur through other channels, such as online deception or tampering with physical terminals. In this context, wallets and sleeves with RFID protection should be considered an additional tool for protection, not an absolute necessity. They offer a physical barrier against a remote risk, bringing with them a value of serenity. The choice to adopt them depends on one’s own level of risk perception and the desire to add a further, and often simple, layer of defense for one’s personal data.

Frequently Asked Questions

It is not strictly indispensable, but it offers an extra level of security. Modern contactless cards already possess advanced security systems, such as encryption and the use of one-time codes for each transaction, which make theft very difficult. Furthermore, the range for a reading is just a few centimeters. An RFID wallet serves mainly to block even just the attempt of unauthorized reading, offering greater peace of mind, especially in very crowded places.

RFID protection works by creating a sort of «Faraday cage» around your cards. Shielded wallets and sleeves are made with specific materials, such as aluminum alloys or carbon fibers, which block radio waves. This protective layer prevents any nearby RFID scanner from powering the card chip and reading its data, effectively neutralizing skimming attempts.

A malicious actor with a scanner could theoretically read the card number and expiration date. However, they could not access crucial information like the CVV code (the 3-digit number on the back) or the PIN, which are indispensable for most online transactions or withdrawals. For physical payments, illicit transactions would still be traceable and limited to small amounts.

Yes, a well-known homemade solution is to wrap cards in a sheet of aluminum foil, the common kitchen foil. This method works on the same principle as shielded wallets, blocking radio signals. Although it is an economical and effective solution, it is not very practical nor durable over time. It can be considered a temporary measure or a way to test the concept of shielding.

A practical test is the simplest way. Try to make a contactless payment in a store by holding the card inside the closed wallet and bringing it close to the POS terminal. If the transaction does not go through and the POS does not detect the card, it means the shielding is working correctly. Another method is to try reading a public transport card (like those for the subway) with a smartphone app while it is in the wallet: if the app does not detect it, the protection is active.

Still have doubts about Contactless Cards: Do You Really Need RFID Protection??

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.