The gesture has become part of our daily routine: a coffee at the café, grocery shopping, a subway ticket. We tap our card, smartphone, or smartwatch on the POS terminal, a “beep” confirms the transaction, and the payment is complete. Fast, convenient, almost magical. Contactless payments have revolutionized our habits, especially in Italy and Europe, where their adoption has grown exponentially. Yet, in a culture like the Mediterranean one, often balancing between embracing innovation and a solid attachment to tradition, a question remains: how safe is this system really? The idea of paying without entering a PIN or handing over one’s card raises doubts and fuels myths. This article aims to provide clarity, separating urban legends from concrete risks and providing a complete guide to using contactless technology with peace of mind and awareness.

How the Magic of Contactless Works

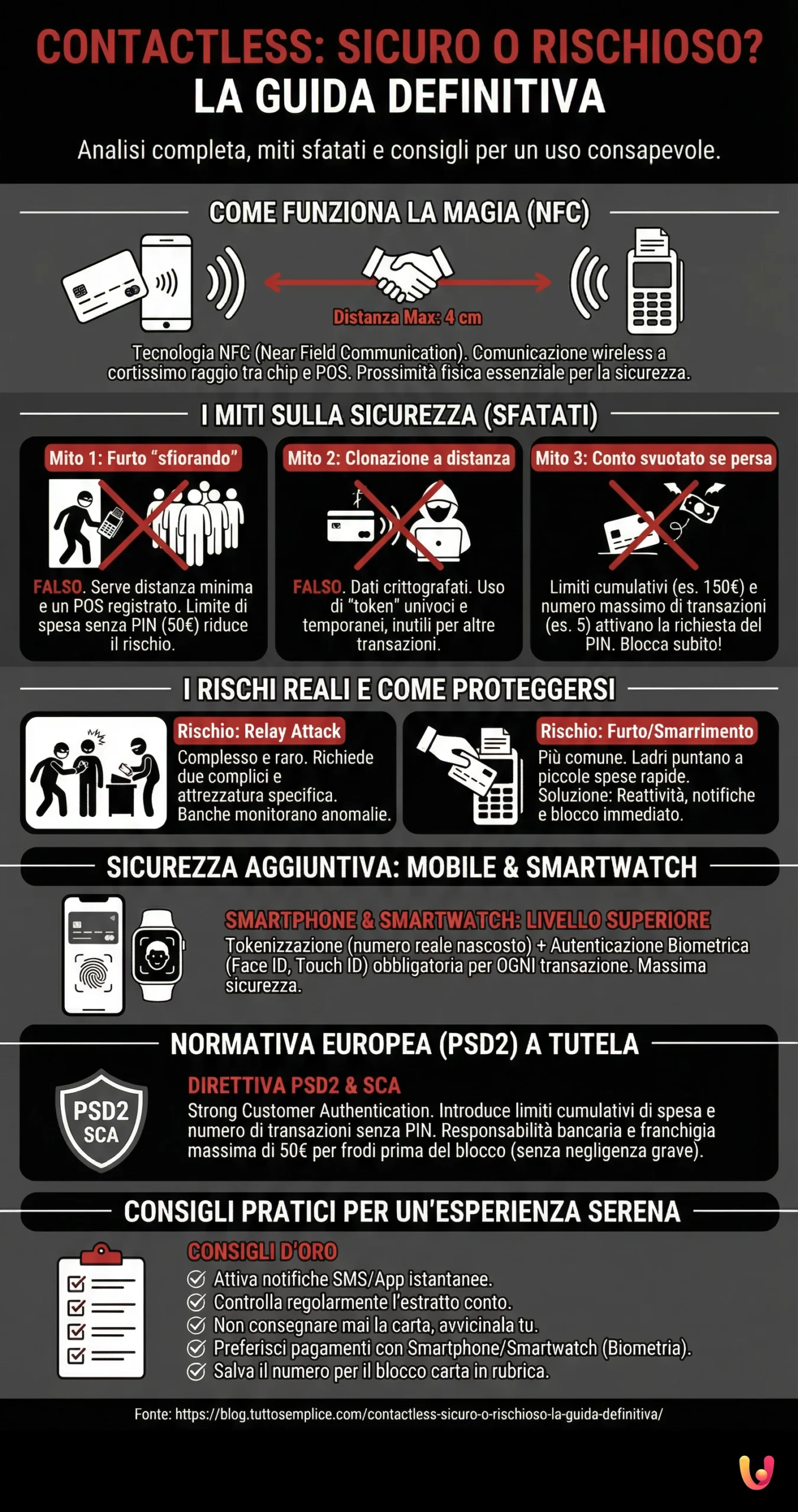

At the heart of “contactless” payments is a technology called NFC (Near Field Communication), a very short-range wireless communication system. Imagine it as a secret, lightning-fast handshake between two devices: the chip in your card (or phone) and the merchant’s POS terminal. For this communication to happen, the two devices must be at a minimum distance, usually no more than 4 centimeters. This physical proximity represents the first, fundamental layer of security. Therefore, it is not possible to initiate a transaction from a distance. To delve deeper into the mechanism, you can consult our guide on how NFC technology works, which explains this daily technological miracle in detail.

Contactless Security Myths: Debunking False Beliefs

The spread of new technology often brings with it a baggage of fears and misinformation. Contactless payments are no exception. However, it is essential to distinguish irrational fears from concrete facts, analyzing the most widespread myths to understand why, in most cases, they are baseless.

Myth 1: “They can steal my money just by walking past me”

This is perhaps the most common fear, but also the most unfounded. A malicious actor cannot empty your account by “brushing against you” on the subway with a POS terminal. As mentioned, NFC technology requires a distance of a few centimeters to work. Furthermore, the criminal would need to possess a POS terminal, which is always linked to a registered and traceable business account, making the operation extremely risky for them. Finally, there is a spending limit for PIN-free transactions, set at 50 euros in Italy, which limits potential damage.

Myth 2: “Criminals can clone my card remotely”

Another die-hard myth is that of “wireless” cloning. Contactless transactions are protected by advanced security standards, such as the EMV protocol (the same as Chip & PIN payments). During a payment, the data exchanged between the card and the POS is encrypted. The card does not transmit the real number, but a unique and temporary code, called a “token”, valid for that single transaction. Even if a hacker managed to intercept this communication (an operation complex in itself), the stolen data would be completely useless for making other transactions or cloning the card.

Myth 3: “If I lose my card, they can empty my account”

The fear that losing your card results in a drained account is understandable but exaggerated. The first and most important shield is the 50 euro limit for a single PIN-free operation. But there is more: the European PSD2 regulation introduced further protections, such as a cumulative limit (often set at 150 euros) or a maximum number of consecutive transactions (usually five) without authentication. Once one of these thresholds is reached, the system will mandatorily require the PIN, effectively blocking further attempts. In case of loss, acting promptly is crucial: our guide on how to block a credit card explains all the steps to follow.

The Real Risks of Contactless and How to Mitigate Them

Having debunked the myths, it is fair to acknowledge that no payment system is 100% immune to risks. However, contactless vulnerabilities are specific, known, and, above all, mitigable with the right awareness and a few simple precautions. The most concrete threat does not lie in complex technological attacks, but in more traditional scenarios.

The Risk of “Relay Attack”

The “relay” attack is one of the most technologically sophisticated scenarios. It requires two criminals acting simultaneously: one positions themselves near the victim with a device that captures the card’s NFC signal, while the accomplice, at a distance, uses a second device connected to the first to make a payment on a real POS. Although technically possible, this type of fraud is very rare and complex to implement for small amounts. Bank security systems are also designed to detect anomalous transactions that could suggest an attack of this type.

Theft or Loss of the Physical Card

This remains the most tangible and common risk. If a thief gets hold of your contactless card, they can attempt to make a series of small purchases under the 50 euro threshold, until the cumulative limits are reached. Speed is their weapon. Therefore, your best defense is reactivity. Always activate notifications via SMS or app for every transaction: they will alert you in real-time of any unauthorized spending. Save the number to block the card in your contacts so you can act instantly. Checking your bank statement regularly is another fundamental habit.

The Additional Security of Smartphones and Smartwatches

If security is your priority, paying with your smartphone or smartwatch is the best choice. These devices add a superior level of protection thanks to two key technologies: tokenization and biometric authentication. As with cards, tokenization ensures that your real card number is never shared with the merchant. But the real advantage is that every single transaction, regardless of the amount, must be authorized via facial recognition (Face ID), fingerprint (Touch ID), or the device’s unlock code. This makes device theft almost useless for fraudulent purposes, as without your authentication, payments cannot be made. To learn more, you can consult our guide on tokenization and biometrics in mobile payments.

European Regulations Protecting Consumers

Watching over the security of our payments is a solid European regulatory framework, the Payment Services Directive (PSD2). This legislation introduced stricter requirements for all sector operators, with the aim of making digital transactions safer and protecting consumers. One of the pillars of PSD2 is Strong Customer Authentication (SCA). In the contactless world, SCA translates into the aforementioned cumulative spending and transaction count limits, beyond which authentication with a PIN is mandatory. This measure creates an automatic barrier against the fraudulent and prolonged use of a lost or stolen card. Furthermore, the regulation establishes precise responsibilities for banks in case of fraud, reducing the deductible charged to the customer for unauthorized operations occurring before the card block to a maximum of 50 euros, provided there was no gross negligence on the user’s part.

Practical Tips for a Serene Contactless Experience

Adopting contactless technology means simplifying life, not complicating it with unjustified anxieties. With a few simple habits, it is possible to take advantage of all the convenience of this system while minimizing any residual risk. Here is a list of practical tips:

- Activate spending notifications: Set up your banking app or SMS service to receive an instant alert for every transaction. It is the quickest way to spot suspicious activity.

- Check your bank statement: Get into the habit of regularly verifying your card movements, even just once a week.

- Do not hand over the card: When paying, always keep the card in your hands. Tap it on the POS yourself.

- Prefer device payments: For maximized security, use digital wallets like Apple Pay or Google Pay. Biometric authentication offers superior protection.

- Use RFID protective cases (optional): Although the risk of remote skimming is extremely low, using shielded wallets can offer greater peace of mind.

- Save useful numbers: Keep the toll-free number to immediately block your card in case of theft or loss handy, perhaps in your phone contacts and also in a safe place at home.

In Brief (TL;DR)

Contactless payments are at the center of a heated debate on security: this ultimate guide clarifies myths to debunk and real risks, so you can use cards and smartphones without fear.

We analyze the real risks, explain protection mechanisms, and offer practical tips for using cards and smartphones without fear.

We analyze protection mechanisms, from spending limits to encryption, and provide practical tips for using your cards without fear.

Conclusions

In light of the analysis, we can state with reasonable certainty that contactless payments are an extremely safe transaction method. The most widespread fears, such as remote money theft or “on-the-fly” cloning, belong more to the realm of myths than reality. Security is based on multiple layers of protection: the proximity requirement of NFC technology, data encryption, tokenization, and, above all, the spending limits imposed by European PSD2 regulations. The most concrete and common risk remains the physical theft of the card, a danger nevertheless effectively curbed by single-operation limits and cumulative limits, which require a PIN after a certain number of uses. Technological evolution, with the introduction of payments via smartphone and smartwatch, has further raised the security bar, making biometric authentication the new frontier of protection. In a world moving between tradition and innovation, understanding and trusting these technologies means embracing the future, simplifying everyday life without sacrificing peace of mind.

Frequently Asked Questions

This is a widespread myth, but extremely unlikely in reality. To perform a transaction, a POS terminal must be connected to a registered commercial account, making the fraudster easily traceable. Furthermore, NFC technology requires a minimum distance of 3-4 centimeters to work, and cards are equipped with security mechanisms that prevent unauthorized multiple and close-range transactions.

In Italy, as in most of Europe, the limit for a single contactless transaction without the need to enter the PIN is 50 euros. There are also cumulative limits: after 5 consecutive operations or upon reaching a total of 150 euros spent, the system will require the PIN to be entered for greater security.

Both methods are very safe, but the smartphone offers additional levels of protection. When you pay with your phone, every transaction, regardless of the amount, must be authorized via a biometric method (fingerprint or facial recognition) or with the device’s unlock code. Furthermore, the smartphone uses «tokenization», a process that replaces your real card data with a unique virtual code for each purchase, preventing the merchant from seeing or storing your card number.

The first thing to do is to block the card immediately to prevent any fraudulent use. You can do this by calling your bank’s emergency toll-free number, active 24/7, or by using the mobile banking app or online banking website. Immediately after, it is essential to file a report with law enforcement (Police).

Remote cloning of a contactless card is a very low risk. The EMV chip generates a unique encrypted code for every single transaction, making intercepted data unusable for subsequent operations. Although it is theoretically possible to capture some data with an RFID reader, the information obtained would not include the CVV security code (the 3-digit number on the back), which is indispensable for most online transactions, nor would it be sufficient to create a functioning physical card.

Still have doubts about Contactless: Safe or Risky? The Ultimate Guide?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.