At the café for a coffee, at the supermarket for the weekly grocery run, or in a store for an impulse buy: the way we pay says a lot about us and the times we live in. On one hand, there is the reassuring solidity of Chip and PIN, a method requiring a deliberate gesture and a secret code. On the other, the almost magical speed of contactless, which concludes the transaction with a simple “tap.” This duality is not just a technological issue but reflects a broader cultural dialogue, especially in a context like Italy, suspended between a strong attachment to tradition and a constant push toward innovation. Understanding the differences between these two payment systems means exploring how speed, security, and habits intertwine in our daily lives.

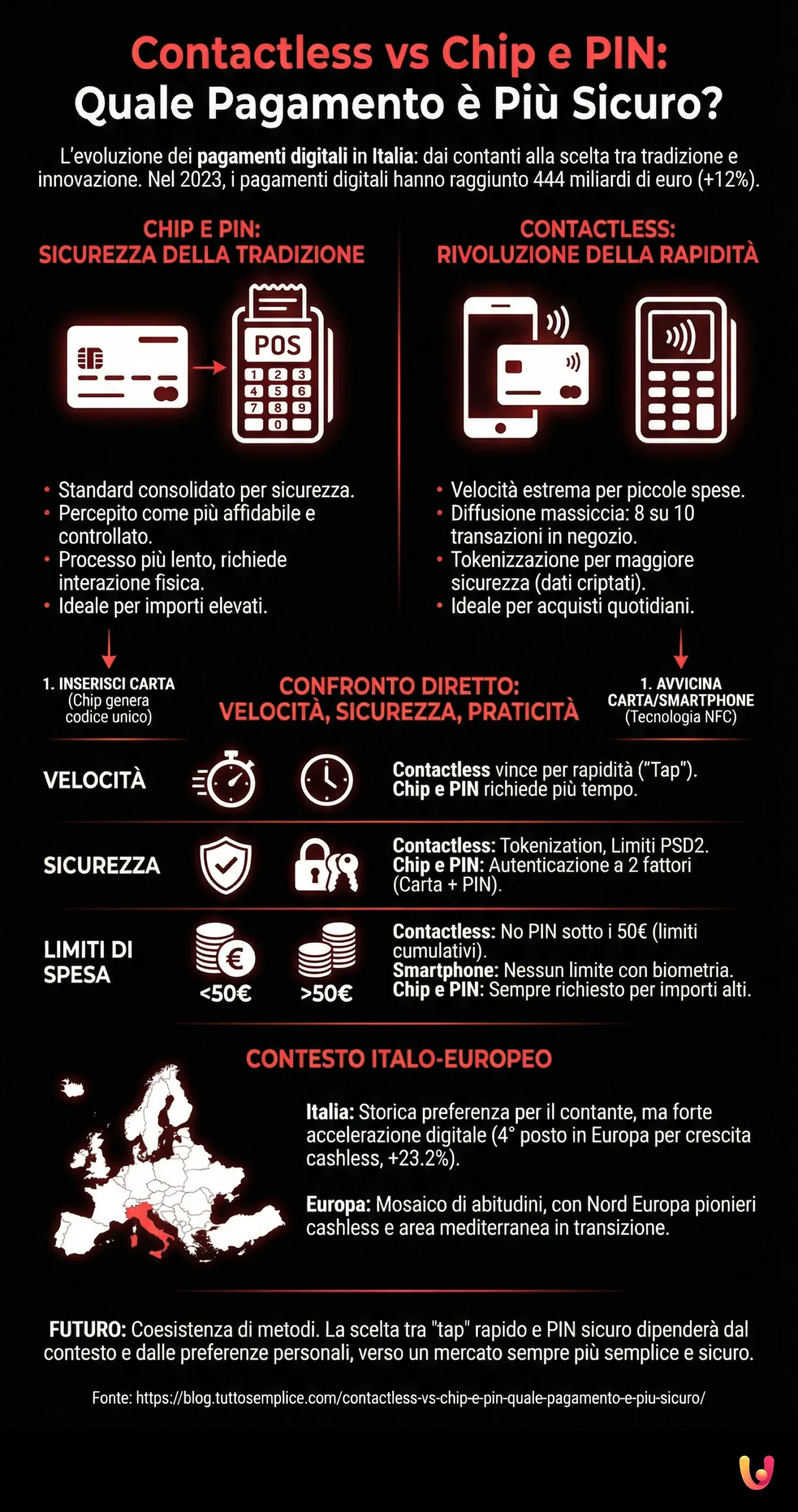

The advent of digital payments has transformed our habits, pushing more and more consumers to abandon cash. In Italy, this transition is evident: in 2023, the value of digital payments reached 444 billion euros, marking a 12% increase compared to the previous year. This change is largely driven by the growing popularity of cards, which today represent the preferred payment method for many, outlining an increasingly cashless future in the European market and Mediterranean culture as well.

Chip and PIN Payments: The Security of Tradition

The Chip and PIN method has been the standard for secure electronic payments for years. Its operation is based on the interaction between two key elements: the microchip embedded in the card and the Personal Identification Number (PIN). When the card is inserted into a POS terminal, the chip generates a unique encrypted code for that specific transaction, making cloning extremely difficult. Entering the PIN serves as an additional layer of authentication, confirming that the person using the card is the legitimate owner. This process, although slower compared to contactless, is perceived by many as safer and more reliable, a consolidated gesture that offers a sense of control over the transaction.

This perception of security has deep roots, especially in a culture like Italy’s, where prudence in financial matters is an important value. The Chip and PIN system embodies a methodical and deliberate approach to payment, in contrast to the near-instantaneity of new technologies. Although innovation advances, the familiarity and robustness of this method continue to make it a fundamental reference point for consumers and merchants, a pillar of the transition from cash to digital.

Contactless Payments: The Revolution of Speed

Contactless payment has introduced a real revolution in everyday life, based on NFC (Near Field Communication) technology. This system allows a purchase to be finalized simply by bringing the card, smartphone, or smartwatch close to the POS terminal, without any physical contact. Speed is its most obvious advantage: transactions are completed in a few seconds, eliminating the need to insert the card or type codes for small amounts. In Italy, as in the rest of Europe, it is possible to pay without entering the PIN for expenses up to 50 euros. This has made contactless the ideal choice for small daily expenses, from coffee to bus tickets.

The spread of this technology has been exponential. In Italy, almost 8 out of 10 digital in-store transactions take place in “tap & go” mode, for a value that has reached 240 billion euros. This success is not just Italian, but European: in many countries, over 80% of card payments occur via contactless mode. Massive adoption has also been accelerated by new social habits, where reducing physical contact has become a priority, consolidating contactless as the new standard of convenience.

Direct Comparison: Speed, Security, and Convenience

When comparing Chip and PIN and contactless, clear differences emerge that respond to different needs. The choice between the two methods often depends on a compromise between speed, perception of security, and context of use.

Speed and User Experience

Contactless wins hands down on the speed front. A simple “tap” of a few seconds is all that is needed to complete a payment, making it ideal in situations where the line needs to move quickly, such as at the bar, on public transport, or in fast-food restaurants. Chip and PIN, requiring card insertion and code entry, is an inherently slower process. However, this more measured pace is preferred by some users for larger purchases, where confirmation via PIN offers a feeling of greater security and deliberate control over spending.

Security Comparison

Both methods are designed to be secure, but with different approaches. Chip and PIN bases its security on a two-factor authentication process: possession of the card (something you have) and knowledge of the PIN (something you know). This makes it very robust against fraud in case of card loss or theft. Contactless, on the other hand, uses tokenization, especially when paying with a smartphone: real card data is not transmitted but replaced by a “disposable” code (token). Furthermore, European PSD2 regulation imposes limits for payments without a PIN, such as a cumulative cap of 150 euros or a maximum of 5 consecutive transactions, after which strong authentication is required. This creates a multi-layered protection system that minimizes risks.

Spending Limits and Regulations

In Italy and much of Europe, the limit for contactless payments without a PIN is set at 50 euros per single transaction. Once this threshold is exceeded, the system still requires the code to be entered, combining the convenience of contactless with the security of the PIN. For payments with smartphones via digital wallets like Apple Pay or Google Pay, however, there are no amount limits for contactless, as authentication takes place directly on the device via facial recognition or fingerprint. The European PSD2 (Payment Services Directive 2) regulation has further strengthened security, introducing Strong Customer Authentication (SCA) to protect consumers from fraud online and in stores.

The Italo-European Context: A Mosaic of Habits

The adoption of digital payments in Europe is not uniform but reflects a mosaic of different cultures and habits. While Northern European countries have long been pioneers of an almost completely cashless society, the Mediterranean area, and Italy in particular, shows a more nuanced picture. Historically, Italy has been a country with a strong preference for cash, but recent data indicates a decisive acceleration towards digital. In 2024, Italy ranked fourth in Europe for the growth of cashless payments, with a 23.2% increase. This overtaking, even if slower compared to other nations, signals a profound cultural shift.

This transition is driven both by technological innovation, such as the widespread diffusion of contactless payments, and by a change in consumer habits, who are increasingly using cards even for small expenses. The challenge for Italy is to balance this innovative push with the need for inclusion, ensuring that everyone, including less digitized population segments, can benefit from the advantages of new payment systems. The future will likely see a coexistence of different methods, where the choice between a quick “tap” and a secure PIN will depend on the context and personal preferences, in a market evolving towards simplicity and security.

In Brief (TL;DR)

This article analyzes in detail the differences between contactless and Chip and PIN payments, comparing their speed, security levels, and daily practicality.

We will analyze the key differences in terms of speed, security, and spending limits to help you choose the solution that best suits you.

We analyze which of the two methods offers the best combination of convenience and protection for your transactions.

Conclusions

The opposition between contactless and Chip and PIN payments does not define an absolute winner, but rather two sides of the same coin: the evolution of personal finance. On one hand, Chip and PIN remains a symbol of tangible security and control, rooted in established habits. On the other, contactless, based on NFC technology, embodies the speed and efficiency required by modern life. The Italian and European experience demonstrates that it is not a matter of substitution, but of integration. The two technologies coexist and complement each other, offering users the flexibility to choose the most suitable tool for every situation.

The future of payments is moving towards an even deeper integration between security and immediacy. As Italy continues its path of digitalization, gradually overcoming dependence on cash, the real innovation will lie in creating an inclusive, simple, and secure payment ecosystem for everyone. Whether inserting a PIN or bringing a smartphone close, the ultimate goal remains the same: to make every transaction a fluid and protected experience in an increasingly connected world.

Frequently Asked Questions

Contactless is not less secure; it simply utilizes different safety protocols. While Chip and PIN relies on a secret code for verification, contactless technology employs encryption and tokenization to protect data. Furthermore, strict transaction limits and the requirement for occasional PIN entry after consecutive low-value purchases ensure that fraud risks remain minimal even without a physical code for every transaction.

In Italy and many European nations, the standard limit for a single tap transaction without entering a code is 50 euros. However, security regulations known as PSD2 may trigger a PIN request if you exceed a cumulative spending threshold of approximately 150 euros or after five consecutive contactless payments, regardless of the individual transaction amounts.

Mobile wallets offer a higher level of security and convenience compared to standard plastic cards. Unlike physical cards that have a 50 euro limit before requiring a PIN, payments made via smartphones usually have no specific cap because they are authenticated via biometrics like facial recognition or fingerprints. Additionally, they use tokenization, meaning your actual card details are never shared with the merchant.

This is a security feature rather than a malfunction. Under European banking regulations, strong customer authentication is periodically required to verify that the legitimate cardholder is making the purchase. This usually happens when you reach a specific cumulative value of contactless spend or a set number of consecutive transactions, ensuring that a lost or stolen card cannot be used indefinitely.

Near Field Communication technology facilitates a secure data exchange between the card or device and the payment terminal over a very short distance. It generates a unique encrypted code for each specific transaction, which makes cloning the card data extremely difficult compared to older magnetic stripe methods. This ensures that even if the signal were intercepted, the data would be useless for future transactions.

Still have doubts about Contactless vs. Chip and PIN: Which Payment Method Is Safer??

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.