In the wallets of millions of Italians, a quiet revolution is changing the way we pay every day. Traditional debit cards, for decades the pillars of daily transactions, are giving way to a new generation of more powerful and versatile tools. This shift, marked primarily by the farewell to the Maestro network, is not just a technical change but a true cultural leap that merges tradition and innovation. Understanding the differences between the old and new networks, such as Maestro, VPay, Debit Mastercard, and Visa Debit, is essential for navigating the world of digital payments confidently and unlocking their full potential.

Payment networks are the technological systems that allow money to move electronically from a customer’s account to a merchant’s. For years, in Italy and across Europe, the landscape was dominated by networks like Maestro and, to a lesser extent, VPay, often alongside the national PagoBANCOMAT network. These tools, designed primarily for in-person use with a PIN, served entire generations exceptionally well. However, the unstoppable rise of e-commerce and increasing globalization have highlighted their limitations, prompting industry giants Mastercard and Visa to lead a monumental transition toward more comprehensive and modern solutions.

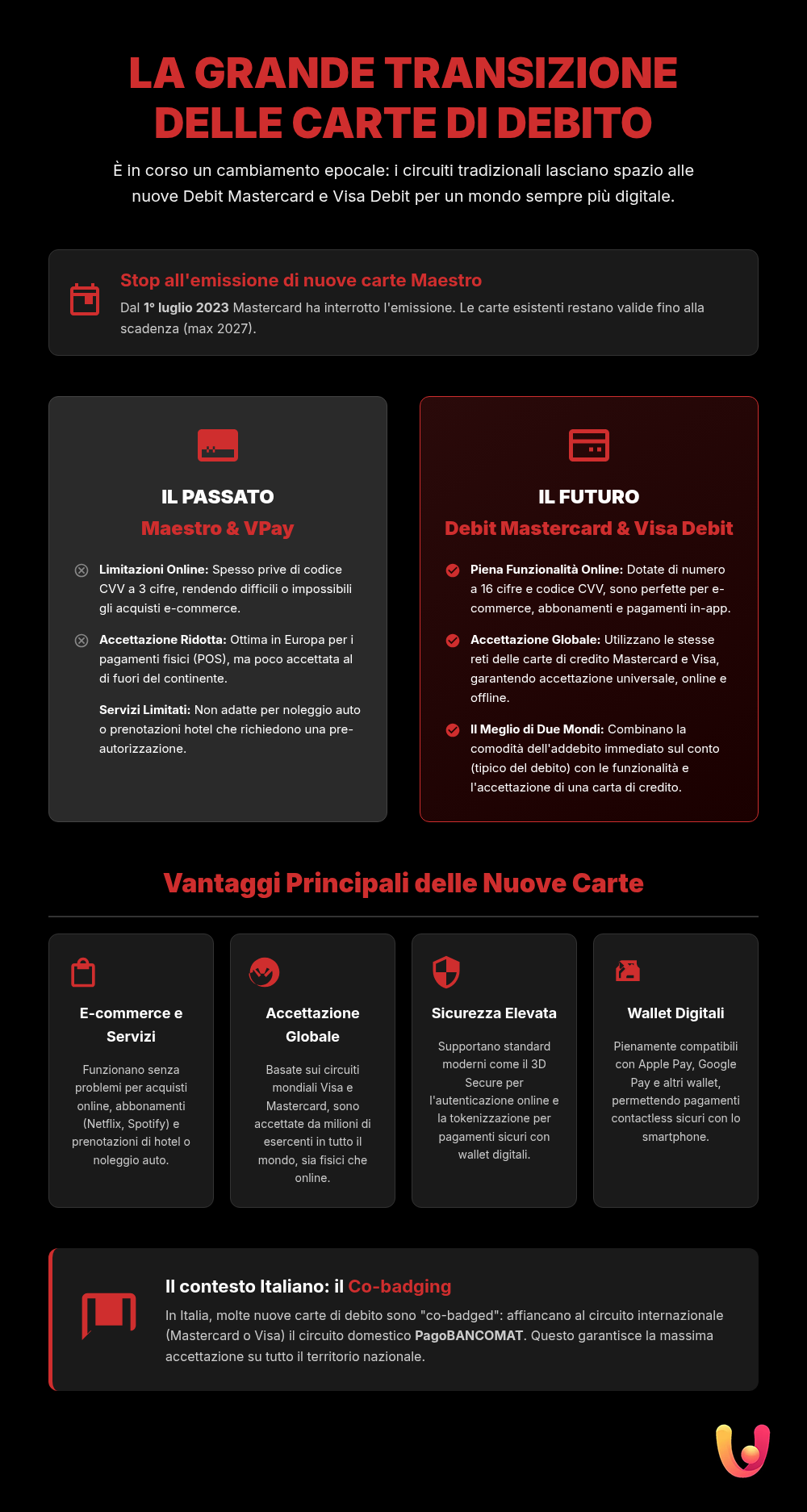

The Current Landscape: Farewell to Maestro and the Role of PagoBANCOMAT

The most significant decision that has reshaped the debit card landscape came from Mastercard. Starting July 1, 2023, the company decided to stop issuing new cards on the Maestro network, a brand that had served consumers for over thirty years. Existing cards will remain valid until their expiration date (and no later than 2027), but all new issues, renewals, and replacements are now being handled through the main Mastercard network, giving rise to what are known as Debit Mastercards. This strategic choice stems from a specific market need: Maestro cards, designed for in-store payments, were not structured for e-commerce, as they often lacked the 3-digit security code (CVV) required for online transactions.

The end of the Maestro era is not a simple replacement but an evolution driven by the need to unify the payment experience, making it seamless and secure both at the corner store and on international e-commerce sites.

In Italy, this change is taking place in a unique context, characterized by the strong presence of the PagoBANCOMAT network. Many Italian debit cards are “co-badged,” meaning they feature both the logo of an international network (like Maestro or, in the future, Debit Mastercard) and the PagoBANCOMAT logo. This allows the cardholder to choose which network to use at the time of payment. Although Italy still shows a strong attachment to cash and ranks among the last in Europe for the number of digital transactions per capita, the growth of electronic payments is steady, and the transition to more modern cards could further accelerate this process.

Maestro: The Tradition Bids Farewell

Launched in 1991, the Maestro network was synonymous with debit cards for decades across much of Europe, including Italy. Its strength lay in its simplicity and security for its time: transactions were conducted almost exclusively by inserting the card into a POS terminal and entering a PIN. This system, based on real-time online authorization, guaranteed the merchant that the funds were available in the customer’s account. Maestro became a trusted companion for daily shopping, ATM withdrawals, and in-store payments, becoming deeply ingrained in the habits of European consumers.

Maestro’s main limitation, however, emerged with the spread of the internet. Born in a pre-digital era, the network was not designed for the world of e-commerce. Most Maestro cards did not have a CVV code, the three-digit number on the back essential for validating online purchases. This absence made it virtually impossible to use the card to buy online, forcing consumers to use other tools like credit or prepaid cards. Furthermore, its acceptance, while widespread in Europe, could be more limited outside the continent compared to the main Mastercard or Visa networks. The farewell to Maestro thus marks the end of an era—that of “physical” payments—to embrace a more integrated and digital future.

VPay: Visa’s Answer

Introduced by Visa starting in 2006, VPay was designed as the direct competitor to Maestro. It is a debit network created specifically for the European market, based entirely on the more secure Chip & PIN technology (EMV standard). Unlike older magnetic stripe cards, the information on a VPay card is stored in the microchip, making cloning and fraud extremely difficult. Every transaction requires the physical insertion of the card and entering the PIN, almost completely ruling out offline or signature-based operations.

Similar to Maestro, VPay also showed its limitations as digitalization advanced. Its architecture, focused on the security of physical transactions, does not make it natively compatible with most online payments. VPay’s acceptance is excellent in Europe, where it can be used for payments and withdrawals at millions of locations within the SEPA area, but it is virtually non-existent in the rest of the world. For these reasons, VPay is also being progressively replaced by its natural evolution: the Visa Debit. Although there is no official “shutdown” date as with Maestro, many banks are already migrating their customers to the new Visa Debit cards, which offer a much more comprehensive user experience.

Debit Mastercard and Visa Debit: The Advancing Innovation

The real change in the world of debit cards is represented by the arrival of Debit Mastercard and Visa Debit. Unlike Maestro and VPay, these are not separate networks but debit cards that operate directly on the global Mastercard and Visa networks—the same ones used for credit cards. This seemingly technical difference translates into a revolution for the end-user, who gets a tool with the advantages of a debit card (immediate debit and spending control) and the power of a credit card.

Imagine being able to use the same card you use for grocery shopping to book a hotel online, rent a car abroad, or subscribe to your favorite streaming service. This is the promise kept by the new debit cards.

The transition is already underway: whenever an old Maestro card expires, the bank automatically replaces it with a new Debit Mastercard, keeping the same linked account number. This process ensures a smooth migration for consumers, who find themselves with a card that looks familiar but has significantly enhanced features.

The Advantages of the Change

The adoption of the new debit cards brings a series of concrete benefits that improve the daily payment experience.

- Global Acceptance: Debit Mastercard and Visa Debit cards are accepted wherever the Mastercard and Visa logos are displayed worldwide, meaning at tens of millions of physical and online stores, far surpassing Maestro’s acceptance network.

- Unlimited Online Payments: Equipped with a 16-digit card number, expiration date, and CVV code, these cards work perfectly for e-commerce. This eliminates the need for a separate card for internet purchases.

- Additional Services: The new debit cards inherit features previously exclusive to credit cards. These include the ability to make pre-authorizations for hotels and car rentals, and access to protection mechanisms like the right to a chargeback in case of unauthorized or disputed transactions.

- Advanced Security: In addition to Chip & PIN, these cards benefit from the most modern security systems like 3D Secure for online payments and tokenization, which replaces the actual card data with a unique code during transactions, especially via digital wallets like Apple Pay and Google Pay.

The Impact on the Italian Consumer

For the Italian consumer, accustomed to a financial culture where cash still plays a significant role and the “Bancomat” card is an institution, this transition represents an important step towards modernity. The switch to Debit Mastercard and Visa Debit greatly simplifies life for those who travel and shop online. It will no longer be necessary to wonder if one’s debit card will be accepted abroad or if it will work to pay for a subscription. The new debit card becomes a universal tool, capable of adapting to every payment need, both in Italy and around the world. For those who travel, it’s always a good practice to know the best ways to use cards abroad safely.

This change also encourages the digitalization of payment habits. The ability to easily save one’s debit card on apps and websites for recurring payments or quick purchases pushes even the most traditional consumers to become familiar with digital tools. In a country that is slowly catching up to the rest of Europe in electronic payments, the adoption of more versatile and powerful cards is a key catalyst for innovation and convenience.

In Brief (TL;DR)

A complete guide to understanding the differences between the Maestro, VPay, Debit Mastercard, and Visa Debit networks, and choosing the card best suited to your needs in Italy and abroad.

Discover the differences in acceptance, security, and online features to choose the debit card that best fits your needs.

Finally, we will evaluate their prevalence and security levels to help you understand which one to choose.

Conclusions

The transition from traditional networks like Maestro and VPay to the new Debit Mastercard and Visa Debit marks a turning point in the payments industry. This is not just a simple replacement, but an evolution that aligns debit cards with the needs of an increasingly connected and digital world. For consumers, this means greater freedom, universal acceptance, and a level of security and services previously reserved only for credit cards. The farewell to the old Maestro card is not a loss, but the beginning of a new era of simpler, safer, and borderless payments, combining the tradition of real-time spending control with the innovation of global acceptance.

Frequently Asked Questions

Maestro and VPay cards are being gradually replaced to align with new payment standards dictated by the evolution of shopping habits. The new networks, like Debit Mastercard and Visa Debit, offer greater compatibility for online purchases and wider international acceptance, overcoming the limitations of the old systems.

The key difference lies in the ability to make online purchases. The new Debit Mastercard and Visa Debit cards have a 16-digit number and a CVV security code, just like credit cards, allowing for simple and secure online shopping. This functionality was often limited with old Maestro cards, which were primarily designed for physical stores.

The VPay card was designed primarily for the European market, and its acceptance is guaranteed within the SEPA area countries. Outside of Europe, its acceptance can be very limited. The new Visa Debit cards, on the other hand, benefit from Visa’s global network, ensuring much broader acceptance almost everywhere in the world.

Yes, the new Debit Mastercard and Visa Debit cards are designed with high security standards for online purchases. They include the 3-digit CVV security code and support protocols like 3D Secure (often called Mastercard Identity Check or Visa Secure), which requires additional authentication to confirm the transaction, for example, via an app or an SMS code.

For in-store payments via POS, almost nothing changes. The big news is the ability to use the card for online purchases and to subscribe to digital services, which were previously often reserved for credit cards. The debit from your bank account remains immediate, unlike with credit cards.

Still have doubts about Debit Cards: A Guide to Maestro, VPay, Mastercard, and Visa?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.