Who hasn’t found themselves at the supermarket checkout with a card that doesn’t work? A moment of embarrassment, followed by the frustration of not being able to complete the purchase. The demagnetization of credit, debit, or prepaid cards is a more common problem than one might think, and it can happen to anyone. But what should you do when your faithful payment companion abandons you? Before rushing to the bank to ask for a replacement, there are some DIY remedies that might save the day. In this article, we will explore the causes of demagnetization, methods to try and recover the card, and, above all, how to prevent this annoying inconvenience.

But be careful: some DIY methods can further damage the card. We will therefore guide you with caution, illustrating the safest solutions and the myths to debunk.

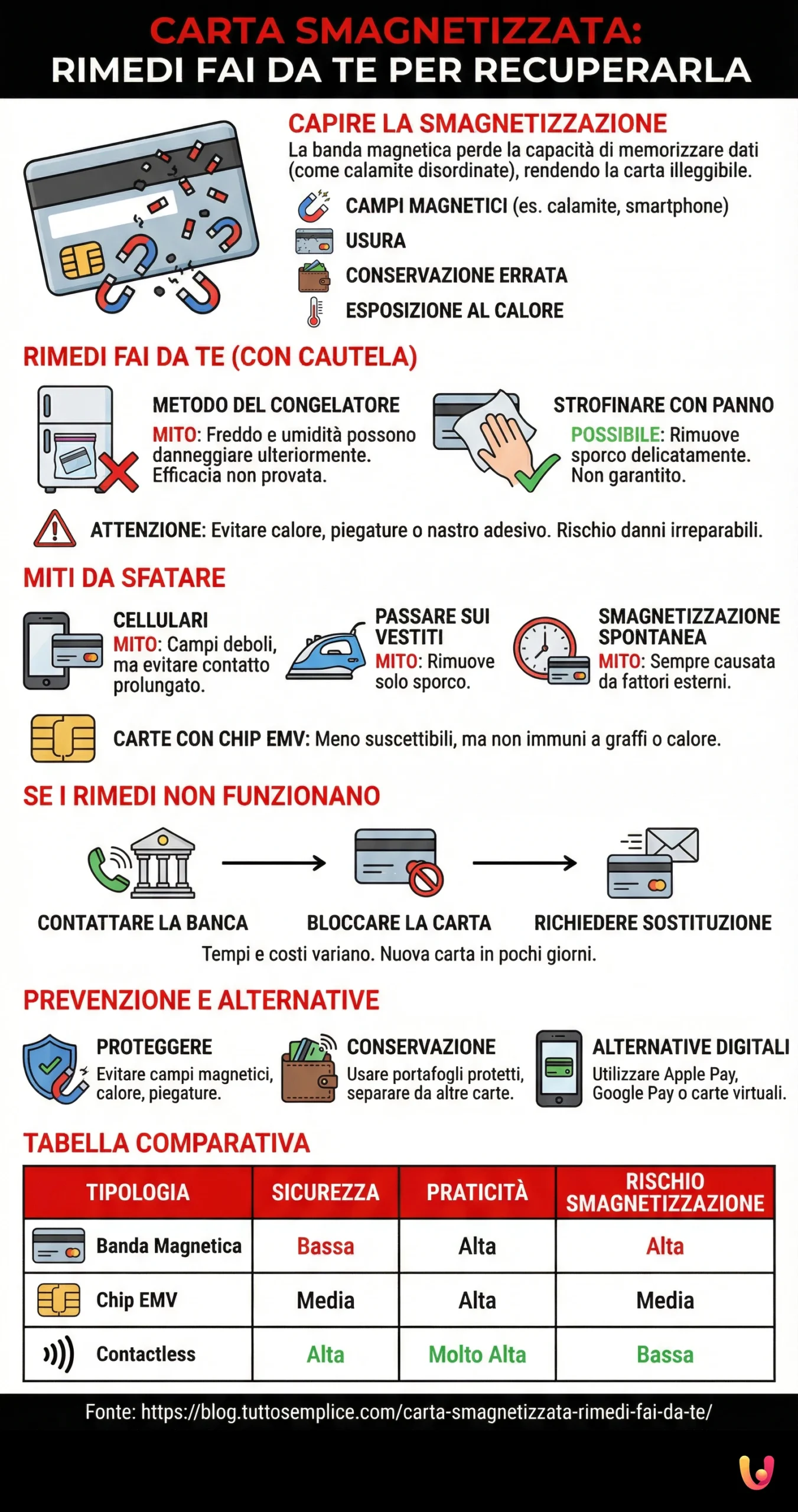

Understanding Demagnetization

What is demagnetization and how does it occur

Traditional payment cards work thanks to a magnetic stripe located on the back. This stripe contains the information necessary to authorize transactions. Demagnetization occurs when this stripe loses its ability to store data, making the card unreadable by POS devices. Imagine the magnetic stripe as a series of tiny magnets aligned: when these magnets lose their order, the card no longer functions correctly.

Signs of a demagnetized card

How can you tell if your card is demagnetized? The most common signs are:

- Declined transactions: the POS cannot read the card and the purchase does not go through.

- Error messages: the POS displays messages like “unreadable card” or “read error”.

- Difficulty withdrawing cash: the ATM does not recognize the card.

Common causes of demagnetization

The causes of demagnetization can be various:

- Magnetic fields: proximity to magnets, smartphones, speakers, or other electronic devices can interfere with the magnetic stripe.

- Wear and tear: frequent use and normal deterioration can damage the magnetic stripe.

- Improper storage: keeping the card in a wallet in contact with other cards or metal objects can scratch or demagnetize it.

- Exposure to heat: high temperatures can alter the properties of the magnetic stripe.

DIY Remedies for Demagnetized Cards

Let’s now look at some DIY remedies that you could try before contacting the bank. However, remember that the effectiveness of these methods is not guaranteed and that, in some cases, they could even worsen the situation.

The freezer method: truth or myth?

A popular, but dubiously effective method, consists of putting the demagnetized card in a plastic bag and then in the freezer for a few hours. The idea behind this method is that the cold can realign the magnetic particles of the stripe. However, there is no scientific evidence to support this theory. On the contrary, the humidity present in the freezer could further damage the card.

Rubbing the card with a cloth: does it really work?

Another common method involves gently rubbing the magnetic stripe with a soft, dry cloth. This could remove any dirt or dust residues interfering with reading. However, it is important to be very gentle to avoid scratching the stripe.

Other DIY methods (heat, force, tape) and their effectiveness

Other DIY methods can be found online, such as bringing the card close to a heat source (for example, a light bulb), bending it slightly, or applying adhesive tape over the magnetic stripe. We strongly advise against trying these methods, as they could irreparably damage the card.

Myths to Debunk About Demagnetization

There are many popular beliefs about card demagnetization, but not all of them are true. Let’s debunk some common myths:

Cell phones and cards: a (sometimes) peaceful coexistence

Many think that keeping a cell phone near a card inevitably demagnetizes it. In reality, modern cell phones generate a relatively weak magnetic field, which is unlikely to damage a card. However, it is good practice to avoid keeping the card in close contact with the cell phone for long periods, especially if it is an older or low-quality model.

Not all cards are equal: differences in susceptibility

Cards with an EMV chip are generally less susceptible to demagnetization compared to cards with only a magnetic stripe. This is because the chip holds information more securely and protected. However, even chip cards can be damaged by scratches, bending, or exposure to excessive heat.

Other common myths to debunk

- Rubbing the card on clothes demagnetizes it: false. This gesture might at most remove a bit of dirt from the magnetic stripe.

- Cards demagnetize by themselves: false. Demagnetization is always caused by an external factor.

- All demagnetized cards are irrecoverable: false. In some cases, the card can be reactivated or replaced.

What to Do if DIY Remedies Don’t Work

If DIY remedies haven’t worked, you need to contact the bank or the card issuer to request a replacement.

Contacting the bank or card issuer

The phone number to contact customer support is usually found on the back of the card or on the bank’s website. Explain what happened and follow the instructions provided by the operator.

Procedures for card replacement

The procedure for card replacement varies depending on the bank. Generally, you need to:

- Block the demagnetized card to prevent fraudulent use.

- Request a new card, which will be mailed to your address or can be picked up at a branch.

- Activate the new card following the instructions provided by the bank.

Replacement times and costs

Replacement times vary depending on the bank and the type of card. Generally, the new card arrives within a few business days. There may be costs for replacement, so it is good to inquire in advance.

Focus on Different Card Types

Credit, debit, and prepaid cards: technological differences

Payment cards are divided into three main categories:

- Credit cards: allow you to make purchases on credit, paying the balance at the end of the month or in installments.

- Debit cards: debit the purchase amount directly from the checking account.

- Prepaid cards: can only be used until the credit loaded onto the card is exhausted.

From a technological point of view, cards can be equipped with:

- Magnetic stripe: the most traditional technology, present on almost all cards.

- EMV Chip: a microchip that holds information more securely.

- Contactless technology: allows you to make payments by bringing the card close to the POS.

Vulnerability to demagnetization: which card is most at risk?

Cards with only a magnetic stripe are the most vulnerable to demagnetization. Cards with an EMV chip are more secure, but can still be damaged by scratches or bending. Contactless cards are the least at risk, as they do not require physical contact with the POS.

What to Do with a Demagnetized Card Abroad

Losing or having a demagnetized card during a trip abroad can be a stressful experience. Here are some tips for dealing with the situation:

Contacting the bank from abroad: useful numbers and procedures

Before leaving, write down the phone number to contact your bank from abroad. This number is usually found on the back of the card or on the bank’s website. If your card has been lost or stolen, block it immediately.

Assistance in the local language: how to get it

If you have difficulty communicating in a foreign language, ask for help from hotel staff or a friend who speaks the local language. Alternatively, you can use a translation app or search online for emergency numbers for tourists.

Precautions to avoid problems

- Carry more than one card, preferably from different networks (Visa, Mastercard, American Express).

- Store cards in a safe place, separate from cash and documents.

- Make a photocopy of your cards and keep it in a separate place.

- Inform your bank of your trip abroad, so they don’t block the card for suspicious fraudulent activity.

Alternative Solutions in Case of a Demagnetized Card

If your card is demagnetized and you need to make payments, you can consider some alternative solutions:

Digital wallets: Apple Pay and Google Pay

If you have a compatible smartphone, you can use a digital wallet like Apple Pay or Google Pay. These services allow you to pay via your phone, without needing the physical card.

Temporary virtual cards

Some banks offer the possibility of generating temporary virtual cards, which can be used to make purchases online or via smartphone. These cards are ideal for emergency situations, as they can be generated and used immediately.

Preventing Demagnetization

Prevention is always better than cure. Here are some tips to protect your card from demagnetization:

How to protect the card from magnetic fields

- Avoid keeping the card near magnets, smartphones, speakers, or other electronic devices.

- Do not leave the card exposed to the sun or heat sources.

- Do not bend or scratch the card.

Tips for proper card storage

- Store the card in a suitable wallet, preferably with RFID protection.

- Separate the card from other cards or metal objects.

- Do not keep the card in your back pocket, where it could bend or break.

Alternatives to traditional cards (chip cards, contactless)

Cards with an EMV chip and contactless cards are less vulnerable to demagnetization compared to cards with only a magnetic stripe. If possible, choose one of these options for your payments.

Comparison Table

| Card Type | Security | Practicality | Susceptibility to Demagnetization |

|---|---|---|---|

| Card with magnetic stripe only | Low | High | High |

| Card with EMV chip | Medium | High | Medium |

| Contactless card | High | Very High | Low |

In Brief (TL;DR)

Payment cards can become demagnetized due to various factors, such as exposure to magnetic fields, wear and tear, and improper storage.

There are some DIY remedies you can try, but the safest solution is to contact the bank and request a card replacement.

To prevent demagnetization, it is important to protect the card from magnetic fields and store it correctly.

Conclusions

Payment card demagnetization can be an annoying inconvenience, but with the right information and precautions, it is possible to minimize risks and manage the problem effectively. Remember that prevention is fundamental: protect your card and store it with care to avoid unpleasant surprises. If, despite precautions, your card becomes demagnetized, don’t despair! Contact your bank and request a new card.

And if you are looking for a new payment card, with safer and more innovative technologies, visit the section of TuttoSemplice.com dedicated to the best offers for credit, debit, and prepaid cards. You will surely find the solution best suited to your needs!

Frequently Asked Questions

It is possible, but unlikely. Modern cell phones generate a weak magnetic field, which is unlikely to damage a card. However, it is better to avoid keeping the card in close contact with the cell phone for long periods.

If the card is not read by the POS or the ATM, it is likely demagnetized. Other signs can be the presence of scratches or bends on the magnetic stripe.

There are some DIY remedies, but their effectiveness is not guaranteed. In case of doubt, it is better to contact the bank and request a card replacement.

Replacement costs vary depending on the bank and the type of card. Check with your bank to find out the expected costs.

Contact your bank immediately and block the card. Carry more than one card with you and keep them in a safe place.

Yes, there are several alternatives, such as digital wallets (Apple Pay, Google Pay) and temporary virtual cards.

Still have doubts about Demagnetized Card: DIY Remedies to Recover It?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.