In an Italy where culinary and cultural tradition blends with an increasingly decisive push toward innovation, payment methods are evolving to keep pace with modern life. Leaving your wallet at home is no longer a utopia, but a convenient reality thanks to solutions like Google Pay, now integrated into Google Wallet. This tool transforms your smartphone into a digital wallet, combining the practicality of technology with the daily need to make purchases quickly and securely. The adoption of digital payments in our country is constantly growing, marking a cultural shift that embraces all generations and reflects a new way of conceiving money.

This guide is designed for anyone wishing to fully understand how Google Pay works within the Italian and European context. We will illustrate step by step how to set up your cards and how to use this service for everyday payments, from coffee at the bar to online purchases. We will analyze aspects related to security, compatibility with Italian banks, and the advantages this technology brings to personal finance management, combining digital efficiency with the consolidated habits of our Mediterranean culture.

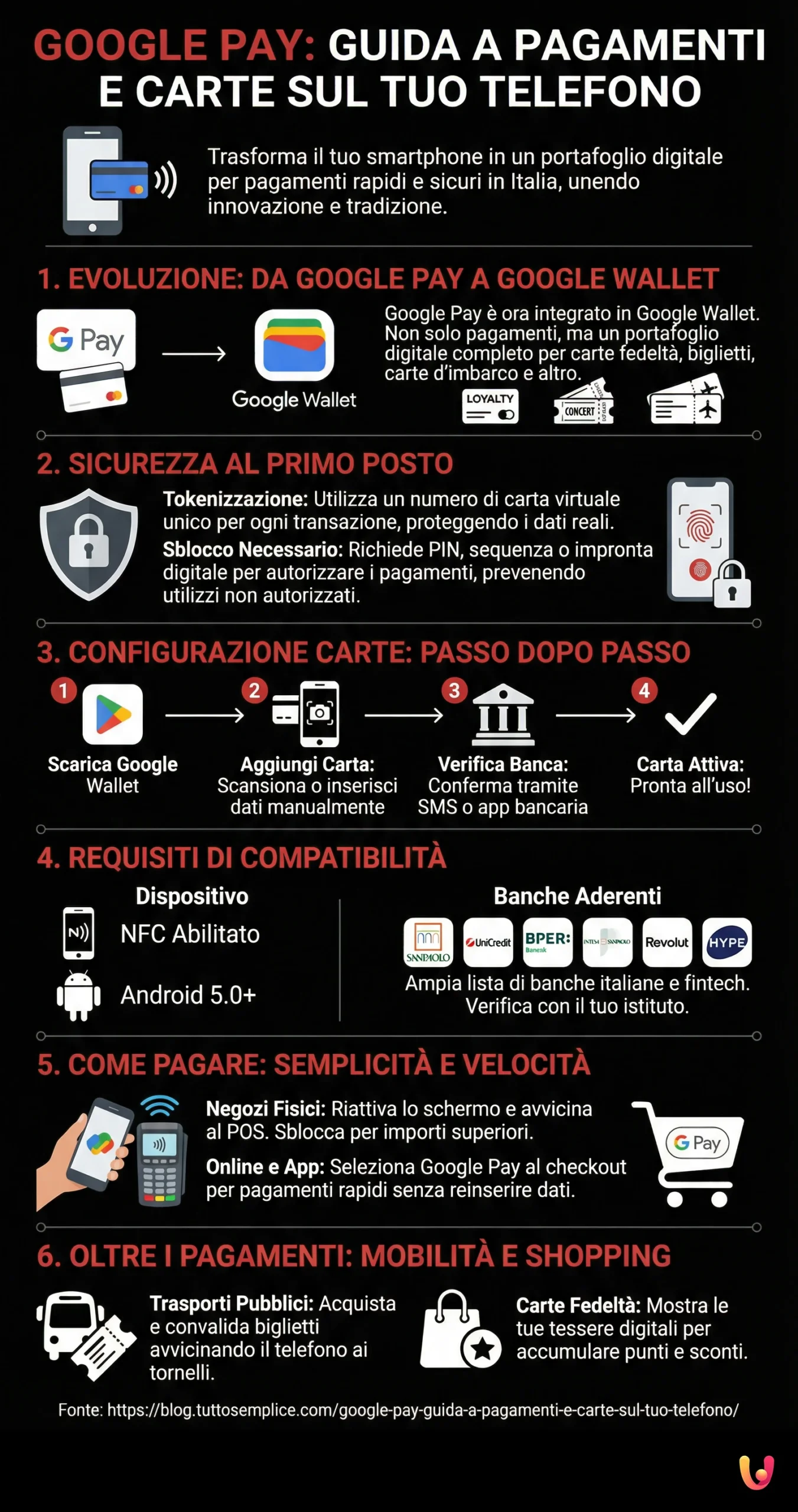

What Is Google Pay and How It Evolved into Google Wallet

Google Pay is the mobile payment service developed by Google that allows you to make purchases using Android devices, such as smartphones and smartwatches. Born to simplify transactions, it allows you to register your credit, debit, and prepaid cards within an application, eliminating the need to carry the physical card with you. Recently, Google integrated the payment features of Google Pay into a new, more comprehensive application: Google Wallet. This evolution has not changed the payment mechanism but has enriched it. Today, Google Wallet functions as a true digital wallet, capable of holding not only payment cards but also loyalty cards, event tickets, boarding passes, and, in the future, ID documents. This transformation responds to the need for a single tool to manage various daily necessities, making the phone the hub of our activities.

Safety First: How Google Protects Your Transactions

Security is one of the main concerns when it comes to digital payments, and Google has implemented several layers of protection to ensure user peace of mind. When making a payment in a physical store, Google Pay does not transmit the real card number to the merchant. Instead, it uses a system called tokenization, which generates a virtual card number (a “token”) unique to each transaction. In this way, sensitive physical card data remains safe and is never stored on the device or shared with the shopkeeper. Furthermore, to authorize most purchases, you must unlock your phone via PIN, pattern, or fingerprint, adding an extra layer of security against unauthorized use in case of loss or theft of the device.

Setting Up Cards: A Step-by-Step Guide

Adding your cards to Google Wallet is a simple and fast operation that takes just a few minutes. To start, you need to download the Google Wallet app from the Play Store. Once installed, open it and tap the “Add to Wallet” button. At this point, select “Payment card”. The application will give you the option to frame your card with the camera to automatically capture data, such as the number and expiration date, or to enter them manually. After entering the required information, including the cardholder’s name and CVC code, you will need to accept your bank’s terms and conditions. Finally, the credit institution will require verification, usually via a code sent by SMS or a notification on the mobile banking app, to confirm that you are indeed the cardholder. Once this step is completed, the card will be active and ready for use.

Compatibility Requirements for a Smooth Experience

Before proceeding with the configuration, it is important to ensure that your device and card are compatible with the service. For in-store payments, the smartphone must be equipped with NFC (Near Field Communication) technology, the system that allows short-range communication with POS terminals. Most modern Android phones are equipped with it. Additionally, the operating system must be Android 5.0 (Lollipop) or later. The payment card must also be issued by a bank or financial institution that supports Google Pay. In Italy, the list of participating banks is very extensive and constantly expanding, including major banking groups such as Intesa Sanpaolo, UniCredit, BPER, Mediolanum, and many others, as well as fintech services like Revolut and Hype. It is always advisable to check compatibility directly on your bank’s website.

How to Pay with Google Pay: Simplicity and Speed

Using Google Pay for daily payments is a gesture that combines innovation and practicality. Whether you are at the supermarket, in a restaurant, or in any shop that accepts contactless payments, the procedure is the same. You do not need to open the app: simply wake up the phone screen and hold it near the payment terminal (POS). For amounts above a certain threshold (usually 25 or 50 euros, depending on POS settings), you will be asked to unlock the device for greater security. Once the payment is successful, you will see a blue checkmark on the phone display. This method, besides being fast, is also hygienic as it avoids physical contact with the terminal. The same simplicity applies to online purchases and within apps: just select Google Pay as the payment method at checkout to avoid entering card details every time.

An Ally for Mobility and Shopping

In addition to traditional payments, Google Wallet proves to be an indispensable travel companion. Many public transport companies in Italy and Europe allow you to purchase and validate tickets directly through the app, simply by bringing your smartphone close to the turnstiles or validators. This feature significantly simplifies travel, eliminating queues at ticket offices. Similarly, the digital wallet can hold loyalty cards from your favorite stores. Instead of searching for the right card in your wallet, just show it from your phone to collect points or take advantage of discounts. This integration of payments, mobility, and shopping makes Google Wallet a versatile tool, designed to simplify small everyday actions, in line with a dynamic and connected lifestyle.

In Brief (TL;DR)

Discover how Google Pay works and how to set up your credit, debit, or prepaid cards to pay with your smartphone simply and securely.

Learn how to configure your credit, debit, and prepaid cards to make contactless and online payments simply and securely.

Discover how to make secure and fast contactless payments in stores, apps, and online directly with your smartphone.

Conclusions

Google Pay, integrated into the Google Wallet ecosystem, represents a solid and secure evolution of digital payments in Italy. Its ease of setup and use makes it accessible to a vast audience, ranging from young digital natives to adults looking for practical solutions for everyday life. The combination of secure technology, based on tokenization, and compatibility with a growing number of Italian banks, makes it a reliable tool for progressively abandoning cash. Adopting these systems is not just a matter of convenience, but a step towards greater digitalization of the country, in a European context that sees contactless payments as protagonists of a silent revolution. Choosing to pay with your smartphone means embracing a future where tradition and innovation coexist, simplifying personal finance management with a simple touch.

Frequently Asked Questions

Yes, Google Pay is a free service for users. There are no fees for making payments, as transactions are treated as normal card operations. Merchants also do not pay additional costs compared to standard fees applied for card payments.

Absolutely. Google Pay uses several layers of security to protect data. Instead of transmitting your real card number during a payment, it uses a virtual and encrypted card number (a «token»). In this way, your real card data is never shared with the merchant. Furthermore, for payments above a certain threshold (usually 25 or 50 euros in Italy), additional confirmation is required by unlocking the phone, adding an extra layer of protection.

If you lose your smartphone, you can use Google’s «Find My Device» feature to locate it, lock it remotely with a new password, or wipe all personal data. Even if the phone were unlocked, no one could access the card data, as it is not physically stored on the device. Contacting your bank to block the digital cards is an additional recommended security measure.

Yes, it is possible to make a limited number of payments with Google Pay even without an active Internet connection (Wi-Fi or mobile data). The smartphone securely stores some single-use tokens that allow authorizing offline transactions. However, it is advisable to connect to the Internet every couple of days to allow the app to refresh these tokens and continue functioning correctly.

In Italy, Google Pay is compatible with most credit, debit, and prepaid cards from the Visa and Mastercard circuits, as well as the PagoBANCOMAT® circuit. Numerous Italian banks, including Intesa Sanpaolo, Banca Sella, Mediolanum, BBVA, and many others, support the service. It is always advisable to verify the specific compatibility of your card directly with your bank or by consulting the official list of partner banks on the Google website.

Still have doubts about Google Pay: Guide to Payments and Cards on Your Phone?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.