Are you a credit card holder struggling to understand the complicated world of interest rates, fees, rewards, and repayments? Don’t worry, you are not alone. Many people find themselves confused and overwhelmed by the inner workings of credit cards. But fear not: in this post, we will explain how credit cards work. From understanding your statements to making smart financial decisions, we will explain everything in a simple and understandable way. So sit back, grab your favorite drink, and get ready to become a pro at using and managing your credit card! Let’s dive into the world of plastic money together with comprehensive information on how it functions.

Before We Start

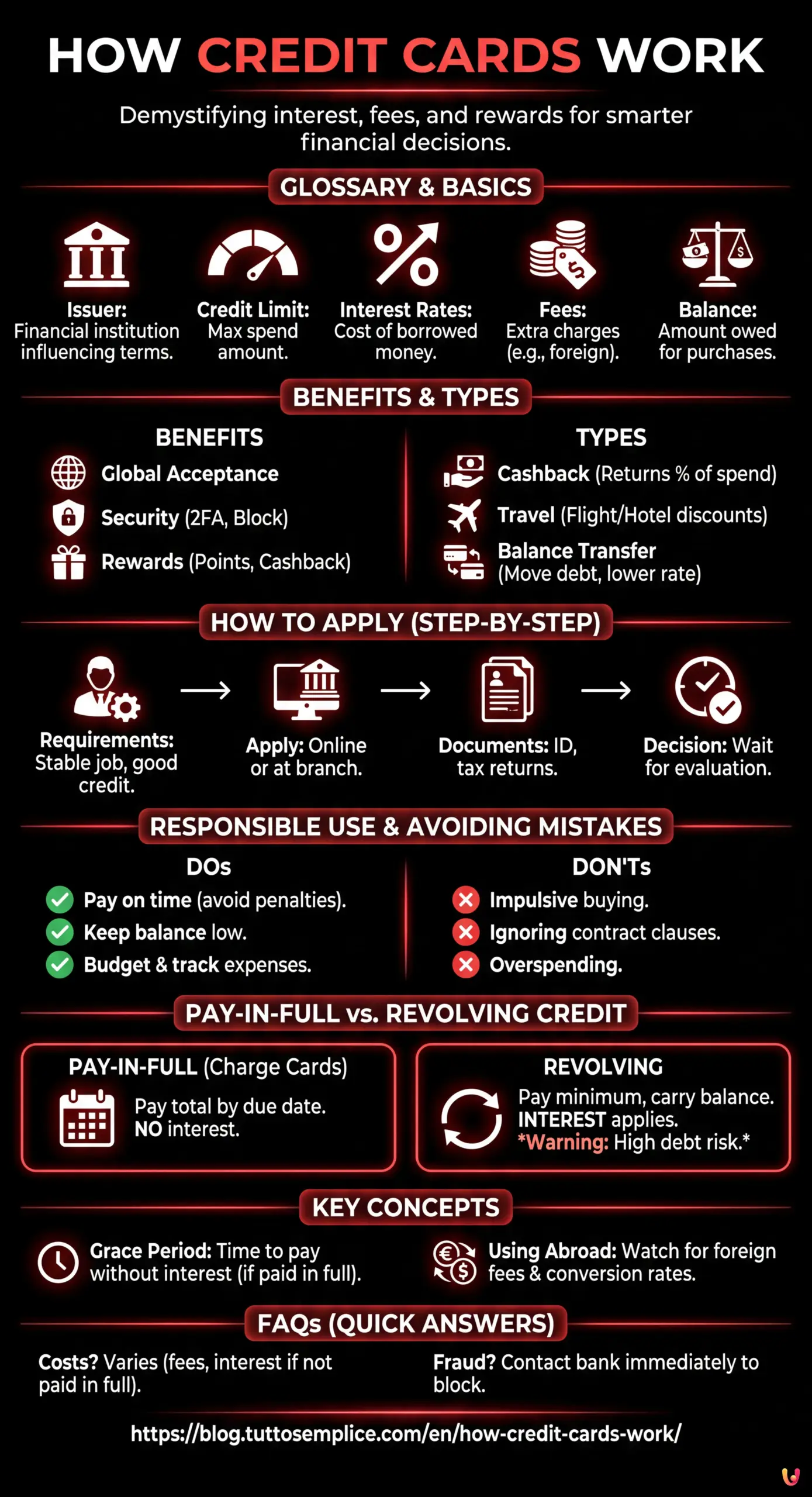

What Are Credit Cards

Credit cards represent an extremely convenient and secure payment tool in everyday life.

Thanks to their global availability, credit cards allow consumers to make purchases online or in-store wherever they are.

The security offered by credit cards is also one of their greatest advantages, with the availability of features such as two-factor authorization and the ability to quickly block a card in case of theft or loss.

Finally, many cardholders enjoy numerous rewards, such as loyalty programs, points, and cash back, making credit cards an attractive and convenient option.

Types of Credit Cards

There are several types of credit cards available on the market, each with specific benefits.

The cashback credit card, for example, returns a percentage of the total expenses made with the card to its users, thus allowing them to save money.

Travel reward credit cards, on the other hand, offer discounts on flights, hotels, and car rentals, not to mention bonuses for the user’s loyalty program.

Balance transfer cards allow you to move expiring debt to another credit card, at zero interest or at reduced rates.

In any case, choosing a credit card means making a conscious choice that takes into account your needs and the expenses you expect to incur.

How to Apply for a Credit Card

Applying for a credit card is not as difficult as you might think. However, there are some requirements to meet before making the request.

First, you should have a stable job and a fixed monthly income. Additionally, you should also have a good credit score so that your application is approved more easily.

Once the requirements are verified, you can proceed with the application.

There are several options available, such as applying via the bank’s website or through a visit to a branch.

You will need to fill out an application form and provide personal information such as your name, address, and phone number.

Make sure you have all the required documents on hand, such as your ID card and tax returns.

Once the application is sent, you will have to wait a few days to know the outcome of the evaluation of your request.

Useful Tips for Choosing a Credit Card

Choosing the right credit card can be an important decision for your budget and lifestyle.

It is crucial to consider your spending habits and the rewards offered by the different options available.

For example, if you spend a lot of time traveling, you might look for a credit card that offers discounts on airlines or hotels.

On the other hand, if you prefer shopping online or at specific stores, it might be advantageous to find a credit card with discounts or reward points for the stores of your choice.

Always remember to check the fees and spending limits of the credit card you are considering, so you can make a responsible decision about choosing the right credit card for you.

How to Use a Credit Card Responsibly

A credit card can be a great tool if used responsibly.

First, it is crucial to pay monthly installments on time to avoid high interest and penalties.

Furthermore, it is important to keep balances low and not go beyond our financial means.

Finally, avoiding unnecessary expenses and limiting yourself to buying only what is necessary can help keep debt under control.

By using the credit card carefully, you can enjoy the benefits it offers without accumulating excessive debt.

Most Common Misconceptions When Using a Credit Card

Credit cards are often the subject of misunderstandings and misconceptions that can lead to poor choices.

In particular, there are many rumors about interest rates and fees that, unfortunately, do not always correspond to the truth.

For example, many believe that credit card interest rates are almost always extremely high, but this is not always the case.

Moreover, there are different types of fees, some of which can be avoided or limited with some care.

It is therefore important to inform yourself correctly, read the contract conditions carefully, and ask your credit card provider for clarification, in order to make the best use of this financial instrument and avoid abuse.

Pay-in-Full vs. Revolving Credit Cards

There are two main types of credit cards: pay-in-full (charge cards) and revolving.

Pay-in-full credit cards require payment of the total expenditure without interest by a set date, usually 30 days.

Revolving credit cards allow you to pay a small percentage of the expenditure monthly, applying an interest rate on the remaining debt.

Warning: if you use a revolving credit card and do not pay the total expenditure every month, you risk accumulating an increasingly large debt due to high interest. Applying for a revolving credit card is like applying for a loan, but usually, the amounts available on these cards are low and the interest rates are higher than those of a personal loan.

Understanding the Grace Period and How It Affects Payments

The grace period is the period of time granted by the creditor to the debtor to make the payment without incurring penalties or default interest.

This period may vary depending on the conditions established in the contract between the parties.

During the grace period, the creditor cannot demand payment of the debt and the debtor cannot be considered late.

However, it is important to keep in mind that the grace period does not mean that the debt will be completely removed or forgotten.

In fact, in the event that the debtor does not make the payment within the grace period, default interest and penalties may be applied which could negatively affect their financial situation.

It is therefore important to understand the grace period and respect the terms of the contract to avoid unpleasant consequences.

Using a Credit Card Abroad

Using a credit card abroad can be convenient for transactions, but you need to be careful about foreign transaction fees and currency conversion rates.

In fact, many banks apply fees for using the card abroad, which may include both a percentage of the sum spent and a fixed fee for each operation.

Furthermore, the conversion rates applied by banks may vary from those of the interbank market, and this can entail additional costs for the consumer.

It is important, therefore, to inform yourself in advance about the costs that the bank applies for using the card abroad and, to avoid surprises, do the math before leaving.

Avoiding Common Mistakes When Using Credit Cards

The credit card is a very common financial tool, but it is important to use it with caution to avoid costly mistakes.

One of the most common mistakes is spending too much, particularly buying items that are not really necessary.

To avoid this, it is important to have a budget in mind and keep a record of expenses made with the credit card.

Another mistake to avoid is impulsive buying; when you want something irresistibly, it is better to take a moment to reflect and verify if it is truly necessary.

Furthermore, it is important to read the clauses of the credit card contract carefully to avoid unpleasant surprises, such as additional charges or interest rate increases.

Remember: caution in using a credit card can help maintain balanced financial health.

In Brief (TL;DR)

Credit cards are a useful and versatile tool for online and in-store expenses.

It is never advisable to use revolving credit cards instead of a personal loan, as interest rates are higher on average.

A credit card should never be used to make purchases beyond one’s financial means.

Conclusions

For many, the credit card is a means to make payments without having to carry cash in their pocket.

However, irresponsible use of a credit card can lead to long-term financial problems. Understanding how to use a credit card responsibly can help build a good credit score and solid financial stability.

This means always paying the full credit card balance every month and not using it for purchases outside of your budget.

Even a simple delay in payments can negatively affect your credit score and remain on your credit report for years, so it is important to pay attention to your payments.

In conclusion, credit cards are a powerful financial tool that can offer numerous benefits if used responsibly.

From their convenience and security to the possibility of earning rewards, credit cards have become an integral part of our daily lives.

However, before diving into the world of plastic money, it is crucial to understand the basics, such as the credit limit, interest rates, and penalties for late payment.

With the different types of credit cards available on the market today, it is essential to consider your spending habits and choose the one best suited to your needs.

Furthermore, responsible use of the credit card, making punctual payments and maintaining low balances, can have a positive impact on your financial health.

Although there are some misconceptions about the use of credit cards, such as scary interest rates and inevitable fees, it is important to dispel these myths and educate on the use of this tool.

It is also worth understanding the concept of the grace period and how it can affect payments.

Another important aspect of using a credit card is to take full advantage of the points collection and cashback programs offered by issuers.

With careful planning and use, it is possible to accumulate points, air miles, or cash for purchases made with the card and redeem them.

It is crucial to pay attention when using the credit card abroad, as foreign transaction fees and currency conversion rates can increase our expenses.

Avoiding common mistakes, such as excessive spending or impulse purchases, can also help you maintain a healthy financial state.

By following the advice indicated, you can manage your credit card with confidence and enjoy all its benefits without getting into debt and without having to face any financial problems.

Therefore, make a responsible decision when applying for a new card or using the existing one.

Frequently Asked Questions

Using a credit card can entail various costs, but they may vary based on the issuing bank and the type of card held. Usually, there could be fees for foreign transactions, interest on financed amounts if the balance is not paid in full by the end of the grace period, and annual fees for possessing the card. In some cases, however, there are credit cards that offer advantageous conditions with few or no fees, especially if the balance payment is made promptly every month. It is therefore important to read your credit card contract carefully to understand all associated costs.

The advantages of using a credit card are manifold and go well beyond simple ease of use. Credit cards offer purchase protection systems that can safeguard users from fraud and wrong purchases. Furthermore, many cards include loyalty programs that allow you to accumulate points or miles through purchases, which can then be redeemed for travel, products, or other rewards. Some cards also provide travel insurance or extended warranties on purchased items.

One of the main disadvantages is the risk of indebtedness: the ease of spending can lead to impulsive purchases, with the accumulation of debt at high interest rates. Furthermore, failure to meet payment deadlines can affect your credit score, making future loans more difficult or expensive. There is also a danger of cyber fraud and identity theft, despite the increasingly sophisticated security measures developed by banks. Finally, some cards have hidden costs that can lead to unexpected expenses if you don’t pay attention.

If you find an unauthorized charge on your credit card, it is crucial to act promptly. The first step is to immediately contact the bank or institution that issued the card, reporting the suspicious charge. This allows blocking the card and preventing further fraudulent use. It is also important to examine previous statements to check for the presence of other unrecognized charges. The bank will provide instructions to proceed with the claim and, if necessary, will start the chargeback process. Memorizing or noting down all references of communications made with the bank can facilitate the problem management process.

To protect your credit card from fraud or theft, adopt preventive measures such as regularly checking statements and keeping your cards in a safe place. It is also essential to use complex passwords for online accounts and change these credentials periodically. Keep antivirus software updated on your computer and mobile devices and avoid entering credit card data on insecure websites or via public Wi-Fi connections. In case of loss or theft of the card, block it immediately. Saving the bank’s customer service phone number can simplify this process in emergency situations.

Among the alternatives to credit cards for making payments are bank transfers, debit cards, and electronic methods like PayPal. Furthermore, the use of digital wallets like Apple Pay, Google Wallet, and Samsung Pay is becoming increasingly popular, thanks to their ability to offer fast and secure transactions through mobile devices. Cryptocurrencies like Bitcoin are emerging as an innovative means of payment, although they are not widely accepted for daily payments. Each method presents advantages and disadvantages, so it is important to choose the most suitable option based on the specific situation.

Still have doubts about How Credit Cards Work?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.