Transferring money to a prepaid card might seem like a complicated operation, but it is actually simpler than you think! Whether you need to send money to a Postepay, top up your PayPal account, or manage your finances with Hype, this guide will provide you with all the necessary information to make a bank transfer quickly, securely, and knowingly. You will discover the different methods, costs, times, and practical tips to avoid errors and make the most of your prepaid cards’ potential. Keep reading and become an expert on prepaid card bank transfers!

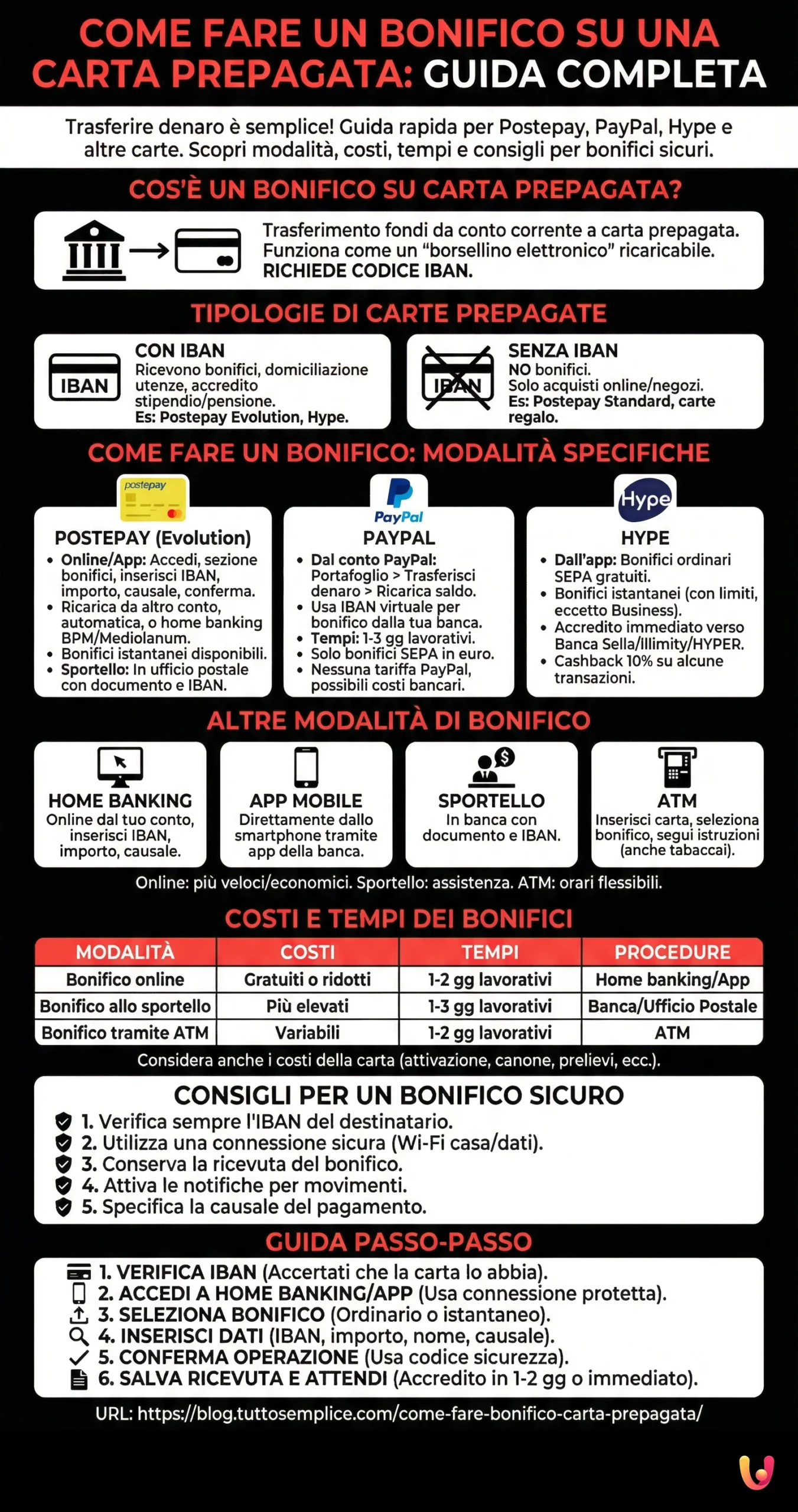

What Is a Bank Transfer to a Prepaid Card?

A bank transfer to a prepaid card is an operation that allows you to transfer funds from a bank or postal current account to a prepaid card. Receiving a bank transfer on a prepaid card usually does not involve any cost for the beneficiary. Unlike credit or debit cards, prepaid cards are not linked to a current account but function as a sort of rechargeable “electronic wallet.” To receive a bank transfer, the prepaid card must be equipped with an IBAN code.

Types of Prepaid Cards

There are different types of prepaid cards, each with specific features and functionalities:

- Prepaid cards with IBAN: Allow you to receive bank transfers, set up direct debits for utilities, and credit your salary or pension. Some cards also allow you to receive your salary directly. Examples: Postepay Evolution, Hype.

- Prepaid cards without IBAN: Do not allow receiving bank transfers but can be used for online purchases and in physical stores. Examples: Postepay Standard, some gift cards.

A fundamental aspect to consider is the presence or absence of an IBAN. Cards with an IBAN offer greater flexibility, allowing you to receive transfers and manage your finances more completely. Cards without an IBAN, on the other hand, are more suitable for those looking for a simple and immediate payment tool for purchases and withdrawals.

How to Make a Bank Transfer to a Prepaid Card

The methods for making a bank transfer to a prepaid card vary depending on the card and the service used. Here are the main options, grouped by card type:

Bank Transfer to Postepay

Online Bank Transfer to Postepay Evolution

To make a bank transfer to a Postepay Evolution via home banking or the Postepay app, follow these steps:

- Log in to your account with your credentials.

- Go to the section dedicated to bank transfers.

- Enter the IBAN code of the beneficiary’s Postepay Evolution.

- Indicate the amount and the reason for the transfer.

- Confirm the operation.

You can also top up your Postepay from another current account in your name, via standard or instant bank transfer (if your bank allows it). Postepay also offers the “Automatic Top-up” feature, which allows you to set periodic automatic top-ups on your card. If you hold a BPM or Mediolanum current account, you can top up your Postepay directly from these banks’ home banking services.

With Postepay Evolution, you can also take advantage of instant bank transfers. Remember that for contactless payments with Postepay Evolution, it is not necessary to enter the PIN for amounts up to 50 euros per transaction. Additionally, with the ScontiPoste program, you can get up to 20% cashback on your purchases.

Bank Transfer at the Counter to Postepay

If you prefer a traditional method, you can go to a post office and request to make a bank transfer to a Postepay card. Bring an ID document and the card’s IBAN code with you. In addition to SEPA transfers, post offices also offer other types of transfers, such as standing orders, foreign transfers, tax deduction transfers, supplementary pension transfers, and transfers to the State Treasury (the latter can also be done online).

Bank Transfer to PayPal

To top up your PayPal account via bank transfer, follow these steps:

- Log in to your PayPal account.

- Go to Wallet > “Transfer Money”.

- Click on “Add money to your balance”.

- Retrieve the virtual IBAN code generated by PayPal.

- Execute the transfer via your bank.

Transferring money from a bank account to a PayPal account typically takes up to 3 business days. Ensure that the name on the bank account matches the one on the PayPal account; otherwise, the transfer will not be processed correctly. PayPal only accepts SEPA transfers (in euros) to top up the account. PayPal does not charge fees for the transfer, but bank fees may apply from your bank. If you do not have enough money in your PayPal balance, you can pay with a credit or debit card. To check the status of your transfer, you can consult the “Activity” section of your PayPal account.

Once you have transferred funds to your PayPal Account, you can use the PayPal Prepaid Card for your expenses.

Bank Transfer to Hype

With Hype, you can send ordinary transfers within the SEPA area directly from the app, free of charge. Hype also offers the possibility of making instant transfers, but with limits on the amount and number of daily operations (these limits do not apply to Hype Business). The crediting times for transfers vary depending on the recipient bank: transfers to a Banca Sella account, illimity, or another HYPER are immediate, while for other banks, times may vary. Another advantage of Hype is the 10% cashback offered on some transactions.

Other Transfer Methods

In addition to the specific online methods for each card, it is possible to make a transfer to a prepaid card also via:

- Home banking: Log in to your online current account and follow the instructions to make a transfer. Enter the prepaid card’s IBAN code, the amount, and the reason. For example, with Banco BPM, you can access the “cards” section and click on “prepaid cards” to proceed with the top-up.

- Mobile App: Download your bank’s app and make the transfer directly from your smartphone.

- Transfer at the counter: Go to your bank’s counter with an ID document and the prepaid card’s IBAN code.

- Transfer via ATM: Some ATMs allow you to make transfers to prepaid cards. Insert your debit or prepaid card into the ATM, select the “transfer” option, and follow the on-screen instructions. Some prepaid cards can also be topped up at tobacconists.

Each method has its pros and cons. Online transfers are generally faster and cheaper, while transfers at the counter offer personalized assistance. Transfers via ATM can be convenient for those who need to make a transfer outside of bank opening hours.

Costs and Times of Bank Transfers

The costs of transfers to a prepaid card vary depending on the execution method, the banking institution, and the type of card. In general, online transfers are cheaper than those made at the counter. PayPal does not charge fees for transfers, but your bank might charge you. In addition to the transfer costs, it is important to also consider the costs associated with the prepaid card itself, such as:

- Activation fee

- Card shipping fee

- Monthly or annual fee

- Commission on withdrawals from counters or ATMs

- Commission on outgoing transfers

- Commission on POS payments

The crediting times depend on the transfer method and the banks’ processing hours. Usually, SEPA transfers are credited within 1-2 business days.

| Method | Costs | Times | Procedures |

|---|---|---|---|

| Online transfer | Generally free or with reduced fees | 1-2 business days | Access to home banking or app, enter beneficiary data |

| Transfer at the counter | Higher fees | 1-3 business days | Go to the bank or post office with ID and IBAN |

| Transfer via ATM | Variable fees | 1-2 business days | Insert card into ATM and follow instructions |

Tips for a Secure Transfer

- Always verify the recipient’s IBAN: Make sure you have correctly entered the IBAN code of the prepaid card to which you want to transfer the money.

- Use a secure connection: Make online transfers only via protected internet connections, such as your home Wi-Fi or a mobile data network.

- Keep the transfer receipt: The receipt is proof of the transaction. Keep it in a safe place.

- Enable notifications: Set up notifications to be alerted in real-time of any movement on your prepaid card.

- Specify the payment reason: Indicating the reason for the transfer can be useful for tracking transactions and identifying them easily.

- Verify the presence of an IBAN

Before starting, ensure that the beneficiary’s prepaid card is equipped with an IBAN code (e.g., Postepay Evolution or Hype). Cards without an IBAN cannot receive bank transfers.

- Access your Home Banking or App

Log in to your online current account via the website or mobile application using your credentials. Ensure you are using a secure internet connection to guarantee safety.

- Select the Transfer option

Navigate the main menu to the payments section and select the “Transfer” item. You can choose between ordinary SEPA transfer or instant transfer, depending on the options offered by your bank.

- Enter beneficiary details

Carefully type the IBAN code of the destination prepaid card. Enter the exact amount to transfer, the beneficiary’s name, and a clear reason to track the payment.

- Confirm the operation

Review the entered data to avoid typing errors. Authorize the transfer by entering the required security code (PIN, OTP, or biometric recognition) from your banking institution.

- Save the receipt and wait for credit

Keep the digital receipt as proof of the transaction. Funds will usually be credited within 1-2 business days for standard transfers, or immediately for instant ones.

In Brief (TL;DR)

Making a bank transfer to a prepaid card is a simple and fast operation, especially if you choose the online method.

To receive a bank transfer, the prepaid card must be equipped with an IBAN code.

Remember to always verify the recipient’s IBAN, use a secure connection, and keep the transfer receipt.

Conclusions

Prepaid cards are an increasingly popular payment tool, thanks to their practicality and flexibility. The ability to receive bank transfers makes them even more versatile, allowing them to be used for various needs, such as salary crediting, bill payments, or sending money to friends and family. Furthermore, they offer an additional level of security in case of theft or loss, as the risk is limited to the available balance on the card.

Before choosing a prepaid card, carefully evaluate your needs and the features of each card, such as costs, transfer limits, and available functionalities. Also consider the level of security offered, the top-up methods, and the customer support provided by the issuer.

Another important aspect to evaluate is the acceptance of the payment circuit (Visa, Mastercard, etc.). Ensure that the card is accepted in the shops and ATMs you habitually use, both in Italy and abroad.

Finally, keep in mind that prepaid cards can be a useful tool to manage your budget and control your expenses. By setting a top-up limit, you can avoid spending more than planned and track your movements in a simple and intuitive way.

Frequently Asked Questions

To make a bank transfer to a prepaid card, you need the card’s IBAN code and can proceed via home banking, app, bank counter, or ATM.

No, only cards with an IBAN can receive bank transfers.

The cost varies based on the bank and the transfer method (online, counter, ATM). Online transfers are often free.

Generally 1-2 business days for SEPA transfers.

Yes, it is safe if you take precautions such as verifying the IBAN and using a secure connection.

Advantages include expense control, security, practicality for online and international purchases, and the ability to receive transfers (if equipped with an IBAN).

Some disadvantages can be management fees, usage limits, and lower fraud protection compared to credit cards.

Enable notifications for movements, use strong passwords, do not share card details online, and beware of fraudulent sites.

Contact the card issuer immediately to block it and avoid unauthorized use. There may be a fee for issuing a new card.

You can use it for online purchases and in physical stores that accept your card’s payment circuit (Visa, Mastercard, etc.).

Yes, you can withdraw cash at ATMs that accept your card’s payment circuit. Fees may apply.

Evaluate your needs, costs, usage limits, features, and the level of security offered by different cards.

Still have doubts about How to Make a Bank Transfer to a Prepaid Card: Complete Guide?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.