Returning to your home country after a period of living or working abroad is a time filled with important decisions, not only on a personal and professional level but also a financial one. One of the most common questions involves managing an Italian bank account. The choice between closing it permanently or keeping it active requires a careful evaluation of various factors, ranging from practical needs to tax and bureaucratic implications. This article provides a comprehensive guide to navigating this scenario, analyzing the procedures, costs, and current regulations within the European market, with a special focus on Italian banking culture, which is balanced between tradition and innovation.

Approaching this choice with awareness is crucial to avoid future complications and to ensure a smooth, stress-free transition. Whether you are a young professional returning from an educational experience or a worker coming back after many years, understanding the available options will allow you to make the decision best suited to your specific situation, optimizing the management of your finances in compliance with regulations.

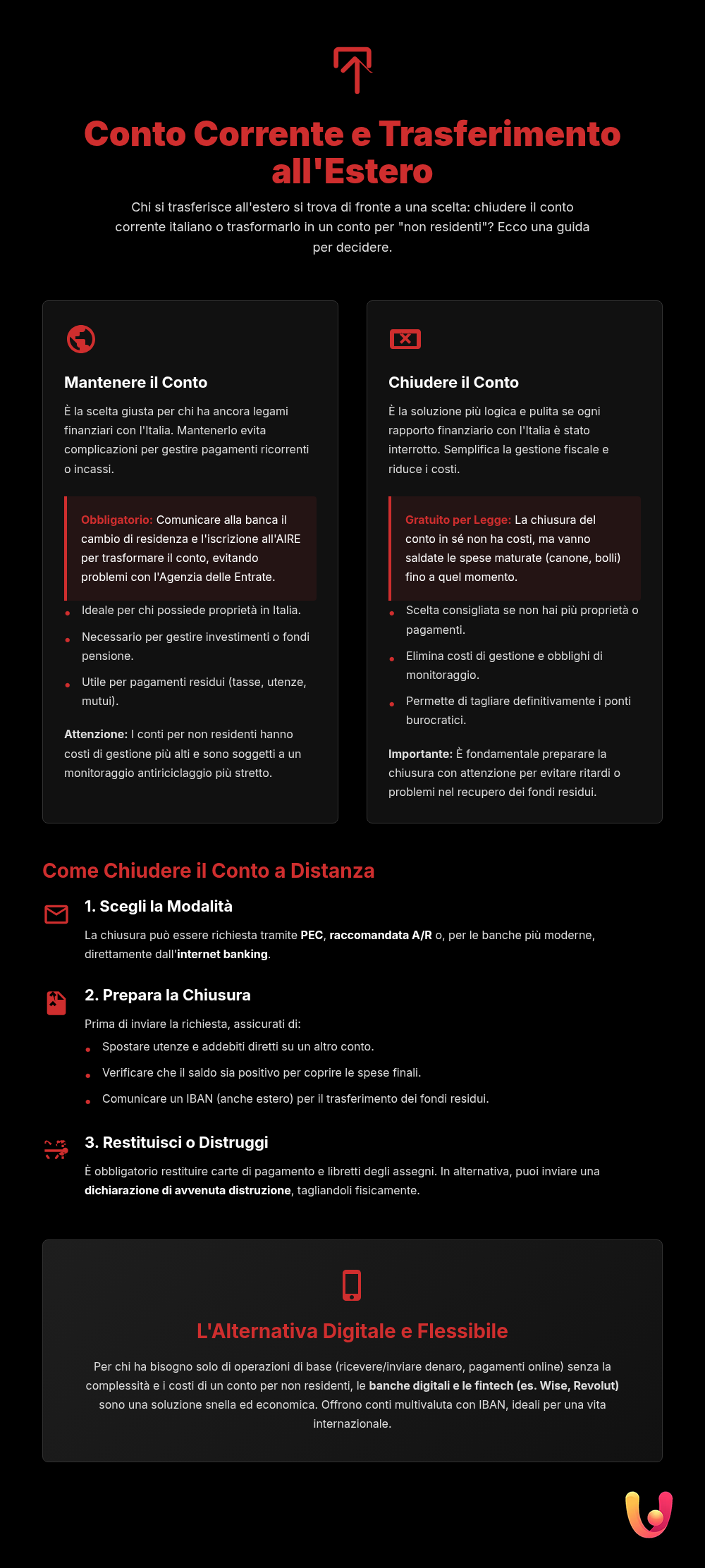

Keeping Your Italian Account: The Non-Resident Account

For those who decide to maintain a financial tie with Italy, the solution is to convert their standard account into a “non-resident bank account.” This is mandatory for anyone who moves their tax residence abroad and registers with AIRE (Anagrafe degli Italiani Residenti all’Estero – the Registry of Italians Residing Abroad). Promptly notifying your bank of your change of residence is a crucial step to comply with regulatory obligations and avoid scrutiny from the Italian Revenue Agency (Agenzia delle Entrate). Keeping a standard account could be interpreted as an indication of a fictitious residence abroad.

Anti-money laundering regulations prohibit non-resident Italian citizens from being joint holders of a standard bank account with a resident of Italy.

Features and Costs

Non-resident accounts are designed for individuals who, despite living outside of Italy, need to conduct financial transactions within the country. They offer basic services like receiving payments, managing utilities or taxes, and access to tools such as debit cards and bank transfers. However, it’s important to know that these accounts generally have higher management costs than standard accounts, due to more expensive fees and the greater complexity of management required by anti-money laundering regulations. Banks are required to carefully monitor transactions, especially money transfers that exceed certain thresholds.

Pros and Cons of Remote Management

The main advantage of keeping an account in Italy lies in the convenience of managing recurring payments, real estate, or investments without resorting to complex international transactions. Thanks to digital innovation, most banks, both traditional and online like Fineco, Unicredit, or Banca Etica, offer internet banking platforms that allow for complete remote management. The main disadvantage, aside from the costs, is related to potential operational limitations and the need to stay compliant with evolving tax laws, which requires diligence to avoid issues like double taxation or penalties.

Closing a Bank Account from Abroad: The Procedure

If your financial needs in Italy have come to an end, the most logical choice is to close your bank account. This process, while requiring careful attention, can be managed entirely remotely, without the need to visit a branch in person. Closing an account is the account holder’s right and can be requested at any time, usually without closing fees, although you will need to settle any outstanding management charges.

Before initiating the procedure, it’s essential to take a few preliminary steps. First, you must ensure that the account balance is positive and sufficient to cover any final charges. It is also crucial to transfer all utility payments and direct debits (RID) to a new account, as well as to provide your new IBAN to your employer for salary payments or to other entities for any incoming funds. Finally, you need to decide where to transfer the remaining balance. To explore transfer options further, it can be useful to consult a guide on instant vs. SEPA transfers.

Methods for Remote Closure

Italian banks offer several legally valid methods for requesting an account closure from abroad. The most common options are:

- Certified Email (PEC): Send a formal request to the bank’s PEC address, attaching the completed and signed closure form, along with a copy of your ID documents. This method is legally equivalent to a registered letter with proof of delivery.

- Registered Mail with Acknowledgment of Receipt (A/R): A traditional but still valid method, which consists of sending a closure request letter to your branch.

- Internet Banking Platform: Some banks, particularly the more digitally advanced ones, allow you to start the closure procedure directly from the secure area of their website.

Regardless of the method you choose, it is mandatory to return all payment instruments linked to the account, such as debit cards, credit cards, and checkbooks. If you cannot return them in person, you will need to send a declaration confirming their destruction.

Tradition and Innovation in the Italian Banking System

The relationship Italians have with their banks is historically rooted in a culture of trust and personal contact. The physical branch has always represented a landmark, a place to receive advice and manage one’s finances with the support of a familiar face. This tradition, typical of Mediterranean culture, clashes with and at the same time integrates with the unstoppable drive toward digital innovation. For those returning to Italy after living in more digitized European contexts, the coexistence of these two worlds is particularly noticeable. While online banking is now a standard, bureaucracy and certain procedures still require a more traditional approach. For those needing to handle complex operations, such as a bank account garnishment, interaction with a physical branch can still prove necessary.

Digital banks and fintechs, such as Revolut or Wise, are gaining ground by offering lean, affordable, and fully app-manageable alternatives, ideal for a young and international customer base. These solutions, often with a European IBAN, represent an excellent alternative for those who need an account for basic operations without the costs and complexity of a traditional non-resident account. On the other hand, traditional banks are responding to this challenge by strengthening their online services and seeking to integrate the convenience of digital with the value of personalized advice, an element that is still highly appreciated. For those wishing to open a bank account online, the options available today are numerous and competitive.

In Brief (TL;DR)

Before moving abroad, it’s crucial to decide whether to keep your Italian bank account active or close it, following the correct procedures to avoid complications.

From remote closure procedures to managing the remaining balance, here is a complete guide to managing your banking situation before leaving Italy.

We will delve into the procedures for remote closure, managing the remaining balance, and securely deactivating internet banking services.

Conclusion

The decision to manage or close an Italian bank account before returning to your home country strictly depends on your individual needs and future plans. If you still foresee financial ties to Italy, such as managing property, investments, or payments, keeping a non-resident account can be a strategic choice, despite the higher costs and tax obligations. In this case, it is imperative to inform the bank of your change of residence to convert the account and remain in compliance with regulations.

If, on the other hand, your return marks the end of all financial ties with Italy, closing the account is the cleanest and most definitive solution. Thanks to remote procedures like PEC and registered mail, the process can be completed without needing to visit a branch, as long as you meticulously follow all the required steps. In a banking world that sees the solidity of tradition alongside the flexibility of innovation, being properly informed is the first step toward peaceful and mindful financial management that will best support your return to the Bel Paese.

Frequently Asked Questions

Yes, it is absolutely possible to close an Italian account while residing abroad. The most common methods are sending a registered letter with acknowledgment of receipt (A/R) or a Certified Email (PEC) to the bank, using the closure request form provided by the institution. Another option is to grant power of attorney to a trusted person in Italy who can go to the branch on your behalf.

By law, closing a bank account is free and does not involve penalties. However, the bank may charge for management costs accrued up to the closing date, such as account or card fees, stamp duty, and any overdraft interest. It is therefore important to leave enough money in the account to cover these final expenses.

It is not mandatory to close it, but it is essential to inform the bank of your change of residence. The account will be converted into a ‘non-resident account.’ Keeping a standard account as a non-resident is not recommended because it could create ambiguity about your tax residence and attract audits from the Italian Revenue Agency. The non-resident account, although sometimes more expensive, regularizes your status.

Failing to inform the bank of your change of residence is a mistake that can have tax consequences. The financial institution would continue to apply the tax regime for residents, which could lead you to violate regulations on the tax monitoring of financial assets. Communicating your AIRE registration and converting the account is a crucial step for regulatory compliance.

In the closure request form, you will need to provide the IBAN of another bank account (Italian or foreign) to which you want the remaining balance to be transferred. After deducting any closing fees, the bank will send the remaining amount via bank transfer to the account you specified. Make sure the destination account can receive transfers from Italy.

Still have doubts about Italian Bank Account Abroad: Close It or Keep It? A Practical Guide?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.